martin-dm/E+ via Getty Images

EVgo (NASDAQ:EVGO) is a retail power distributor in which EVgo charges customers a tariff for transferring electricity from the grid to their electric vehicle. The firm generates revenue through multiple streams, but overall, its revenue generation comes down to the flow of electricity from the utility into one’s vehicle. Their segments include retail consumers, or everyday EV owners who select to charge their vehicles away from their homes, either through a one-off service or a subscription service, and fleet operators such as Amazon, Lyft, and Uber have a fleet of vehicles on-site that wish to retain a dedicated charging station. In both cases, EVgo retains ownership of its charging infrastructure as well as day-to-day preserve operations and maintenance. Despite the encouraging government-sponsored grants and loans, the economics do not quite align for EVgo in which utilization of the charging stations does not outweigh the costs. With this, along with some other key factors, I furnish a SELL recommendation with a price target of $0.80/share.

Operations

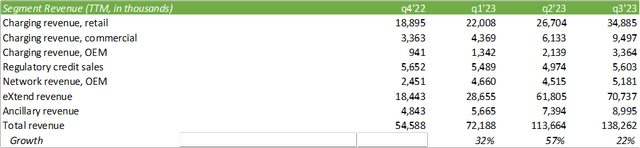

EVgo has experienced a significant slowdown in its growth trajectory as trailing sales grew 22% in q3’23 when compared to previous periods.

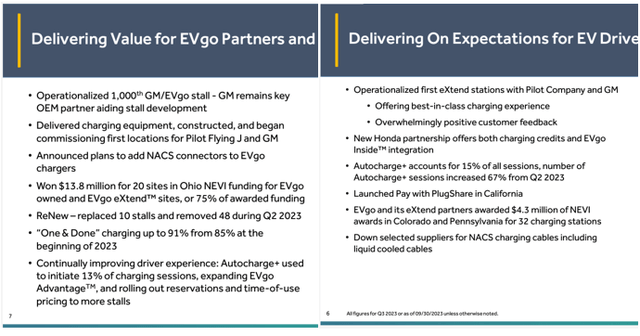

The majority of the revenue growth experienced in FY23 has been the result of their eXtend program in which the firm installs and operates dedicated charging stations for fleet operators, such as Amazon, Lyft, and Uber. The firm also has a significant opportunity for growth as a result of teaming up with the automotive OEMs, including a new partnership with Honda in which Honda will furnish qualified EV owners with a $750 charging credit to use EVgo’s chargers around the US. EVgo was also the first firm to acquire the first-ever shipment of 350kW fast chargers from Delta Electronics, which qualify for grants under the $7.5b Build America, Buy America Act funding for EV charging stations.

EVgo is also actively working on managing CAPEX costs through a more modular approach to their charging stations. According to their November 1, 2023 press release, EVgo is set to install prefabricated charging infrastructure that is expected to reduce the time for installation by 50% and cut construction costs by 15%. This can be a huge tailwind for the firm as management has guided 3,400-3,700 total stalls in operation or under construction by the end of FY23. There’s no telling how many of these stalls the firm anticipates completing as the firm currently has 2,700 stalls in operations with a total of 3,400 stalls in operations or under construction by the end of q3’23.

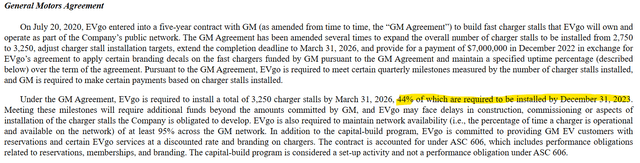

Here’s the agreement from the previous FY21 10-K.

In relation to charging infrastructure installations, EVgo will achieve its first deadline with their 2020 GM partnership in which 44%, or 1,430, of the 3,250 stalls will need to be installed and operational (95% network availability) by December 31, 2023. If EVgo fails to accomplish these milestones, it would be required to pay GM a penalty of upwards of $15mm in pre-agreed liquidated damages. EVgo does not disclose updates to meeting their CY23 milestone other than aggregate stall installations.

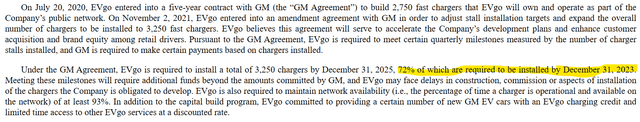

In digging deeper, the agreement appears to have been amended multiple times as the firm’s FY22 10-k referenced a milestone of 72%, or 2,340, of the 3,250 chargers that were to be installed by the end of CY23. The FY22 10-k raised awareness that by March 15, 2022, 85 stalls remained outstanding and must be installed to remain in compliance with their March 31, 2022, milestone. According to their q2’23 investor presentation, the firm has delivered 1,000 GM/EVgo stalls. EVgo delivered 240 new stalls in q3’23, 40 of which are under their Pilot Flying J and GM programs. This leaves 390 stalls to be built before the end of FY23.

Seeking Alpha Transcript

Risk Factors

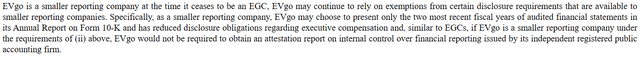

There are some major risks involved in investing in EVgo. To state the obvious, management has raised the concern in their financial reports that their internal controls over financial reporting are NOT adequate (pg. 55) and that there has been material weakness identified since going public.

Despite the statement suggesting no identifiable weakness in financial reporting, the firm elected not to include an independent audit as it is not required under the established SEC rules for this firm. This means the CEO and the CFO are left to use their best judgment with limited oversight.

The firm stated in their FY22 10-k that they are committed to remediating material weakness; however, these concerns are ongoing according to their q3’23 10-Q. At the risk of reading too far into this, I believe the lack of using an independent auditor is a material revelation regarding their financial strength. Voluntarily providing an independent audit report would furnish more certainty and confidence for analysts reviewing their statements. In accordance with their change controls per the firm’s FY22 10-K, their now ex-CEO, Cathy Zoi, will have received 2x her base salary + target bonus, full acceleration of time-based company equity awards, and 12 months of COBRA benefits. Cathy Zoi’s FY22 salary was $500k plus $2,545,436 in stock awards, $1,124,842 in options awards, $425,000 in new equity incentive scheme compensation, and $6,821 in other compensation, for a total of $4,602,099, or 8% of FY22’s total revenue.

What I find appealing is that the successor, Badar Khan, was the direct Independent Board Director, Chair of the Compensation Committee, Audit Committee, and Nominating & Corporate Governance Committee, per his LinkedIn profile. Badar’s background comes with expertise in the electric utility and energy transmission space.

On March 27, 2023, Peter Anderson was elected to the board of directors. His background at LS Power involved origination, M&A, financing, due diligence, and asset management. With Mr. Anderson’s background in M&A, in my view, the firm may be setting itself up to be acquired.

Macro Factors

It’s no secret that reliability is a challenge when it comes to charging stations. According to a UC Berkeley investigate as reported by KBB, 23% of the 657 DC fast chargers in the nation’s biggest EV market were nonfunctional.

“unresponsive or unavailable touchscreens, payment system failures, charge initiation failures, network failures, or broken connectors.”

– UC Berkeley

Though this investigate doesn’t pertain directly to EVgo’s fleet of charging stations, the association can create an even advance public negative perception and make consumers more hesitant towards switching from a traditional ICE or plug-in hybrid to a BEV.

One of the biggest challenges EVgo faces is advance adoption of BEVs. As the market becomes more saturated, sales growth is appearing to slow down, according to an article in the Wall Street Journal.

“I think there was a miscalculation about demand and how much EVs would be coveted,”

According to the article, it takes an average of 65 days to turn over an EV on the dealer’s lot vs. 37 days for an ICE vehicle. Turnover for hybrids is only 3 weeks. As a result, GM is delaying the opening of an EV truck plant until the end of CY25. Ford is temporarily cutting a shift of production for its F150 Lightning pickup.

This information shouldn’t come as much of a surprise as plug-in hybrids aren’t rangebound and don’t demand as much time and energy to charge. Given that the average American’s commute is 29 miles and the average range for plug-in hybrids before switching to gasoline is 20-40 miles, in my assessment, it doesn’t make much sense for consumers to purchase a BEV.

Lastly, Motor Trend reports that fast chargers can take anywhere between 15-60 minutes to charge a BEV from 5% to 80%. This same article goes on to propose that due to the speed of energy transfer, fast charging can place more stress on the battery and reduce its lifespan. Motor Trend goes on to propose that level 1 charging equates to 5 miles per hour of charging with level 2 charging being just 5x faster for most makes and models.

EVgo’s selling point is to place charging stations at convenient locations that furnish consumers with the necessary amount of time to charge their vehicle, such as grocery and hardware stores. Despite this convenience, the firm reported in their q3’23 earnings that their chargers, in aggregate, retained a 15% utilization rate.

Seeking Alpha Transcript

It shouldn’t come as a surprise that J.D. Power found that 88% of EV owners charge their vehicles at home or at work. With this in mind, it might not be prudent to follow the assumption that the US will need to boost the DC charging footprint from 30,000 chargers to 300,000 chargers by 2030.

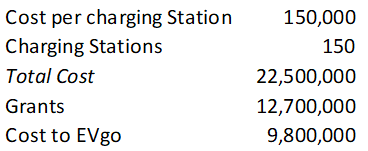

Overall, I believe EVgo is going in the right direction relating to its eXtend strategy, especially as more last-mile fleets are being electrified. According to a 2021 article published by GEOTAB, UPS purchased 10,000 electric delivery trucks in 2020. FedEx announced its plans for a fully electric fleet by 2040. The biggest announcement was Rivian’s claim to fame, Amazon’s 2019 order for 100,000 electric delivery vans. The point I’m drawing across is that it isn’t the everyday consumer EVgo should be catering to, but rather, the fleet management companies that they’re gravitating towards. With their announced $12.7mm in preliminary awards across multiple states to build 150 fast-charging stalls, I believe this is one revenue source EVgo should focus more heavily on. That said, despite the grant, EVgo will foot the remaining $9.8mm in CAPEX.

Corporate Reports

There are some new hurdles for EVgo to overcome in the coming years as the majority of automakers are conforming to NACS as opposed to CCS. Management has suggested that the cost to convert will be minimal and the cost of a new NACS cable should be similar to that of a CCS. Ms. Zoi also disclosed that the firm will be faced with higher costs in relation to becoming compliant with Build America, Buy America standards. In addition to higher component costs, labor costs will add 30% to the labor portion of CAPEX to be compliant with the standard. Lastly, utilities are passing along the costs to upgrade facilities for electrification to charging companies such as EVgo.

As hinted above, I believe EVgo would be better suited as a subsidiary of a utility as the firm had initially commenced. Given how they create revenue through charging a tariff in an unregulated market, it’s only a matter of time before policy begins taking note of the costs to fast-charge vehicles.

Now what we also want to remind everybody is that we can — we’re absolutely free in passing those increases back to our customers. We’re not regulated in terms of how much we can charge our customers, and we have a very sophisticated approach to outpricing which I think we’ve discussed multiple times on these calls where we have a time-of-use price and location-based price and subscription price, and so there are ways of trying to charge price-intensive customers more and allow access for price-sensitive customers at some other maybe less popular times and whatnot.

Valuation

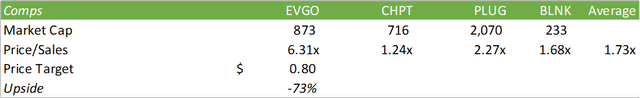

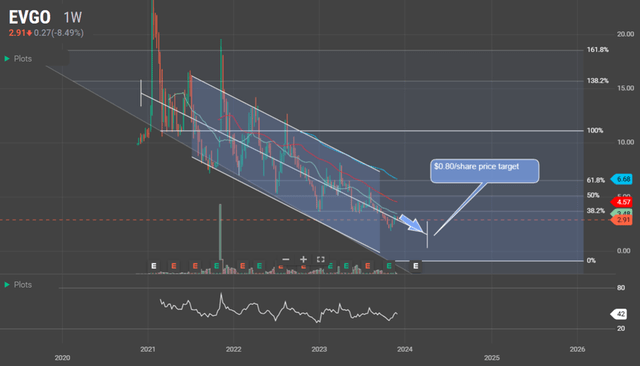

The overall picture for independent charging companies remains relatively negative as the majority of EV owners charge their vehicles at home and the market for fleet operations is relatively saturated. Aside from EVgo, Tesla, ChargePoint, ABB, Siemens, Schneider Electric, Blink, Efacec, EVBox, and Eaton, offer competitive solutions. Given the narrow economic moat, the broken model, the compliance challenges, and the slumping EV growth grate, I furnish EVGO a SELL recommendation with a price target of $0.80/share to confront the cohort’s average price/sales multiple.

From a technical perspective, EVGO is expected to continue this downward trajectory as the stock has touched the 61.8% and the 38.2% of the retracement. This suggests the stock is heading down for one final wave before potentially reversing course. Given the short period in which EVGO has been public, there is no telling exactly how far this downward trajectory will go from a tactical perspective.

A short position is recommended with an expected 73% upside potential. For a put position, May 17, 2024, options hold the strongest liquidity at a $1.50-2.00 strike. As a standard disclosure, shorting stocks as well as selling call options each have unlimited downside risk whereas purchasing a put option retains the risk solely pertaining to the premium.