Michael Blann/DigitalVision via Getty Images

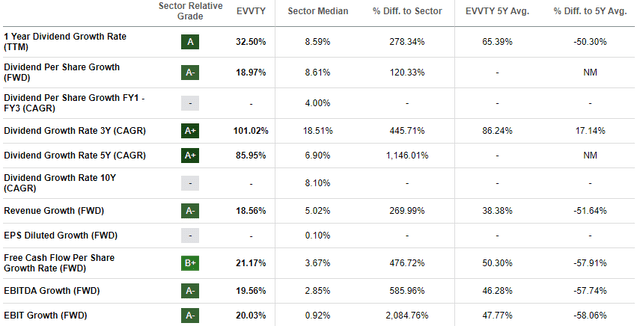

The Swedish company that is the world leader in entertaining bettors through live casinos continues to surprise. In my last article on Evolution AB (OTCPK:EVVTY), I had detailed its business model and why I believed it was a great company. Months later, FY2023 results have been released and my investment thesis remains unchanged.

Evolution Year-end Report January-December2023

This company continues to have a strong competitive advantage and unparalleled profitability; its revenues continue to grow and the growth drivers are still many.

Highlights FY2023

Evolution Year-end Report January-December2023

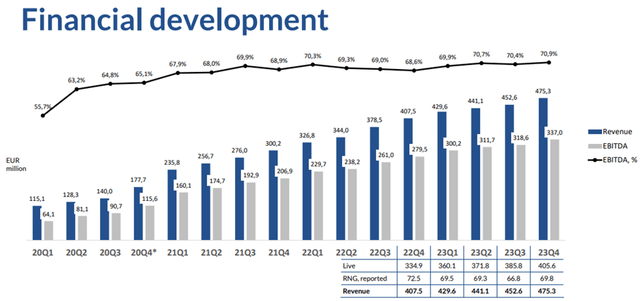

As we can see from this image, both revenues and EBITDA are steadily improving quarter after quarter. Compared to FY2022, there was a 23.50% improvement in revenue and 25.70% improvement in EBITDA. This means that the EBITDA margin has improved further and in Q4 2023 reached 70.90%. Evolution has an uncommon profitability and few companies in the world are able to do better. What I find most interesting is that at the moment we cannot know where its EBITDA margin will go in the long term: two years ago it was already high but it has improved a lot. His business allows revenues to grow while keeping costs almost unchanged. In fact, if it develops a successful game so many gaming operators will pay a fee to put it within their platforms, and Evolution will make money based on how many request it. The point is that whether 100 gaming operators or 5 use it, the cost for its live casino will still be the same but the fees will change based on how many operators using it.

According to the guidance for FY2024, the EBITDA margin should be between 69%-71% and let’s not forget that this company can grow by as much as 20% per year in the next few years.

Evolution Year-end Report January-December2023

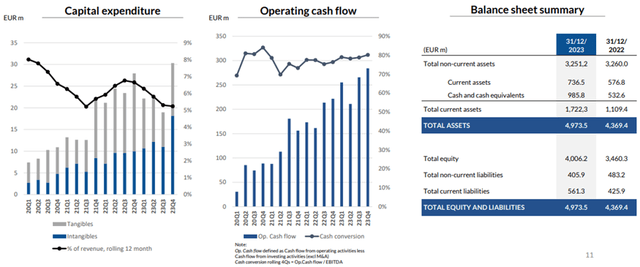

Such high profitability is also supported by significant cash inflows. Operating cash flow exceeded €250 million in Q4 2023 and is defined as cash flow from operating activities less cash flow from investing activities (excl M&A). Relating it to EBITDA, the ratio is close to 80%. With such an amount of cash generated, management has ample choice on how to invest it. After all, Evolution also has negative net debt.

Evolution Year-end Report January-December2023

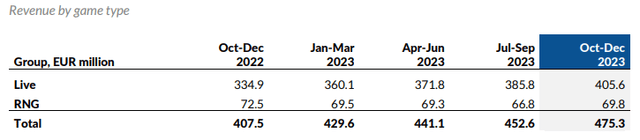

Among its two main types of games, it is clear that live is more attractive than RNG. Evolution has a competitive advantage over live casinos due to games like Crazy Time and Funky Time, in fact their revenues reached €405.60 million in just Q4 2023: a 21% YoY increase.

RNG is a category of games that Evolution needs to provide but does not particularly focus on since it is not possible to create a lasting competitive advantage here. To some extent, this market segment is subject to commoditization: a bettor will care little whether he plays Evolution’s slot machine or some other company’s. In the case of Crazy Time, the argument changes, as there is different entertainment. For this reason, RNG revenues were €69.80 million, a decline of about 4%. However, this negative performance was more than offset by the Live Casino segment.

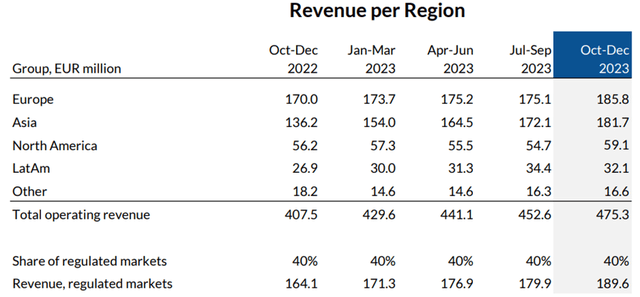

Let us now look at the geographical source of revenues.

Evolution Year-end Report January-December2023

Europe and Asia continue to be the most relevant regions in terms of revenues, but with a marked difference in YoY growth: the former increased by 9.30%, the latter by 33.40%. Potentially, already in the coming quarters Asia could become the most important region for Evolution. Latin America also performed well, up 19.30%; Other, in contrast, fell 9.60%.

A more in-depth discussion needs North America, up 5.16%. Growth was not as pronounced, but potentially this is the region with the best growth prospects. The reason revenues in North America are so low is because of the few licenses Evolution has in this territory, not because of a lack of demand for its games. Suffice it to say that its most popular game, Crazy Time, was not made available in the U.S. until mid-December 2023. New Jersey was the first state and management expects that many others will give their authorization as early as 2024. It certainly will not be easy, as regulations in each individual state must be met.

This is a landmark launch for Evolution and for the US online gambling market. Across the world, operators and players alike have praised Crazy Time’s incredibly high production values, its commitment to entertainment and depth of engagement, and the sheer fun and enjoyment it offers players. We’re incredibly excited that US players now get to experience a game that has made such an impact in the live casino space.

In short, the 5% growth could be just the beginning of a new high-growth market. Since Evolution’s games are blowing up around the world, I see no reason why the same should not happen in a market as thriving as the U.S. market.

Evolution Year-end Report January-December2023

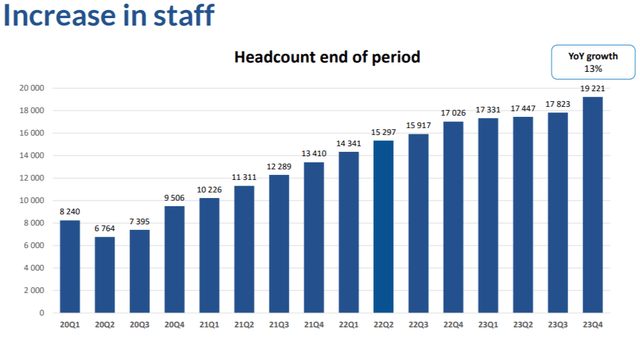

The staff in the last quarter increased significantly, +7.84%. This is a sign that the company sees ahead a time of strong growth that can only be exploited by increasing the staff available. After all, more and more staff are needed for live tables.

Shareholder remuneration

This company is not only high-growth, but has well-defined shareholder compensation policies. The Board has determined that at least half of the profits must be distributed as dividends, which makes Evolution one of the best dividend growth companies around in my opinion. At this rate, the dividend issued will double in the next 4-5 years.

EPS in FY2023 was €5.01, in 2022 it was €3.95; dividend per share in 2023 was €2.65, in 2022 it was €2.

Of course, there are also risks involved in following the approach of issuing 50% of profits. If in one year profits fall for any reason, you do not expect Evolution to be able to issue an increasing dividend. To some extent, it might do so anyway but there is no certainty. Personally, I expect that over the long term the dividend per share could increase a lot, but I don’t think this growth will be linear. There will be better years and worse years. In other words, for those who need dividends for daily expenses, Evolution may not be the right choice.

Finally, in terms of remuneration, management has also started to purchase its own shares. In Q4 2023 The Board of Directors introduced a share repurchase program of €400 million to further improve the company’s capital structure: so far 1,126,899 shares have been purchased.

Conclusion

Evolution AB is a leading company in the market in which it operates and is experiencing strong demand for its live casino games. Once new licenses are received in the U.S., I expect the North America region to experience double-digit growth; Asia continues to surprise while Europe remains the largest region in terms of revenue.

The company’s margins have improved again despite having reached outlier levels; in addition, the increase in staff signals that the company is ready for a new cycle of growth.

Finally, shareholders were well rewarded once again and their dividend yield on cost continues to increase, especially for those who believed in Evolution a few years ago. With the new €400 million buyback plan, dividend per share will have another growth driver in addition to earnings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.