Roland Magnusson

Breaking news today in the telecom space had traders shifting positions. AT&T (T) announced that it would buy up to $14 billion of cell tower equipment with Ericsson (NASDAQ:ERIC). Shares of the Swedish supplier closed 4% higher on Tuesday while rival Nokia (NOK) suffered a 5% stock price dip. The contract was considered a major win for ERIC, a company that had been struggling in the days, weeks, and quarters leading up to the announcement, but questions linger as to how the industry will look under the open RAN construct.

It is a 5-year deal, with the swap transaction commencing next year. Interestingly, NOK had already fallen in advance of news on Monday, and ERIC rose 4% to start the week. If price action is any indication, open standards could help turn around ERIC’s profitability trends. Critics say, however, that the breakdown of vendor lock-ins within the industry calls into question barriers to entry and margins in the space.

Based on the news, the current valuation situation, and improved technical assessment, I am upgrading ERIC from a sell to a hold. I would appreciate to see evidence that there’s flow through to the bottom line as risks remain for the Swedish company.

According to Bank of America Global Research, Ericsson is a leading global network equipment and software supplier to wireless carriers with a focus on Radio Access Network/RAN equipment, mobile core network/IMS, and OSS/BSS solutions. The company also provides professional services such as consulting and network outsourcing to carriers.

The Sweden-based $17.4 billion market cap Communications Equipment industry company within the Information Technology sector trades at a near-market 17.1 forward operating price-to-earnings multiple and pays a high 4.7% dividend yield. With Q4 2023 earnings not due out until late January, shares trade with a moderate 31% implied volatility percentage.

Back in October, ERIC reported Q3 GAAP EPS of -SEK 9.21, but net income was positive by SEK 1.4 billion ex a large goodwill impairment charge. Revenue for the quarter dipped 5% from year-ago levels while its group organic sales fell 10% YoY. EBITDA suffered in the quarter, falling from SEK 7.7 billion to SEK 4.7 billion, along with a 400-basis-point drop in its EBITDA margin. Shares fell 3% in US ADR trading the following session. For US investors, operating EPS of $0.08 came in a penny above estimates and the January EPS assess is $0.10, which would be a sharp refuse from $0.21 reported in the same period this past year.

While the management team is sticking with its 15% to 18% EBITDA margin target, they did not offer guidance beyond Q4, which is not an encouraging sign, though it did up its FY 2023 EPS guidance by 9.5%. Keep your eye on cost-control measures which could direct to better free cash flow in the coming quarters, though weak investment trends in Europe and with its India roll-out are potential risks.

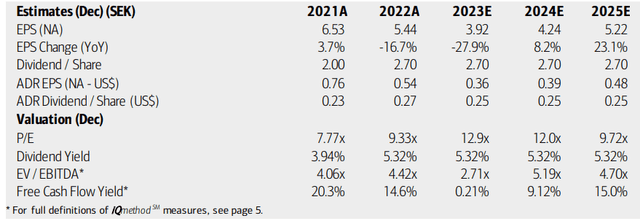

On valuation, analysts at BofA see as-reported earnings falling by nearly 28% this year before per-share profit growth bounces back in 2024. Operating EPS is seen improving sharply in 2025, but uncertainty remains high following the news today and ongoing challenges noted earlier. Still, ADR EPS could top $0.50, according to Seeking Alpha’s latest consensus assess, while dividends per share for US investors should enhance rather impressively over the coming quarters. Given a trough in its free cash flow yield this year, there are mixed signals with respect to the valuation and fundamental outlooks.

Ericsson: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume normalized ADR operating EPS of $0.45 over the next 12 months and apply a below-market 11 earnings multiple based on how uncertain the outlook is, then shares should be near $5. Moreover, a 7x EV/EBITDA multiple also puts the stock in the mid-single digit – that is currently right in the middle of the firm’s 4x to 9x historical EV/EBITDA range.

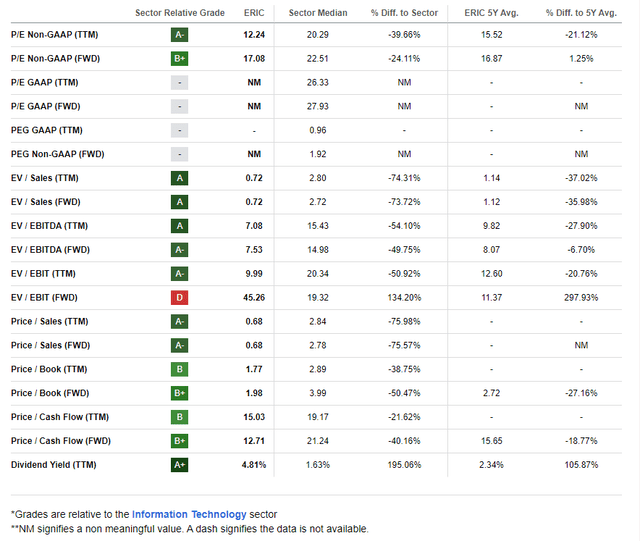

ERIC: Beaten-Down Stock Results In Low Valuation Metrics

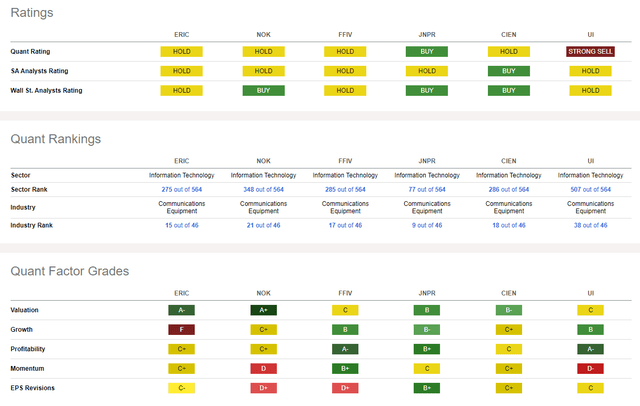

Compared to its peers, ERIC features a strong valuation rating, given the depressed stock price and high dividend yield, so much pessimism is priced in. Profitability has been weak lately, but a turnaround story could be in play based on the latest estimates. Still, the growth trajectory has been volatile while share-price momentum is relatively poor. EPS revisions have been mixed lately, and there’s reason for optimism following this week’s news that the analyst community may raise targets. Once again, it’s a mixed bag here.

Competitor Analysis

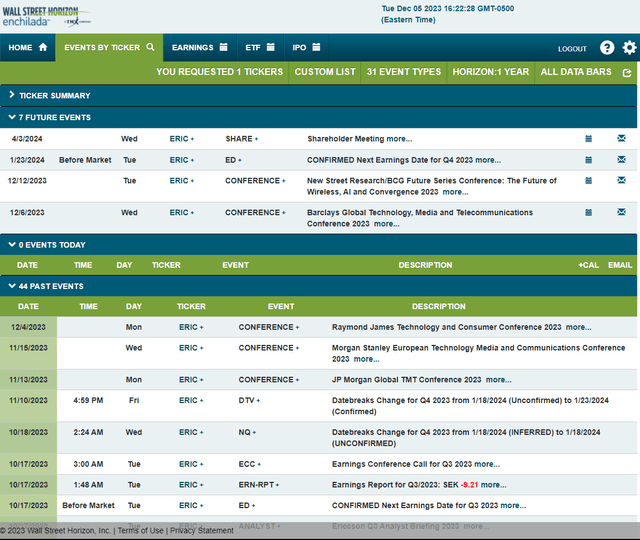

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2023 earnings date of Tuesday, January 23. Before that, the firm’s management team speaks at a trio of telecom conferences from this week through next, and the stock has already been in the news, so I expect volatility to continue to run high through next week.

Corporate Event Risk Calendar

The Technical Take

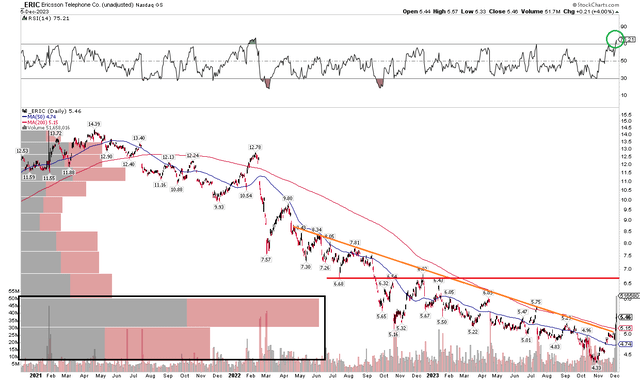

It has been a tough last few years for ERIC shareholders, and I highlighted risks on the chart about a year ago. Notice in the chart below that shares peaked near $15 in early 2021, but have since fallen dramatically, but steadily to a low under $5 this past October. An important proceed was made this week, though. ERIC jumped through its falling long-term 200-day moving average for the first time in almost two years. The Monday-Tuesday rally came on big volume, too, helping to assert that the bulls have regained some momentum here.

Also, take a look at the RSI momentum oscillator at the top of the graph – it has hit technically overbought territory – also the highest since February 2022. I would not be surprised to see the stock back-fill a gap to near $5.25, and the Friday-Monday gap lies under that at $5.02. On the upside, a possible target to take profits on a long position would be in the $6.68 to $6.82 zone – that was a key battleground range from mid-2022 through late last year.

Overall, with a break of the multi-year downtrend on big volume, shares look good for a continued rally to the mid-$6s.

ERIC: Bearish Downtrend Broken Following This Week’s Share-Price Jump

The Bottom Line

I am upgrading ERIC from a sell to a hold. I think enough pessimism has been priced in, and the technical situation has improved after a multi-year downtrend.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.