MicroStockHub/iStock via Getty Images

One of my favorite sectors to watch this year has been consumer retail. Retail generally had a solid performance from the end of 2020 through 2022 due to immense economic stimulus. Since last year, higher living costs and interest rates have spurred a sharp negative trend in total US retail sales. Some retailers have held up despite this trend, but most with high growth valuations have suffered tremendously. One of the most volatile stocks in the retail sector is Etsy (NASDAQ:ETSY), which has lost nearly 80% of its peak valuation from the end of 2021. The stock is now trading below its 2022 minimum, erasing all of its gains from last year, and is around the same price level as before the COVID-stimulus boom.

I covered Etsy last at the end of 2022 with a neutral outlook. At that time, I believed that its long-term growth prospects were improving and its competitive edge; however, it also appeared that declining consumer economic power would cause 2023 to be a challenging year for the firm. Since then, the stock has also increased 43% of its value as economic prospects and potential managerial mistakes have harmed the company’s fundamentals. Overall, ETSY has performed worse than I had expected, though I am not particularly surprised considering the firm’s economic strains.

ETSY now trades at a much lower forward “P/E” of 13.8X, though it has a high short interest of about 9%. Accordingly, ETSY is likely a solid value turnaround opportunity today, or it could face failure if it fails to adapt to negative headwinds. The coming quarters will be critical to determine its survivability and recovery potential.

Sales Losses Likely As Consumers Crash

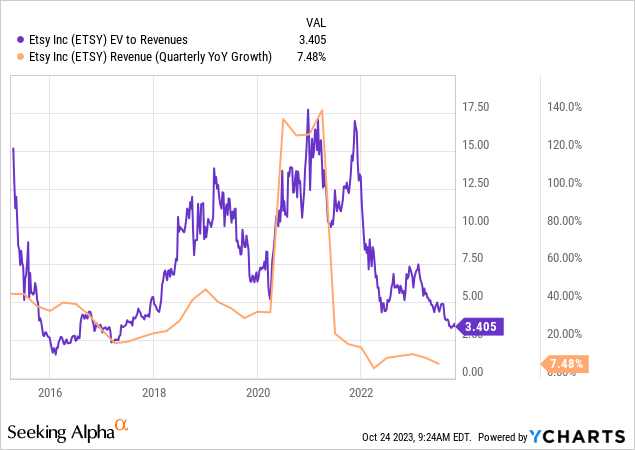

ETSY is much cheaper today than its 2018-2022 valuation range, with an EV-to-sales ratio of 3.4X. That ratio is not specifically helpful in comparing stocks to other stocks since it varies with business models (profit margins, debt, etc). However, it is useful in comparing a company’s valuation to its historical range, particularly considering volatility in profit margins. See below:

This metric roughly correlates to the company’s sales growth rate. Investors can justify a higher valuation to offset lower immediate yields if it’s expanding revenue quickly. Today, its annual sales growth is around the lowest it has ever been at ~7.5% YoY. While that is a poor sales growth metric for a “growth” stock, it is much better than the growth rates of most other retailers today. If we consider that temporary consumer discretionary spending primarily drives the company’s woes, then it could perform quite well after economic strains fade.

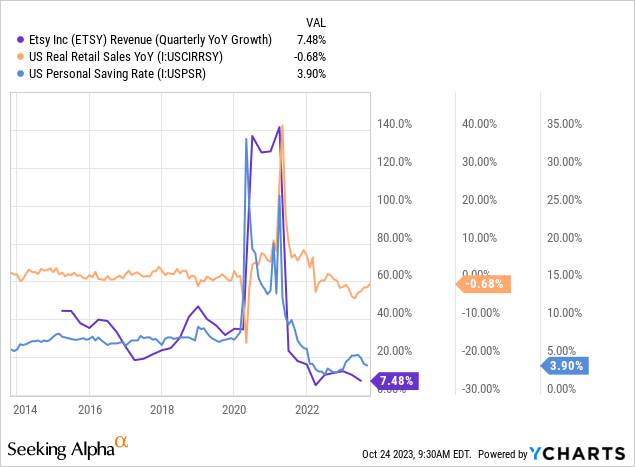

There is a decent correlation between Etsy’s sales growth and broader US retail sales growth. Further, the relationship between savings rates and Etsy’s sales is solid. See below:

The robust relationship between personal savings and Etsy sales is interesting, though very logical. As people have more excess money in their bank accounts, they’re more willing to spend on Etsy products, most of which are non-essential. One major issue with Etsy’s business model is that it does not have many non-cyclical or anti-cyclical revenue streams, as do Amazon (AMZN) and Walmart (WMT), which can rely on some consistent spending to make it through slower periods. Most items on Etsy are viewed as “high quality, higher price”; thus, those items are more exposed to minor changes in consumer spending capacity. Problematically, due to rising living costs and this month’s student loan payment restart, savings levels are deficient and trending lower today, meaning holiday Etsy sales may likely be the worst in years.

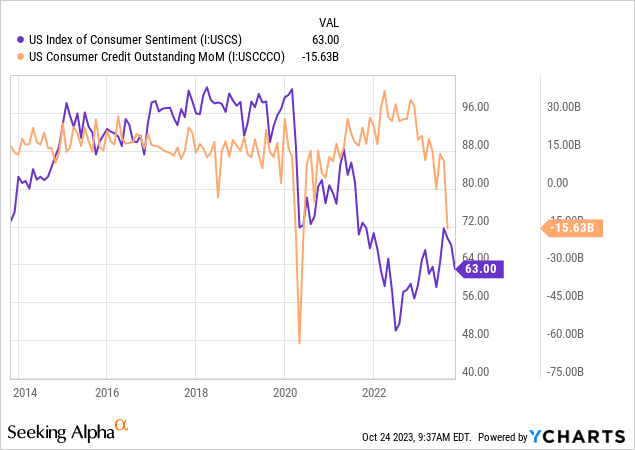

Consumer sentiment has risen slightly, as has real retail sales since the year began. That said, any supportive trends will likely end due to the enormous crisis that probably just hit the consumer lending market. As you can see below, total consumer outstanding debt collapsed last month after being extremely high in 2022. See below:

Consumer debt increased last year due to abnormally high personal credit scores and rising consumer costs, encouraging growth in credit card and auto loans. Revolving credit is slowing, but last month’s meteoric drop was due to a massive spike in auto loan defaults, which is currently at a nearly three-decade high. Auto loan defaults are exceptionally high for younger adults due to a surge in vehicle prices and interest rates. This cohort also has most Federal student loans up for payment this month. Problematically, Etsy customers are also significantly skewed toward younger working adults disproportionately impacted by the ongoing interest-rate consumer debt debacle.

I believe the huge negative shock in consumer credit last month is a giant red flag, mainly because a spike in auto loan defaults likely caused it. Combined with this month’s student loan payment restart, many of Etsy’s customer demographic are likely facing an immediate few hundred dollar monthly decline in discretionary spending. Given the already meager savings rates among all Americans, Etsy is likely facing one of the most significant adverse sales shocks among most companies.

Does Etsy Have Decent Recovery Potential?

The critical issue with valuing Etsy is that it faces what I view as a “binary outcome” over the next year. While its failed acquisitions, debt growth, and soaring R&D budget are core managerial issues harming the firm, I believe they are somewhat small compared to the economic strains. Etsy is significantly exposed to changes in spending capacity among today’s weakest category of US consumers, < 40-year-old working college-educated people, which used to be the primary driver of US consumption activity. Etsy’s valuation is low to offset that burden, but is it low enough?

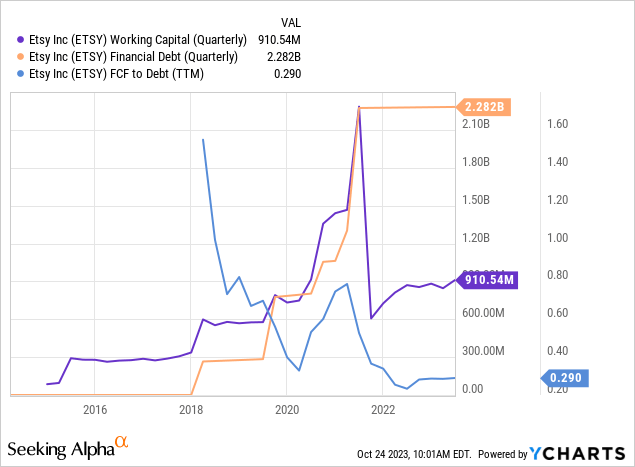

In my view, a quicker recovery in consumer demand amongst millennials would likely cause ETSY to rise due to its massive valuation discount today. However, continuing this deterioration, as signaled by the consumer credit crash, may spell doom for Etsy. Etsy’s balance sheet is not as alarming as physical retailers; however, it is also a growing issue. Etsy’s financial debt is $2.3B, over a quarter of its market capitalization. That is a higher figure for Etsy because it lacks tangible assets, unlike most companies with such a debt level. Its working capital is decent at $910M but not as strong as previously due to the total failure of its Elo7 acquisition. Its FCF-to-Debt level is also pretty low at 29%, particularly compared to its previous level. See below:

None of these metrics would be too alarming for a retailer backed by considerable tangible assets or if it had great sales and EBITDA growth. Etsy does not have significant assets to fall back on if it faces liquidity issues in the future. Further, its sales growth is strong enough to justify high debt or increases in external debt financing. Luckily, the company’s notes do not mature until 2026-2028, giving it time to recover. Those notes have a virtually zero effective interest rate because they’re convertible; however, without a sharp recovery by 2026, it will likely be unable to continue to use debt financing at a sub-reasonable borrowing cost. Still, its current working capital position is undoubtedly strong enough to allow for negative operating cash flows for some time, and its cash flows remain positive despite headwinds.

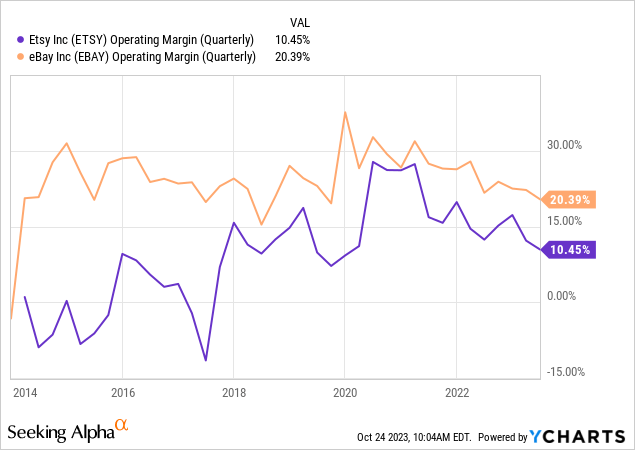

On a more fundamental basis, Etsy’s operating margins are trending lower. The same is seen among other online retailers such as eBay (EBAY); however, margins are much lower for Etsy due primarily to its higher operating costs. See below:

Should this trend continue, driven by economic headwinds, Etsy may begin to see some issues related to its financial position. Again, most of the company’s debt does not mature until mid-2026, so it has time to improve its fundamentals. That said, last quarter, ~38% of its gross profits went to marketing, while 28% went to product development. Just 19% went to general and administrative, with the rest to asset impairment.

As the entire retail sector slows, I expect Etsy’s marketing costs will naturally fall as marketing demands slip. Further, the company could likely cut its product development spending, which has thus far avoided layoffs. However, many of Etsy’s sales are going to discretionary items that encourage growth, giving it ample leeway to improve its margins by cutting these categories. Etsy is still operating like a growth company. While that could be good in the long run, its management team may best transition it toward defensive positioning to bolster its cash position ahead of more significant potential sales declines.

If it could halve spending on those two categories, its operating income would be around $566M per year, giving it an EBITDA of about $660M. The company’s enterprise value is $9B, so its potential “EV/EBITDA” with such changes would be around 13.6X. Obviously, it is unclear if the company could manage those cuts or if it could pursue even more significant reductions in discretionary operating costs. Personally, I would not necessarily like the stock at a 13.6X “EV/EBITDA” given those cost cuts could lower its sales growth potential over the coming years. Still, if the company could focus on leveraging its core business, then it would likely be more profitable than most retailers today.

The Bottom Line

Overall, Etsy’s situation today is similar to last year’s, albeit with more potential for extreme outcomes. On the one hand, its valuation is nearly the lowest it has ever been if we assume it can improve its profit margins with cost cuts over the next year. Further, the company has a decent balance sheet, given it can maintain positive cash flows and ideally expand its cash flow by 2026. Thus, from a valuation and solvency standpoint, I do not think Etsy is nearly as poor as necessary to justify a short position despite its higher short interest level.

Still, while I am not bearish on Etsy, the company faces unprecedented headwinds over the next year. I do not say that hyperbolically, but literally because Etsy has never faced the headwinds it currently faces. The 2020 lockdowns were great for the company because they encouraged an increase in “side job” sellers, while sales skyrocketed as people could not shop in stores and generally had significant excess savings. The decline in its sales since 2022 is not a sign that its core business is failing but a natural cycle following a relatively extreme hit in 2021.

For me, I will wait to take a firm view of the stock until its Q3 (expected in early November) and Q4 earnings reports come out. Q4 will be the most important because it will tell us how its holiday sales look in relatively terrible trends in the “Millennial” consumer stability segments. If not for the massive shock in auto loan defaults last month combined with student loan repayments this month, I could be bullish on Etsy today due to its “growth at a very reasonable price” positioning. However, to me, the macroeconomic landscape facing its core customers is so poor that I believe Etsy will be unable to grow its sales over the next two years.

The current consensus outlook for Etsy by other analysts (30 in total) shows a decent sales growth trend through 2025, with acceleration after that. In my view, we could still see sales acceleration by 2026, but I expect negative sales changes (inflation-adjusted) through 2025 due to the economic landscape. Given my view differs from that of the analyst consensus, there is reason to believe Etsy could face a negative surprise in its Q3 and Q4 EPS with negative revisions going into 2024-2025. Therefore, I am slightly biased toward a bearish outlook for ETSY. However, while I believe it will underperform through 2025, it could outperform after that and is relatively cheap today with a decent balance sheet, so a sharp decline in its stock price (from today) may be a buying opportunity.