CHUNYIP WONG

Introduction

First Citizens BancShares Inc. (NASDAQ:FCNCA) (OTCPK:FCNCB) is a holding company that owns First Citizens Bank, an entity that renders a broad range of financial services for consumer and commercial clients across 600 branches in the US.

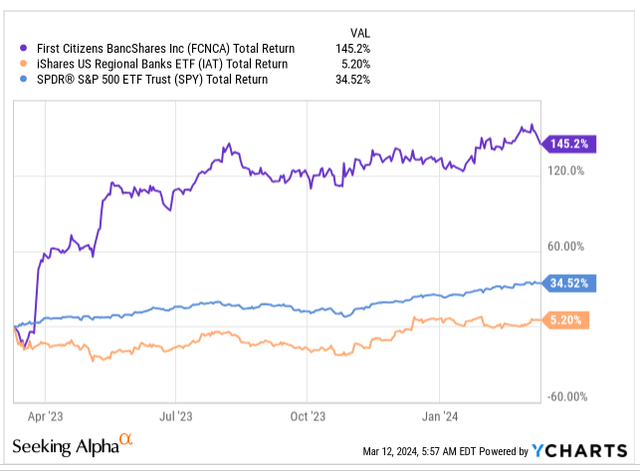

Over the past 12 months, the FCNCA stock has managed to generate an outstanding alpha of over 4x the return threshold of the US benchmark. FCNCA’s exemplary performance is magnified even further when you juxtapose it against its regional banking peers, which have only managed to eke mid-single-digit returns during the same period.

After this long haloed period, we think the degree of outperformance may well fade. Having said that, we don’t also expect the FCNCA stock to fall off a cliff, as there are still quite a few favorable sub-plots. Nonetheless, here’s a mixture of good and bad themes supporting our neutral stance on the stock.

Key Factors Driving The Neutral Stance

Towards the end of Q1 last year, FCNCA agreed to take over the beleaguered Silicon Valley Bank (SVB), which ended up catapulting the former to the top 15 US banking rankings. Given the enhanced asset base that FCNCA would be dealing with going forward, it was perfectly acceptable that we saw an expansion in the market cap of the stock, but a fair few may certainly question if the degree of re-rating may have gone a bit overboard. For context, note that FCNCA’s asset base has nearly doubled on a YoY basis (95.6% to be precise), over the past year, but at the same time, we’ve seen the market-cap expand by a much larger cadence of 144%.

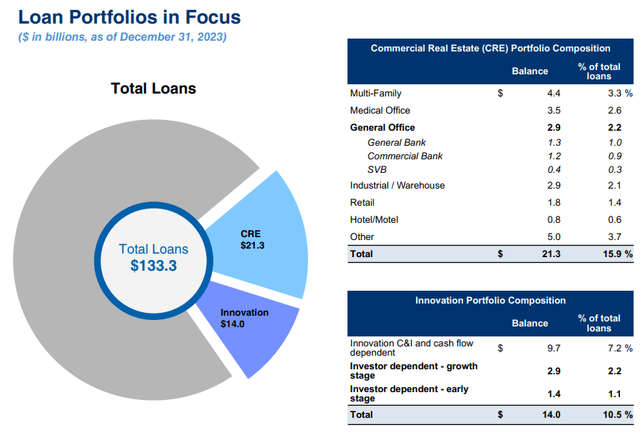

Granted, the SVB portfolio provides FCNCA with fresh exposure to the innovative economy such as tech and healthcare, but as things stand, appetite for new funding here remains weak, and management suggested this trend could continue through 2024. The SVB segment is also being weighed down by low activity levels in private equity and venture capital.

Looking even beyond the SVB segment to include FCNCA’s portfolio, one can’t get too excited. Management suggested that in Q1, loan growth would likely only come in flat to modestly higher, but even for the FY loan growth will only come in at mid-single digits.

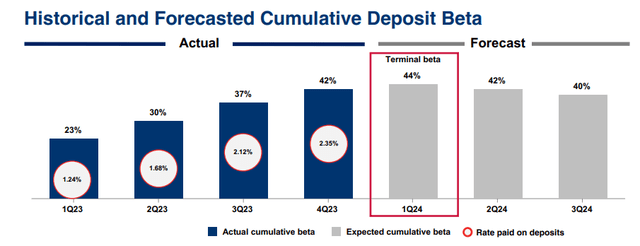

Then, note that after peaking in Q3, FCNCA’s net interest income (NII) profile appears to be on the way down (4% sequential decline in Q4) as the inimical impact of deposit betas plays a part. At the start of last year, FCNCA was only paying a rate of 1.24% on its deposits, but by the end of the year this had surged to 2.35%. Expect further pressure in Q1, as the deposit beta is expected to grow by another 2% and hit 44%.

Moving away from net interest income, to the non-interest income side, it’s heartening to note that the company is involved in various activities that are contributing well over half a billion every quarter, but even here, you have a trend of sequential declines.

Fair value-related adjustments on client derivative positions are likely to be quite volatile every quarter, but going forward, one aspect of the non-interest income side that could cause some pressure is higher maintenance expense and lower utilization levels linked to the leasing business.

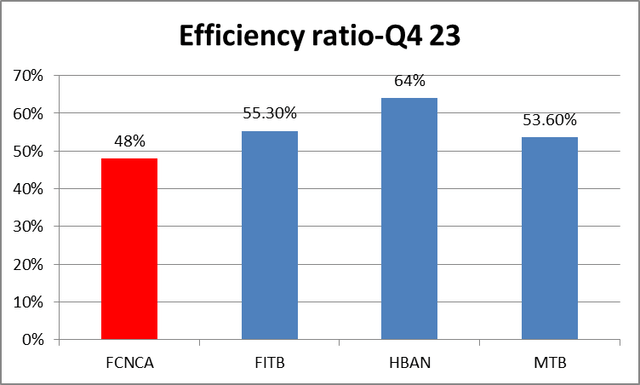

Structurally, FCNCA does very well in managing its costs, and this is captured by its low-efficiency ratio (adjusted), versus other regional banking peers of a similar market-cap threshold. FCNCA has done well to cap this at a low level, despite ramping up project and consulting expenses (which had been deferred from H1) recently. Even in FY24, management believes they can cap the efficiency ratio at the low 50s range, which is quite commendable.

Given the commercial real estate cloud that is floating around, investors may be reluctant to be too gung ho about regional banks (the St. Louis Fed believes that two-thirds of CRE loans are held by regional or community banks), but we feel FCNCA is better positioned on this front. Even though 16% of its loan book comes from commercial real estate, note that the troubled general office segment only accounts for 2% of the loan book.

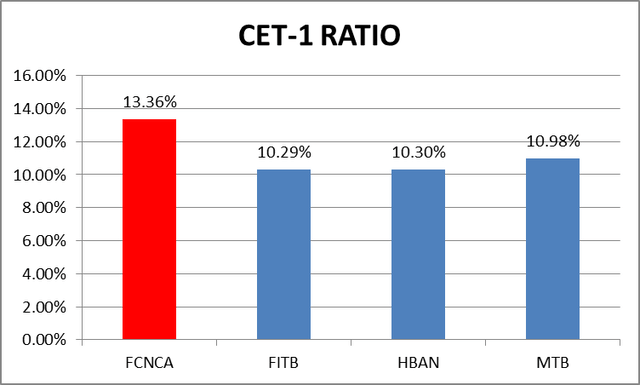

Where FCNCA offers solid merit is on the capital front; its current CET1 ratio stands at a hefty level of 13.36%, well ahead of its peers. This certainly also opens up the prospect of share buybacks, which will likely take place in H2 and could end up supporting the share price.

Closing Thoughts: Technical Considerations

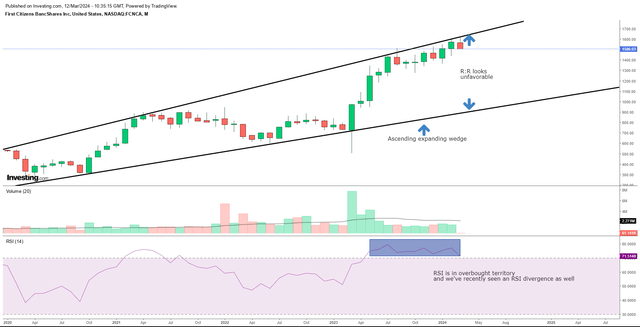

If one looks at the charts alone, it’s hard to get too excited given the current risk-reward on offer. If we consider FCNCA’s monthly price imprints since the onset of the pandemic, it’s rather evident that this stock has been forming an ascending broadening wedge pattern, which points to the onset of bearish hues at peak levels. Note that the price has been hugging the upper boundary for multiple months now, but hasn’t quite been able to break out from there. As things stand, the 14 period RSI indicator is suggesting overbought conditions, even as it looks like we may have had an RSI divergence (a pivot on the direction of the overbought RSI, even as the price hits a peak). All in all, we feel investors would be better served pursuing FCNCA if it pulls away from the upper boundary edge, and trades a lot closer to the lower boundary.

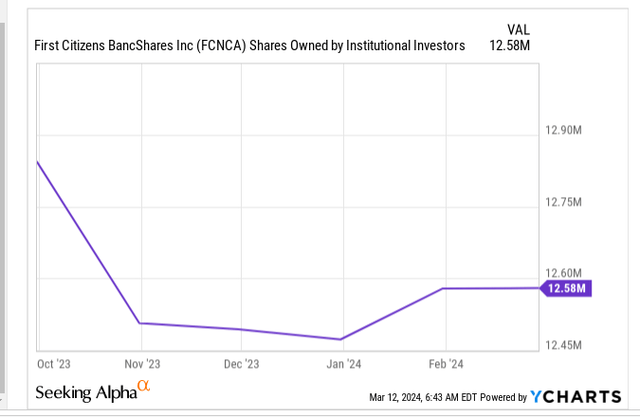

Investors may also want to note that the smart money hasn’t really felt confident enough to participate in the rally over the past 6 months; on a net basis, shares owned by the institutional segment are down by over 2%.

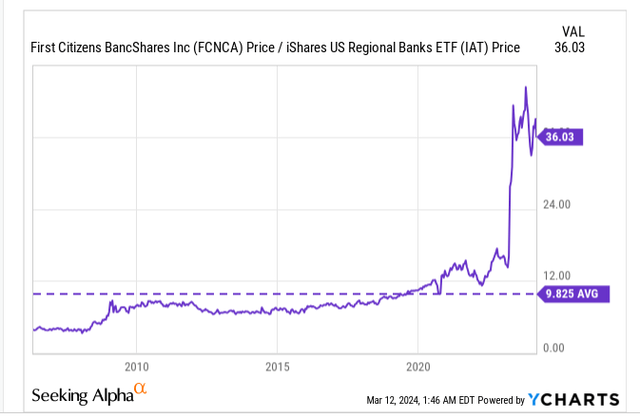

Finally, we also have some concerns over how overbought the FCNCA stock looks relative to other regional banking options. The chart below highlights how FCNCA’s relative strength ratio versus the IAT ETF is now almost 3.6x the level of its long-term average.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.