nattrass/E+ via Getty Images

The iShares MSCI South Africa ETF (NYSEARCA:EZA) is an exposure to the rather developed South African stock market. While there are plenty sophisticated picks with EZA, the financial exposures in particular share the issue of having to do business in the South African Rand, a currency with structural pressure due to the lack of reform in the country, and recent strength in the USD. It’s a market that requires a lot of selectivity. Pass on EZA.

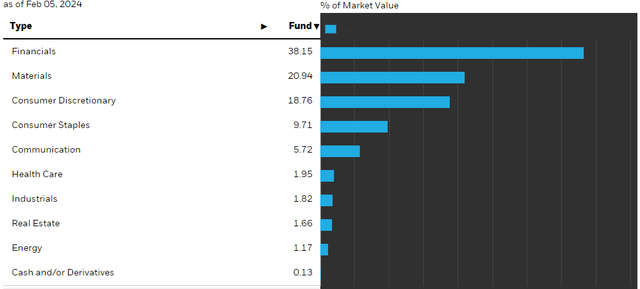

EZA Breakdown

Let’s have a look at the sector exposures.

Quite a lot of financials at 38%, decent amount of materials exposure, at least half of that exposure is in gold. Consumer discretionary allocation is to Naspers (OTCPK:NPSNY).

The Naspers allocation looks really nice. With a substantial holding in Tencent (OTCPK:TCEHY) of 25%, they have an interesting basis for a SotP thesis even, as other than that they have a pretty broad portfolio of interesting companies, including Stack Overflow, PayU and honor. They are levered to funding conditions in venture, and there may be some ChatGPT disruption in their EdTech businesses, so these are potential downsides in an environment where costs of capital aren’t low. Also the Chinese markets are suffering, and are likely to be under considerable pressure including Tencent, which has had major businesses in direct government crosshairs. Nonetheless, it is a quality exposure and a testament to the fact that the JSE is quite sophisticated. This is where almost all their consumer discretionary exposures are.

The issue is that while there may be some pockets of promise in South Africa concentrated among the public companies, the general issues of the country have a substantial impact on the exchange rate of the ZAR, which creates risk in particular among the financial exposures despite the benefits of higher interest rates in ZA to support NIMs. South Africa has major social issues. Wealthier households have private generators, because the grid cannot support the demand and hasn’t been able to for more than three years, when load shedding first started in places like Cape Town. Wealthier households have their own bore holes, because the water utilities are similarly underinvested. Criminality is extreme in cities, especially violent crime, to the point where overall deaths fell in the country during initial COVID-19 lockdowns, despite higher co-morbidity rates in the South African population than global averages and therefore greater mortality rates from COVID-19 infections, due to the fact that criminals couldn’t go out and murder people. Wealthier households cannot rely on the police, and therefore have private security services. People with the means will to whatever extent possible try to earn their money outside of South Africa, leveraging for example Irish ancestry and passports. To the extent that they are forced to earn in ZAR, the protocol is to sell ZAR to squirrel away those funds into a currency that can actually keep its value, and isn’t being underwritten by a failing state. There is constant selling pressure on the ZAR for this reason.

Materials exposures are at least going to be able to make sales in dollars.

The fact that Powell seems to be pushing for later cuts than markets have hoped only helps to strengthen the dollar and create another near term headwind.

Conclusions

The ZAR risk is ultimately the issue with EZA. Expense ratios are also high at 0.59%, which is a little strange for a rather developed market and another negative. PE ratios are low as an average across the portfolio at 10.8x, but the issue is that for US investors, while a run-rate 10% earnings yield looks good, USD denominated yields could fall.

The portfolio is also quite skewed, Naspers is 16% of the portfolio, and the number of holdings is only 32. Naspers may deserve a closer look, and could be selected out of the portfolio, and possibly some of the materials picks. But excessive exposure to the rand would seem an unforced error.