jgroup/iStock via Getty Images

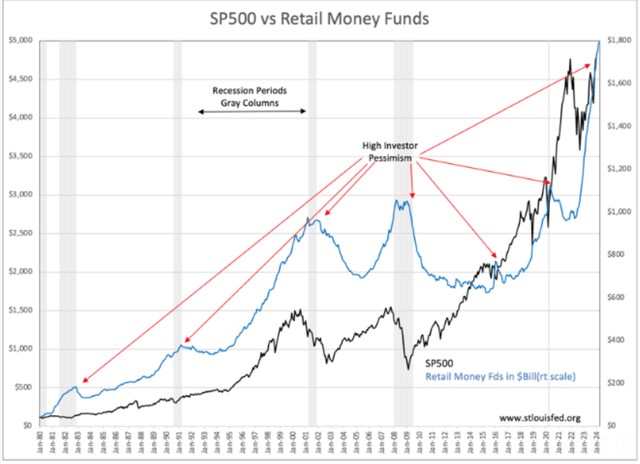

Investing is more art than science, i.e., mathematical models. The last 70yrs experts have tried to convince investors and themselves that Modern Portfolio Theory operated by computers produced the highest returns over time. Today, an overwhelming majority using this tool is still expecting a recession, and some of this is reflected in the record high Retail Money Fund level (S&P 500 vs Retail Money Funds). This level and its very rapid rise has a historical relationship with pessimism. But it is identifiable with market lows during a recession. It is a pattern everywhere in investment history that high pessimism indicates major market lows and moderate pessimism correlates with moderate market dips. The history shown is from Jan 1980, encompassing 6 recessions. Psychology is better at calling market lows than computers using Modern Portfolio Theory.

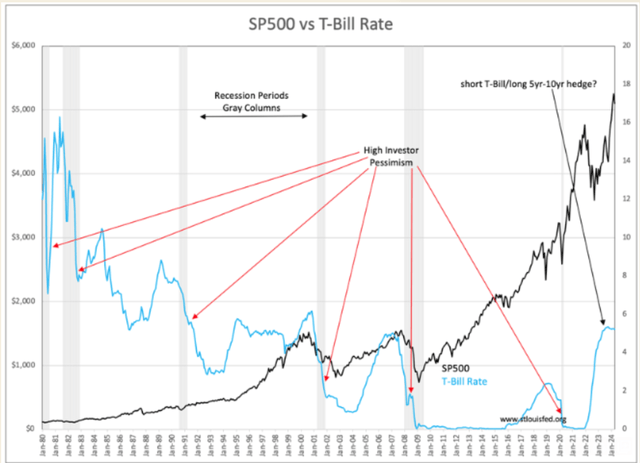

However, the current market is unusual. High Retail Money Funds typically matched the lows in the T-Bill rates for the cycle, but not this time (S&P 500 vs T-Bill Rate). The T-Bill rate comparison for the same time span is below the Retail Money Fund comparison to make it easier to visualize that high demand for T-Bills drives its rate low for the cycle. What we are seeing today is a T-Bill rate rise, which is very unusual. My own interpretation, based on monitoring the recent hedge fund strategies deployed, is that it is hedge funds who have shorted T-Bill to buy 5yr-10yr Treasury maturities. This has three effects:

- Shorting T-Bills pushes rates higher and out of sync with the current level of pessimism

- Buying 5yr-10yr Treasuries pushes their rates lower in anticipation of lower rates from a recession

- T-Bill rates higher than inflation have pulled consumer funds into Retail Money Funds disintermediating banks (some of the funds entering money funds do not reflect abject pessimism)

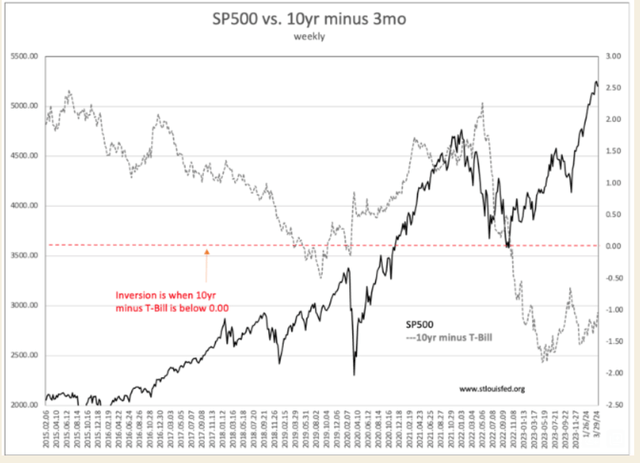

It is Modern Portfolio Theory in my opinion and computer modeling that has created a massive and record yield curve inversion with a bearish market bet while we are in the middle of economic growth. T-Bills have inverted, leaving 10yr Treasury rates -1.82% below T-Bill rates June 2023 as shown in the comparison from Feb 2015 S&P 500 vs 10yr minus 3mo. As of last week’s Bank of America Fund Manager Survey, 88% were still expecting to see rates decline this year. The economic growth being reported by many industries today indicates that the majority is wrong. Growth by companies representing the core of the US economy, i.e., manufacturing and construction, being driven in part by reshoring supply chains. These companies have reported better-than-expected financials. They are passing through inflation cost with little friction and make good investments as inflation persists. These same companies also reflect growing backlogs and have been raising their annual guidance. In short, there is no recession in sight, but there remains considerable pessimism that a recession is right around the next corner.

Psychology makes the market! Market prices reflect market psychology. The mega-high tech issues comprise 25% of the S&P 500 and have been the drivers of this index since Apr 2020. The advice by institutional managers is that these are the only issues to own in the coming slowdown caused by higher rates. A few have begun to see that there is decent growth in non-tech issues, but they remain a minority. The push higher in the S&P 500 has remained high-tech issues, namely Nvidia and AI (Artificial Intelligence) related issues. These issues are significantly overpriced being the focus of so much capital. A lesson few have incorporated into their thinking is the fact that single theme markets never sustain. They always roll over into sectors that have been ignored. There are always cycles within every major cycle of market psychology. Investors always go to excess in the current favorites, then return to the forlorn as if these are the new discoveries. The facts are that they were always there, but in the rush to chase returns, they had been temporarily ignored.

The net/net in this perspective is that all the signs continue to point to high levels of pessimism, with high-tech overvalued by institutional investors using them to protect themselves from recession. That is why the S&P 500 is at record highs at the same time Retail Money Funds and other indicators register pessimism. This is an unusual mix controlled by very significant pools of capital. In my opinion, they are flat-out wrong and are missing the considerable economic growth in the heart of the US. Investors should remain focused on well-managed companies now reporting upside surprises with raised guidance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.