nensuria/iStock via Getty Images

The Federal Reserve did not cut its policy rate of interest on Wednesday, at the Fed’s meeting of its Open Market Committee.

Stock market prices dropped. Investors were carrying some hope that the Fed was going to reduce its rate.

But the Federal Reserve is not ready to move…yet.

Look at this: Inflation has been dropping.

The specific measure of consumer price inflation that Federal Reserve officials focus on has fallen to a 2.9 percent rate, year-over-year, in its latest reading. In October, the year-over-year rate of increase was 3.5 percent.

Furthermore, the United States economy registered a 3.1 percent year-over-year rate of growth.

And, this performance is projected to continue into 2024.

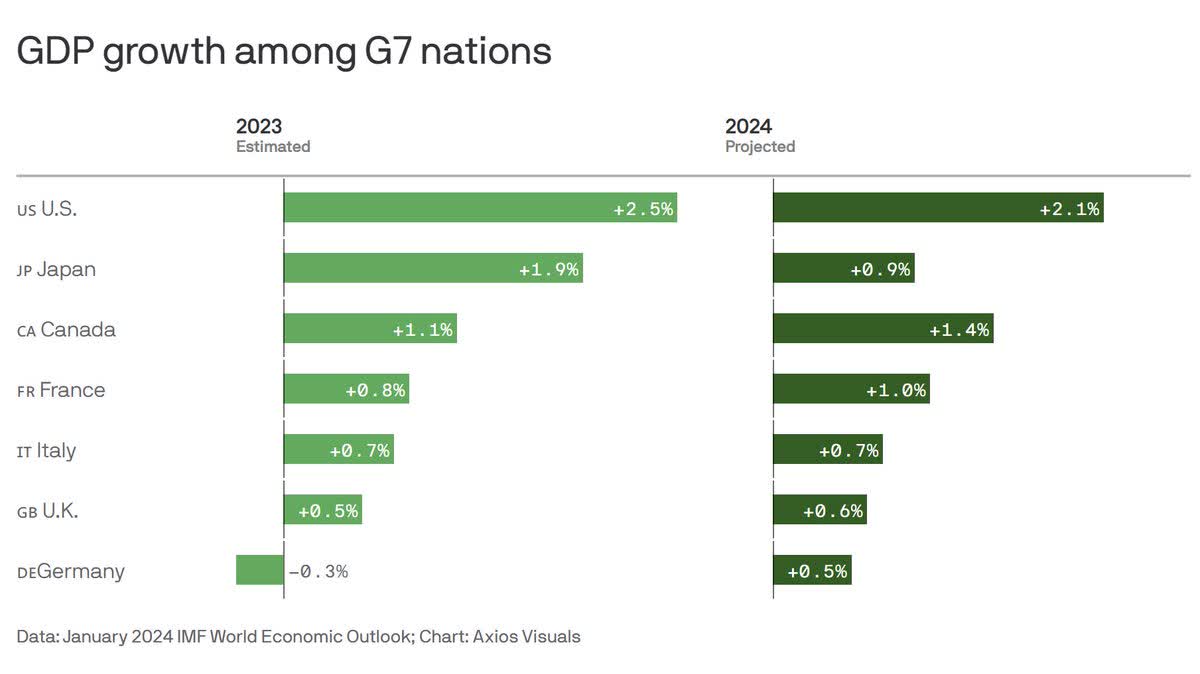

For example, recently the International Monetary Fund put out the following picture for the performance of the major economies in the developed world.

GDP Growth (IMF)

Not only is the U.S. doing better than other major economies, but the growth in the U.S. is expected to remain a good deal stronger than there of other countries.

Why does the Federal Reserve need to cut its policy rate of interest in this case?

The Federal Reserve still needs to maintain its control over inflation and then it needs to evolve its monetary policy into one of financial stability.

The problem is, as I have tried to describe in many other posts, that the Federal Reserve still has some work to do to handle the vast amount of liquidity it pumped into the financial system during 2020-2022 as it was overcompensating for the destructive progress of the Covid-19 pandemic.

As I have discussed elsewhere, the Fed injected somewhere over $3.0 trillion of funds into the banking system that was in excess. The banks and the financial system were floating in cash.

That is, the Fed’s effective policy rate is now at 5.33 percent, yet with massive amounts of reserves are still at rest in the commercial banking system.

This situation is the major reason that the Federal Reserve continues to focus on a monetary policy of quantitative tightening.

The Federal Reserve still needs to reduce the amount of excess reserves that are in the banking system and subsequently in the financial markets.

If the Fed attempts to “stimulate” the economy further at this time by lowering its policy rate of interest, I believe that it will just be adding to the liquidity situation that already exists.

The Federal Reserve has been removing securities from its securities portfolio since the middle of March 2022. Its existence is approaching two years. The removal has been consistent and steady.

The Federal Reserve’s behavior has convinced many market participants that the Federal Reserve is very serious about bringing inflation under control without upsetting the whole economic system.

This effort, to me, has convinced investors, as well as the business community, that the Fed is doing what it needs to do to keep the economy moving forward in a stable way.

That is, the Federal Reserve has been able to reduce its securities portfolio by over $1.3 trillion without having to cause major market movements, movements that might have occurred if the Federal Reserve had acted, as it has in the past, by selling massive amounts of securities into the financial markets.

But the problem now is that the Fed still has plenty of work to do.

The Fed’s securities portfolio still needs to be reduced by figures that go into the trillions.

Investors seem to be comfortable with the current way that the Fed is working in its attempt to continue to reduce the size of its securities portfolio.

To me, this is not a scenario where the Federal Reserve starts cutting its policy rate of interest. The Fed needs to keep things steady. Starting to reduce its policy rate of interest would signal, I believe, that the Fed was, in some way, backing off its current program of quantitative tightening.

So, I see the Federal Reserve maintaining its current level for its policy rate of interest and I see the Federal Reserve maintaining its current efforts to reduce the size of its securities portfolio.

And, to me, this latter effort, the effort to continue to reduce the size of its securities portfolio is the “core” part of the program.

This is the part of the program that has proven to be so convincing to the investment community.

It is this part of the Fed’s effort that will carry the Federal Reserve on to the next stage of economic stability.

But it will not be an easy path.

Still, the point for the Federal Reserve is to continue to reduce the excess reserves that lie in the banking system and the financial markets. This reduction needs to be conducted in the regular and persistent decline in the securities portfolio.

Investor reaction

The stock markets may be reacting negatively to the failure of the Fed to cut its policy rate of interest and to the fact that there may not be as many cuts in

To me, however, investors will respond much as they have over the past year or so. That is, investors will not wait too long to come back into the stock market…and into other financial outlets.

The U.S. economy is growing.

Corporations and others have money or access to money. In some cases, some areas have too much money for their current needs. An article in the Wall Street Journal has pointed to the fact that a certain class of venture capitalists are carrying too much money on their books and are trying to shed these funds.

The availability of these funds will keep the U.S. economy growing…see chart above…and will keep the stock market rising.

Just remember that the S&P 500 stock index has just been trading at historic highs.

The situation has not changed. The S&P 500 stock index will turn around and continue to rise given the strength of the economy and the presence of so much money available to support economic growth.

The current state of the economy may not be one that is found in economic textbooks, but that has not…and will not…keep the economy from moving forward or keep stock prices from rising.

The crucial thing for the Federal Reserve now is to “not upset the apple cart.”

The Federal Reserve has brought us a long way since the dreary days of the pandemic. But it looks as if 2024 is not going to be so bad.

And, with all the money around, investors should find 2024 as a very good year.