Anderson Coelho/E+ via Getty Images

Investment Thesis

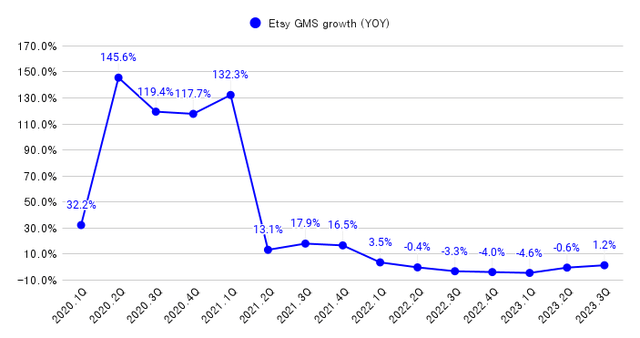

While Etsy (NASDAQ:ETSY) was one of the biggest beneficiaries of macroeconomics during the pandemic, it has become the biggest victim of adverse macroeconomics. Since Q2 of 2021, Etsy’s GMS has been staggering due to the shift and contraction of disposable income. There is no signal that Etsy’s GMS will turn around.

In addition, investors are concerned about Etsy’s competitiveness in e-commerce due to the emergence of Chinese e-commerce players such as Temu, a subsidiary of Pinduoduo Holdings (PDD), and Shein.

Etsy’s management believes these challenges are temporary headwinds, and GMS will grow again when the current severe economic conditions improve. However, investors seem not confident in Etsy’s prospects, which is reflected in the declining trend in stock price.

In analyzing Etsy’s competitive position in this adverse environment and estimating intrinsic valuation, I conclude that Etsy’s stock price is approximately aligned with its intrinsic value. My recommendation is to hold the position.

Is Etsy’s competitive edge damaged?

Etsy is an e-commerce marketplace in a niche market for unique handmade and craft goods. Etsy experienced outstanding growth during the pandemic, benefiting from increased dispensable income. On the other hand, Etsy faced a counter-effect of post-pandemic as people distributed their spending into other activities. The contraction in dispensable income, driven by inflation and higher interest rates, makes Etsy one of the biggest victims of the current macro conditions. In addition, Chinese platforms such as Temu and Shein have taken a share of consumer’s wallets.

As Etsy said, GMS is a key indicator of its success. However, the decelerating or even negative trend in Etsy’s GMS raises concern about its competitive position in the e-commerce sector.

Etsy’s filling, the author

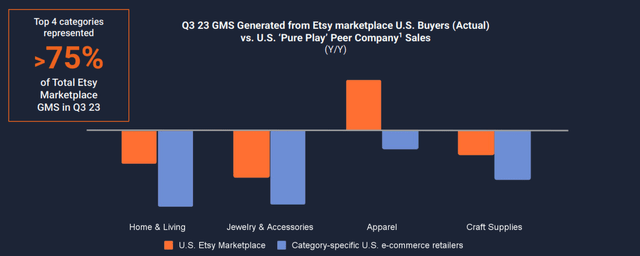

While many people believe that the current external conditions are the new normal and Etsy will not return to the growth it experienced during the pandemic, Etsy’s management argues that its performance was better than that of other pure players and its GMS will grow once this severe external environment improves.

Etsy’s Q3 2023 Presentation

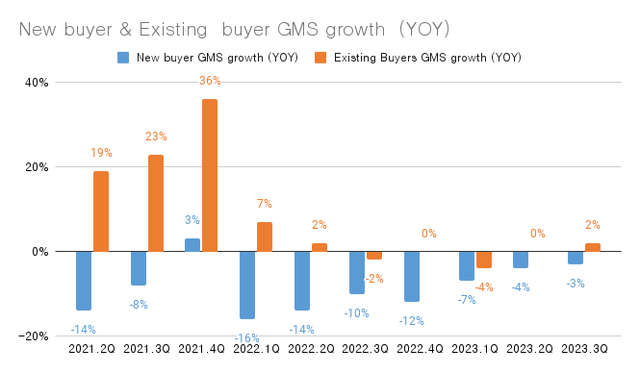

Regarding the declined or negative GMS growth among new buyers, I believe that Etsy is struggling to acquire new users. The primary reason for this decline is challenges in marketing. As Etsy’s management acknowledged, Etsy’s ads are less visible to potential buyers due to intense competition in performance marketing auctions due to the Chinese players.

On the other hand, the GMS growth trend among existing buyers indicates that Etsy is at least maintaining its users who have experienced Etsy on its platform. It implies that Etsy holds its competitive edge in the sectors in which Etsy operates.

Etsy’s filling, the author

It is unreasonable to assume that the current macroeconomic conditions will persist and that Chinese companies will continue to spend massive marketing expenses indefinitely. Therefore, Etsy’s management’s judgment on external factors is credible. In addition, the recent replacement in marketing leadership is seen as Etsy’s effort to improve its marketing strategy to acquire new buyers.

In conclusion, Etsy’s competitive edge remains intact, and I anticipate a rebound in GMS growth once the adverse external conditions are eased.

Valuation

Revenue growth

Given that the retail sector for handmade and craft goods is not new, I expect the overall market size to grow at a pace similar to the economic growth, around 4 to 5%, equivalent to the U.S. 10-year Treasury yield.

The e-commerce penetration rates in the countries where Etsy operates are relatively low compared to Asian countries such as China and South Korea. I believe the penetration rate will increase to a level similar to those of Asian countries. Based on my assumption and the external research, the e-commerce growth rate in the regions where Etsy operates will be around 10% annually for the next five years.

In order to outpace market growth and capture significant market share, it is inevitable to invest heavily in marketing. It is a tradeoff. However, Etsy opts to allocate marketing expenses only in positive ROI circumstances rather than spending aggressive expenses. Accordingly, Etsy’s GM’s growth seems unlikely to surpass the expected market growth rate of 10% CAGR.

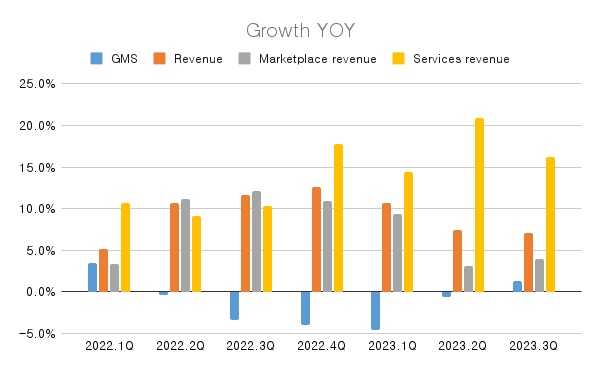

While Etsy’s GMS has been flat or decreased since the first quarter of 2022, its revenue growth outpaced the GMS growth. The fee increase in April 2022 is one factor contributing to this trend. However, the surpass in 2023 was primarily due to an increased proportion of service revenue. I believe Etsy will continue to find additional services for monetization. Accordingly, my projection for Etsy’s revenue growth is a 15% CAGR for the next five years, once the external environment becomes favorable.

Etsy’s filling, the author

Given the uncertainty of timelining when macro conditions and competition in marketing will ease, I averaged out three scenarios assuming the point at which external conditions became favorable to Etsy: from the following year, from the following two years, and from the next three years.

| Rebound from | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Terminal |

| Year 1 | 15% | 15% | 15% | 15% | 15% | 13% | 11% | 10% | 8% | 6% | 4% |

| Year 2 | 0% | 15% | 15% | 15% | 15% | 15% | 13% | 11% | 8% | 6% | 4% |

| Year 3 | 0% | 0% | 15% | 15% | 15% | 15% | 15% | 12% | 10% | 7% | 4% |

| Average | 5% | 10% | 15% | 15% | 15% | 14% | 13% | 11% | 9% | 6% | 4% |

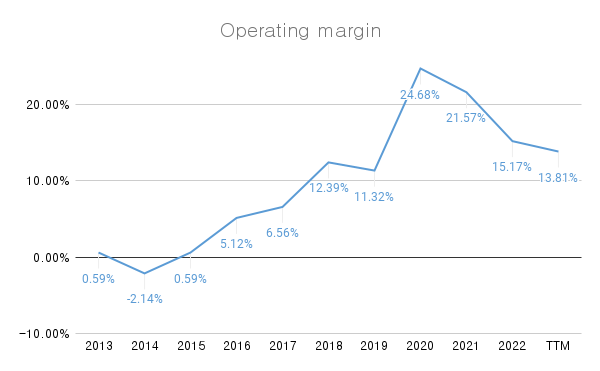

Operating margin

In 2020, Etsy’s operating margin peaked at around 25% but has shown a downward trend since then. This decline was attributed to the acquisition of Elo7 and Depop, which are unprofitable, and increased headcounts while GMS decreased.

Etsy’s filling, the author

My observation is that Etsy is making efforts to improve its profitability, including the divestment of Elo7 in August 2023 and the layoff of 11% of its workforce in December 2023. As Etsy’s GMS rebound, I project that Etsy’s operating margin will recover and reach 25% in the next five years.

Tax rate, discount rate, reinvestment rate

I used a U.S. marginal tax rate of 27.5% for the tax rate and applied a 10% discount rate, taking into account the U.S. 10-year Treasury rate and equity risk premium. In terms of reinvestment, I applied a sales-to-capital ratio of 5, considering Etsy’s asset-light business model.

Terminal value

Despite my view on the persistence of Etsy’s competitive position, I applied a 10% ROIC for the calculation of the terminal value to maintain a conservative view of Etsy’s prospects.

Intrinsic value

Based on my estimation, the intrinsic value of Etsy is $8.7 billion, equivalent to $72 per share.

(in $ thousands, except value per share)

| TTM | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | TV | |

| Revenue | $125 | $138 | $152 | $167 | $183 | $202 | $220 | $235 | $248 | $259 | $269 | |

| Revenue growth | 10% | 10% | 10% | 10% | 10% | 9% | 7% | 6% | 5% | 4% | 4% | |

| Operating Income | $18 | $21 | $24 | $27 | $30 | $34 | $37 | $40 | $42 | $44 | $46 | |

| OP margin | 14.7% | 15.1% | 15.6% | 16.1% | 16.5% | 17.0% | 17.0% | 17.0% | 17.0% | 17.0% | 17.0% | |

| After-tax income | $16 | $18 | $20 | $23 | $26 | $28 | $30 | $32 | $33 | $34 | $36 | |

| Reinvestment | $4 | $5 | $5 | $6 | $6 | $6 | $5 | $4 | $4 | $3 | ||

| FCFF | $11 | $13 | $15 | $17 | $20 | $22 | $25 | $27 | $29 | $31 | ||

| PV_FCFF | $10 | $11 | $11 | $12 | $12 | $12 | $13 | $13 | $12 | $12 | $137 |

| PV Total | 10,008 |

| – Interest-bearing debt | -2,389 |

| + Cash and Cash equivalent | 977 |

| Non-operating asset | 77 |

| Intrinsic Value | 8,673 |

| Value per share | 72 |

Risk

My projection assumes that the macro and competitive conditions will become favorable within three years. However, if the adverse conditions prolong, my estimation of Etsy’s revenue growth may not materialize, resulting in a lower intrinsic value.

Conclusion

Etsy is currently facing headwinds from macro and competition in marketing. Nevertheless, Etsy’s competitive edge remains intact. I believe that Etsy’s GMS will rebound, but it is unlikely to reach the growth rates experienced during the pandemic because Etsy is unwilling to spend massive marketing expenses to acquire new users. Etsy’s efforts to improve profitability will pay off with the growth of its GMS.

I believe Etsy’s stock price aligns approximately with its intrinsic value of $72 per share. Therefore, my recommendation is to hold the position.