Jordan Lye/Moment via Getty Images

The Federal Reserve still is keeping investors hanging when it comes to the concern over the future path of its policy rate of interest.

This past week, actual inflation came in above the level projected by financial analysts and investors took the U.S. stock markets for a sharp drop.

This drop was reversed the day after. All three major indices posted positive gains on Thursday and the S&P 500 Stock Index hit a new historical high.

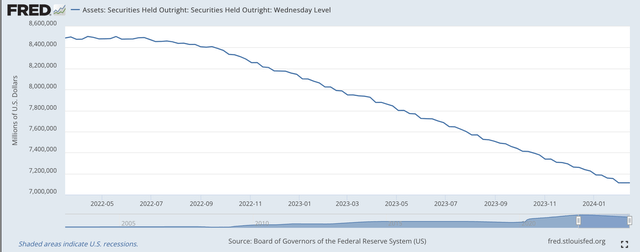

Meanwhile, the Federal Reserve carries on reducing the size of its securities portfolio. Since January 24, 2024, the Fed’s securities portfolio has declined by more than $40.0 billion.

Reserve balances with commercial banks have gone down a little less than $100.0 billion.

The overall summary of this picture is that the Federal Reserve continues to apply its quantitative tightening to the financial system.

Securities Held Outright (Federal Reserve)

Talk about “steady,” the Federal Reserve has been following this policy of quantitative tightening for almost two years now.

Talk about persistence. Jerome Powell and the Federal Reserve have been very, very dedicated to the fight against inflation, The investment community needs to stay focused on what the Fed is doing with respect to its securities portfolio, because it is the foundation of what the Fed is attempting to achieve.

In my estimation the Fed is doing a very good job, but, given all the securities it purchased during the spread of the Covid-19 pandemic and the subsequent recession, it still has a ways to go to reduce the securities portfolio back to levels more consistent with where the U.S. economy is.

But, so far, it is doing an excellent job in reducing the size of its securities portfolio.

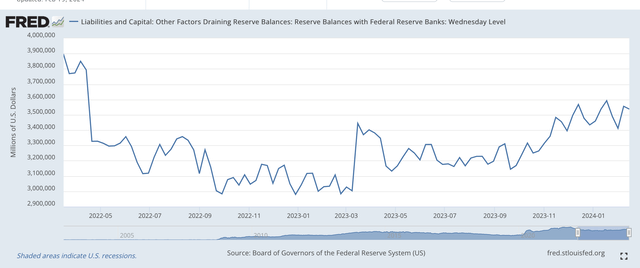

Along with this effort, the Federal Reserve has also managed the reserve position of the commercial banking system. For this, we turn to the movement of Reserve Balances at Commercial Banks. These are often referred to as “excess reserves” in the banking system.

Reserve Balances With F.R. Banks (Federal Reserve)

Here we see that through the first year of the quantitative tightening, “excess reserves” in the banking system declined. This time period was from March of 2022 through March of 2023.

Here the Federal Reserve lowered reduced excess reserves consistent with the Fed’s efforts to raise its policy rate of interest.

In March of 2023, the Fed hit a “bump in the road.” At this time, several banks in the banking system ran into financial problems and the banking system had to be cared for. As a consequence, excess reserves were allowed to rise and the pressures on the banking system decreased.

Excess reserves were allowed to rise during the next twelve months as Federal Reserve officials managed the “tightness” of the banking system through the use of reverse repurchase agreements.

The Federal Reserve continued to reduce the size of its securities portfolio while at the same time, it used reverse repos to manage the “tightness” of the bank’s reserve position. Therefore, it kept the size of the securities portfolio in decline, while at the same time continuing to keep the stability of the banking system under control.

This whole effort allowed the Fed to keep up its foundational policy…reducing the size of its securities portfolio.

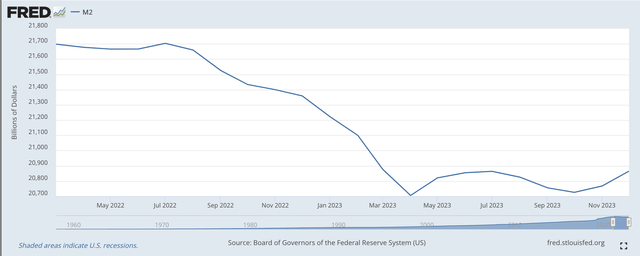

M2 Money Stock (Federal Reserve)

During this time period, the M2 money stock began to decline.

Again, like the Fed’s securities portfolio, the M2 money stock was declining from the major peaks reached during the time the Covid-19 pandemic was spreading and the Fed was fighting these consequences and those of the recession that followed the pandemic.

As can be seen, the decline flattened out in the spring of 2023 and this reflects, to me, the growing stabilization of the financial system and the economy.

I am not that concerned about the decline in the M2 money stock because it reflects to fall off from the peak that was reached as a result of the earlier Federal Reserve action.

The Federal Reserve is keeping “on track” as far as its efforts to follow a policy of quantitative tightening.

I believe that the Fed will continue on with this policy for the near future.

I am not so concerned with where the Fed’s policy rate of interest goes for, to me, this is secondary to what the Fed is trying to achieve.

Furthermore, continuing with this policy will be favorable for the stock market.

As I see it, the next era, the technological era, we are in the early stages of, will be sufficient to drive the financial markets. And, the money is “out there” to support rising markets.

There is still the possibility that there may be “bumps” along the way, but, to me, the overall setting for the near future is a positive one, set up by the actions of the Federal Reserve System.