da-kuk

The Eaton Vance Enhanced Equity Income Fund II (NYSE:EOS) is a closed-end fund that investors can purchase in order to acquire a reasonably high level of current income without needing to sacrifice the potential appreciation of common stock. The fund does have a respectable yield of 7.47% right now, but this is nowhere near as high as other funds that utilize a similar strategy. For example, please consider the following:

|

Fund |

Current Distribution Yield |

|

Eaton Vance Enhanced Equity Income Fund II |

7.47% |

|

Eaton Vance Enhanced Equity Income Fund (EOI) |

8.18% |

|

BlackRock Enhanced Capital and Income Fund (CII) |

6.40% |

|

BlackRock Enhanced Equity Dividend Trust (BDJ) |

8.53% |

|

Madison Covered Call & Equity Strategy Fund (MCN) |

9.99% |

A few years ago, a 7.47% yield would have been incredibly attractive. After all, the federal funds rate was barely above 0% for most of the past fifteen years and it was very difficult to acquire a reasonable level of income from pretty much any investment. However, today that yield is lower than many bonds or floating-rate securities and income-focused investors may be better off looking in the fixed-income space. When we consider that bonds have a somewhat more attractive expected return profile right now due to their high yield and lower volatility, there does not appear to be any real reason to purchase this fund for income when compared to one of its higher-yielding peers or a leveraged fixed-income fund. With that said, this fund could be positioned to supply some gains in a declining interest rate environment that a high-yielding floating-rate or leveraged loan fund would not supply, so that could be a positive for this fund right now.

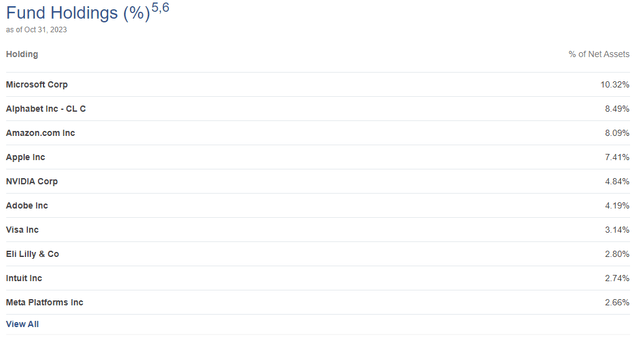

As regular readers will undoubtedly recall, we last discussed the Eaton Vance Enhanced Equity Income Fund II in late September. At the time, I saw some very attractive things with respect to the fund but was concerned about its limited diversity. That is still the case today, as the fund has extremely heavy exposure to a handful of large technology companies just appreciate many other funds on the market. As such, any investor who purchases this fund will need to structure the rest of their portfolio appropriately to ensure that they have adequate diversification across sectors and asset classes.

With that said, the Eaton Vance Enhanced Equity Income Fund II has delivered a very attractive performance in the market since the last time that we discussed it. As we can see here, investors who purchased the fund on the date that my prior article was released have seen a total return of 9.17%, which is much better than the 7.15% total return that the S&P 500 Index (SP500) has delivered over the same period:

This is certainly the kind of return that seems likely to appeal to any investor, including one whose goals primarily revolve around the generation of income. However, past performance is no assure of future results so we should still take a closer look at this fund in order to ascertain whether or not purchasing it makes sense today.

About The Fund

According to the fund’s website, the Eaton Vance Enhanced Equity Income Fund II has the primary objective of providing its investors with a high level of current income. This makes a certain amount of sense considering that this fund is basically using a covered call option-writing strategy. As I explained in my previous article on this fund:

The fund invests in a portfolio of primarily large- and midcap securities that the investment advisor believes have above-average growth and financial strength and writes call options on individual securities to create current earnings from the option premium.

Unlike some of Eaton Vance’s other option-income funds, this one makes no cite of specifically favoring dividend-paying stocks. This makes a lot of sense because a substantial percentage of the fund’s assets are invested in securities that either pay no dividends or pay such a small dividend that they may as well be non-dividend-paying stocks. We can see this quite clearly by looking at the largest positions in the fund’s portfolio. Here they are:

Here are the current dividend yields of these securities:

|

Company |

Current Dividend Yield |

|

Microsoft Corp. (MSFT) |

0.80% |

|

Alphabet Inc. (GOOG) |

N/A |

|

Amazon.com (AMZN) |

N/A |

|

Apple Inc. (AAPL) |

0.50% |

|

Nvidia (NVDA) |

0.03% |

|

Adobe Inc. (ADBE) |

N/A |

|

Visa (V) |

0.81% |

|

Eli Lilly & Co. (LLY) |

0.77% |

|

Intuit (INTU) |

0.63% |

|

Meta Platforms (META) |

N/A |

As of the time of writing, the S&P 500 Index has a 1.52% yield, so all of these stocks are currently yielding well below the market average. This alone is something that could discourage income-focused investors from purchasing shares of this fund. That attitude certainly makes sense, as none of the companies shown in the above chart are ones that will appeal to those investors who are dependent on their portfolios to supply the income that they need to cover their bills or finance their lifestyles. That is not to say that such investors will completely ignore these stocks, as the capital appreciation that many of them have delivered over the past year is quite appealing, but they are hardly income plays.

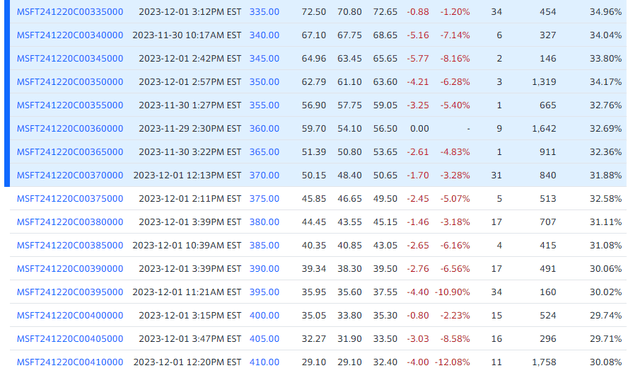

As I pointed out in my previous article on this fund, the income that the fund earns from its common stock portfolio does not come from dividends. Rather, the fund writes call options against the common stocks in its portfolio. It receives an upfront premium when it conducts this sale and basically hopes that the option will expire worthless. If it does indeed expire worthlessly, the premium that it receives acts as a synthetic dividend. The effective yield from this strategy can be quite high. For example, let us look at the one-year options for Microsoft, which is by far the single largest holding in the fund’s portfolio. Here are the current prices for options on this stock:

The strike price is obviously the dollar figure in blue. After that, the numbers go “last price,” “bid,” “ask” in that order. It would be nice if Yahoo! Finance would change their site so that the column headings were always visible, but that was not the case at the time that I took this screenshot.

As of right now, Microsoft stock trades at $374.51, so an at-the-money call option is the $375.00 strike price. That has a current bid price of $46.65. As this is one year out, we do not need to annualize the figures. If the fund were to sell this at-the-money option today, the premium received is 12.46% of the stock price. That is the effective yield of the synthetic dividend, although the fund naturally has to sacrifice all of the upside to acquire it. Obviously, if the fund sells an out-of-the-money call option, it can get a smaller synthetic yield but retain more of the stock’s potential upside. In short, we can very quickly see how this strategy can effectively produce yields that are pretty close to what most income investors really want to see.

The real downside to the covered call strategy is that the fund has to sacrifice the upside of the common stock above the strike price of the option. This is because the option buyer will almost certainly force the fund to sell the common stock at its strike price if the stock’s market price exceeds the strike price of the option. Fortunately, this fund does not have the same problem as some of the index covered call exchange-traded funds appreciate the Global X NASDAQ 100 Covered Call ETF (QYLD). The Eaton Vance Enhanced Equity Income Fund II does not have to sell covered calls against all of the stocks in its portfolio. As of right now, only 49% of the stocks in the portfolio have call options written against them. Thus, the fund can still benefit from capital appreciation on the other 51% of its portfolio. As is the case with all closed-end funds, it can then attain capital gains on these stocks and distribute the money to the shareholders. It can also hold onto them and write covered calls at some future date. Unfortunately, it is a fair assumption that the majority of the fund’s outstanding calls are currently in the money as the mega-cap technology stocks that comprise the largest positions in this fund’s portfolio have seen a substantial amount of capital appreciation over the past month or two. The fact sheet states that only 7.20% of the fund’s call options are out of the money, so we do have some preserve for this assumption. As such, the fund’s capital gains will not be as much as we would otherwise expect based on the fund’s current holdings.

As we have already seen, the Eaton Vance Enhanced Equity Income Fund II has outperformed the S&P 500 Index over the past two months. However, this fund actually benchmarks itself against the Russell 1000 Growth Index (IWF). Its performance against this index has been rather disappointing, to say the least. The date that my prior article on this fund was published was September 29, 2023. The fund’s total return since that date was 9.17%, which is slightly worse than the 9.77% total return of the index:

The fund’s performance relative to the index has been much more disappointing, however. For example, over the past three years, the Eaton Vance Enhanced Equity Income Fund II has delivered a 12.39% total return. That is far worse than the 27.68% total return of the index:

This is generally what we would expect from a fund appreciate this, however. As a covered call-writing strategy requires a fund to sacrifice some of the potential upside of the equities, it will almost certainly underperform during a bull market. The growth stocks that comprise the largest holdings in this fund have been in a bull market for pretty much the entire trailing three-year period except for 2022. In fact, as I pointed out in a recent article, basically all of the total returns of the S&P 500 (and most other stock market indices) year-to-date have been due to seven stocks. All of these stocks are in the fund’s top holdings except for Tesla (TSLA). That certainly explains the fund’s strong recent performance.

However, the fund’s substantial exposure to six of the mega-cap technology stocks could also present a risk to investors. As of the time of writing, the combined weight of Microsoft, Alphabet, Apple, Amazon.com, Nvidia, and Meta Platforms in this fund is 41.81% of its total assets. That is a substantial amount of exposure to only a few stocks, especially when we consider that the valuations of these stocks appear to be stretched pretty thin. While it is certainly possible that the share prices of these companies will continue to perform well over the next year, there are some very big risks here. For example, the Federal Reserve might not cut interest rates to nearly the degree that the market expects. In fact, the members of the Federal Open Market Committee currently anticipate that it will not cut the federal funds rate by very much unless the country enters a recession within the next few months. It is hard to see how stocks will perform well in a serious recession. As such, it would be a good idea to consider this fund’s incredibly high exposure to a handful of technology companies when considering its inclusion in your portfolio and make sure that you have sufficient diversification across all of the funds and individual stocks or other assets that you might own.

Dividend Analysis

As mentioned earlier in this article, the primary objective of the Eaton Vance Enhanced Equity Income Fund II is to supply its investors with a very high level of current income. That is a bit of a strange objective considering that only half of the portfolio is overwritten. We would expect that total return would be a more appropriate objective since the fund is using an option-writing strategy to create premium income and still realizing capital gains from the stocks in the portfolio that do not have options written against them. It pools together the money that it receives from these two sources, along with the relatively low level of dividends that it receives from the stocks in the portfolio, and pays out the money to its investors. As we have already seen, the yield from an options-writing strategy can be pretty high and when we consider the capital gains that certain segments of the market have provided over the past few years, we can assume that the basic strategy would allow this fund to have a fairly high yield.

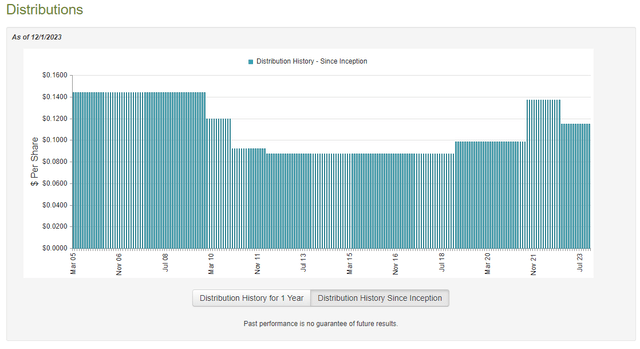

This is indeed the case, as the Eaton Vance Enhanced Equity Income Fund II currently pays a monthly distribution of $0.1152 per share ($1.3824 per share annually), which gives the fund a 7.47% yield at the current price. Unfortunately, this fund’s distribution has not been particularly consistent over the years, as it was much higher back in the raging bull market following the pandemic:

The reason for this volatility is probably due to the fund’s heavy exposure to the mega-cap technology stocks and growth stocks in general. These stocks tend to be somewhat more sensitive to interest rate changes than short-duration energy or materials companies, so they declined quite a lot when the Federal Reserve started monetary tightening. That certainly caused the fund to take some losses in 2022 and it is only natural that it would have to reduce its payout as a result since we do not want the fund’s distribution to be destructive to its portfolio valuation. The current distribution is still larger than the fund had back in 2020 though.

As I have pointed out in the past, the fund’s past distribution history is not necessarily the most important thing for investors today. This is because anyone who purchases the fund’s shares today will acquire the current distribution at the current yield and will not be affected by any actions that the fund had to take in the past. As such, the most important thing is how well it can uphold its current distribution.

Fortunately, we do have a fairly recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. Obviously, this report covers the first half of this year, which was a pretty good period for growth stocks. As everyone reading this is certainly aware, the market was widely anticipated that the Federal Reserve would cut interest rates in the second half of 2023 and started bidding up the price of long-duration stocks, such as the ones that are heavily weighted in this fund. That undoubtedly provided the opportunity for it to earn some capital gains, even though the market proved to be wrong about the direction of interest rates and eventually corrected.

During the six-month period, the Eaton Vance Enhanced Equity Income Fund II received $3,980,049 in dividends from the assets in its portfolio. The fund surprisingly had no interest income, so the dividends constituted all of its investment income during the period. This was not enough to cover the fund’s expenses, and it reported a net investment loss of $844,620 during the period. At first glance, this is likely to be concerning as the fund obviously did not have enough net investment income to cover any distribution, but it still paid out $36,147,657 to its shareholders during the period.

However, there are other ways through which the fund can acquire the money that it needs to cover the distribution. For example, it might have been able to attain some capital gains from the appreciation of the common stocks in its portfolio. It also collects premiums from the covered call writing strategy. Neither of these things are considered investment income for tax purposes, but they obviously represent money coming into the fund that can then be distributed to the shareholders. As might be expected from the bull run in the major technology names during the first half of the year, the fund had an enormous amount of success in this task during the period. The fund reported net realized gains of $56,398,444 and it had another $129,969,535 net unrealized gains over the six-month period. That was easily enough to cover all of the distributions, and the fund’s net assets increased by $153,193,625 after accounting for all inflows and outflows during the period.

As we can clearly see, the fund’s net realized gains were more than enough to cover the distributions and the net investment loss. Thus, the fund covered its distributions handily during the first half of the year. However, over the July to mid-October period, the market was much weaker for many of the big technology names. Fortunately, it appears that the fund has still managed to cover its distribution during the second half of this year. As we can see here, the fund’s net asset value per share has gone up by 2.96% since July 1, 2023:

This suggests that the fund has managed to bring in enough money from the assets in its portfolio (realized or unrealized) to cover the distribution and still has money left over. Thus, we probably do not need to worry about a distribution cut in the near future. There is even a chance that the fund will raise its distribution next year to distribute the returns that it has generated this year in excess of what it is paying out.

Valuation

As of November 30, 2023 (the most recent date for which data is currently available), the Eaton Vance Enhanced Equity Income Fund II has a net asset value of $19.07 per share but the shares currently trade for $18.51 each. This gives the fund a 2.94% discount on net asset value at the current price. This is nowhere near as attractive as the 7.12% discount that the shares have averaged over the past month, so it may be possible to get a better entry price by waiting a bit longer. The fund is still trading for less than its intrinsic value though.

Conclusion

In conclusion, the Eaton Vance Enhanced Equity Income Fund II looks appreciate a decent way to earn some income while still retaining some of the capital gains potential inherent in an equity investment. The caveat though is that this fund is heavily invested in only a few technology companies, so it is important to ensure that you diversify appropriately across the rest of your portfolio. There is a very real risk that the performance of some of these stocks will fall off next year and nobody really wants to be blindsided by such an event. The fund is easily covering its distribution out of net realized and net unrealized gains and might be able to boost its payout next year if the market continues to exhibit the bull characteristics that we see right now. The biggest problem here is the lack of diversification in the fund’s portfolio and its relatively low yield compared to other covered call funds.