Bet_Noire

The First Trust Enhanced Equity Income Fund (FFA) is a closed-end fund that income-focused investors can use to achieve their goal of producing a high level of current income from the assets in their portfolios without the need to sacrifice the upside potential of common equities. As is the case with most funds that describe themselves as “enhanced equity” funds, this one accomplishes that goal by employing a covered call-writing strategy against the common stocks that it holds in its portfolio. Unfortunately, the fund’s current 7.01% yield is not nearly as high as some of the other funds that employ this strategy. We can see this here:

|

Fund |

Current Yield |

|

First Trust Enhanced Equity Income Fund |

7.01% |

|

BlackRock Enhanced Equity Dividend Trust (BDJ) |

8.56% |

|

BlackRock Enhanced Capital & Income Fund (CII) |

6.33% |

|

Eaton Vance Enhanced Equity Income Fund (EOI) |

7.90% |

|

Eaton Vance Enhanced Equity Income Fund II (EOS) |

7.35% |

|

Madison Covered Call & Equity Strategy Fund (MCN) |

9.94% |

As we can see, the First Trust Enhanced Equity Income Fund has a lower current yield than any of its peers except for the BlackRock Enhanced Capital & Income Fund. As such, it may be somewhat less appealing to investors who are seeking a very high level of income than some of these comparable funds. There are a lot of reasons that could cause the fund’s yield to be lower than that of its peers though, some of which could actually improve the fund in the eyes of some investors. For example, if the fund is overwriting a lower percentage of its portfolio than peers, that would cause its premium income to be lower, but would also cause the fund to have more upside exposure from the common stock portfolio. As such, we should investigate the fund closely in order to determine whether the lower yield relative to peers is a real problem or not.

At first glance, the performance of the First Trust Enhanced Equity Income Fund is likely to be somewhat underwhelming. As we can see here, the shares of the fund are up 3.34% over the past three years. This compares very poorly to the 25.85% gain that the S&P 500 Index (SP500) delivered over the same period:

However, this is exactly what we would expect from a covered call fund. One of the defining characteristics of these funds is that they sacrifice the upside potential of the securities that are in their portfolio and receive a much higher level of income in return. The fund then pays this income out to its shareholders, which is why it has a far higher yield than the scant 1.39% of the SPDR S&P 500 ETF Trust (SPY). As such, we should incorporate these payments into any analysis of the fund’s returns. When we do that, we see that the First Trust Enhanced Equity Income Fund actually beat the S&P 500 Index over the past three years, albeit not by very much:

This is also exactly what we would expect from a fund such as this. Generally speaking, a covered call-writing strategy will outperform during bear or flat markets and underperform during raging bull markets. This gave this fund an advantage over the index in the 2022 bear market. It also is something that could be valuable today, as there are numerous concerns emerging that the market will not be able to hold onto its recent gains. After all, the market’s rate cut expectations essentially require a very severe recession and it is difficult to see how stocks can hold onto their recent gains if the economy does plunge into a recession. On the other hand, it is also hard to see how stocks will hold onto their recent gains if the economy avoids a recession and the Federal Reserve does not cut rates to the degree that the market expects. As such, it may be a good idea to use a fund like this as a way to reduce the overall volatility that may be coming in the near future.

About The Fund

According to the fund’s website, the First Trust Enhanced Equity Income Fund has the primary objective of providing its investors with a very high level of current income and current gains. This makes a lot of sense considering that the fund is generally employing a covered call-writing strategy, as explained in the introduction. Naturally, the website explains the fund’s objectives and strategies in more detail:

First Trust Enhanced Equity Income Fund is a diversified, closed-end management investment company. The Fund’s investment objective is to provide a high level of current income and gains and, to a lesser extent, capital appreciation. The Fund pursues its investment objective by investing in a diversified portfolio of equity securities. Under normal market conditions, the Fund pursues an integrated investment strategy in which the Fund invests substantially all of its Managed Assets in a diversified portfolio of commons stocks of U.S. corporations and U.S. dollar-denominated equity securities of non-U.S. issuers in each case that are traded on U.S. securities exchanges. In addition, on an ongoing and consistent basis, the Fund writes (sells) covered call options on a portion of the Fund’s Managed Assets. “Managed Assets” means the total asset value of the Fund minus the sum of the Fund’s liabilities, including the value of the call options written (sold).

This is a very similar strategy to the one employed by various other funds that we have discussed in previous articles in this column. Most of them are mentioned in the table that is provided in the introduction. Basically, the fund’s goal is to write call options against the common stocks that it contains in its portfolio. This provides the fund with synthetic dividends from the option premiums, which in the case of certain stocks can be very high. For example, as I showed in a recent article, this strategy is basically able to convert Microsoft (MSFT) into a double-digit yielding dividend stock. That is certainly better than the 0.77% yield that Microsoft currently possesses. The unfortunate downside to this strategy is that the fund has to sacrifice any upside above the strike price of the written options, which is why the strategy underperforms during raging bull markets. It does reduce the volatility of the overall fund though and can therefore be a very appealing strategy for those investors who want to reduce their risks and earn a bit of extra income. The fund only has 67.09% of its portfolio overwritten with call options though, but it does not disclose what percentage of its call options are currently in-the-money. We can still see though that the fund has not given up all of its upside potential, so it still has some opportunities to earn more capital gains if the current bull market run continues for a few more months.

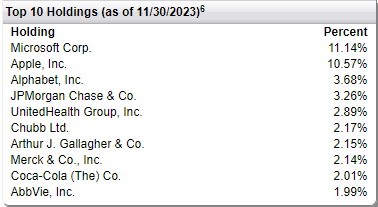

Many of the largest positions in the First Trust Enhanced Equity Income Fund are similar to what we have seen in numerous other domestic common stock funds. Here they are:

First Trust

Microsoft, Apple (AAPL), Alphabet (GOOG), and JPMorgan Chase (JPM) are almost always found among the largest positions in most domestic stock funds. These are all among the largest companies in the world by market cap and are major constituents of most American large-cap indices. For example, here is the weighting of each of these companies in the S&P 500 Index:

|

Company |

S&P 500 Index Weighting |

|

Microsoft |

7.19% |

|

Apple |

6.77% |

|

Alphabet |

3.89% |

|

JPMorgan Chase |

1.23% |

UnitedHealth Group (UNH) is another company that we frequently see among the largest positions of most domestic common stock funds, but its presence is not nearly as universal as the other four. The fact that these four companies are among the fund’s largest positions does somewhat reduce this fund’s ability to improve the overall diversity of an investor’s portfolio. This is particularly true in the case of Microsoft and Apple, which account for enormous positions in this fund. After all, if every fund is holding these stocks among the largest positions in their portfolios, then just about every investor is likely to already have a great deal of exposure to these companies and adding this fund will not change that fact. Fortunately, the remaining five companies – Chubb (CB), Arthur J. Gallagher & Co. (AJG), Merck & Co. (MRK), The Coca-Cola Company (KO), and AbbVie (ABBV) – are somewhat less common holdings among closed-end funds so that is nice to see.

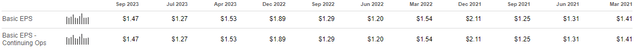

With that said, the presence of three of the mega-cap technology stocks does make a certain amount of sense considering the fund’s strategy. Microsoft, Apple, and Alphabet are all pretty good stocks to write covered call options against as the premiums are fairly high and can easily result in double-digit yields annually. That obviously provides the fund with a respectable level of income, which can then be distributed to the investors. However, I would still prefer to see the Microsoft and Apple positions scaled back as the fund’s investors may prefer not to be exposed to the company-specific risks involved with those two companies, but their current positions are so large that they might end up dragging the entire fund down with them if something causes the stock price to decline. Apple, in particular, could be a concern as it has been struggling to grow its net income in recent quarters. As we can see here, the company’s net income has basically shown no growth over the past two years:

The share buyback has not helped, as the company’s earnings per share has also shown essentially no growth over the period:

The stock price appreciation that we have seen over the past two years has been almost entirely driven by multiple expansion, and that may not be sustainable. As such, the fact that this fund has 10.57% of its assets invested in Apple’s common stock could be a very real risk that many of the risk-averse income-focused investors that tend to be interested in a fund like this may not be comfortable assuming.

Rate Cut Expectations And The Market

As mentioned in the introduction, most of the major American domestic equity indices have delivered enormous gains over the past three months due to expectations that the Federal Reserve will aggressively cut interest rates this year. For example, the S&P 500 Index is up 9.38% over the past three months:

The narrative that has been offered to explain this is that the market is anticipating that the monetary tightening stance that the Federal Reserve adopted to combat the incredibly high inflation that the economy experienced in 2021 and 2022 will soon be relaxed. In fact, as of right now, the fed funds futures market is anticipating six or seven 25-basis point cuts over the next eleven months.

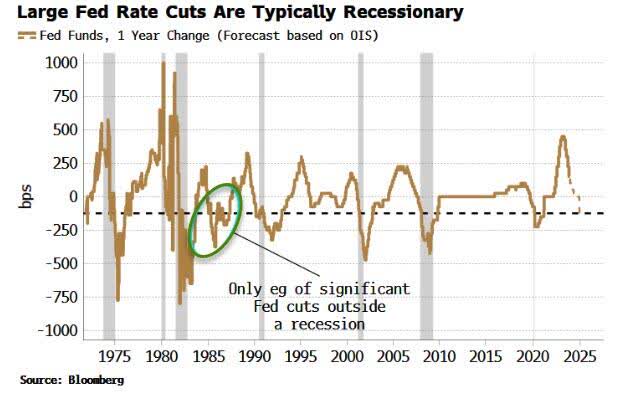

As Simon White, Bloomberg’s macro strategist points out, the only realistic way that the Federal Reserve will be able to cut interest rates to that degree is if the economy falls into a very severe recession in the next two or three weeks. In his article, he provided this chart that shows the Federal Reserve’s rate changes by year:

Zero Hedge/Data from Bloomberg

As we can see, there has only been one time in history that the Federal Reserve has cut interest rates by more than 125 basis points in the absence of a recession. Thus, the current expectations essentially require a recession in order to be justified. It is very hard to see how stocks will hold onto their current valuations if such a recession hits. After all, recent recessions have seen the unemployment rate easily surpass 10%, which would obviously pummel stock valuations in an economy that is as heavily dependent on consumer spending as the American one is. Recent job reports do not support such a near-term deterioration of economic conditions at any rate.

As such, the market appears to be assuming a “Goldilocks scenario” in which inflation is rapidly beaten and the Federal Reserve can quickly reduce interest rates without reigniting inflation. That seems unlikely, especially since the inflation report last week showed no signs of progress at beating inflation. Indeed, it showed the opposite and that a lot more work still needs to be done on that front.

The point with respect to this fund is that stocks may be due for a near-term correction. As we have already seen, this fund tends to outperform during market corrections so it may be appealing for investors to hold right now. However, the fund itself will still be affected by such a correction, just not as much as an S&P 500 Index fund would be. This is because the option premiums that the fund receives offset some, but not all, of the stock price declines. The fund’s outsized exposure to Microsoft and Apple could hurt it too, since those stocks are somewhat more interest-rate sensitive than low-duration stocks such as those in the energy or healthcare sectors. As such, this fund might not offer as much protection from a market decline as the BlackRock Enhanced Equity Dividend Trust, which tends to hold stocks that are somewhat less sensitive to interest rates.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the First Trust Enhanced Equity Income Fund is to provide its investors with a very high level of current income and current gains. In pursuance of that objective, the fund invests its assets in a portfolio of common equities and then writes call options against some of its positions, with the goal that the options expire worthlessly and it keeps the option premiums as income. If successful, the option premiums act much like synthetic dividends, and the yields can be quite high. The fund also collects dividends from the common stocks in its portfolio, but as it is investing in American common equities, the yield from this is not especially high. The premium income should more than offset that though, and overall result in the fund earning a significant amount of income as a percentage of its total portfolio value. The fund collects the profits that it makes from these two sources and adds any capital gains that it manages to realize to the profits, then pays this money out to its shareholders. We can probably assume that this would give the fund’s shares a very respectable yield themselves.

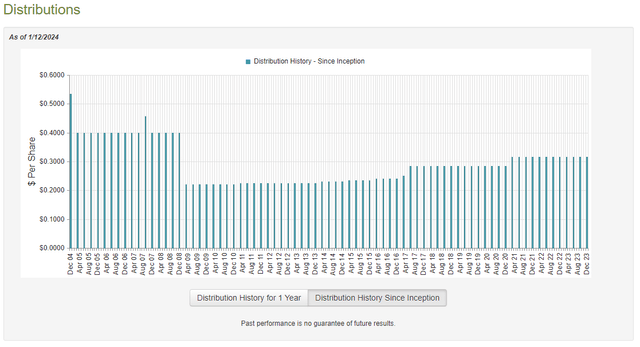

This is certainly the case, as the First Trust Enhanced Equity Income Fund pays a quarterly distribution of $0.3150 per share ($1.26 per share annually), which gives it a 7.01% yield at the current price. As mentioned in the introduction, this is a lower yield than many other covered call funds possess, but it is still higher than many other things in the market today. The fund has proven to be reasonably consistent and reliable with its distribution though, as it has generally grown it over the past fifteen years:

While the fund did have to cut its distribution following the 2008 Financial Crisis and the recession that accompanied it, so did just about every other closed-end fund in the market so we can somewhat overlook that. The fact that the fund has been increasing its distribution since then does set it apart from peers though, as it is one of the few closed-end funds that has managed to accomplish that feat. It is also nice because the rising distributions help to offset some of the impact that inflation has had on our purchasing power over the years. However, we do still want to take a look at the fund’s finances in order to determine how sustainable its current distribution is likely to be, as the fact that it has been able to accomplish a feat that few other funds have been able to does beg some questions.

Unfortunately, we do not have an especially recent document that we can consult for the purposes of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. As such, it will not include any information about the fund’s performance over the past six or seven months. This is disappointing as the market has been quite volatile over that period. After all, during the summer of 2023 we saw the market price of most assets decline as investors began to come to terms with the very strong possibility that monetary conditions are going to be tighter than we have seen in a generation for quite some time. That changed in October when various market participants started pushing up the prices of all assets in anticipation of a near-term monetary policy pivot by the Federal Reserve. The first of these two disparate environments may have resulted in the fund taking some losses as the value of the common stock portfolio declined, although the option premiums should have partially offset this. During the most recent quarter, the fund certainly had the potential to realize some capital gains as stock prices shot up. The most recent report will unfortunately not give us any idea of how well the fund managed to perform in either environment. We will need to wait for the annual report to be released in order to get that information, which might be another month or two away. As such, we have to go with what we currently have available to us.

During the six-month period, the First Trust Enhanced Equity Income Fund received $3,457,510 in dividends and $59,412 in interest from the assets in its portfolio. We subtract out the foreign withholding taxes that the fund had to pay, which results in it having a total investment income of $3,501,513 during the period. The fund paid its expenses out of this amount, which left it with $1,517,146 available for shareholders. As might be expected, that was nowhere near enough to cover all of the distributions that the fund paid out over the period. The First Trust Enhanced Equity Income Fund paid its investors a total of $12,592,494 in distributions over the six-month period. At first glance, this might be concerning as the fund clearly does not have sufficient net investment income to cover its payout.

However, there are other ways through which the fund can earn the money that it needs to cover the distributions. In particular, the fund might have been able to realize some capital gains from the equity portfolio that can be distributed. In addition, a sizable percentage of its overall income comes from the premiums that it receives from the call option-writing strategy. Neither realized capital gains nor option premiums are considered to be investment income for tax or accounting purposes, but obviously, they do result in the fund receiving money that can be paid out to the investors.

Fortunately, the fund did have a great deal of success at earning money from these alternative sources. It reported net realized capital gains of $16,483,153 and had another $24,522,718 in net unrealized capital gains over the period. Overall, the fund’s net assets increased by $29,930,523 after accounting for all inflows and outflows during the period. Thus, this fund clearly managed to fully cover its distributions and still had a substantial amount of money left over. The fund had no real trouble covering its distributions over this period and it does not appear that we need to worry very much about it right now. The fund should not be at risk of a distribution cut.

Valuation

As of January 12, 2024 (the most recent date for which data is currently available), the First Trust Enhanced Equity Income Fund has a net asset value of $18.81 per share but the shares currently trade for $17.97 each. That gives the fund’s shares a 4.67% discount on net asset value at the current price. This is a larger discount than the 2.51% discount that the shares have had on average over the past month. Thus, the current price appears to be quite reasonable.

Conclusion

In conclusion, the First Trust Enhanced Equity Income Fund is a decent covered call closed-end fund that provides investors with a method of earning a high level of current income without needing to fully sacrifice the upside potential of investing in common equities. Unfortunately, this fund is somewhat disappointing in terms of its diversification as it has very substantial exposure to two large technology companies that might be at risk in the event of a market correction. When this is combined with the fund’s lower yield relative to some of its peers, I am hesitant to recommend that investors buy it today even though the fund should hold up a bit better than the market as a whole in the event of a near-term correction. As such, a hold rating seems appropriate as it is still a good fund and there is no reason to recommend selling it.