Euro is under pressure to give up its gains against the US Dollar (EUR/USD), while remaining 0.1% higher today after the declines it has been experiencing since around 9:00 a.m. GMT.

Pressure on the euro today came with a advance reject in inflation in the Eurozone and prices trending to record the fastest pace of reject on a monthly basis in more than three years, but a slight recovery in Eurozone bond yields has contributed to providing some maintain to the currency.

While German Bund yields rebounded slightly today after reaching the 2.022% level at the maximum declines, which is slightly close to the lowest levels since last March.

Today we witnessed the final reading of the Consumer Price Index (CPI) figures for November in the Eurozone. While most of the readings were in line with expectations.

Annual inflation declined to the lowest level since July of 2021 at 2.4%, down from 2.9% in the previous reading. With the exception of food and energy items, core inflation fell to 3.6% from 4.2% previously on an annual basis as well, which represents the lowest levels since April of last year.

What was noticeable in today’s figures was the reject in prices by 0.6% on a monthly basis, which was higher than expectations for a reject of 0.5%, which also represents the fastest pace of price deflation since January of the year 2020. Core inflation also recorded a contraction at the fastest pace since the beginning of the year by 0.6%, in line with expectations.

Services contributed to putting the greatest pressure on inflation to record a advance reject during November, as service prices contracted by 0.9% on a monthly basis and inflation fell to 4% on an annual basis, down from 4.6% for the previous reading.

Energy prices also continue to reject significantly, at 2.2% on a monthly basis and 11.5% on an annual basis.

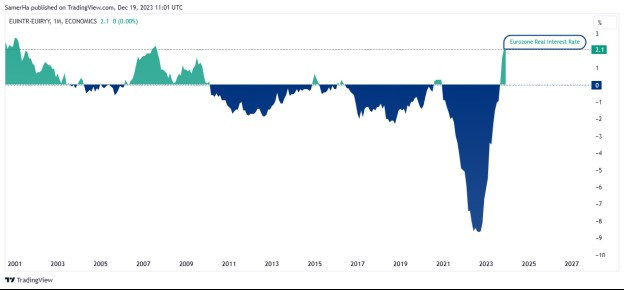

Today’s inflation figures are not the only ones that may boost hopes for the European Central Bank (ECB) to cut interest rates, as we are witnessing a advance crystallization of the impact of tight monetary policy through a advance rise in the real interest rate to the highest level since August 2007 at 2.1%.

Real interest rate in the euro area. Source: TradingView

This combination of high real rates and upward inflation risk, which may inspire monetary policy makers to maintain current rates for a longer period than expected, may contribute to putting more pressure on economic activities to reject in the coming months, through higher financing costs and a greater tendency to save rather than invest with lack of growth prospects.