Richard Drury

Shares of F&G Annuities & Life (NYSE:FG) have been a tremendous performer over the past year, rising over 140% as higher rates and strong investment returns have buoyed its financial performance. On Wednesday, the company reported solid quarterly results, and we have seen modest profit taking in response, given its large run. I last covered FG in November, rating shares a buy. Since then, the stock has rallied about 9%, a solid total return, though this has lagged the market’s 18% rally. I saw about 13% upside in the stock, alongside its 2% dividend for about a 15% total return opportunity. With much of this realized, now is a good time to revisit FG. I continue to be bullish.

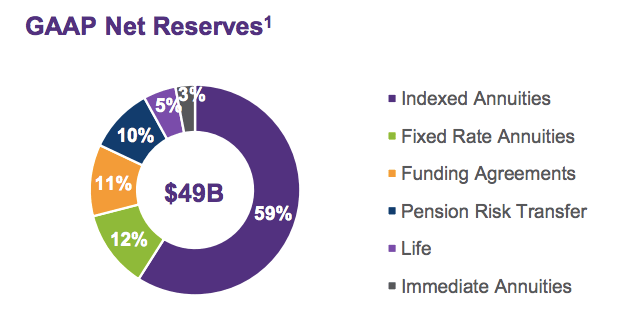

In the company’s first quarter, F&G earned $0.86 in adjusted EPS as revenue rose 4% from last year to $2.3 billion. EPS were up 76% from last year even with a 4% increase in the share count as it has issued equity to facilitate its strong sales growth. Given the strength in financial markets alongside sales activity, the company’s AUM net of reinsurance rose by 10% from last year to $49.8 billion. One blemish during the quarter was that alternative investments underperformed expectations by $52 million at $100 vs $152 million. It assumes a long-term return of 10% and this was just below 7% (not a bad return), though they can be volatile quarter to quarter.

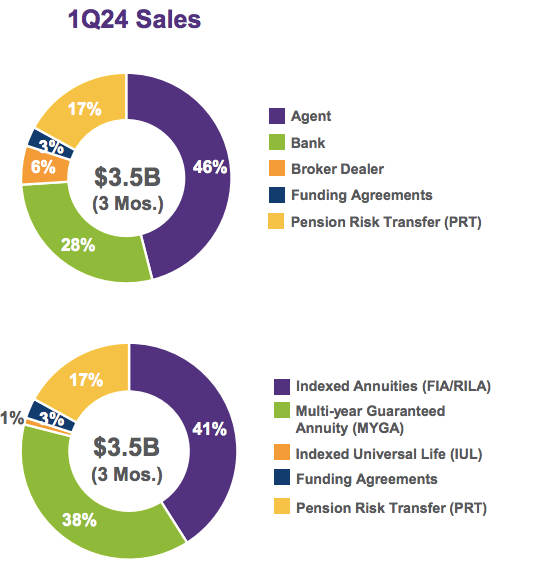

The elevated interest rate environment has increased investor demand for annuities as they seek to lock in yields, and FG has been a beneficiary of this trend as gross sales rose by 6% to $3.5 billion. Retail gross sales were $2.8 billion with institutional $0.7 billion, led by strength in pension risk transfers. Many corporate pensions are now fully funded, given the strong stock market and higher rates, which has increased PRT activity to insurers.

Over time, F&G has increased the diversity of its channels and products. Whereas it used to sell almost entirely through agents, that is now less than half of the business, with strong sales through banks and to pensions. Indexed annuities remain the largest share of its business, but total PRT activity has now surpassed $5 billion.

F&G

F&G does not sell extremely complex variable annuities, focusing on easier to model indexed annuities (FIA) and similar products. FIA values are up to $27.9 billion of its AUM. In Q1, fixed index annuity deposits were strong at $1.4 billion. Indexed annuities remain the majority of its reserves, but pension risk transfers continue to rise.

F&G

Alongside strong inflows, terminations are elevated at $804 million from $501 million a year ago, which has limited AUM growth. Higher rates have led to more surrendering as investors close out of policies when rates were lower to enter more favorable contracts. This activity has both positives and negatives for FG. There has been an increase in surrender fees, as policyholders typically pay a penalty to cash out, and these policy closures free up capital to use elsewhere on new business. On the other hand, it does lose lower funding-cost policies.

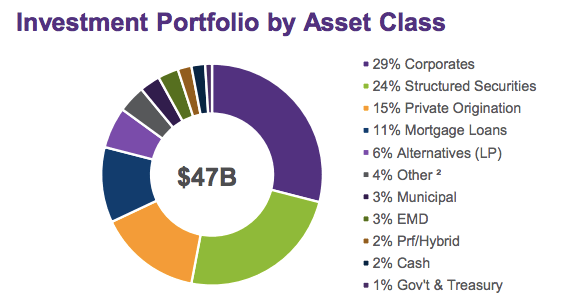

Still, given the demand for annuities, F&G is enjoying wide spreads on its insurance portfolio. The portfolio earned a yield of 5.29% vs a cost of funds of 2.93%. Thanks to limited credit losses, its Q1 return on assets of 1.25% exceeded its 1.1% forecast. I view F&G as a company that maintains fairly standard insurance offerings but runs a more aggressive investment portfolio. This is in some ways the opposite of companies like Brighthouse (BHF) and Jackson Financial (JXN), which carry legacy complex variable annuities but more conservative investment portfolios. As such, I view F&G as less likely to have a significant underwriting problem, but the bigger question is how investment returns would hold up in a downturn. I would note still 96% of the portfolio is investment grade.

F&G

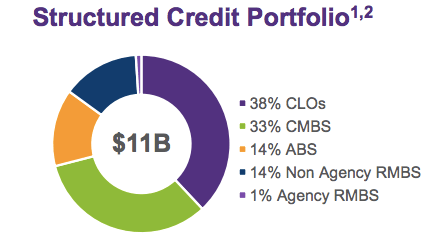

With Blackstone (BX) managing much of its portfolio, F&G has a significant allocation to structured products, about 25% of its portfolio. These products tend to be more complex and also less liquid. This lack of liquidity can lead to more volatility in mark-to-market movements. Importantly, as an insurance company with long-dated liabilities, F&G is highly unlikely to be a forced seller and can ride out volatility, holding securities to maturity. Because it is unlikely to need to access liquidity, it has chosen to earn an illiquidity premium in its portfolio.

F&G

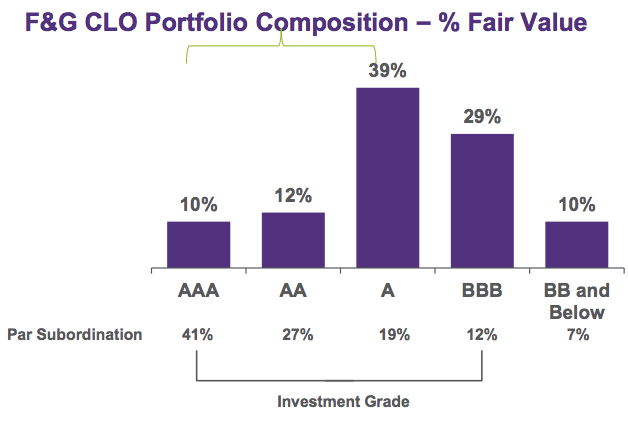

I believe this is reasonable. I would be more concerned if a bank had this portfolio, as deposits can leave at any time. F&G has less liquid liabilities, and so it can afford to have a less liquid set of assets. Still in periods of market turmoil, this fact could pressure the stock. I would note nearly 10% of its portfolio sits in collateralized loan obligations (CLOs). As discussed in my prior article, CLOs are vehicles that own loans to highly-levered companies. Most borrowers are “junk” rated, but CLOs are then tranched with the top tranche having seniority to lower tranches, providing protection against defaults.

CLOs have performed well during past downturns, faring far better than complex MBS securities 2007-2009, given these protections, but in a recession when defaults spike, credit enhancement in these vehicles erodes and junior tranches can face losses. I would note that the majority of its CLO portfolio is rated “A” or higher, which has greater than 19% subordination. As such, we would need to see material defaults and losses on each default before its portfolio faces an impact. Some BB CLOs could face more pressure during a recession, but this is just 1% of the total portfolio. These securities can also have double-digit yields, so even if some face losses, earnings from others can lead to a positive total return for the bucket.

F&G

Additionally, it currently does not appear a recession is likely in my view, which eliminates near-term risk. Currently, F&G has been over-earning its ROA target in part because credit losses have been persistently below budget given the low default environment. As such, I do see risk if economic conditions worse that we see returns decline closer to target, but given structural protections in its portfolio, I do not expect to see net losses.

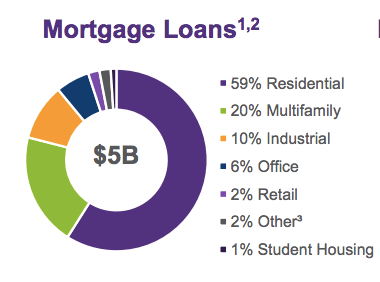

Just over 10% of its portfolio is in commercial real estate, a relatively small allocation. This portfolio is also largely residential, and with home prices having risen substantially, these loans have meaningful equity cushions. Just 6% of its real estate exposure or less than 1% of its total portfolio is in office, the sector I am most concerned about. This is a very small allocation, and so any losses will be manageable. I see greater risk of commercial real estate losses than corporate default losses, and so I view this portfolio construction favorably.

F&G

F&G also maintains a solid balance sheet. It has a debt to capital of 24% with $1.76 billion of debt, in-line with its 25% target. In January, it sold $250 million of 6.875% mandatory $50 convertible preferred stock to Fidelity (FNF), its majority shareholders, in January to support growth. These convert by January 2027. Given the current environment and strike price, this is fairly attractive financing. In Q1, F&G earned an 11% adjusted return on equity based on its $41.10 book value excluding accumulated other comprehensive income. On a more normalized alternative investment basis, F&G earned about $4.60 annualized in Q1. Ongoing sales growth is a further tailwind to earnings, though I also expect over time there will be some credit loss degradation, just given how low losses are currently. As such, I see run-rate earnings of $4-4.20. I view shares trading below book value and for just under 10x earnings as attractive, given its wide investment spreads and the fact it takes more liquidity risk than true credit risk.

Given perceived risk around its asset portfolio, shares likely can only trade modestly above book value. But with a double-digit ROE and strong premium growth, I can see shares move to about 1.1x book value, given its relatively low cost liabilities, providing upside to ~$45 or about 11x earnings. That provides a further ~12% upside alongside its 2% dividend. As such, I remain a buyer of F&G. Given its current valuation, it is not a stock likely to generate the same returns going forward as in the past, but it can still provide low double-digit returns for investors.