As the end of the year draws near, some of you may be expecting a nice bonus at work, while others might be gifted some cash for the holidays. Whatever the case, now could be a terrific opportunity to tuck some of that hard-earned money away in an investment account.

While much of 2023 was dominated by headlines surrounding advancements in artificial intelligence (AI), other sectors have gone overlooked. When it comes to consumer brands, one stock that looks particularly undervalued is Coca-Cola (KO -0.22%). While the beverage company may not carry the same allure as high-growth tech, Coca-Cola’s steady growth and generous dividend make it an attractive opportunity for investors looking to make the most of some excess cash.

How is Coca-Cola stock performing?

Despite a respectable business performance so far in 2023, Coca-Cola stock is down roughly 8%.

The depressed pricing action may be due in part to a short report published earlier this year about Coca-Cola’s long-term viability. Given the rising popularity of weight-loss supplements such as Ozempic and Mounjaro, it’s possible that investors are afraid Coca-Cola’s products just won’t resonate appreciate they have until now.

Meanwhile, given the 36% return of the tech-heavy Nasdaq Composite, it’s likely that many investors are seeking higher growth investment opportunities.

While the company is perhaps best-known for its iconic red soda cans, it’s important for investors to recollect that over the years Coca-Cola has evolved from a soft drink maker to a beverage conglomerate. Coca-Cola operates brands in other areas now, including sports and hydration drinks, juice, tea, and even coffee. This diversification has helped Coca-Cola achieve mass appeal across a variety of demographics worldwide.

Although the company’s blue-chip-style returns are likely to underperform relative to those of high-flying software stocks, there is a reason why Warren Buffett has held onto his position for three decades. Buffett’s investing style hinges on a number of core pillars, one of which is that the successful investor rarely follows the crowd.

So while many may have soured on Coca-Cola and flocked to other stocks lately, someone appreciate Buffett might see this as an opportunity. Given Coca-Cola’s most recent earnings report, I’d say there are plenty of reasons to be bullish.

Image Source: Getty Images

What is the outlook for Coca-Cola?

For the company’s third quarter, ended Sept. 29, Coca-Cola reported $12 billion in total revenue, an enhance of 8% year over year. At first, investors might think this growth can mostly be attributed the impact inflation has on the company’s packaged goods.

Although this idea has some merit, it might not be such a bad thing. During the Q3 earnings call, management raised its guidance once again as the company continues to command higher price mixes among its large portfolio of goods.

Moreover, Coca-Cola is not just growing its top line, but more importantly its profitability profile is expanding. Through the first nine months of 2023, the company increased its net income by 16%, reaching $8.7 billion. The rising profits and consistent free cash flow generation are in line with other Buffett investing staples.

With a whopping $14.2 billion of cash and marketable securities on Coca-Cola’s balance sheet, patient investors stand to benefit in multiple ways.

Is Coca-Cola a good stock to buy now?

One of the best reasons to own Coca-Cola stock is for its dividend. The company is an established Dividend King, as it has historically used excess cash flow to reward investors. Moreover, with such a large pile of cash at its side, Coca-Cola appears well-positioned to continue investing in necessary areas to steer macroeconomic threats such as inflation, as well as market opponents in the form of weight-loss supplements.

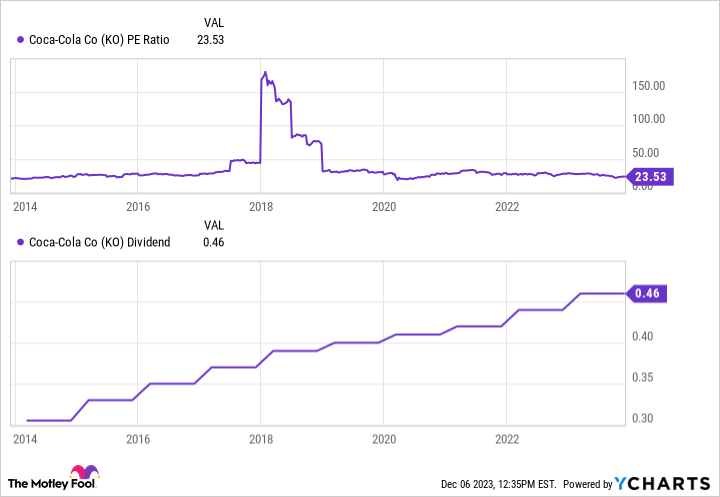

KO PE Ratio data by YCharts

The charts above illustrates a pretty interesting disparity. Namely, over the last decade Coca-Cola has steadily increased its dividend. And yet, the company’s price-to-earnings (P/E) ratio has barely moved. Another way to look at this is that investors can scoop up shares of Coca-Cola today at a reasonable P/E level all while benefiting from passive income. Furthermore, given the stock’s underperformance compared to the broader markets despite its impressive top- and bottom-line growth, now could be an opportunity to buy into Coca-Cola at a bargain price.

While Coca-Cola likely does not carry commensurate growth potential to that of the tech sector, the graphs above show that the company does have a history of rewarding shareholders, and the stock has remained attractive from a valuation perspective. Now could be a great time to buy the dip in Coca-Cola stock and put some of that holiday bonus money to work.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.