Douglas Rissing

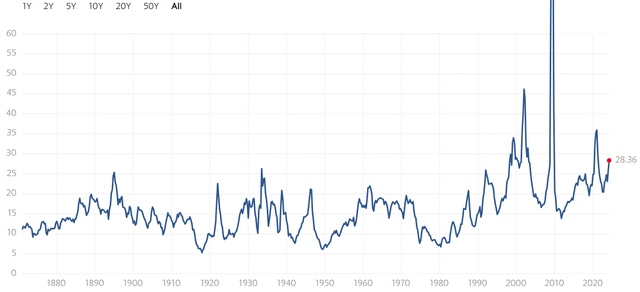

Investment thesis: The market is currently pricing in Federal Reserve interest rate cuts, with expectations recently boosted by its latest signals. The S&P 500 Index (SP500) is trading at a P/E rate of about 28, whereas historically it has been averaging about 16, which is arguably an indication of rate-cut expectations being baked into market valuations.

S&P 500 P/E ratio (Multipl.com)

The thesis behind rate cut expectations is supported by the assumption that lower economic growth combined with cooling inflation, which is down significantly from its peak provides the Federal Reserve ample room to switch from a policy of containing inflation to one of helping the economy regain momentum.

The main obstacle to the thesis is that inflation seems to be stubbornly holding above the 3% level, whereas the Federal Reserve traditionally targets 2% inflation. As I shall explain, several factors could push the economy toward a renewed inflationary cycle this year, which in a worst-case scenario could even necessitate interest rate hikes. Before that, it may become increasingly clear that rate cuts are not forthcoming.

If this is the case, this year could be one of the worst of the century so far in terms of overall stock market performance.

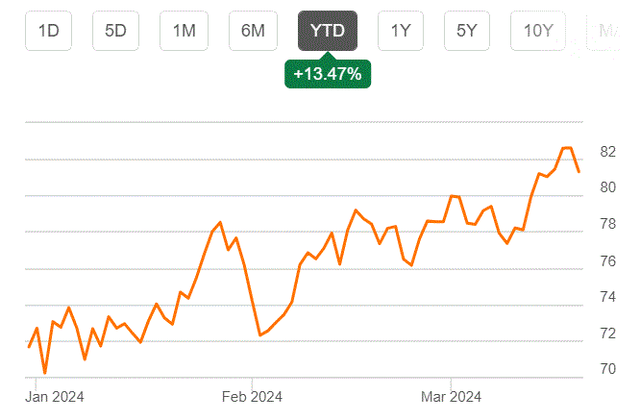

Inflation could be on the verge of picking up steam again, with rising oil prices being one of the main driving factors

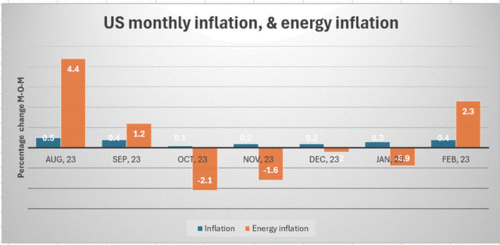

February’s Y-O-Y CPI inflation measure came in at 3.2%, which is still significantly higher than the 2% target that the Federal Reserve officially, or perhaps ideally, seeks to reach before considering lowering rates.

Data source: Bureau of Labor Statistics

Energy prices tend to be volatile, which is why it is often thought that the Core CPI inflation measure that strips out food & energy is more reliable. Incidentally, Core CPI is running higher than overall inflation at 3.8% currently, meaning that there are underlying structural factors that are pushing inflation higher, aside from volatile factors that are often labeled as being transitory. If oil prices start to pick up steam in the next few months, the trend of declining inflation we have seen since the peak in the summer of 2022 may be reversed.

Deglobalization adds to global supply constraints for goods & services, which is inflationary

It has been reported that global trade may have shrunk by 5% in 2023 compared with the previous year and there is pessimism on this year’s outlook as well. A reduction in global trade is inflationary in my view because it means that we are no longer maximizing the efficiency of the World Economy through trade, thus many things end up costing more.

This trend of deglobalization has two main components. The first centers around geopolitical conflicts between the Western World on the one hand and Russia & China on the other, which currently manifests itself as an economic confrontation, among other things. The geopolitical competition reached a point where it seems both sides are willing to take some economic pain to economically harm the other side. In practical terms, it disrupted supply chains, which resulted in some degree of scarcity, or higher prices.

The second factor is at times related to the first, at times not so much, but it involves the breakdown of safety. We have the war in Ukraine, which indirectly affects trade throughout the Black Sea region. There is the ME situation in the Red Sea, where a Yemeni militia group managed to disrupt a sizable share of global shipping that now either has to be re-routed or in some cases just stopped.

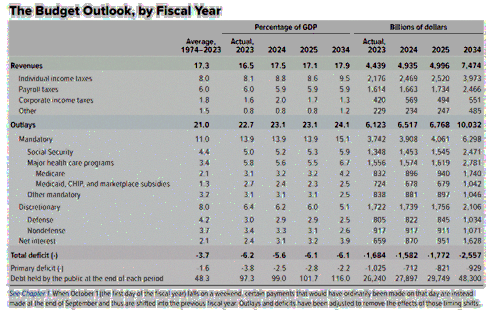

The $2 Trillion/year deficits are inflationary, especially when combined with scarcities in the real economy

Based on current CBO estimates, yearly deficits in the coming decade are set to average about $2 Trillion.

My personal view is that the budgetary shortfall situation is far worse than it is currently being projected. In other words, most revisions going forward will show widening budgetary shortfalls.

During the post-2008 financial crisis era, many people raised the alarm concerning the inflationary risks posed by bailouts and massive monetary & fiscal stimulus measures meant to prevent a meltdown of the global financial system. They were proven wrong, mostly because the vital ingredient namely a scarcity of goods & services never materialized. The shale boom prevented oil & gas prices from spiraling out of control, while China continued to churn out manufactured goods at an affordable price.

This time around, we still have the post-COVID deficits largely in place, pumping money into the economy, while the shale boom may have just ended this decade, meaning that energy price inflation is now a real risk as more and more freshly printed or borrowed money is pushed into the economy. The geopolitical tensions I touched on are also creating supply constraints, as well as triggering producer price inflation. In other words, more goods can be made available but at a higher price, which then has to be sold at a higher price, so firms do not take a loss.

Investment implications:

- Current market valuations priced in rate cut expectations, which makes for a potentially steep selloff once the market catches on that it will not happen.

As I pointed out at the end of 2023, I expect to see the S&P 500 finish at 3,500 points by the end of this year. Based on trends, including inflation data which seems to trend higher, as well as potentially rising oil prices, it seems that I may have a case to make in favor of the market finally reaching a point where P/E valuations will move toward the historical average from about 28 currently, toward 16. All it will take to derail rate cut expectations is for month-over-month inflation numbers to continue coming in at .3% to .4%, as we saw in the last two months. It eventually adds up to annualized inflation rates in the 4% range, which I doubt the Federal Reserve will see as good enough to lower rates.

If we continue to see a 1% or higher monthly average increase in energy prices going forward, which so far seems to be the trend, given the evolution of oil prices, this by itself is likely to provide enough inflationary pressures through the economy to maintain the recent monthly inflation trajectory.

The oil market tends to be very volatile, so there may be some temporary respite from what seems an overall upward trend. Markets will likely react positively to data points that give hope of rate cuts. At the same time, in some months we will likely see a significant upside in oil price swings that will push monthly inflation data to levels that will crush the hopes of those still clinging to the thesis of rate cuts on the horizon. All this will probably make for a very volatile market in the coming months and perhaps beyond. The overall trend however will be down.

There is very little to cling on to in my view in terms of expecting significant upside for markets from these levels, aside from perhaps a short-term pop in stock prices if rate cuts do materialize, but even that will be limited since the market already seems to have priced in those rate cuts, as evidenced by market valuations. At the individual company level, a slow-growing global economy is far from the ideal environment to produce higher revenues & profits. Persistently higher interest rates than what we got used to in the 2009-2021 period make it less attractive to take out new loans to grow businesses, while outstanding debt that needs to be refinanced becomes more expensive to keep on the books due to higher yields.

This all adds up to a situation where a 28 P/E ratio for the S&P 500 is an indication of a market that is way ahead of itself by historical standards. Earnings cannot grow into those valuations as long as interest rates remain high, therefore the market will in theory come back down to a more sensible valuation level at some point.

- Hoarding cash to have available for better investment opportunities down the road.

While I am always on the lookout for favorable entry points that may arise for individual stocks or sectors, I have been a net seller of stocks last year and I am increasing my cash position so far this year. For instance, I recently pointed out my intention to reduce my position in Greenbrier Cos (GBX), which I did. At the same time, I recently took a nibble at Albemarle (ALB), which is trading at just one-third of the stock price it reached just over a year ago, adding to my already existing position. The lithium mining sector has been battered to the point where lithium prices are arguably unsustainably low. We are therefore at a point where investors can feel somewhat confident in a rebound in lithium miners, even if the timing of it may be somewhat uncertain.

I am currently sitting on about 1/3 cash in my investment portfolio, and I expect this ratio to rise perhaps even higher, as I intend to start reducing my oil stock positions as oil prices start approaching $100/barrel. Oil stocks currently make up about a fifth of my portfolio. I will probably never sell out of my oil positions completely, but I intend to take profits going into an expected oil price rally and buy back shares once the price of oil meets resistance in the form of demand destruction. I currently hold Suncor (SU), and CNQ (CNQ) stocks as my upstream oil plays.

Conclusions

We should keep in mind that this is an election year, therefore any Federal Reserve comments, indications, or moves are likely to have some degree of sensitivity to political considerations, whatever those may be. The very fact that the Federal Reserve might want to avoid looking like it is in any way playing any role in affecting voter preferences might affect its decision-making. After November, its actions may become more data-driven, but until then it may focus as much as data may permit on providing as little ammunition as possible for anyone to turn any of its moves into an accusation of a politicized Federal Reserve.

It remains to be seen whether the Federal Reserve will afford to maintain a posture that will make it look politically impartial. The Core Inflation data shows that inflation has some staying power even when factoring out energy prices.

As I pointed out in an article about a month ago, oil prices should rise significantly this year, based on supply factors, namely US shale production facing stagnation, after a decade and a half of providing the bulk of global oil supply growth. With Core Inflation still going strong, an oil price spike, which I believe is increasingly likely this year has the potential to accelerate the price inflation of goods & services beyond comfortable levels, in other words, threaten to reach double digits.

The prospects of this outcome may still seem remote at the moment, but perhaps, in the next three to six months we will start to see month-over-month inflation rates coming in .5% or higher. The market will probably react by pricing rate cuts out of valuations, followed by a shift toward rate hike expectations being baked into market pricing. If I am correct, 2024 will be one of the worst years for stocks so far this century.