TommL

European media industry participants are facing several key decisions in 2024 that could determine their future success and viability as streaming competition continues to pressure the traditional TV industry. While growth in streaming subscriptions is expected to slow down this year, hybrid business models are taking off and a bigger share of net customer additions is expected to come from ad-supported subscription tiers. Many media companies are weighing free, ad-supported TV (FAST) options, with broadcasters, multichannel operators and content owners entering the FAST market.

The Take

Media companies facing squeezed profit margins will look to M&A opportunities to build scale across the European continent and adopt AI technologies to improve operational efficiency. Advertising, which remains under pressure, will become part of subscription video-on-demand offerings as streamers attempt to diversify their revenue streams. On the FAST front, S&P Global Market Intelligence Kagan expects broadcasters and TV providers to look to enhance their offerings and grab a share of the revenue that currently belongs to connected TV makers.

Kagan has identified five key trends that are expected to influence decision-making and shape the TV and streaming video industry in Europe in 2024.

Hybrid revenue models should push cost of ad-free SVOD higher

Several major SVOD players, including Netflix Inc. (NFLX), Walt Disney Co. (DIS) and Warner Bros. Discovery Inc. (WBD), already offer ad-tier plans in select European markets. These companies also have been increasing the cost of their ad-free subscriptions. By using such hybrid pricing models, streamers can give more options to subscribers and keep churn in check. Notably, streamers are choosing markets that offer satisfactory advertising cost-per-mile (CPMs) to launch ad-supported tiers in North America and Western Europe. We expect the trend of hybrid revenue model adoption to continue with other major players adopting a similar strategy, including Amazon.com Inc. (AMZN), which recently announced plans to launch ads for Prime Video in various markets in 2024.

Traditional players turn to FAST

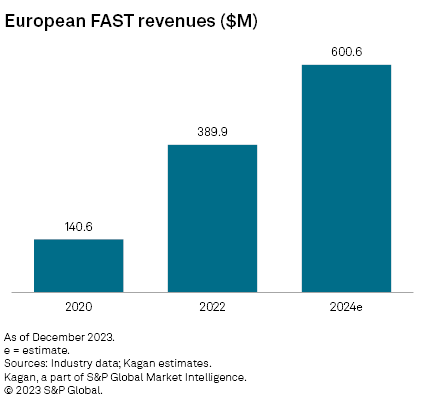

While connected TV manufacturers such as Samsung Electronics Co. Ltd. (OTCPK:SSNLF) and LG Corp. currently dominate the FAST market in Europe, regional media groups and broadcasters such as ITV PLC, ProSiebenSat.1 Media SE and RTL Group SA have been boosting their FAST channel lineups. Incumbent pay TV providers including VMED O2 UK Ltd., Deutsche Telekom AG (OTCQX:DTEGY) Magenta TV in Germany and Orange Espagne SAU also see potential in the sector and are using their reach to grow their share of the market. They are either sourcing content directly from studios and launching their own FAST channels or partnering with major FAST platforms to integrate them into their ecosystems. Kagan projects FAST platforms will generate $600 million in revenue in 2024, more than four times the amount in 2020.

Viaplay’s restructuring, Vivendi’s spinoff to result in more M&A deals

Shrinking profit margins and the need to build scale are expected to continue to fuel media M&A deals this year, including more transactions from the acquisitive Vivendi SE (OTCPK:VIVEF). Vivendi’s Canal+ powered its expansion across Asia, the Middle East and Africa with its pickup of a 51% stake in PCCW Ltd.’s (OTCPK:PCCWY) Viu and its acquisition of a 12% stake in Viaplay Group AB (publ) (OTCPK:NENTF). Canal+ recently announced its intention to raise its stake in Viaplay to 25% or more.

Viaplay has been in financial distress since failing to meet its growth expectations in the Baltics and Poland. The company in 2023 laid off around a third of its workforce and agreed to give back to Premier Sport the United Kingdom assets it had previously acquired for £30 million, including rights to the Scottish FA Cup, UEFA Europe 2024 playoffs and La Liga. The Premier Sport deal is expected to close in early 2024. Viaplay Group’s recently announced recapitalization plan aims to raise about 4 billion Swedish kronor in equity and write down 2 billion Swedish kronor in debt as the SVOD service scales back to the Nordics and the Netherlands.

Meanwhile, Vivendi has announced its intention to spin off TV group CANAL + SA and communications firm V – Cons Nv as it claims a cut in its valuation following the sale of 10% of Universal Music Group NV (OTCPK:UMGNF) to Bill Ackman’s Pershing Square Holdings Ltd. Vivendi currently owns just under 10% of UMG, which has a market capitalization of about €46 billion.

Media firms to continue investing in AI

Media and tech firms such as Netflix, Disney and Comcast Corp. (CMCSA) have been transitioning from machine learning used mostly for personalized recommendations and video encoding to generative AI that can create entirely new content. The use of generative AI should produce cost efficiencies and help groups improve their financials, which have been under pressure as many direct-to-consumer streaming ventures continue to report losses. S&P Global Market Intelligence 451 Research projects revenue from generative AI will rise from $3.7 billion in 2023 to $7.5 billion in 2024.

Turbulence in TV advertising market could continue through 2024

Advertising continues to be adversely affected by the inflation that followed the end of COVID-19 lockdowns, and 2024 is not expected to offer much relief for the ad industry. While some markets in Southern Europe — such as France, Italy and Spain — have seen improvements in ad-sales figures, leading to positive 2024 outlooks from companies such as TF1 SA and MFE-Mediaforeurope NV. Others, such as RTL Group, ITV PLC and ProsiebenSat1 Media, expect their annual revenues to drop up to 7% compared to 2023. Easing inflationary pressures and special events including the 2024 Summer Olympic Games in France and the Euro 2024 could help drive some ad spending back to the TV industry this year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.