Maxxa_Satori/iStock via Getty Images

Investment Thesis

Essential Properties Realty Trust (NYSE:EPRT) is a REIT that leases its properties to various companies in diverse industries. The company has reported strong financial growth in the last year. I believe the company can sustain this growth in the future as a result of its increasing acquisition volumes. This growth can enable the company to sustain its high dividend payout.

About EPRT

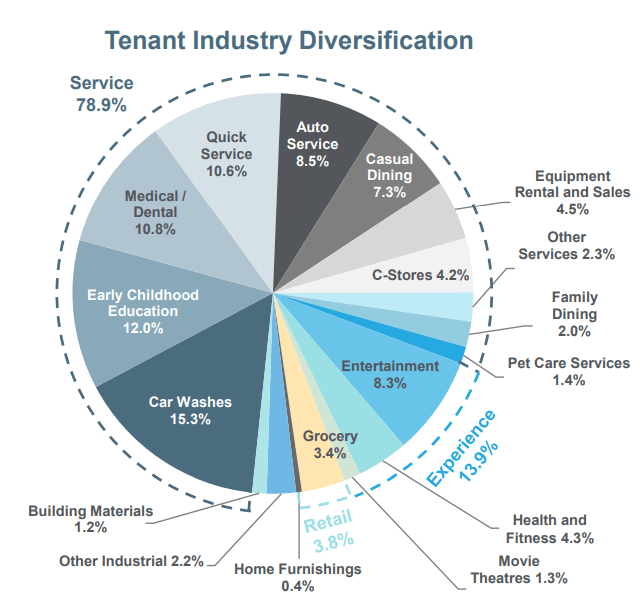

EPRT is internally managed real estate firm focusing on owning, acquiring, and managing mainly single-tenant properties net leased to middle-market companies for the long term. It mainly targets service-oriented or experience-based companies. Its diversified portfolio includes tenants in various businesses: Early Childhood Education, Medical & Dental Services, Car Washes, Restaurants, Automotive Services, Grocery, Health & Fitness, Convenience Stores, and Entertainment. Its properties are 99.9% occupied in sixteen industries across 48 states. It targets tenants with annual revenues between $200 million and $500 million. The company has 1653 properties in its portfolio with an annualized base rent of $297.20 million. Its top tenants include various industry players: Equipment Share, Chicken N Pickle, Cadence Education, Festival Foods, and Accelerated Brands.

Tenant Industry Diversification (Investor Presentation: Slide No: 7)

Financials

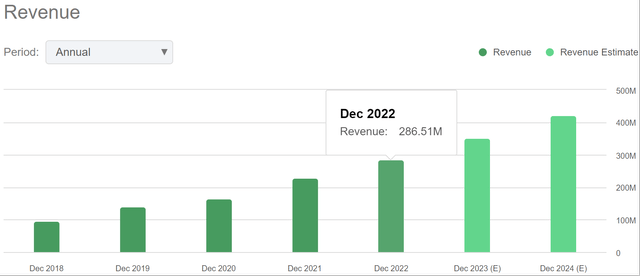

Revenue Trends of EPRT (Seeking Alpha)

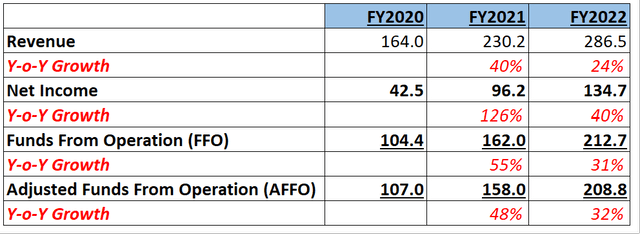

EPRT has experienced significant growth in the last three years. The company’s revenue was $230.2 million in FY2021 which is 40.37% increase compared to revenue of $164.01 million in FY2020. The driver of this growth was increased rentable space and weighted average annual rent escalation. EPRT’s revenue was $286.51 million in FY2022 which is 24.5% YoY growth from $230.2 million in FY2021. The key reason for this growth was solid growth in rental revenue from the properties. The rental sales growth was the result of 18% YoY increase in rentable space, from 13,519,838 sq. ft. in FY2021 to 16,059,492 sq. ft. in FY2022.

Financial Trends of EPRT (Value Quest)

The increased revenue has resulted in solid growth in net income and net income margin (NIM). EPRT’s NIM increased in FY2021 due to revenue growth outperforming expense growth. The company’s NIM climbed by 1586 basis points to 41.8% in FY2021 from its NIM of 25.9% in FY2020. EPRT was able to increase its NIM by 523 bps (FY2022 NIM: 47.01%) YoY in FY2022 with the help of lower property expenses and loss on loan extinguishment.

The inflationary pressures in the previous year slowed the growth of leasing activities all over the world. However single-tenant retail leasing has maintained its upside trajectory despite the downturn. Though the absorption rates increased compared to the previous year, it recorded the lowest vacancy rates (4.1%) in the decade (Page No.2). This growth was boosted heavily as the consumer demand for convenience has accelerated tremendously which has increased the consumption of food in restaurants. The demand dynamics for automotive parts and grocers also remained positive. Identifying these opportunities, EPRT has recently completed the acquisition of 65 properties in Q3FY23 for $213 million in 30 separate transactions which were 100% sale-leaseback. It will have an 8.7% average return over the main lease period of 17.6 years. In addition, all the leases will have a 2% increase in annual rents. I believe these acquisitions can act as a catalyst to boost the company’s growth as it can potentially increase its rental income and increase its profit margins by making it strongly positioned to address the rapidly growing demand in the retail sector. As per my analysis, the company can continue to make investments in the future which can sustain its upward trajectory as recently it has stated that it will be utilizing almost $100 million of forecasted retained free cash flow to expand its investment pipeline. In Q3FY23, it had 1793 properties in its portfolio which were highly diversified.

The company has reported its quarterly results. It reported a revenue of $91.65 million, up 29.71% compared to $70.66 million in Q3FY22. This growth was mainly fueled by healthy demand dynamics and increased investment in properties. Net income surged by 26.04% YoY from $36.42 million to $45.91 million. The weighted average rent coverage ratio was 4x. It reported a diluted EPS of $0.29. The Rental revenue, Interest income, and other revenues were $86.96 million, $4.56 million, and $0.12 million, respectively. EPRT reported $36.10 million in cash and cash equivalents and total liabilities stood at $1.67 billion.

The firm has delivered robust growth and experienced an upside as a result of its strong positioning and healthy demand dynamics. I believe we can expect that the company can further boost its profitability in the coming quarters as it has recently made investments in new properties which can influence its profit margins positively and increase its rental revenues. The management is also optimistic about the growth and has projected an AFFO per share of $1.71 to $1.75 in FY2024 which is approximately 4% to 6% YoY growth from the company’s AFFO estimates for FY2023. After considering the company’s rising investments and rental income, I think the company’s estimates are accurate. To keep my estimates conservative, I am taking the average of upper & lower limits of EPRT’s FY2024 estimates. Therefore, I forecast that the company’s AFFO for FY2024 might be $1.73.

Dividend Yield

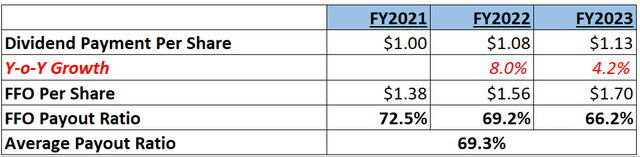

Dividend History of EPRT (Value Quest)

EPRT has been paying consistent dividends to its investors over the period of past five years. The company had decent payout levels in the previous years which indicates its strong positioning. In FY2023, it paid dividends of $0.275, $0.28, and $0.28 in the first three quarters, respectively. EPRT paid $0.285 in Q4FY23 which makes the FY2023’s yearly dividend $1.125. A comparison of the annual dividend with current share price indicates a dividend yield of 4.36%. EPRT’s dividend yield is lower than the sector median dividend yield of 4.75%. Its 4-year average dividend yield is 4.5%. This appealing dividend yield makes the company an attractive stock, especially for risk-averse and retired investors who are seeking regular income along with capital appreciation.

What is the Main Risk Faced by EPRT?

The company has a few tenants who operate under franchise and license agreements. In the previous year, such tenants contributed approximately 11.90% to its annualized base rent. Its license agreements or franchise deals might end before the expiration dates of the leased properties. In case of such vacancies, the company might have to make significant capital expenditures for re-tenanting the properties, which can further increase its cost and contract its profit margins.

Valuation

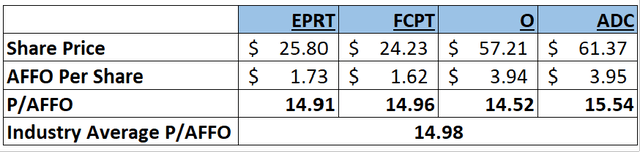

The company has achieved robust growth in financials and I believe it can sustain this upside in the future as the demand dynamics are highly positive & the firm can potentially increase its revenues because it has recently acquired new properties which can increase its profitability by helping it increase its rental income. Considering all the above factors and AFFO estimate calculation in the financial section of this report, I am predicting an AFFO of $1.73 for FY2024 which gives forward P/AFFO ratio of 14.9x. A comparison of EPRT’s forward P/AFFO ratio with sector median of 15.14x signals that the company is undervalued. The company’s primary competitors are Four Corners Property Trust (FCPT), Agree Realty (ADC), and Realty Income (O).

Peer Comparison of P/AFFO Ratio (Value Quest)

I think the EPRT’s positive demand in the industry and its expansion activities can accelerate its growth in the coming quarters and help it to trade above its sector median. Therefore, I predict that the company might trade at P/AFFO ratio of 17x in FY2024, giving the target price of $31.05 which is 14% upside compared to current share price of $25.8.

Conclusion

The demand for retail space has remained positive over time which has helped the company to record robust growth. I think EPRT is strongly positioned to address this rapidly increasing demand as it has acquired additional properties which can help to increase its rental income and further expand its profit margins. However, it is exposed to the risk of license agreement-based tenants which can reduce its profitability in case of termination of lease. It also pays decent dividend and I believe it can increase its payout in future as new acquisitions can potentially increase its cash flows. The stock is currently undervalued and I think it can grow by 14% from current price levels as a result of its expansion activities and improving demand in the market. After analyzing all these scenarios, I assign a buy rating to EPRT.