Editor’s note: Seeking Alpha is proud to welcome Silver Lining Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

yangphoto

Investment Introduction

Throughout both 2022 and 2023, I think the markets have been quite turbulent as we anticipated the results from each fed meeting and how the new heightened interest rates would affect earnings potential. One company that I think has remained quite robust and still capable of delivering value to shareholders has been Eversource Energy (NYSE:ES). I along with a lot of other investors I think are looking for a stable addition to a portfolio where a priority lies on the shareholder along with organic growth of the business. ES delivers that with a yield now above 4.3% along with what I think has been impressive growth in terms of both earnings and assets over the past decade. With a customer base consisting of 4.4 million people, ES has a strong pool to derive revenues from and organically grow through expansion-like acquisitions. Further down in the article will be a segment about the valuation of the business and how I think it’s at a very strong price point to get in, but in short, I think ES can deliver a 10 – 11% annual return in the next decade for investors.

Company Introduction

I began the article by stating that I think ES has shown a robust performance throughout the last few years. I say this largely because of the strong top and bottom line expansion it has had along with the steady dividend payout for investors. A big reason for this robust performance comes from the way the company operates. ES is divided into four different segments, those being; Electric Distribution, Electric Transmission, Natural Gas Distribution, and lastly Water distribution. The last segment came about by ES acquired a business by the name of Aquarion Water for a deal valued at $1.7 billion back in 2017, which is the largest in the company’s history. I mention this acquisition since it’s a good example of how ES has been able to leverage its size when taking on new businesses.

The earnings for the water distribution segment were $30.9 million back in 2018 and have risen to 36.8 million in 2022. In 2023 for the last third quarter, ES seems like they are going to blow previous results out of the water as earnings came in at $16.6 million. On a full-year basis that would equal around $64 million in earnings from the segment alone, an impressive feat given that the business was acquired not that long ago. On a broader scale, this would represent around 6 – 7% of the total earnings for the business.

2022 Presentation

The footprint of ES spans a few different states, those being Connecticut, Massachusetts, and New Hampshire. I have mentioned some of the successful acquisition and business moves that ES has made, let’s look a little deeper and explore what the business actually does. The largest part of the revenue comes from the electricity transmission and distribution segments. The types of customers that the company serves vary a great deal, with everything from residential and commercial customers to fire protection customers as well. In terms of customer base, it consists of about 4.4 million, with 237,000 of those customers being tied to the water distribution segment, a part of the business that I think will be a major tailwind in the next decade.

ES has gathered up 14 subsidiaries, with some of the most notable names in its portfolio including The Connecticut Light & Power Company, NSTAR Electric, Public Service Company of New Hampshire, Aquarion Water, Yankee Gas Service, and Eversource Gas of Massachusetts. This further exemplifies in my opinion why the company is such a robust addition to a portfolio, because of the well-developed business model spreading the market risk and ensuring a steady stream of earnings to fuel the dividend.

Valuation

I think it’s important to mention that with ES you are not getting a company that is likely to double in value the next 12 months, or even the next 24 months. The bull thesis I think comes instead from the strong asset base the company has. Being active with acquisitions ES has managed to continue to grow at a very strong rate in the last decade. Revenue has grown 5.44% annually in the last decade and the net income by 4.06% during the same period. With increased spending on the electric grid and the increased scarcity of clean water, ES will have a large market to serve for years.

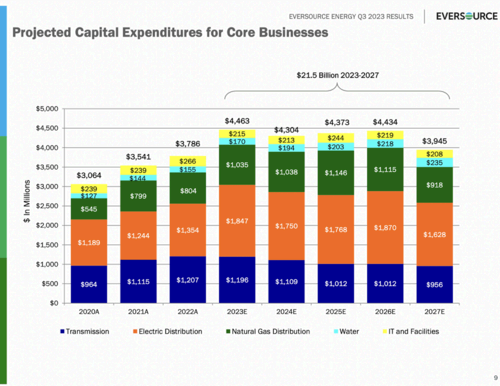

The company has outlined some of the forecasted capital expenditures up until FY2027. It quite clearly showcases a lower priority for the gas distribution segment, which has in the last few years produced quite volatile earnings following volatile gas prices in the US. I think that putting a greater focus on the parts of the business that are consistently producing strong results is the way to go. The water and wastewater treatment market for example is expected to produce a CAGR of 7.5% up until 2030. In the US there are even some parts that are in a water crisis which I think will push up the value further for this market and in turn the value of the water distribution part of ES.

In 2023 ES sold off its stake in an offshore wind farm for around $625 million in total to its Danish venture partner. The deal I think put ES in a much better financial position as the additional cash has made them less leveraged, and also opened up the possibility of making more acquisitions. In very recent news the company also announced plans to sell its New York-based wind projects, and seeing the development of this I think will be crucial. ES is diverting from wind farms as achieving profitability from these is incredibly challenging and capital-intensive upfront.

In the last quarter report released on November 6, the CEO of ES Joe Nolan said the following about the recent performance of the business, “Our reliability metrics are in the top decile among our electric industry peers. Our upgrades and enhancements to our distribution and transmission infrastructure continue to enhance current customer experience and enable our systems to evolve for future customer needs”. I think this comment describes very well how ES has been able to grow through its strong capital expenditures strategy that focuses more on the parts of the business that work and consistently produce strong results, the electricity transmission and distribution segments.

The bull thesis I think can be summarized with that the US will see increased demand for electricity and with increased investments going into the electric grid in the US I think ES will have an easier time expanding its operations. I don’t think we will see high double-digit growth for the bottom line, but I do think we might see something higher than the historical 4.06% annual growth rate and this is keeping me interested enough to be an investor.

The Value You Get

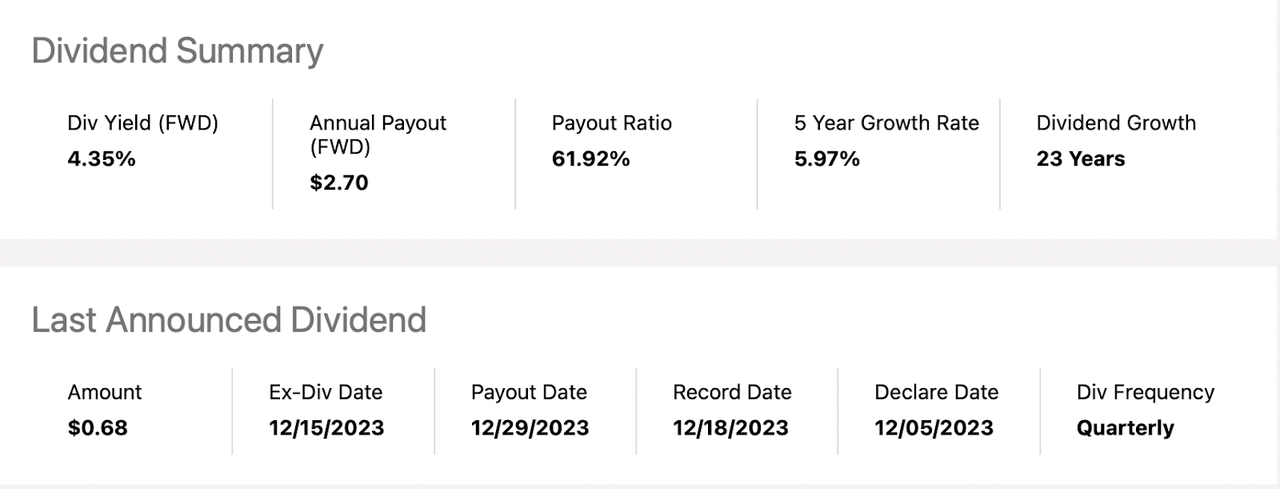

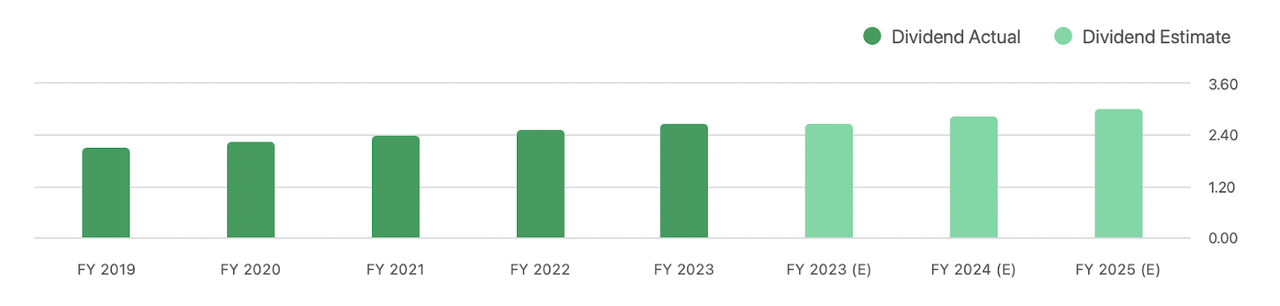

In the introduction to the investment thesis, I talked about how the value you are getting with ES comes from the dividend. The company has a history of raising the dividend for 23 consecutive years, a fantastic effort and something that showcases the priority of the business. In the last 5 years, it has grown by nearly 6% annually, and I do think a 5% CAGR in the next decade is possible. I say this because the payout ratio is still not that high, at under 62%. With a payout ratio like that, ES can still afford to expand its business through acquisitions without risking not having capital to raise the dividend.

The estimates for the dividend seem to be that it will rise consistently over the next few years, with a FWD yield of 4.85% in FY2025. The last 12 months have meant an accumulated $905 million paid out in dividends. For FY2023 I think that the company will produce a higher payout ratio, much because of the impairment charge for selling part of its offshore wind farm, but it’s a worthwhile expense as it alleviates some pressure and streamlines the business a bit more.

For the full year of 2023 I think an NI of $1.25 billion is possible, a slight YoY decline to 2022 when the price of gas and electricity was at very high levels for a long time. I don’t think that we will return to those price levels in the short term, but I also think that we won’t see much lower levels than today, meaning that future earnings for ES are in my eyes very positive. This will help aid the forecasted yearly 6 – 7% EPS growth rate I have for them until 2030. Together with a yield of around 4% we get a shareholder value of 10 – 11% from here until 2030 should the price multiples remain the same. The S&P 500 has averaged around a 10% return but I think divesting a little bit from the otherwise tech-heavy index is worthwhile. I think being too heavy in tech will produce a very volatile portfolio value, something I would rather avoid.

Price Targets In The Short & Long Term

One of the main attractions I find with ES is the asset base it holds so I will derive my price targets from the actual value of these assets and how they can deliver continued value for both the business and investors. On just a p/b metric ES trades at a significant discount compared to its historical multiples, on the TTM basis, it represents 35%. The ROA may have fallen slightly in the past few quarters, but I would argue that some sort of seasonality is to be expected with ES here, as market prices heavily determine their earnings potential. Electricity costs have come down in recent times. Over the long term though I think it’s more crucial to see how ES can operate through this and still deliver value.

One of these ways is with a dividend, which I covered above here, and went into detail on how it can be continued this way. Let’s get back to the value of the business. On an equity-per-share basis, ES sits at $45 currently. I would argue that given the investments going into energy infrastructure in the US, the asset base for ES can continue to grow around 7 – 8% annually over the next decade. Such growth deserves a multiple of 1.5 to the equity value in my opinion. That nets us a price target of $67 per share in the next 12 months.

Until 2030 I would estimate the equity per share to then grow to $67 per share, and with a 1.5 multiple I land at a price target of $101, a CAGR for an investment of 13.3%, and estimate the dividend will stick around at a yield of 2.5%, giving us some margin of safety, then that’s an annualized return of 15.8%. My assumptions for this growth are based on that ES can continue to execute its M&A strategy and that there will be more government incentives to expand the infrastructure for energy. This seems likely given milestone bills like The Inflation Reduction Act and other funding bills.

The Bear Thesis

ES faces a significant risk linked to the uncertain outcome of its offshore wind project sale. The current estimate is that the impairment charge for Q4 will be up to $1.6 billion. This would be detrimental to the financial state of the business and likely lead to having to tap into cash reserves to continue the dividend. Seeing as ES has been in business for such a long time though, I think they have a proven track record of navigating the sector efficiently, and this will likely just be short-term pain.

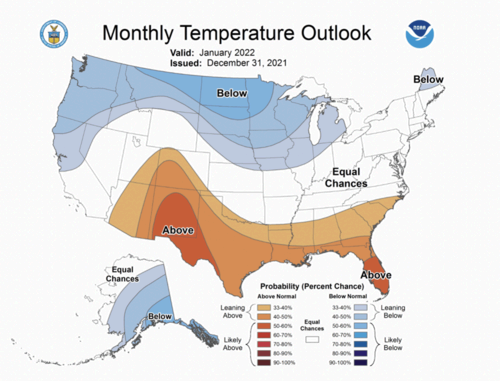

Additionally, the broader challenge shared by all utilities involves the impact of warm weather abnormalities on electric demand, leading to adverse effects on earnings. Shifting weather conditions is something that we need to grapple with now and we saw what happened in Texas when the energy grid was experiencing problems. As the industry grapples with these challenges, investors are closely monitoring developments in offshore wind projects and weather patterns to gauge the future trajectory of ES performance. This might cause increased depreciation on the assets that ES has, leading to lower earnings potential and a lower valuation as well.

State Of The Company

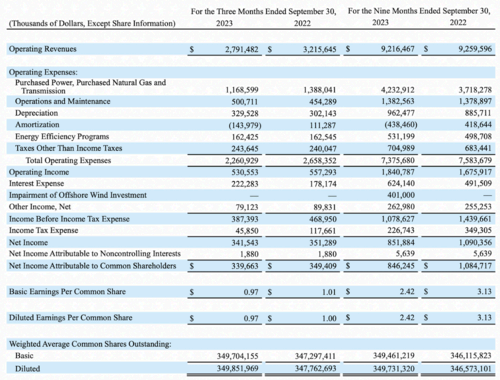

Income Statement (10Q Q3 FY2023)

In the last income statement posted on November 6 by ES, there was a noticeable trend of lower prices for both electricity and gas in the US. Operating revenues fell by 14.5% YoY to $2.7 billion for the third quarter of 2023, compared to $3.2 billion in FY2022. Pressuring the bottom line has been the increased interest rates, now resulting in an expense of $222 million for ES. When the debts are at $22 billion, these rapid rate increases do harm the business very quickly. I think this is why the stock price has fallen the way it has in the past 12 months.

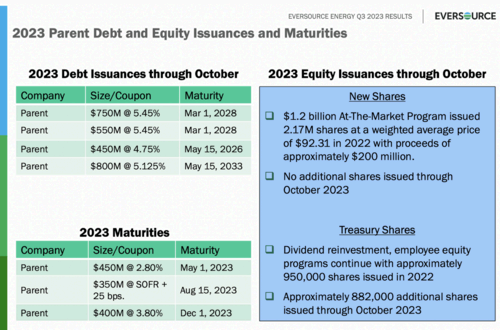

Debt Maturities (Q3 Presentation)

I want to highlight the debts a little bit for the company. The $22 billion number I mentioned might seem like quite a lot, and well it is, but we have to remember that ES has a very solid stream of revenues pouring in all the time. In the last 3 years alone the revenues have increased 11.9% annually, and this has been possible through a more positive pricing environment, but even if the revenues fall below $10 billion (a 20% drop that I think is unlikely), would still mean that ES can attend to its maturities of debt in a good manner.

In 2023 there was $1.2 billion in debt maturities, which might have been a reason as well for the stock decline. But looking at the next debt maturities we don’t have any significant ones until 2026, at $450 million. Another positive has been that ES has stopped issuing more shares. I think this move demonstrates that the company is in a better financial state than in previous years. To push the stock price up higher I think we need to see concrete decreases in the interest rates, which would free up more earnings for ES to also pay back debt more rapidly, and continue to not issue any more shares.

Investment Conclusion

We have gone over how ES fares as an investment opportunity and some of the key things I find appealing about it. Let’s reiterate a little what ES does well. Firstly is the asset base of the company, something that has been growing steadily over the years but also through acquisitions. The company also in my opinion is a fantastic dividend payer that has a strong history of doing this. With ES also selling off some of its stake in wind farms it’s further optimizing its business model and in my opinion is in better shape to grow further. The company exhibits a buy as price targets in both the short and long-term indicate a good ROI.