Chonlatee Sangsawang

The year 2023 ended with a surprise!

Real GDP growth for 2023, year over year, came in at 3.1 percent.

How good was this?

Well, U.S. growth during the 2010-2019 period only averaged 2.4 percent.

And, the Federal Reserve has taken on the monetary posture of quantitative tightening since March 2022. What is going on here?

I have been trying to explain this situation as one of excessive Federal Reserve ease in the past leading to the existence of a substantial amount of liquidity in the banking and financial system.

The quantitative tightening on the part of the Federal Reserve has kept markets calm in the face of the large amounts of money supporting current banking and financial markets.

Bank profits, on the whole, remain very strong and the stock market is hitting new historical highs. This is in spite of the quantitative tightening and the fact that the Fed’s policy rate of interest has risen by over 500 basis points.

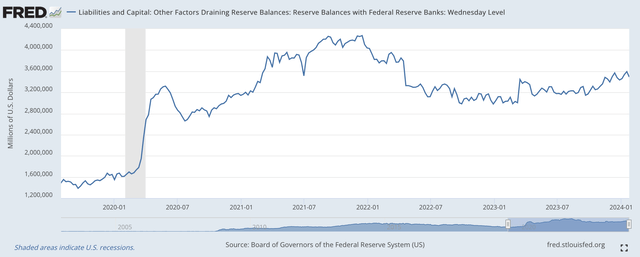

Some picture of this excessive liquidity can be picked up by looking at the balance sheet of the Federal Reserve.

Currently, the commercial banking system holds about $3.5 trillion in reserve balances with the Federal Reserve. As I have often argued, these can be considered to be the excess reserves of the banking system.

If we look at the statistics on the banking system as a whole we see on the Fed’s H.8 that commercial banks in the United States held $3.6 trillion in Cash Assets during the banking week ending January 17, 2024.

Believe me, there is lots and lots of money floating around in the banking…and financial…system at this time.

But, one can see that these excess reserves did not enter the banking system just recently.

Reserve Balances with Commercial Banks (Federal Reserve )

Four periods can be noticed in this chart.

The first part of the chart shows where “Reserve Balances” rested before the Federal Reserve began is major efforts to fight off the problems being created by the Covid-19 pandemic and the short recession that followed it.

How aggressive did the Fed become?

Well, I think you can get a pretty good idea of just how aggressive the Federal Reserve was during this short period of time.

The Fed continued to oversee the rise in the “excess reserves” in the banking system. The monetary easing continued on through until March 2022.

We are now in the fourth period, the period of monetary tightening.

As can be seen, however, the “excess reserves” in the banking system did not decline, even though the Federal Reserve went into its period of quantitative tightening.

The Federal Reserve managed the excess reserves in the banking system at this time using reverse repurchase agreements to achieve the results it wanted for the Fed’s policy rate of interest even though the Fed was persistently pursuing its policy of quantitative tightening.

But, look…the excess reserves of the banking system now run around $3.6 trillion

Before the “big splurge” took place when the Fed responded to the Covid-19 threat, the excess reserves of the banking system were below $1.6 trillion.

The maximum, “excess reserves” got above $4.0 trillion, so the quantitative easing has resulted in reducing these funds somewhat.

The point is, however, that lots and lots of cash still is present in the banking system, in the financial system, and in the economy.

Thus the economy has plenty of resources to grow, the stock market has plenty of money to rise, and those that have access to these resources have lots and lots of cash to play around with.

But why aren’t these monies flowing into higher and higher consumer prices?

My belief, as mentioned in last week’s post, is that we have returned to a time more like the 2010s, a period that I talked about credit inflation.

This is the scenario: the federal government does not want to have much inflation around and therefore works to set its policy to keep inflation at manageable levels. And, the investment community works off of this view.

As a consequence, the investment community uses the funds available to drive up asset prices and not consumer prices. This approach I have referred to as the policy of “credit inflation.” The government maintains its stance on consumer price inflation but generates more and more credit to push up credit prices. So consumer prices rise only modestly and stock prices, commodity prices, and other asset prices see much greater advances.

Given all the cash that is around, it would seem as if this credit inflation could continue on for some period of time. That is the economy can continue to grow, unemployment can continue to remain low, and inflation levels can remain at modest levels.

As for the stock market?

The S&P 500 Stock Index is already hitting new historical highs.

One could read the new book by former Federal Reserve Chairman Ben Bernanke and make the argument that this is just the kind of economy that Mr. Bernanke was attempting to achieve. The foundation for this particular picture is one of quantitative easing or quantitative tightening.

In the current situation, the foundation is the smooth, steady approach the Federal Reserve has taken to the securities portfolio. The quantitative tightening now in place was begun more than 20 months ago. No surprises here. The Fed has stated its purpose and has followed up with a steady pattern of support.

Investors should be very happy with the results.