PM Images

The First Trust Senior Floating Rate Income Fund II (NYSE:FCT) is a closed-end fund, or CEF, that income-focused investors can employ as a method of achieving their goals. The fund performs reasonably well at this task, as its 11.90% current yield compares reasonably well with many other options that are currently available in the market. For example, consider the current yields of some other closed-end funds that primarily invest in floating-rate debt securities:

|

Fund Name |

Current Distribution Yield |

|

First Trust Senior Floating Rate Income Fund II |

11.90% |

|

Apollo Senior Floating Rate Fund (AFT) |

12.31% |

|

Eaton Vance Floating-Rate Income Trust (EFT) |

11.18% |

|

BlackRock Floating Rate Income Strategies Fund Inc (FRA) |

11.97% |

|

Pioneer Floating Rate Fund |

12.14% |

Regular readers will undoubtedly notice that all of the floating-rate funds on this list have substantially higher yields than those closed-end funds that invest primarily in fixed-rate investment-grade or junk bonds. This is because the market is widely anticipating that the Federal Reserve will substantially reduce interest rates this year and has bid up the price of fixed-rate bonds in an attempt to front-run the central bank. This actually forms the basis for our thesis, as the market has almost certainly overestimated the degree to which the central bank will pivot on monetary policy. As such, fixed-rate bonds are looking very overpriced and positioned for a correction in the near future. The floating-rate securities that the First Trust Senior Floating Rate Income Fund II holds in its portfolio should prove to be resistant to this correction and thus avoid the losses that will undoubtedly accompany fixed-rate bonds when the Federal Reserve fails to meet the expectations of the market. It therefore makes a lot of sense for investors to take some of the gains that they made from traditional bonds last year and put the money into a fund like this to avoid suffering near-term losses as well as boost their income a bit from the higher yield that this fund offers relative to investment-grade or junk bond funds.

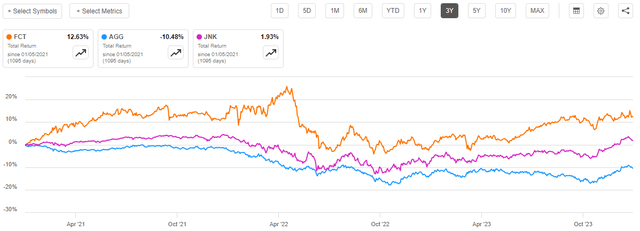

The First Trust Senior Floating Rate Income Fund II has delivered a very respectable performance over the past few years. This chart shows the share price performance of the First Trust Senior Floating Rate Income Fund II against the Bloomberg U.S. Aggregate Bond Index (AGG) and the SPDR Bloomberg High Yield Bond ETF (JNK):

As we can clearly see, shares of the fund are down 14.81% over the three-year period. This is better than the 16.72% loss of the aggregate bond index, but unfortunately, it is slightly worse than the 13.67% loss delivered by the junk bond index. However, we can see that this fund was generally outperforming both indices until December 2023 when the market experienced a massive rally in fixed-rate bonds. That is exactly what we would expect from a floating-rate fund, as floating-rate debt securities typically outperform fixed-rate bonds in a rising interest rate environment and vice versa.

As I have pointed out numerous times in the past though, it does not make sense to look solely at the share price performance of a closed-end fund. This is especially true for those funds that invest in debt securities. This is because closed-end funds pay out all of their investment profits to the shareholders, essentially trying to maintain a relatively stable net asset value over time. Bonds likewise deliver most of their investment returns in the form of direct payments made to their owners. As such, we need to incorporate these payments into our performance discussion, as these payments could help to partially or fully offset price declines. When we do this, we see that the First Trust Senior Floating Rate Income Fund II has outperformed either of the indices by quite a lot:

Investors in the First Trust Senior Floating Rate Income Fund II have benefited from a 12.63% total return over the past three years. This is much better than the Bloomberg U.S. Aggregate Bond Index, which shows losses even after the coupon payments from the bonds are considered. Investors in the junk bond index made a relatively small profit, but it is certainly nothing to write home about.

The fund’s reasonable past performance seems certain to appeal to just about any investor who is looking to put money into debt securities. However, past performance is no guarantee of future results. Fortunately, there are some reasons to believe that this fund will continue to deliver very solid performance and probably beat both indices over the next few months at least.

About The Fund

According to the fund’s website, the First Trust Senior Floating Rate Income Fund II has the primary objective of providing its investors with a high level of current income. This makes a lot of sense considering the assets in which the fund invests. As the website explains:

First Trust Senior Floating Rate Income Fund II is a diversified, closed-end management investment company. The primary investment objective of the Fund is to seek a high level of current income. As a secondary objective, the Fund attempts to preserve capital. The Fund pursues its objectives by investing primarily in a portfolio of senior secured floating-rate corporate loans (“Senior Loans”). Under normal market conditions, at least 80% of the Fund’s Managed Assets are generally invested in a portfolio of Senior Loans.

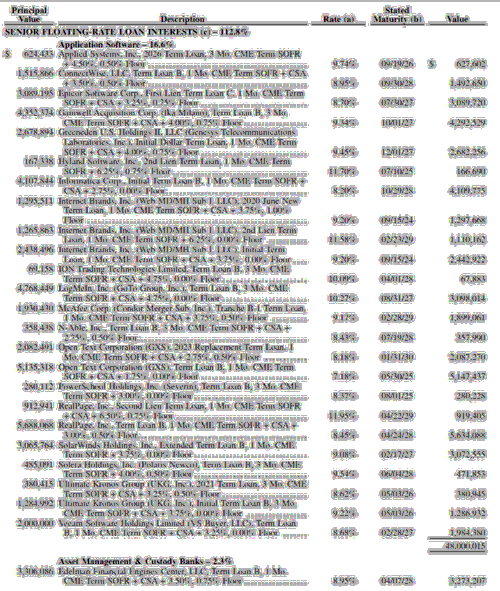

Senior loans are an asset class that we have been discussing with increasing regularity in this column over the past year or two and for good reason. These securities work very much like traditional bonds, except that the coupon payment changes on a regular basis so that the bond pays its investors a yield that changes based on some interest rate benchmark. For example, many of these funds have a variable coupon that is designed to make a payment that gives it a yield that is a few hundred basis points above LIBOR, SOFR, or short-term U.S. Treasury securities. For example, here is the first page from the fund’s most recent holdings report:

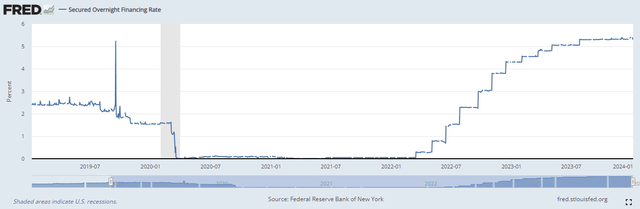

As we can see here, many of these bonds are paying an interest rate that is equivalent to SOFR plus three to six percentage points. As of right now, the SOFR is 5.31%, a figure that has been consistently increasing over the past few years:

Federal Reserve Bank of St. Louis

Thus, a coupon that is SOFR plus 3.25%, which some of the securities listed in the chart above have, would give the bond a current yield of 8.56% today. As we can see above, the fund includes some securities that have far higher spreads above SOFR than 3.25% so we can easily see that the fund is collecting very high yields from some of its assets. This is probably the biggest reason why the fund can pay out such a high yield to its shareholders. The fund also uses leverage to effectively boost the overall yield, which we will discuss later in this article. The current environment is certainly a much more attractive one than the situation that income-focused investors have had to contend with over most of the past fifteen years or so.

The coupon rate of the securities in the portfolio readjusts on a regular basis (usually quarterly, semi-annually, or annually) to deliver the yield that the calculation results in given the benchmark rate at the time of reset. This allows these securities to avoid one of the problems with fixed-rate bonds that investors encounter during a rising interest rate environment. In short, in a rising rate environment, the price of existing bonds declines. This is because brand-new bonds will have a higher coupon rate than the bonds that are currently trading in the market. No investor in their right mind would purchase a bond with a coupon rate that is lower than the market rate when they could obtain a brand-new bond with a higher yield and otherwise identical characteristics. As such, the price of the existing bond must decline in order to deliver a yield-to-maturity that is competitive with otherwise identical brand-new bonds. This is the reason why the major bond indices have delivered losses to investors over the past few years as interest rates have risen significantly from the incredibly low levels that they had during the COVID-19 pandemic. As the securities that are held by the First Trust Senior Floating Rate Income Fund II have a coupon rate that changes based on the prevailing interest rate in the market, they will always deliver a competitive yield to that of otherwise identical brand-new securities. As such, their price is much more resistant to changes in interest rates than traditional bonds. We can see this quite clearly by looking at the BBG US Floating Rate Notes 5 Yrs. And Less Index (FLOT) over the past decade:

As we can see, the index was almost perfectly flat over the past decade despite the fact that interest rates changed a few times over the period. The sole exception to this rule was in the early stages of the COVID-19 pandemic when investors were dumping everything and going to cash. The index quickly recovered though and ended up pretty much flat over the entire period. This resistance of floating-rate securities, such as the ones that are held by the First Trust Senior Floating Income Fund II to changes in interest rates is critical to our thesis and will be discussed in a few minutes.

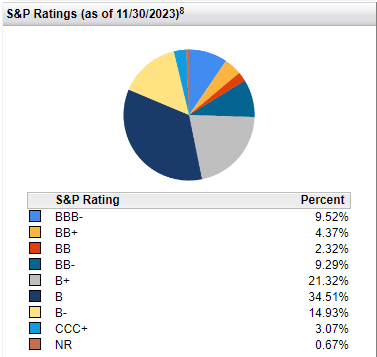

One thing that investors will almost certainly notice is that many of the securities that are held by this fund have variable coupons that give them effective yields that are three to six percentage points above the overnight rate. That is a very large spread, and it will undoubtedly lead many readers to expect that the securities that are held by this fund are not investment-grade assets. This is indeed the case, as floating-rate securities are often issued by companies that have a substantial amount of debt on their balance sheet at the time of issuance. This is why these securities are typically called “leveraged loans.” That is something that might worry some readers as companies that already have substantial amounts of leverage are much more likely to default on their debt. Defaults would naturally have a negative impact on the overall value of the fund’s portfolio. We may be able to derive some comfort and have an easier time sleeping at night by looking at the credit ratings that have been assigned to the securities that are held by the fund. Here is a summary:

First Trust

An investment-grade security is anything rated BBB or higher. As we can see that description only applies to 9.52% of the securities in the fund’s portfolio. Even those have a BBB- rating, which is the lowest possible investment-grade rating. The remainder of the portfolio is invested in junk debt. However, we can see that fully 86.74% of the fund’s assets are invested in securities that are rated as BB or B by one of the major credit-rating agencies. According to the official bond ratings scale, companies that have one of these two ratings should have sufficient financial strength to carry their debt even in the event of a short-term economic shock. When we combine this with the fact that the fund has 152 positions, which should mean that any individual issuer only accounts for a very small proportion of the portfolio, we should be comfortable that our capital is reasonably safe with this fund.

It makes sense that the majority of the fund’s holdings are speculative-grade securities. This is because a floating-rate loan requires that the company take on the risk of rising interest rates instead of passing that risk onto the investors. Most companies do not want to take on such risks, especially since interest rates were at historic lows over most of the past decade so it was essentially certain that they would rise at some point. Thus, the only companies that were willing to borrow using variable-rate debt were those companies that had weak balance sheets and limited options for obtaining capital. Fortunately, as we have already seen, the First Trust Senior Floating Rate Income Fund II has taken steps to limit its risks of exposure to any individual company.

Forward Interest Rate Predictions And The Thesis

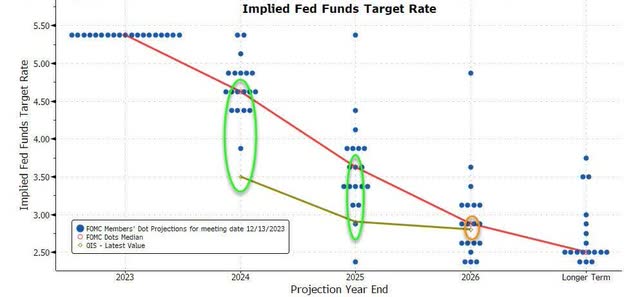

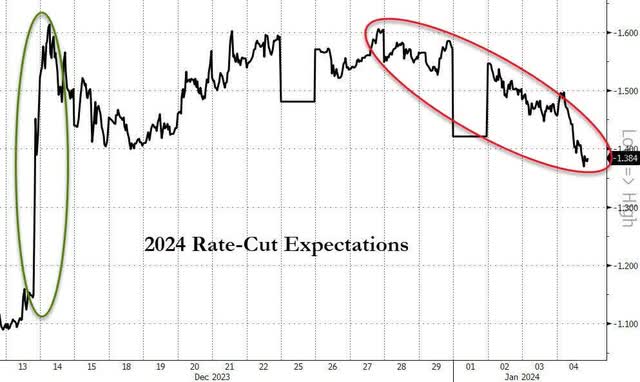

As mentioned in the introduction, the bond market has seen considerable strength over the past month or two due to expectations that the Federal Reserve will pivot and slash interest rates this year. The federal funds futures market is currently projecting that the nation’s central bank will cut interest rates five or six times this year, reducing the effective federal funds rate by 1.384 percentage points by December:

Zero Hedge/Data from Bloomberg

That seems to be highly unlikely to actually occur. As I have pointed out in previous articles, there has only been one time in history that the central bank has cut interest rates to such a degree outside of an extremely severe recession. Recent economic data is too strong to support any sort of recession narrative, and it seems very likely that the Federal Government will use all of the tools that are available to it in terms of fiscal policy in order to avoid a severe recession during an election year. This is one of the reasons why long-term interest rates rose last week and very long-duration stocks (such as the technology sector) declined in value. The market is beginning to realize that it became unjustifiably excited in December and has begun to pare back those expectations. However, the current expectations are still too optimistic.

At the December meeting of the Federal Open Market Committee, the median projection was that the terminal 2024 effective federal funds rate would be 4.6%. That is much less than the market’s current expectations, as it suggests a maximum of three 25-basis point cuts or about half of what the market is currently pricing into fixed-rate bonds. It is important to note though that eight of the members of the committee thought that fewer rate cuts would be appropriate. There were only five that thought that more than three rate cuts would occur during 2024:

There is only one member of the Federal Open Market Committee who expects that the central bank will deliver rate cuts that are anywhere close to the market’s current expectations.

This strongly suggests that traditional fixed-rate bonds, and by extension, closed-end funds that primarily invest in fixed-rate bonds are substantially overpriced and will decline in value as the market realizes that it almost certainly overbid these assets. That means that investors who moved their assets into traditional bond funds are likely to lose money over the next few months. It therefore makes sense to sell off those funds and purchase the First Trust Senior Floating Rate Income Fund II instead. As we have already seen, the securities that this fund includes in its portfolio should be resistant to the price changes that would accompany the market repricing assets in response to the actions that the Federal Reserve actually takes. Thus, investors can protect their gains and increase their incomes due to the higher yield that this fund offers compared to traditional bond funds.

Leverage

As is the case with most closed-end funds, the First Trust Senior Floating Rate Income Fund II employs leverage as a method of boosting its effective yield beyond that possessed by any of the assets that are actually contained in the fund. I have explained how this works in various previous articles. To paraphrase:

Basically, the fund borrows money and then uses that borrowed money to purchase floating-rate debt issued by companies that have less-than-stellar credit ratings. As long as the yield of the purchased securities is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the fund’s portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will normally be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, it is important to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like a fund’s leverage to exceed a third as a percentage of its assets for this reason.

As of the time of writing, the First Trust Senior Floating Rate Income Fund II has leveraged assets comprising 14.29% of its portfolio. This is a lower level of leverage than what we see in some other floating-rate funds. It is also considerably lower than what is employed by most traditional bond funds, despite the fund that this fund can probably carry higher levels of leverage than even other fixed-income funds due to the incredibly low volatility of its assets.

The fund’s leverage is nothing that investors need to worry about. In fact, as just stated, this fund could probably increase its leverage somewhat and still have a reasonable balance between the risk and the reward.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the First Trust Senior Floating Rate Income II is to provide its investors with a very high level of current income. In pursuance of this objective, the fund invests in a portfolio of floating-rate senior loans that typically have a variable coupon that delivers a three to six percent spread above the market overnight rate. That is sufficient to give these securities a very high yield in the current environment, but this fund takes things a step further and borrows money to purchase securities. That allows the fund to control more securities than it could solely by relying on its own equity capital and thus results in the portfolio having a higher effective yield than the securities themselves offer. The fund collects the payments that it receives from all of these securities and then distributes them to its shareholders, net of its own expenses. This might be expected to result in the fund’s shares having a very high yield.

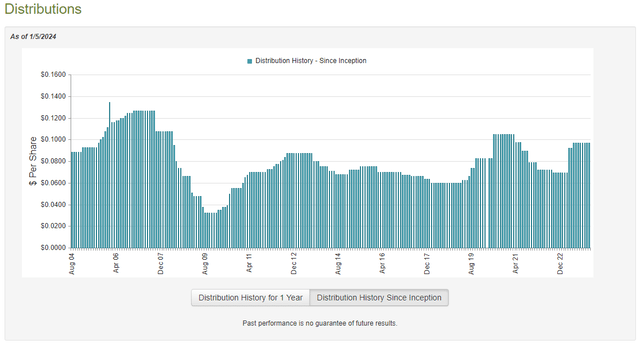

That is indeed the case, as the First Trust Senior Floating Rate Income Fund II pays a monthly distribution of $0.0970 per share ($1.1640 per share annually), which gives it an 11.90% yield at the current yield. As mentioned in the introduction, this is comparable to the current yield possessed by most other floating-rate funds and is higher than the yield that is possessed by most funds that invest in traditional fixed-rate bonds. Unfortunately, this fund has not been especially consistent with respect to its distribution. As we can see here, the fund has both raised and cut its distribution several times throughout its history:

This history could certainly prove to be quite unappealing to any investor who is seeking to earn a safe and consistent income from the assets in their portfolios. However, it is not unusual for a fund like this to vary its distribution like this. The reason for this variability is that the fund’s income is highly dependent on interest rates. As we have already seen, the higher the overnight financing rate, the higher the fund’s income will be. The fund’s managers change its distribution based on its income. As such, we can almost imagine this fund as a leveraged way to play interest rates.

As is always the case, we want to have a look at the fund’s finances in order to ensure that it is not distributing more to its shareholders than it can actually afford and destroying its net asset value in the process. After all, any destruction of net assets means that the fund needs to generate higher returns simply to break even and get back to where it originally was. This is a very difficult task, especially if it persists over an extended period of time.

Unfortunately, we do not have an especially recent document that we can consult for the purposes of our analysis. As of the time of writing, the most recent financial report for the First Trust Senior Floating Rate Income Fund II corresponds to the full-year period that ended on May 31, 2023. As such, it will not include any information about the fund’s performance over the past seven months. This is very disappointing because a lot of things have occurred in the interim period, including the challenging period for bonds over the summer and the market rally that started in October. While the fund’s assets should be relatively resistant to any changes in asset prices that accompany either of these market environments, we cannot be certain of that without seeing an updated financial report for the fund. That information will likely be available within the next few weeks, but for now, we have to work with the data that is available to us.

Over the full-year period, the First Trust Senior Floating Rate Income Fund II received $26,036,268 in interest from the assets in its portfolio. The fund received no income from any other source, so its total investment income is the same figure. The fund paid its expenses out of that amount, which left it with $20,042,020 available for the shareholders. That was, unfortunately, not enough to finance the fund’s distribution over the period. The fund reports that it paid out a total of $23,034,273 to its investors over the same period. This is something that is likely to be quite concerning at first glance, as we would normally prefer a debt-focused closed-end fund to fully finance its distributions out of net investment income. This fund obviously failed to accomplish that task over the full-year period.

There are other methods through which a fund can obtain the money that it needs to cover the distributions. For example, the fund might be able to earn some capital gains by taking advantage of fluctuations in security prices. Although floating-rate securities exhibit much more price stability than other assets, they do fluctuate in price from time to time. The fund unfortunately failed at this task over the full-year period. It reported net realized losses of $18,246,359 but these were partially offset by $12,180,168 in reported net unrealized gains.

Overall, the fund’s net assets declined by $9,058,444 after accounting for all gains and losses during the period. This is quite concerning, as it tells us that the fund failed to cover its distributions over the full-year period. As regular readers can likely recall, nearly every other closed-end fund that focuses on investing in floating-rate securities has managed to cover its distributions solely out of net investment income, so this is doubly disappointing as this fund is clearly failing to achieve a task that its peers have had no trouble with.

With that said, the fund did raise its distribution in June immediately following the end date of this report despite failing to fully cover the previous payout. Let us look at the fund’s net asset value to see how well it is covering the distribution at the new level:

This is certainly encouraging. As we can clearly see, the fund’s net asset value per share has increased by 1.93% since June 1, 2023. This implies that the fund has managed to fully cover every distribution payment that it has made since the most recent financial report was released and then some. This is generally a good sign, as it suggests that the fund is currently not overdistributing and is not destroying its net asset value with the higher distribution.

Valuation

As of January 5, 2024 (the most recent date for which data is currently available), the First Trust Senior Floating Rate Income Fund II has a net asset value of $11.08 per share. The fund’s shares currently trade for $9.82 each, which means that the fund’s shares are currently trading at an 11.37% discount on net asset value at the current price. This is a much more attractive entry point than the 9.67% discount that the shares have averaged over the past month, so it certainly looks like a reasonable time to buy the fund’s shares right now.

Conclusion

In conclusion, the First Trust Senior Floating Rate Income Fund II offers investors a way to protect their recent market gains in the face of what is probably going to be a challenging few months for the bond market. It seems highly unlikely that the Federal Reserve will reduce interest rates to the degree that the market is anticipating, which means that traditional bond funds will likely give up their recent gains. The First Trust Senior Floating Rate Income Fund II should be able to hold its price much better, and it boasts a higher yield than most traditional bond funds. Thus, it should be able to offer a degree of capital protection and increase your income at the same time.