miriam-doerr

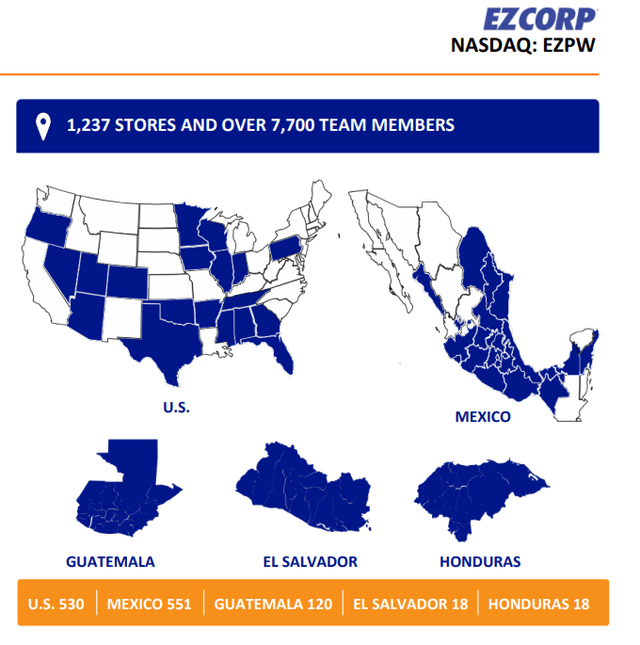

EZCORP, Inc. (NASDAQ:EZPW) reported its latest quarterly results highlighted by strong profitability, with EPS well ahead of estimates. The pawn store operator with 1,237 locations across the U.S. and Central America is capturing climbing demand for pawn loans as an alternative form of consumer credit.

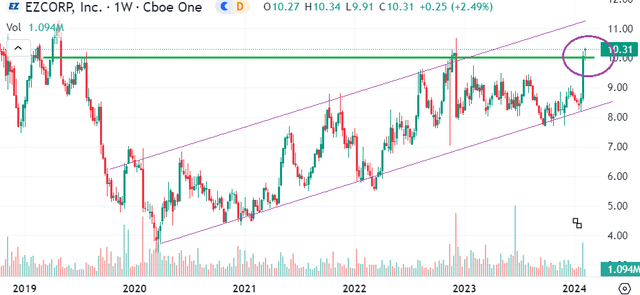

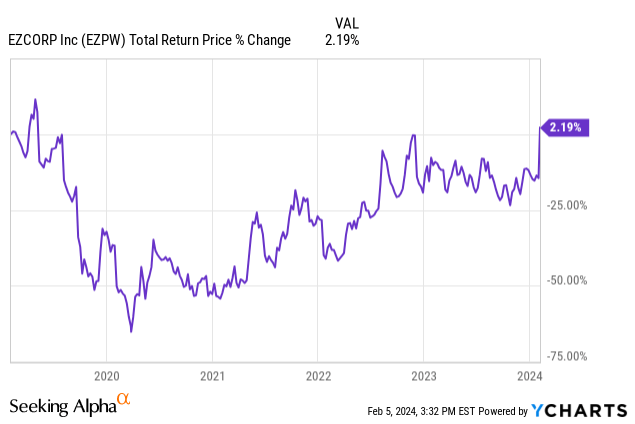

We last covered the stock back in 2022 with a bullish note suggesting the company was well-positioned to benefit from a volatile macro backdrop. In many ways, the operating and financial trends for EZCORP have evolved better than we expected with the story being otherwise impressive strategic execution. Indeed, shares have climbed to a 5-year high with a case to be made that the outlook is stronger than ever.

Initiatives like a loyalty program and efforts to optimize its retail merchandise offerings are paying off. We like the stock as a category leader that remains at an attractive valuation level. We see room for EZPW to rally through 2024.

EZPW Earnings Recap

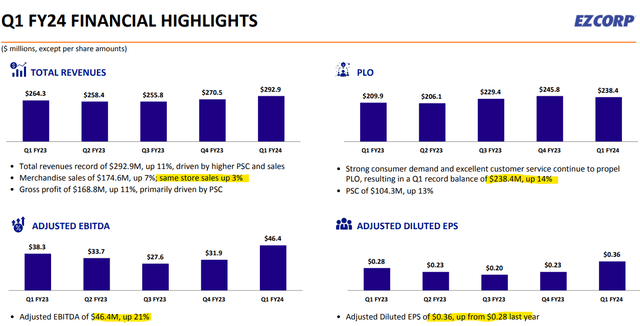

EZPW Q1 fiscal 2024 adjusted EPS of $0.36, which was $0.08 above consensus, and also up from $0.28 in the period last year. Revenue of $292.9 million climbed by 11% year-over-year.

Within that amount, merchandise sales reached $175 million, up 7% y/y, or 3% on a same-store basis. The other component of the top line is the pawn service charge (PSC), which climbed by a stronger 13% y/y to $104 million between the U.S. and Latin America operations. This reflects the fees and interest rates from cash advances against collateralized personal property.

A portion of those goods ends up forfeited allowing EZCORP to re-sell at its stores at a high margin while the customers that reclaim the property do so at rates average nearly 20% per month on the contracted value. EZCORP has focused on strong inventory turnover through in-demand item categories like jewelry and used-luxury items while limiting aged merchandise.

An important metric here is the total value of pawn loans outstanding (PLO), ending Q1 at $238 million, up 14% y/y, a Q1 record balance for the company. In this case, comments by management suggest an overall high level of activity and store traffic.

We mentioned the loyalty program “EZ+ Rewards” now counts 4.2 million members globally, with 1.4 million making transactions in Q1. Benefits include mobile tracking of existing pawns through an integrated app while facilitating online payments. The understanding is that these options have added to engagement and repeat customers.

For context, the 530 U.S. store locations represent about 40% of the global footprint covering various regional brands but around 80% of current PLO. That said, the momentum in Latin America has been strong, particularly in terms of the average loan size, up 8% y/y in Q1. Mexico is seen as an ongoing growth opportunity with climbing jewelry merchandise adding to margins.

While EZCORP is not issuing formal financial guidance, comments during the earnings conference call projected optimism for the recent trends to continue citing an expectation for further PLO increases as a PSC driver.

The company ended the quarter with $219 million in cash against $326 million in long-term debt. Considering adjusted EBITDA of $46.4 million this last quarter or $140 million over the past year, a net leverage ratio under 0.8x highlights the strong balance sheet position.

During the quarter, the company repurchased $3 million in shares which goes back to a $50 million authorization announced in 2022. With that program nearly complete, CEO Lachlan Given made comments during the confidence call suggesting their internal perception that company stock was undervalued and an intention to continue buybacks going forward.

We believe that our stock is very, very cheap. And so we are balancing buying that back with the significant growth opportunities that we think we have just even in the regions in which we operate. So we’re trying to strike a balance between growth and scaling up our cash flows and our store base with what we see as a good return on investment in buying back stock.

What’s Next For EZPW?

With a theme of the U.S. economy performing better than expected into 2024 in terms of resilient consumer spending conditions, the understanding is that consumer credit remains restrictive amid two-decade high-interest rates. We believe this setup is favorable for pawn shops to cater to a segment of borrowers who need access to cash advances and short-term funding. The reality here is that this is a lucrative business.

EZCORP has proven capable of navigating multiple economic cycles and we sense it has finally found its operational stride under new management considering the current CEO took over in 2022. The investments in technology appear to be paying off and we see plenty of room to consolidate its market positioning in a highly fragmented global segment.

At the same time, the elephant in the room of long-running knocks on EZPW has been its share structure where executive chairman Philip Cohen controls 100% of the Class B voting shares. In effect, holding a final say on all high-level corporate actions and strategic decisions.

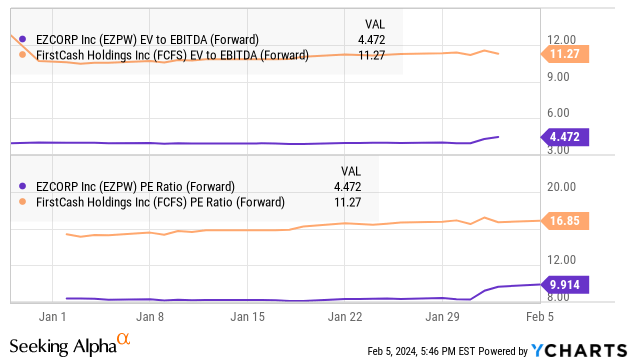

This dynamic explains a structural discount of EZCORP’s valuation relative to its larger industry peer FirstCash Holdings, Inc. (FCFS). For context, even as both companies reported similar growth this past quarter, EZPW has generated a higher gross margin yet trades at a large spread in terms of its earnings multiple. EZPW at a 10x forward P/E is well below the 17x by FCFS.

While these two names are not necessarily an apples-to-apples comparison as FCFS has a larger footprint in the United States and EZPW is pursuing growth in Latin America, we agree with CEO Lachlan Given that shares are simply undervalued.

In our view, while it is fair to assign some discount given the questions of control, the assumption is that it’s in the best interest of Chairman Cohen to maximize profits for shareholders and there is room for the valuation spread to narrow from here.

Ultimately, continued financial momentum and the ability to exceed expectations will allow shares to reprice higher over time. We’re looking at EZPW breaking out above the $10.00 level and we expect that there is more upside from here.

Final Thoughts

We rate EZPW as a buy with a price target for the year ahead at $13.00 representing a forward P/E ratio of 12.5x on the consensus EPS estimate for the current year of $1.04, essentially meeting halfway to the valuation spread with FCFS.

As we see it playing out, pawn loans should continue to be in demand and supportive of financial results over the next few quarters. Key monitoring points will be the PLO and PSC levels, as well as the gross margin and cash flow trends.

On the downside, a break in the stock under $8.50 would signal a more concerning deterioration of the outlook. The risk here is that results come in weaker than expected, or there is some setback in terms of the company’s expansion plans.