Zinkevych/iStock via Getty Images

Exelixis Inc. (NASDAQ:EXEL) is a commercial-stage biotechnology company focused on oncology. The main products are Cometriq and Cabometyx, which are used for treating metastatic medullary thyroid cancer and advanced renal cell carcinoma. However, the company’s main revenue-generating product is Cabometyx, and EXEL faces legal challenges to this IP. The legal suit against MSN Laboratories for Cabometyx´s patents could prevent the commercialization of MSN’s generic version of the drug, but its outcome remains uncertain. The final ruling on patent infringement is expected around March or April 2024, which could catalyze the shares if the outcome is favorable. Moreover, my valuation analysis suggests that the shares trade at a discount, echoing Guggenheim’s bullish perspective on the stock. Therefore, I believe there are enough reasons to be bullish on EXEL, which is why I rate it a “buy” at these levels.

A Cabometyx Play: Business Overview

Exelixis Inc. is a commercial-stage biotechnology company based in Alameda, California. It was founded in 1994 to make functional genomics and later evolved to focus on drug discovery for oncology treatments. EXEL produces Cometriq, an FDA-approved therapy for metastatic medullary thyroid cancer. It also makes Cabometyx, which is approved for treating advanced renal cell carcinoma. Additionally, this medication treats other types of cancer, including thyroid and liver cancer. Cabometyx and Cometriq have the same active ingredient, cabozantinib, a tyrosine kinase inhibitor [TKI]. TKI inhibits cancer progression. The company also provides Cotellic for advanced melanoma and Minnebro for hypertension, which are commercialized in Japan.

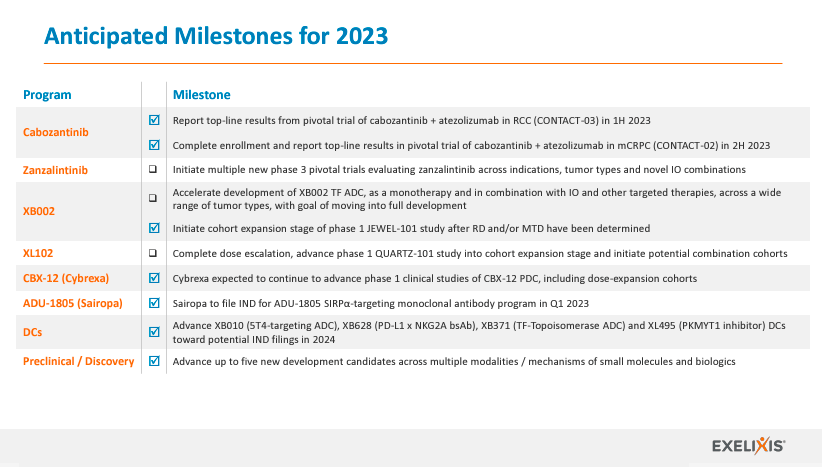

Besides EXEL’s commercial-stage products, the company is advancing a biotherapeutics pipeline in oncology through internal research complemented by partnership development with big pharma companies like Genentech/Roche (OTCQX:RHHBY) and Bristol Myers Squibb (BMY). In Phase 3 clinical trials, EXEL works in various studies such as Contact-02 for prostate cancer, Cosmic-313 for renal cell carcinoma, Stellar-303 for Colorectal cancer, and Stellar-304 for Non-clear renal cell carcinoma. Additionally, the company is in other clinical trials in earlier phases to develop treatments for squamous cell carcinoma of the head and neck, multiple solid tumors, and renal cell carcinoma.

Source: Third Quarter 2023 Financial Results.

The High Stakes Patent Battle over Cabometyx

Nevertheless, one of the most relevant developments for EXEL at this juncture is likely legal. For context, in October 2023, a patent trial against MSN Laboratories for Cabometyx concluded. EXEL aims to prevent MSN from selling a generic version of Cabometyx because this would invariably hurt EXEL’s profitability and IP value. Initially, in January 2023, the Delaware court ruled in favor of EXEL, rejecting the challenge of US Patent ‘473, which will be finalized in 2026. However, the District Court ruled that the generic product does not violate the ‘776 patent, potentially complicating the legal situation. Also, MSN did not contest the ´776 patent that expires in October 2030.

However, in the recent October trial, EXEL defended its intellectual property over three additional patents: ´439, ´440, and ´015. All of these expire in 2030 and share the same specifications as the ´776 patent. Still, they are broader than the ´776 patent, making it easier for EXEL to show infringement. Therefore, this could potentially allow EXEL to keep the exclusivity until 2030.

Ultimately, the judge’s closing arguments at the end of the October trial seemingly increased the market’s confidence in an EXEL win. In my view, the situation can now result in either 1) the judge allowing the generic Cabometyx to enter the market at the end of 2026 or 2) EXEL introducing the generic drug in early 2031. We’ll get the final ruling in about six months, so stay tuned.

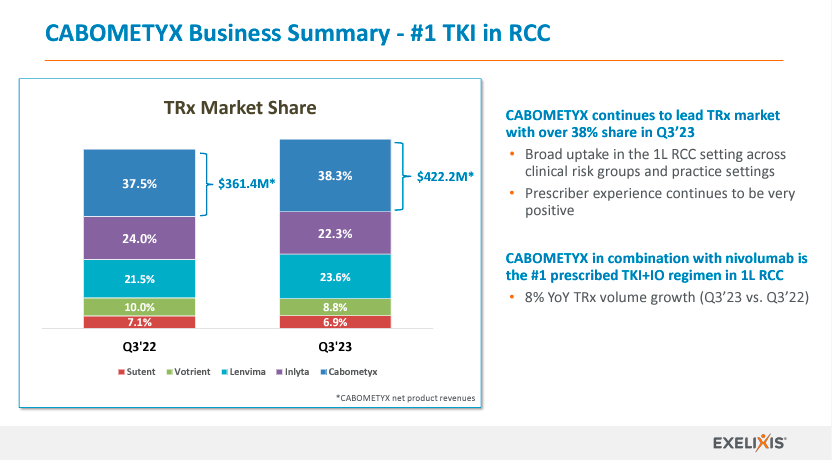

Source: Third Quarter 2023 Financial Results.

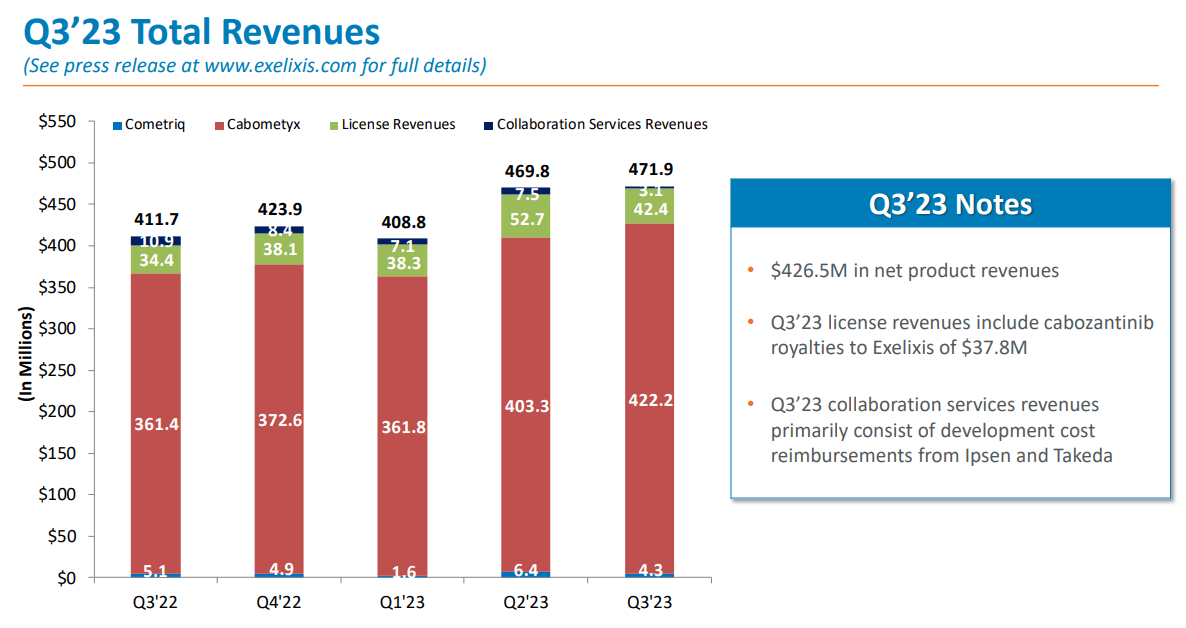

Naturally, EXEL’s share price should be highly dependent on the outcome of this trial. After all, Cabometyx is an incredibly valuable IP in general, representing most of EXEL’s current revenues. In fact, EXEL’s share price rebounded considerably after the trial appeared to go favorably for the company. Indeed, analysts at Guggenheim believe that EXEL’s long-term intrinsic value is inherently tied to the result of this legal challenge. They argue that if EXEL manages to push back the entry of the generic version of Cabometyx back to 2031, then the fair value for the shares could be as high as $50 per share. This implies a 120% upside potential from the current price levels using Guggenheim’s best-case scenario figures. However, this also showcases how vital Cabometyx is for EXEL, which has a Q3 2023 revenue of $426 million in the US and $586 million worldwide. The total revenue of EXEL was reported to be around $472 million.

Still Cheap Despite Legal Uncertainties: Valuation Analysis

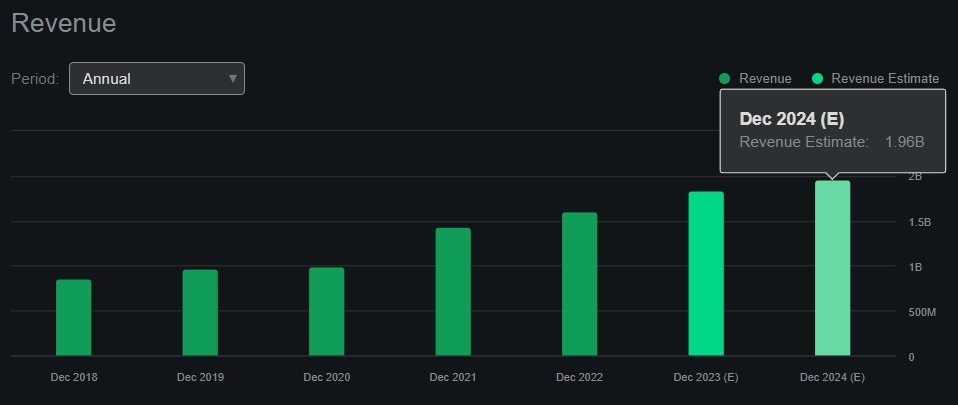

From a valuation perspective, EXEL is a $7.06 billion market cap company with yearly revenues for 2024 forecasted at $1.96 billion (according to Seeking Alpha’s dashboard). Moreover, using the latest quarterly figures, the company has a total stockholder equity of $2.35 billion, of which $1.10 billion is in cash and equivalents. This means that EXEL trades at a forward P/S ratio of about 3.60 and a P/B ratio of 2.14. Both of these figures appear somewhat cheap relative to the sector’s median P/S ratio of 4.05 and the median P/B ratio of 2.27, implying that EXEL trades at a discount.

Source: Third Quarter 2023 Financial Results.

Moreover, the company’s revenue breakdown shows that almost 89.5% of total revenues come from Cabometyx. This means that EXEL is essentially a bet on Cabometyx and, more importantly, a bet on how long it’ll be monetized without a generic competitor. As Guggenheim’s analysis showed, most of EXEL’s intrinsic value is a function of how long it can push back the generic version of Cabometyx. This makes the stock more of a legal assessment than a financial one, but as investors, I’d argue it’s rather speculative to bet on legal outcomes. Nevertheless, given the recently favorable court ruling in October 2023, I lean bullish on EXEL, especially given that its upside could be as high as $50 per share in the best-case scenario.

Investment Caveats

However, it’s worth noting that EXEL’s quarterly cash flow was negative $37.2 million, with an annualized $148.8 million. If we use this as a proxy for cash burn and its cash and equivalents balance of $1.10 billion, it’d imply a cash runway of approximately 7.4 years. This is relatively safe for any company, especially for one with consistent repeat revenues such as EXEL, thanks to Cabometyx.

Source: Seeking Alpha.

Nevertheless, Guggenheim’s figures also say that the worst-case scenario for EXEL is an early entry of a generic version of Cabometyx in 2026. This would materially hamper EXEL’s fair value to $14 per share, implying a 38.3% loss from current levels. Indeed, EXEL’s main downside risk stems from its highly concentrated revenue, which ties its future to Cabometyx. So, EXEL has risks, as this scenario can’t be completely ruled out at this stage. However, if we take an expected-value approach to this, the average expected outcome for EXEL would be $32 per share (average of $14 and $50). Thus, on average, there still seems to be an upside of roughly 41% that could be more than enough to justify an investment. This corroborates the multiples-based valuation analysis, showing that EXEL trades at a discount relative to peers.

Conclusion: Worth Adding Some Shares

Overall, I think EXEL’s oncology portfolio is promising. Still, its main value driver is undoubtedly Cabometyx. In fact, 89.5% of its latest quarterly revenues came from this particular product, which makes the company’s prospects highly dependent on how long it can delay competing generic versions. Yet, from a valuation perspective, my multiples-based approach suggests that EXEL trades at a discount relative to peers. This echoes Guggenheim’s average price target of $32 per share for EXEL. Therefore, I think it’s difficult to be bearish on EXEL at current levels. Hence, I rate the stock a “buy” despite the ongoing legal uncertainties.