bin kontan/iStock via Getty Images

Investment Thesis

Fastly (NYSE:FSLY) is a content delivery network (“CDN”) company that accelerates the Internet by strategically storing copies of websites and online content closer to users, reducing data travel distances. By doing so, Fastly ensures swift and reliable content delivery for large websites, enhancing the overall user experience.

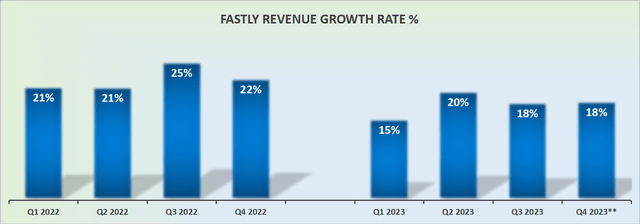

There are many reasons not to admire Fastly. For one, it’s a tech company that’s living in the shadow of its former self. More specifically, its growth rates are nowhere near as exciting as they once were.

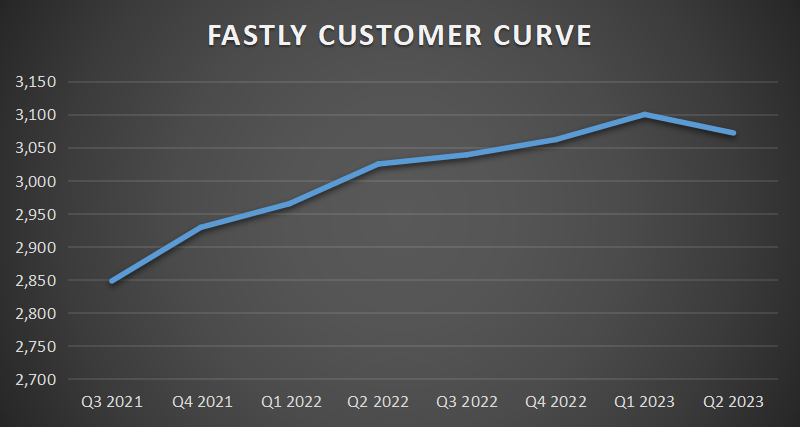

Furthermore, its customer adoption curve, while it did boost in Q3 2023 relative to Q2 2023, still leaves a lot to be desired.

That being said, its valuation is now more attractively priced. advance, if I were to highlight just one concrete positive consideration, it would be that its balance sheet is much more manageable and no longer overly restrictive.

I remain tepidly bullish on FSLY.

Rapid Recap

Back in September, I wrote a bullish analysis about Fastly titled, Attractively Priced Amid Solid Turnaround where I said,

Fastly is attractively priced while undergoing a solid turnaround. As you’ll read, an investment in Fastly is not blemish-free. There are different considerations that keep me wary.

Perhaps the most weighty is the pace of its customer adoption curve. That being said, I believe this consideration is already reflected in its valuation.

Therefore, I continue to be bullish on this stock and believe that paying 6x forward sales is an attractive point for new investors to get involved with this stock.

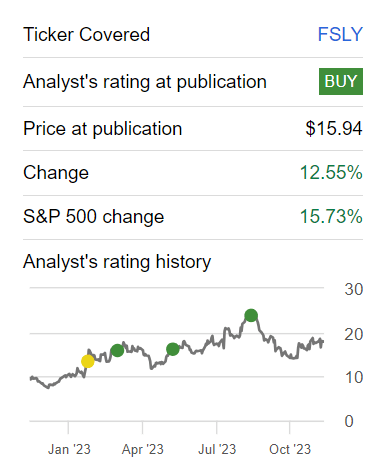

Those comments come on the back of a recommendation where I turned bullish on Fastly earlier in 2023. Here’s the performance since I turned bullish on Fastly.

Michael Wiggins De Oliveira on FSLY

The stock has lagged the S&P500 by more than 300 basis points. Nonetheless, the bullish recommendation was directionally correct.

What’s more, today I reiterate that I’m hopeful of Fastly’s medium-term prospects.

Fastly’s Near-Term Prospects

Fastly functions as a high-speed courier service for the Internet, akin to rapid mail delivery. Its role is to expedite the loading of websites and online content by strategically storing copies nearer to users, diminishing the distance that data must travel.

This proves advantageous for prominent websites, guaranteeing swift and dependable content delivery to users. Notably, Fastly has recently incorporated AI technology into its operations, envisioning a pivotal role in the AI-driven future.

The company aims to use AI for various tasks, including personalized recommendations and sentiment analysis, with the promise of delivering rapid, safeguard, and captivating user experiences. Fastly enhances the speed and enjoyment of the Internet for all users.

Moving on, in my previous analysis, I highlighted the following chart.

Author’s calculations on FSLY

At the time I said,

I’m keeping a watchful eye on [the customer adoption] progress in the following quarters and leave myself open to changing my mind from my bullish rating here.

Luckily, Fastly’s customer figures came in at 3,102 as of Q3 2023, increasing by 30 customers sequentially. Altogether, this reinforces my overall thesis, that Fastly’s underlying business has stabilized.

Fastly describes its growth prospects by highlighting how its international expansion is bearing fruit, with a strong performance in enterprise customer acquisitions, vendor consolidation, and seasonal strengths in streaming activity.

One advance pesky detraction to Fastly’s investment thesis is that its revenue growth rates are being bolstered by Fastly’s aggressive enhance in dollar-based net retention to 120%.

I’ve spoken about this on numerous occasions. To put this point succinctly, you can only raise prices on your customers so far. At some point you need to enhance the total number of customers you are serving, if you want to be viewed as a rapidly growing tech company, and to uphold a commensurate growth multiple on your stock.

That being said, Fastly’s dollar-based net retention stood at 123% in the prior quarter, so this figure has started to moderate somewhat. A trend we must keep a watchful eye over.

Revenue Growth Rates Are Stable

As a growth company, a lot can be forgiven provided you not only confront but also upwards revise your revenue growth rates consistently.

From Q2 into Q3, Fastly ever-so-slightly downwards revised the high-end of its revenue growth rate guidance for 2023. Naturally, this more conservative outlook has weighed on the stock.

On the other hand, I don’t believe this meaningfully detracts from my bull thesis, as investors are not being asked to pay a stretched multiple for its stock.

As we look out to 2024, I suspect that Fastly’s growth rates will probably decelerate slightly. This means that Fastly will probably grow in 2024 at around 14% to 16% CAGR.

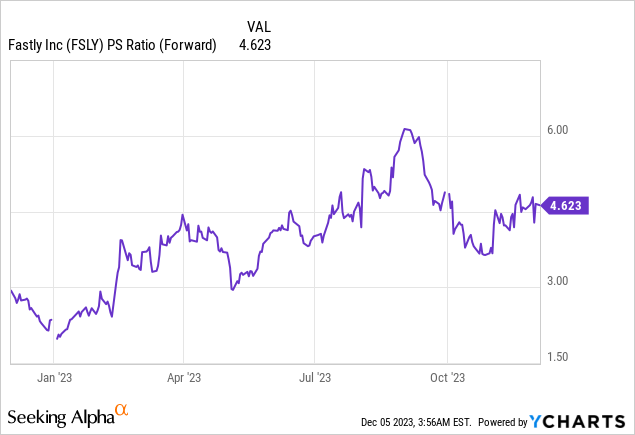

FSLY Stock Valuation — 4x Next Year’s Revenues

Assuming that in 2024 Fastly’s revenues grow by approximately 16%, this implies that Fastly is priced at about 4x next year’s revenues. This valuation is more or less what Fastly has been priced at all year.

The main change to the thesis is that Fastly is making some progress on its bottom-line profitability. Consequently, although Fastly holds approximately $470 million of debt, it has more than $400 million of cash and equivalents, meaning that it’s succeeding in improving its financial footing throughout this past year.

The Bottom Line

In wrapping up my analysis of Fastly, I find myself with a mixed sentiment towards the company.

Despite facing challenges such as a sluggish customer adoption curve and moderated revenue growth rates, there are encouraging signs in its valuation.

The stock, previously considered attractively priced, has made strides in bottom-line profitability, coupled with a more manageable balance sheet.

While the recent moderation in dollar-based net retention and a slightly conservative revenue growth rate guidance for 2023 are points of scrutiny, taking a forward-looking perspective, Fastly’s current valuation at around 4x next year’s revenues presents an intriguing opportunity.

With improvements in financial footing and the evolving landscape of the content delivery network industry, there seems to be bullish potential for Fastly in the medium term.