Phiromya Intawongpan

Investment Outlook

EPAM Systems, Inc. (NYSE:EPAM) is producing declining revenue on reduced client demand for discretionary projects and decreased earnings from lowered efficiencies from employee utilization.

While management seeks to maintain its most productive employee base as it hopes for revenue stabilization, until EPAM Systems, Inc. returns to top line revenue growth, stabilized earnings and improved employee utilization, I’m doubtful for a materially positive stock catalyst.

With an apparently full stock price valuation and negative revenue and expense trends, I’m Neutral [Hold] for EPAM in the near term.

EPAM’s Revenue And Employee Trends

EPAM is a digital engineering company that provides transformation services to companies around the world, but obtains most of its revenue from the regions of North America and Europe.

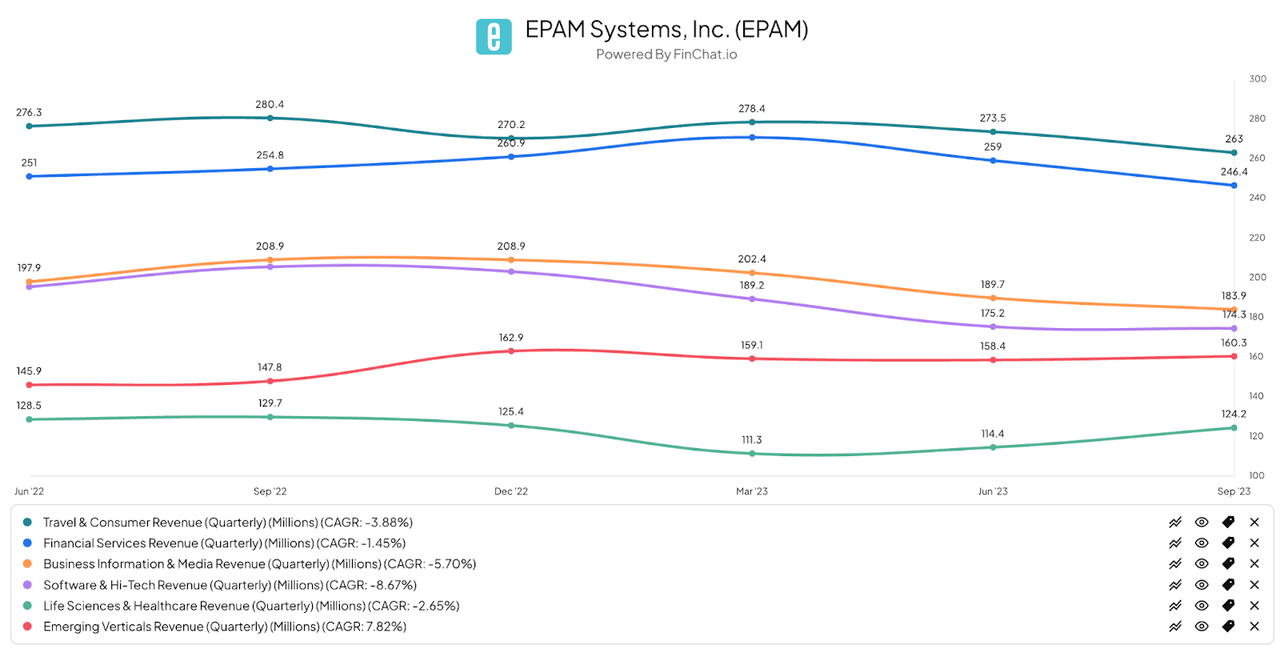

The firm generates revenue from six industry segments, but the majority of its revenue is from the Travel & Consumer and Financial Services verticals, as the chart shows here:

EPAM Revenue Segments (FinChat.io)

However, the Software and Hi-Tech and Business Information and Media revenue segments have produced the largest percentage drop in revenue in recent quarters.

Given the previous over-hiring the tech sector is continuing to unwind, it isn’t surprising that discretionary consulting projects have dwindled from that important growth element.

This has been all-too-common for consulting companies these days in the aftermath of the pandemic and especially so for IT-centric consulting firms such as EPAM.

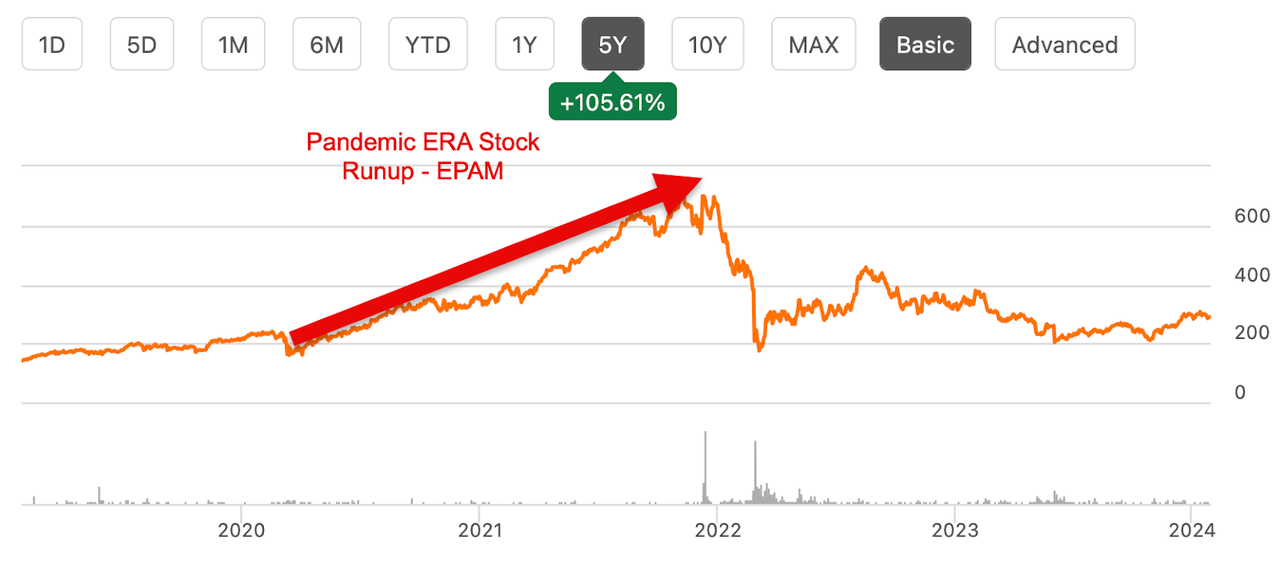

IT consulting company stocks generally performed extremely well during the pandemic and EPAM was no different as the Seeking Alpha chart shows here:

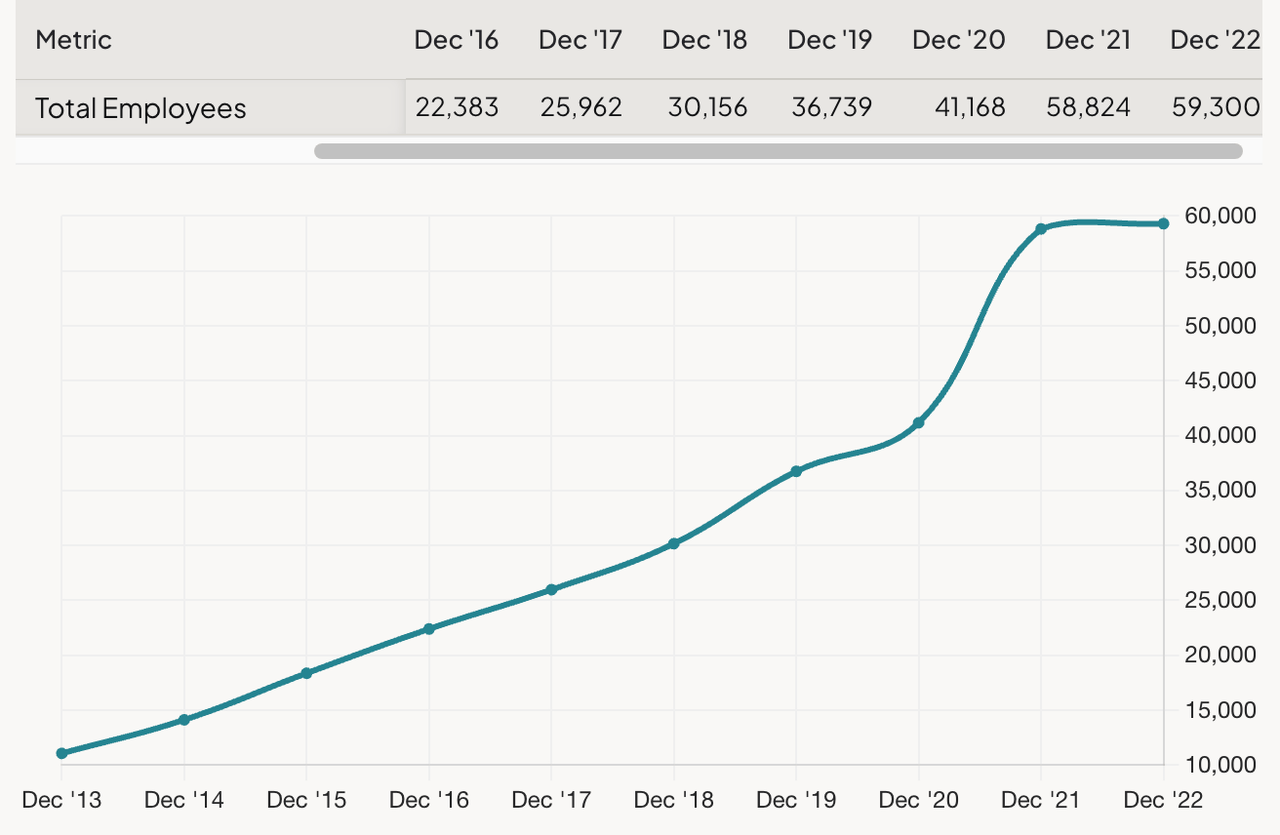

As to the firm’s employee count, the chart below shows the strong growth in employees from 2013 to 2021 and a plateauing in 2022:

The most recent headcount was 54,600 total employees as of September 30, 2023, so the overall figure has dropped around 8%, from 59,300 at the end of 2022.

More importantly, employee utilization has dropped to 72.7% in Q3 2023 from 77.1% two years prior in Q3 2021, highlighting the need for management to take steps to optimize employee utilization across its various geographies.

Recent Financial And Valuation Aspects

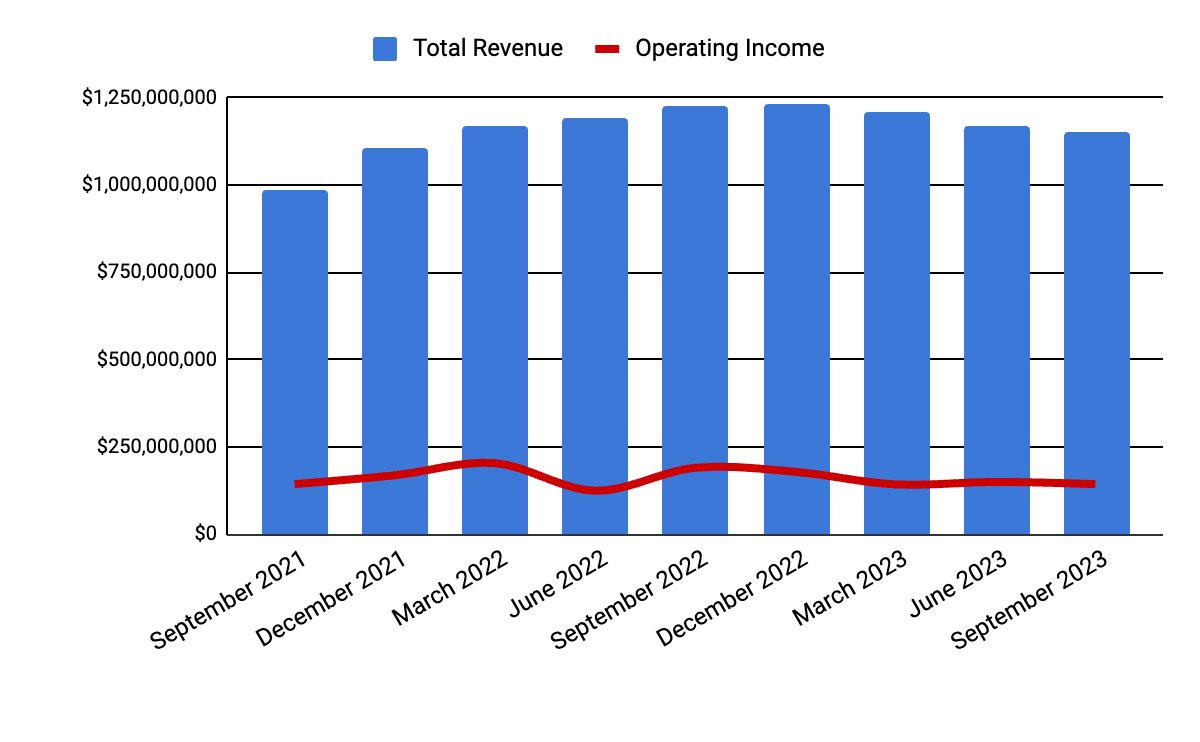

Total revenue by quarter (columns) has fallen due to the aforementioned drop in client demand across most industry verticals; Operating income by quarter (line) has fallen from its peak because the firm has sought to retain its employee base as it awaits a turnaround in demand.

Seeking Alpha Data

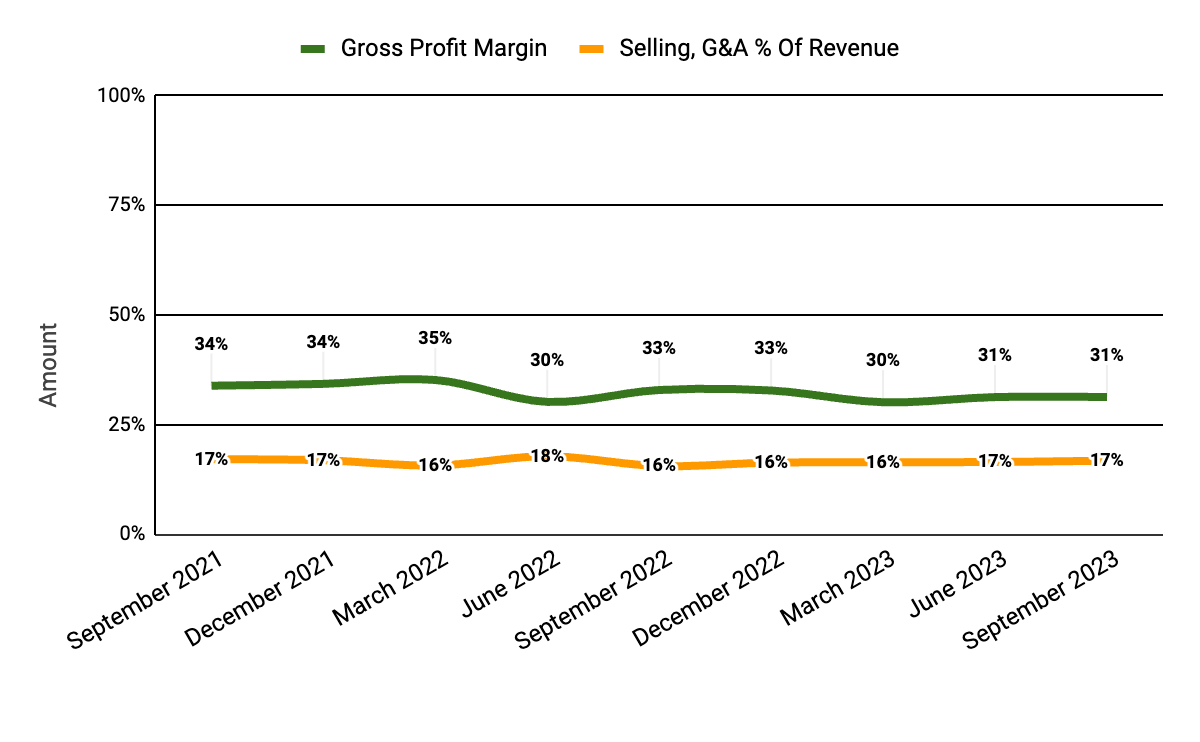

Gross profit margin by quarter (green line) has fallen as a result of downward pricing pressure and reduced employee utilization offset by some reduction in variable compensation expense; Selling and G&A expenses as a percentage of total revenue by quarter (orange line) have risen due to the company’s efforts to widen and broaden its marketing efforts globally, especially in India, where it is seeing stronger growth potential.

Seeking Alpha Data

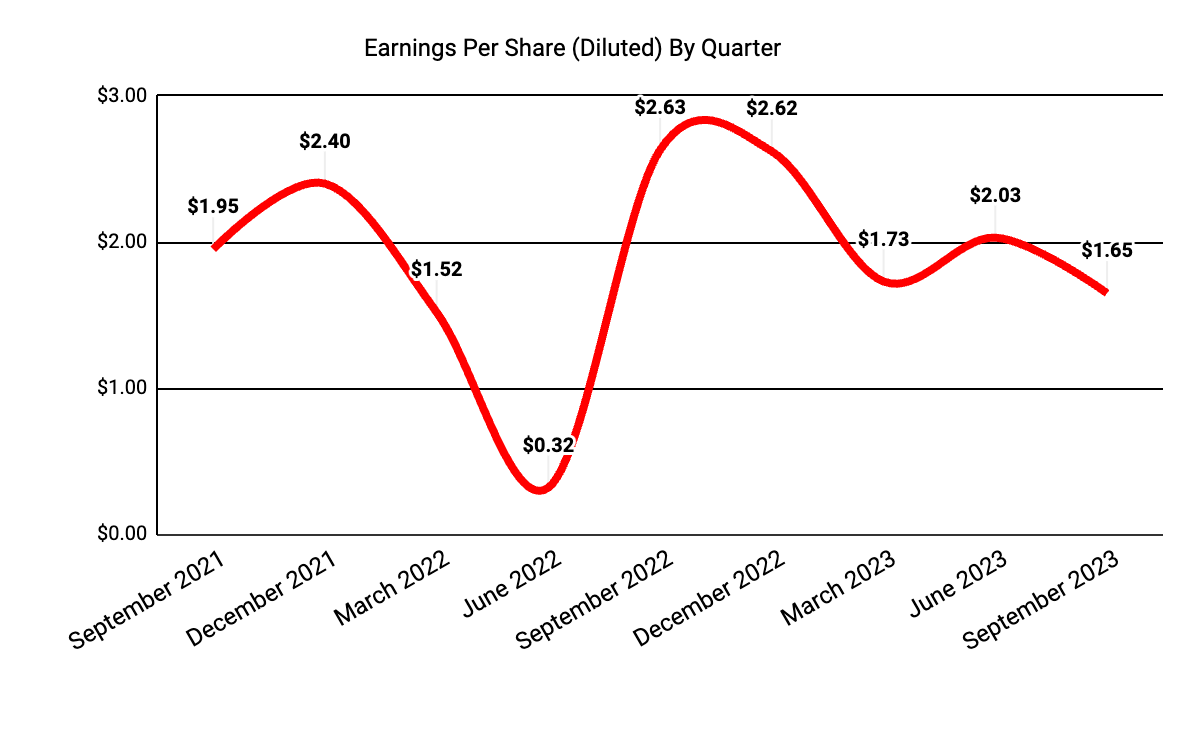

Earnings per share (Diluted) have been fairly volatile and have fallen from a peak of $2.63 in late 2022 to $1.65 on reduced revenue and utilization efficiencies.

Seeking Alpha Data

(All data in the above charts is GAAP.)

Compared to Cognizant Technology Solutions (CTSH) as a public comparable, the two firms’ major valuation metrics are shown here:

|

Metric |

Cognizant Tech. |

EPAM Systems |

Variance |

|

EV/Sales (“FWD”) |

2.0 |

3.2 |

62.9% |

|

EV/EBITDA (“FWD”) |

11.5 |

18.4 |

59.8% |

|

Rev. Growth Estimate (“FWD”) |

2.3% |

9.0% |

292.5% |

|

Net Income Margin |

10.8% |

10.0% |

-7.3% |

|

Operating Cash Flow |

$2,300,000,000 |

$577,330,000 |

-74.9% |

(Source: Seeking Alpha Data.)

Consensus revenue estimates indicate a higher top line revenue growth rate for EPAM in the coming year, but approximately the same Net Income Margin as that for CTSH.

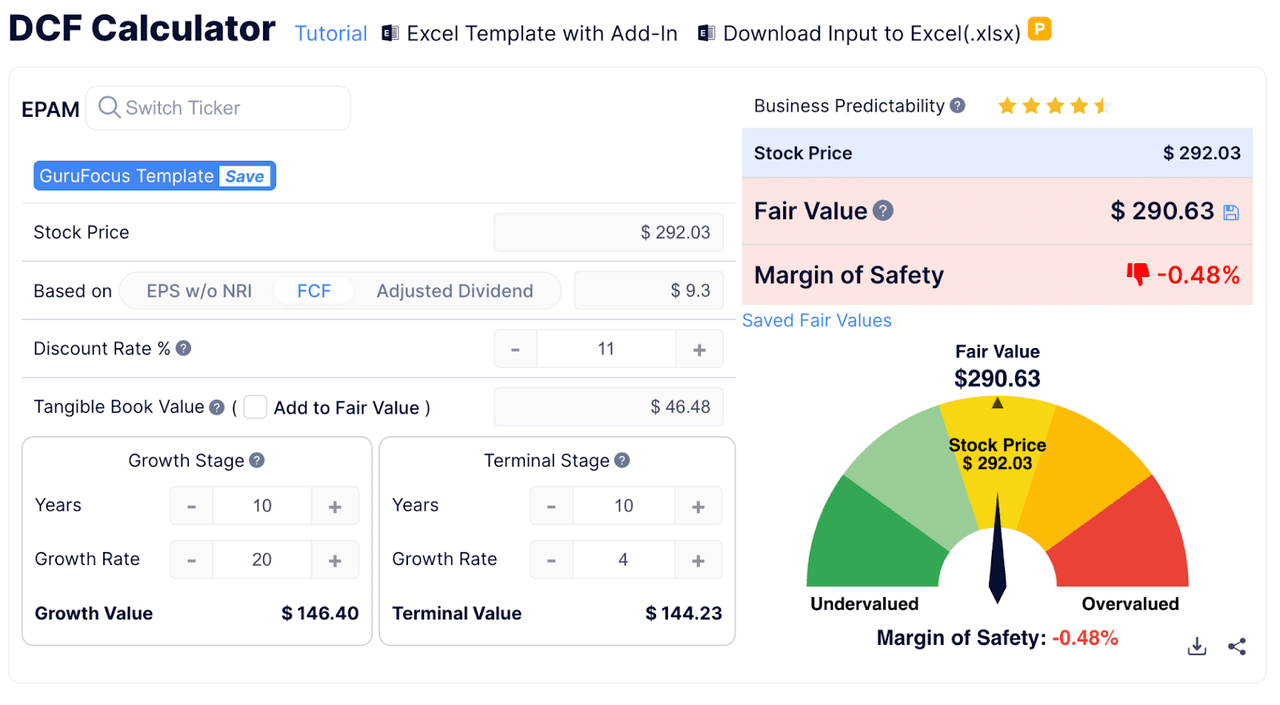

My discounted cash flow calculation, which assumes a discount rate of 11%, its trailing twelve-month free cash flow of $9.30 per share and a very generous cash flow growth rate, indicates EPAM’s stock may be fully valued at its current level of around $292:

Why I’m Neutral On EPAM

EPAM is struggling with a problem that many consulting firms are facing, which is reduced spending by technology-enabled firms after a sharp increase during the pandemic.

Management’s in the major consulting firms are holding onto employees in the hope that client demand will pick up, but with recent continuing layoff announcements by tech firms, I believe that hope is misplaced.

Also, investors who think that “AI” will save the day for consulting companies should be aware that most AI projects now are only pilot projects.

While there are numerous pilots being run and developed, the real revenue opportunity from weaving generative AI technologies into client company operations hasn’t materialized yet.

I believe it will materialize in the coming years as clients compete to automate operations wherever possible, but these projects are now more focused on cost-takeout and less on discretionary projects.

As a result, while AI projects will continue to show promise, true revenue upside is still some distance ahead.

Meanwhile, the Travel & Consumer revenue vertical has shown signs of weakness as the end-of-pandemic YOLO trends of consumers taking long-delayed vacations has played out.

Also, consumer excess cash balances continue to dwindle, so travel and consumer-oriented companies are beginning to pull back on discretionary spending and scrutinize new projects for ROI factors.

So, the picture I see for consulting firms in general and EPAM in particular is one of a challenged revenue growth environment while seeking to retain employee base in an uncertain macroeconomic environment.

This will likely result in the unhappy combination of sagging revenue and reduced earnings from higher-than-justified employee costs.

Whether the U.S. and Europe face an outright recession in 2024 is anyone’s guess. But, I’m cautious about the consulting industry overall due to this combination of revenue uncertainty and employee retention.

While management said it was going to be implementing a cost “optimization” plan by the end of 2023, this won’t likely take full effect until well ahead in 2024. And, we’ve yet to hear of the plan’s specifics.

With 2024 shaping up to be a transitional year for the company, I’m Neutral [Hold] on EPAM due to an apparently full stock price valuation and concerning prospects for reduced revenue and high expenses in a questionable macroeconomic environment.