anyaberkut/iStock via Getty Images

FiscalNote (NYSE:NOTE) is a first-mover platform, that applies proprietary AI and data science to furnish structured political, legislative, and regulatory data. Customers include government agencies, businesses, trade groups, and non-profit agencies in over 80 countries.

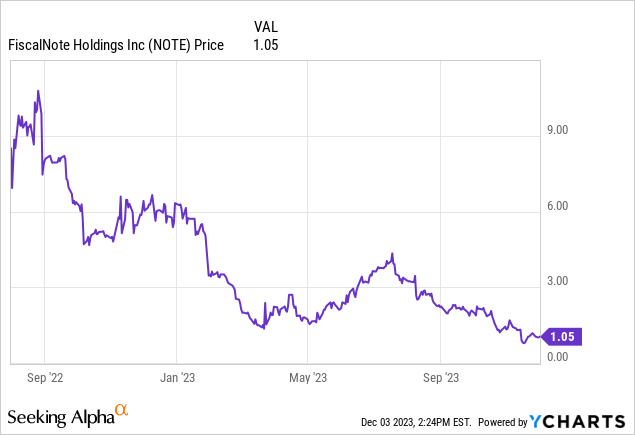

NOTE’s stock price has plunged from its IPO price of $10/share in the fall of 2022 to its current price of about $1/share. My investment thesis is that the stock price will rerate as the company continues to successfully scale.

NOTE STOCK PRICE (Y CHARTS)

In this research, I will offer evidence to uphold my thesis by reviewing the problem that the company offers a solution for, the strategy, management, the company’s ecosystem, financial information, concerns, and risks. I will also review the implications relative to NOTE being a microcap stock.

The Problem

Digital transformation has created a massive amount of data that is unmanageable without AI and data science enhancements to furnish real-time structure and analyses. Several enterprises offer this type of solution, for example, Bloomberg specializes in financial analytics and information.

FiscalNote’s founders found an unserved data management category. Reviewing the top 100 AI companies, you won’t even find the category that FiscalNote’s founders have addressed; applying AI to furnish meaningful political, legislative, and regulatory data.

The U.S. Congress has on average produced five million words of proposed legislation every two years, involving thousands of new legislative acts. The opportunity is widened on an international basis as each country has different legislation, creating complexities for governments and international enterprises to pilot ESG, data integrity, and compliance.

Strategy

The company employs a Software as a Service (“SaaS”) model and derives the majority of its revenue from subscriptions. It uses a land and extend strategy which is typical in the SaaS industry, beginning with a small contract for one product and adding additional services and products for each respective customer. Typically, starter contracts are in the $10-$15K per year range with some enterprises such as the U.S. Department of Defense (“DOD”) expanding to several million dollars.

The company has about 5000 customers. Dividing the annual revenue, about $140 M at the current run rate, by the number of customers, investors might not achieve that the company is deriving several million dollars of annual revenue from some individual contracts.

The company has a webpage dedicated to examples of its land and extend model and also has examples on the investor deck. Revenue from the DOD is based on several contracts that were added to the original contract over the last ten years, but before the company became public, so there aren’t any press releases on the value of these contracts. I believe that the DOD is the company’s biggest customer.

Products

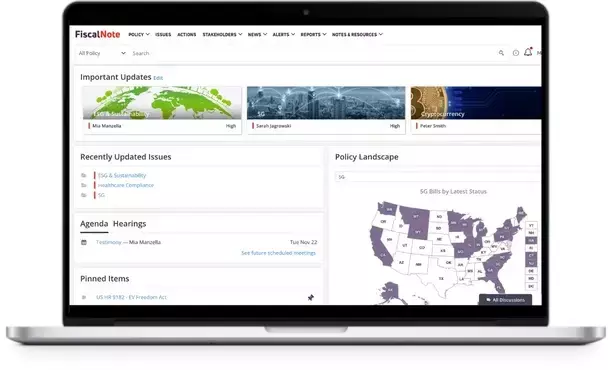

The flagship product is the FiscalNote Government Relationship Management (“GRM”) system that identifies new legislation and its implications, in real-time. GRM is the only legislative tracking solution that is SOC2 Type 2 compliant. This designation adds credibility to the product while assuring clients lower risk with improved security. From an industry blog:

If data were money, then SOC 2 compliance would be the best vault in town. The importance of SOC 2 compliance lies in its ability to reassure stakeholders that a company’s data management is robust, reliable, and resistant to security breaches.

NOTE GRM (FiscalNote website)

FiscalNote’s clients include every member of the U.S. Congress, 60 of the Fortune 100 companies, just about every U.S. federal government agency, local, state, and foreign governments, and non-profit organizations. The company has 17 patents and a wide range of products offering data, analytics, and information on government funding, legislation, regulation, supply chain updates, risk mitigation, and compliance requirements.

FiscalNote has used acquisitions to extend into adjacent applications but it has also maintained a healthy 10% of revenue dedicated to R&D for the creation of new products. FiscalNote has acquired fifteen small data companies serving small markets and then sold the acquired data to a larger market than the acquired company could on its own.

Management

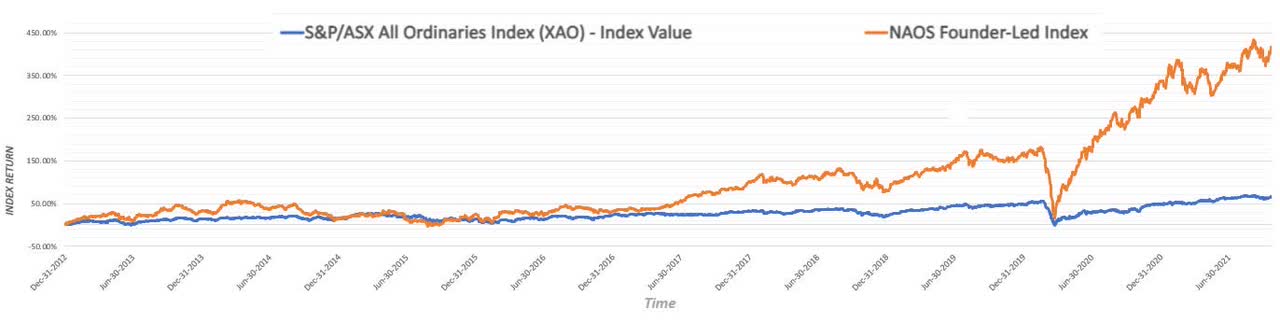

Good management is crucial for microcaps, particularly startups, because absent good management it is unlikely that a microcap will survive. The criteria that I use to evaluate microcap management include having a clear vision, a roadmap, and execution. Extra credit goes to founder-led companies as they tend to outperform ordinary companies.

Founder owned businesses beat the market (LiveWire)

FiscalNote is led by Co-founder and CEO Timothy Hwang who along with the management team has established and executed a clear strategy as described above. How Mr. Hwang came to gain his perspective in the world of politics is of interest here. He became involved as a teenager living in the Washington, DC area, working as a volunteer for several political candidates including Barack Obama in 2007. The following year, Mr. Hwang was elected to serve in the Montgomery County, Maryland Board of Education.

Mr. Hwang received his education in computer science at Princeton and was accepted to Harvard Business School, which he did not attend. Instead, he co-founded FiscalNote, wanting to use his computer skills to help make politics more efficient from what he experienced as a campaign worker and public official in D.C. He co-founded FiscalNote at the age of 21 in 2013 along with his high school friends, Gerald Yao, and Jonathan Chen. The founders used a Motel 6 room in Sunnyvale, California as the company’s first headquarters where they worked round the clock to create the company’s initial product, follow funding, and attract initial clients.

Mr. Hwang obtained the uphold of Mark Cuban through a simple email. Mr. Cuban went on to become a direct investor along with Jerry Yang, providing seed money of $1.3 M to fund the creation of new products. From there, FiscalNote was able to attract other investors and land a listing on the NYSE through a merger with Duddell Street Acquisition Corp, a special purpose acquisition company (“SPAC”)

A full listing of management and the board of directors can be found here.

Ecosystem

Microcaps must partner with industry giants as early as possible to succeed in gaining market acceptance. The Big Brothers help small companies establish credibility and offer enhanced customer acquisition opportunities, while the larger company is provided with access to innovation that the small company offers. From Better Together: Making Magic Between Big Companies and Startups:

When rising startups and big companies combine resources, they can experience the best of both worlds in terms of innovation and clout, complementing each other’s strengths and weaknesses.

FiscalNote has an established ecosystem by partnering with industry giant Google’s

(GOOG) launch of Bard, a conversational AI chatbot, and with equally gigantic Microsoft’s (MSFT) application of AI to its explore engine Bing.

FiscalNote was chosen as one of 14 original partners by Open AI as the sole provider of political and regulatory data for its Chat GPT platform and the application of Chat GPT to FiscalNote’s Voter Voice, perhaps the only advocacy solution offered with AI enhancement.

Databricks selected FiscalNote as one of the original partners in its Marketplace for data analytics and AI.

Oxford Analytica, a daily brief on global politics produced by FiscalNote for its clients, is available on the Bloomberg terminal. Oxford Analytica has been providing daily reports since 1984 and was acquired by FiscalNote in 2021,

FiscalNote partners with Peraton for its Predata solution which monitors market changes for risk and supply and demand changes.

The company’s product for risk detection and supply chain monitoring for financial institutions, Risk Connector, is offered through its partnership with True Digital, a technology provider for banks.

Financial

There are about 129 million shares. The company is considered a micro-cap due to its market cap being $247 M. Last reported the company had about $24 M in cash and $243 M in debt. The EV is $387 M.

Insiders have skin in the game owning about 8% of the shares and institutions own about 43% of the shares. It is not common to find large institutional interest in micro-cap stocks.

President and COO Josh Resnik has been selling stock to offset taxes on his employee stock options (“ESO”).

Annual revenue growth has averaged almost 20% over the last three years with recurring revenue topping $120 million and an annual run rate exceeding $140 million. Gross margins are about 80%. The company recorded its first positive adjusted EBITDA report for Q3 2023 as stated by the CEO on the earnings call:

On today’s call, we will review our third quarter results which mark our first quarter of adjusted EBITDA profitability. This is a tremendous milestone for the company. A year ago, we committed to adjusted EBITDA profitability, and that is exactly what we’ve delivered. In fact, we’ve delivered this one quarter earlier than we originally forecast, even amidst the more challenging macroeconomic environment. If you look at where we were when we began this year, we’ve essentially shifted our adjusted EBITDA from minus $7 million per quarter loss in Q1 to positive adjusted EBITDA in Q3. This is an annualized improvement of over $30 million in adjusted EBITDA, as compared to where the company started this year in Q1. We have been laser focused on this milestone, and we are delighted to accomplish it ahead of initial expectations.

I use Price-to-sales as a good comparison tool for companies that aren’t profitable. NOTE sells at a P/S of 1.8, a steep discount to its peer group P/S of 9.7.

Six analysts offer coverage on NOTE with an average price target 200% higher than the current market price. It is rare to find six analysts offering coverage on a microcap stock.

Risks and Concerns

The amount of shares outstanding has more than doubled from 61 million to 137 million since the IPO, but despite the dilution, losses have narrowed from $19.80/share to a loss of $0.81/share. This is something to monitor because the company has insufficient funds to carry out its operations over the next 12 months as well as lacking funds to continue on its acquisition growth strategize. The company is almost certain to do a capital raise very shortly. Continued success in reducing losses to offset share count dilution is the formula for profitability that will attract investors.

Management set a goal of attaining positive adjusted EBITDA and reached that goal a quarter ahead of arrange. I am a bit concerned about the lack of forward guidance or discussion from management on reaching positive free cash flow.

I share Warren Buffett’s opinion on EBITDA:

It amazes me how widespread the use of EBITDA has become. People try to dress up financial statements with it. We won’t buy into companies where someone’s talking about EBITDA. If you look at all companies and split them into companies that use EBITDA as a metric and those that don’t, I suspect you’ll find a lot more fraud in the former group. Look at companies appreciate Wal-Mart, GE, and Microsoft — they’ll never use EBITDA in their annual report.”

In all fairness, when I asked CEO Hwang about this concern during a recent conversation, his response was “The first goal was positive EBITDA, and attaining that, free cash flow will follow.” Hopefully, we will acquire guidance on attaining free cash flow profitability when the 2024 guidance is released.

FiscalNote competes against much larger data management companies that have much greater resources, such as Bloomberg, that could execute to offer competing products.

Conclusion

The company has grown to be the dominant market share player in the political, regulatory, and legislative data industry, serving over 5000 customers in over 80 nations. The customers include major political bodies, government agencies, and some of the world’s largest companies. All sticky customers on recurring revenue SaaS contracts.

FiscalNote has established credibility by being selected to partner with the industry giants and offers the only SOC 2 Type 2 certification in its field. Management has successfully executed its strategy of growth by developing and introducing new organic products, acquiring smaller companies, and implementing its land and expansion strategies.

The stock price has declined severely since the company became a public entity. The stock now trades at a discount to its peer group, and should rerate as the company continues to scale and management turns its attention to positive free cash flow.