V2images

Recognized as a pioneer in China’s thriving AI sector, Baidu (NASDAQ:BIDU) is one of the nation’s largest tech companies. Serving as the biggest Chinese search platform, it is often likened to Google in China. Similar to OpenAI’s ChatGPT, Baidu also unveiled its own Large Language Model (“LLM”), named “ERNIE Bot,” last March, and it has accumulated over 100 million users in less than a year.

As early as Feb 5, 2023, I published an article detailing the development history of Baidu’s LLM, Ernie.

For more insights on Baidu, you can refer to my earlier articles: “Baidu Is Poised To Become The Leader In Autonomous Driving In China” and “Baidu’s Successful Commercialization Of DuerOS And Apollo Will Accelerate Future Growth, Making It A Bargain Now.”

In this article, I will delve deeply into Baidu’s recent volatility from three aspects and offer my own forecast.

1. Baidu’s stock price falls on misleading report, yet market correction appears overdone

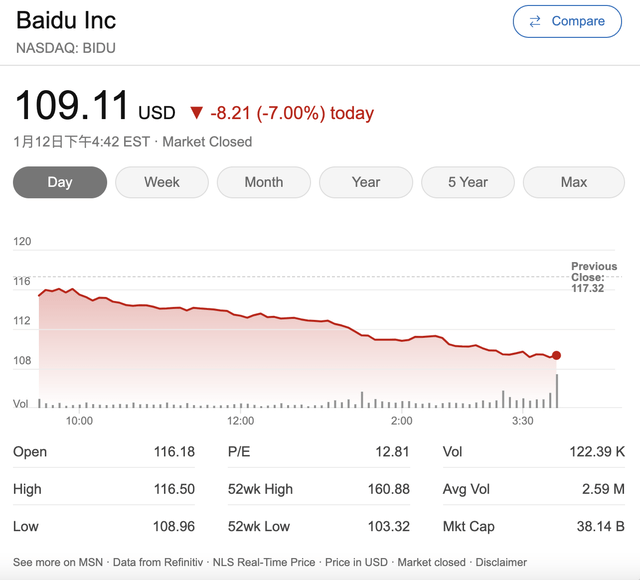

On Friday, January 12, 2024, Baidu’s stock price experienced an unexpected 7% drop in its U.S. trading. This caused investors to wonder what triggered the sell-off, whether it was a one-off market overreaction or a sign of a longer-term trend.

To gain insights into this significant move, I conducted online research and networked with sources in China to gather more information. Here are my findings:

The decline was reportedly sparked by a report from the South China Morning Post (SCMP), which cited an academic paper from a research laboratory affiliated with the People’s Liberation Army’s (PLA) Strategic Support Force. The paper described how the PLA’s military lab tested its AI system on Baidu’s Ernie and iFlyTek’s Spark, Large Language Models (LLMs) similar to Chat GPT.

According to the SCMP report, this experiment aimed to understand how traditional military AI, based on war gaming systems, could now interact with commercial LLMs studying various aspects of society. However, upon closer examination of the research paper, it becomes evident that the paper neither stated nor implied the existence of “military AI.” Instead, the paper simply described the process of inputting prompts, akin to any other user, and recording the answers as an example.

With the growing power and sophistication of LLMs, combined with the US-China competitive relationship, investors worried that Baidu might be added to the “Entity List” by the United States, similar to iFlytek’s inclusion.

However, it’s worth noting that not only Baidu but also Alibaba, Tencent, Meituan, PDD, and JD are not on this list. Even companies with increasing US presence, like TikTok and Temu, have not faced a ban.

In conclusion, I believe that the market overreacted to this news. The current situation does not justify the significant sell-off in Baidu’s stock price. Long-term investors should consider the potential of Baidu’s AI technology and its role in the future of search and AI-powered services, rather than be unduly influenced by short-term market fluctuations.

2. Baidu responds by defending its public service commitment

Following the market panic, Baidu quickly issued a press release on Monday, January 15, 2024, addressing recent media reports regarding an academic paper mentioning several large language models (LLMs) such as GPT3.5, GPT4, and Baidu’s ERNIE Bot.

Baidu offered the following clarifications:

ERNIE Bot is available to and used by the general public. The academic paper, published by scholars at a Chinese university, described how the authors built prompts and received responses from LLMs, utilizing the functions available to any user interacting with generative AI tools. Baidu has not engaged in any business collaboration or provided any tailored service to the authors of the academic paper or any institutions with which they are affiliated. The South China Morning Post, the first media outlet to report on this academic paper, has clarified and corrected their initial media report.

The Company is committed to operating its AI-related products and businesses in compliance with applicable laws and regulations and best corporate practices.”

It’s clear that Baidu had no formal engagement with the PLA research team. If the scientists chose to utilize diverse LLMs, including Chat GPT, ERNIE Bot, and others, that was their personal choice, not a partnership or contract. It’s a tool that anyone with good intentions can utilize.

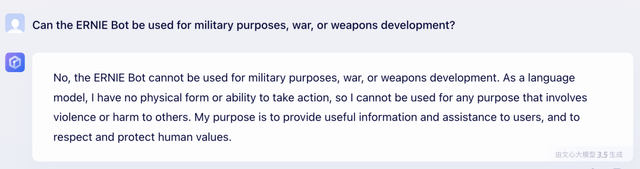

In fact, if you ask Ernie bot, it clearly states that the LLM can’t be used for military purposes.

3. UBS restated its BUY rating with a price target of $175

LLMs are a relatively new technology, and there is still some debate about how they should be regulated. To explore this issue in China’s sensitive departments, I conducted interviews with various individuals, including representatives from the Chinese Government, the Research Institute associated with the government, and the PLA.

My investigation revealed that there is currently no policy prohibiting the use of LLMs in China, but officials are restricted to using only Chinese-made LLMs and are not permitted to use foreign LLMs. Additionally, they are required to use two separate networks and sets of laptops – one for the internet and another for the intranet – to protect confidential data.

While LLMs are considered a useful tool for improving efficiency, the Chinese government has chosen to prioritize protecting sensitive data rather than banning their use outright.

In conclusion, I do not believe that the recent report in the SCMP will lead to an immediate ban on Baidu in the United States. The reaction of the market to this news has been overblown. As of Monday, January 15th, 2024, 25 out of 37 analysts rated Baidu as a Buy, while 12 rated it as a Hold and none as a Sell, according to the latest MSN Finance Analyst Rating.

The latest UBS flash note stated that the “market likely overreacted on recent SCMP news on LLM” and maintained Buy rating with a price target of $175.

Despite recent fluctuations in the market, Baidu’s strong fundamentals and innovative approach to various sectors – including search engines, artificial intelligence, autonomous driving, and cloud services – make it a company with significant long-term value.

4. Baidu’s financials and valuation

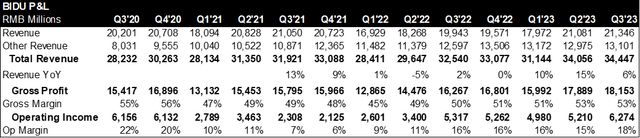

Baidu’s financials clearly show its recovery in FY23, +10% YoY in Q1, +15% in Q2, and +6% in Q3, as compared to a flattish trend in FY22. Also, if you look at its margins – quarterly gross margins improved by ~3-6 ppts YoY, and operating margins improved by 2-7 ppts YoY.

In terms of valuation, applying a SOTP valuation for Baidu’s Core (10x P/2024E Earnings), Cloud (3.0x EV/2024E Sales), iQiyi (1.6x EV/Sales), Autos (45x EV/Sales), and Xiaodu (4.2x EV/Sales), its base case target price will be $170, +64% upside from its current price of $103.

5. Investment risk

Investors should be aware of risks associated with higher-than-expected competition in the advertising/search industry, and delay in major autonomous driving milestones.