grandriver

While commodity prices are no longer as favorable as they were in 2022, EOG (NYSE:EOG) continues to return capital to shareholders and drive efficiency gains. EOG is now probably large enough that investors shouldn’t expect significant growth, but the company still appears well positioned to generate strong profits over the long-term. Economic conditions and the unity of OPEC remain near-term concerns, although EOG is well placed to navigate any downturn. While EOG isn’t cheap, it is not hard to see the stock continuing to perform solidly, absent significant economic weakness.

Returns Focused

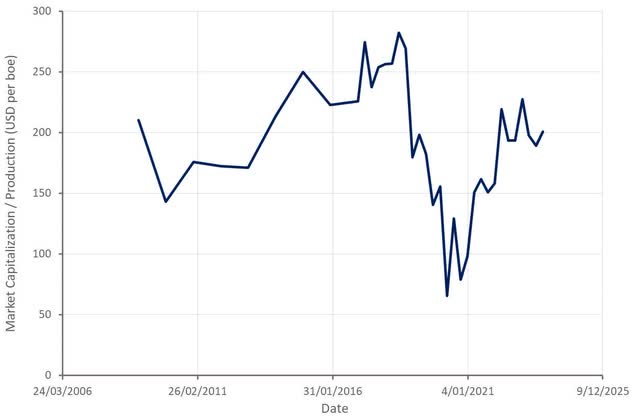

EOG continues to be focused on returns, which is supported by the company’s discipline and commitment to return most of its free cash flow to shareholders. The company’s breakeven oil and gas prices also continue to decline on the back of productivity and efficiency improvements. This is somewhat surprising as productivity and efficiency gains should plateau at some point and resource quality should decline. While this will inevitably happen, EOG has so far demonstrated an uncanny ability to continue organically high grading its resources.

Figure 1: EOG Return on Capital Employed (source: EOG)

Organic Growth

One of the most impressive aspects of EOG is its ability to convert overlooked resources into highly profitable unconventional plays. Recent examples of this include the Utica, Dorado and Niobrara.

The Utica is a liquids rich play and could be the next basin where EOG really begins to ramp production. EOG has been acquiring seismic data in several areas of the Utica which it will use to generate a better estimate of the play’s potential. The target zone in the Utica is both shallow and consistent, making it well suited to long laterals. Lateral length is one area where EOG is likely to continue pushing the limits to drive greater returns. EOG has suggested the switch from 2-mile to 3-mile laterals in the Eagle Ford and Delaware has reduced costs by 15-25%. Nabors (NBR) has suggested that its M1000 rig with a specially designed top drive is capable of handling 5-mile laterals. Consistent geology also makes it easier to stay within the target zone while drilling.

Production here could ramp rapidly when EOG is ready as there is abundant existing midstream infrastructure. EOG has also built its own pipeline and is working with a third-party to establish another, making in-field gathering to bottleneck to scaling production. EOG currently plans on operating one drilling rig in the Utica in 2024 to continue testing optimal well spacing and to improve operational efficiency.

EOG also continues to explore the potential of the Dorado play and install the necessary infrastructure to support large scale production. EOG recently placed a facility into service to treat gas from the Dorado play prior to transportation through EOG’s pipeline. The first phase of a 36-inch pipeline has also been completed, with the second phase expected to commence construction in early 2023. Phase 2 will provide connectivity to growing LNG demand, and potentially premium pricing relative to Henry Hub. The pipeline could also help EOG save 0.20-0.30 USD per MCF in transportation costs over the life of the asset versus third-party alternatives. EOG anticipates drilling a few additional wells in the Dorado in 2024.

The South Powder River Basin is likely to be another growth area for EOG in the future, with development efforts in this play interrupted by the pandemic. 2023 was basically the first year that EOG has had a full-time rig targeting the Mowry. EOG has suggested that the Mowry is structurally complicated but relatively homogeneous. In comparison, the Niobrara does not have much faulting but the stratigraphy changes substantially. EOG is initially targeting the Mowry as it is the deepest formation, and this provides insight into the overlying heterogeneous Niobrara.

Productivity and Efficiency

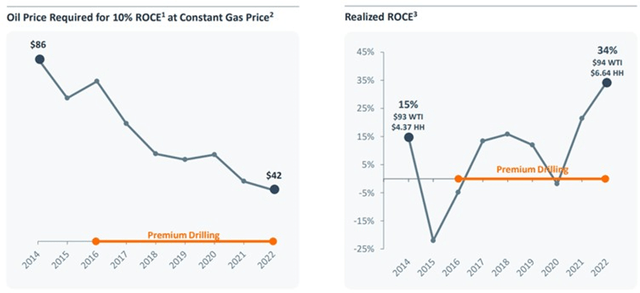

EOG also has a track record of improving productivity and efficiency, driving returns higher even as resource quality remains constant or declines. Over the past five years, EOG has increased production 33% and decreased per unit operating costs 17%, and these types of gains continue today. For example, EOG increased completed lateral foot per day by 19% YoY in the Eagle Ford. In the Delaware basin, a new completion design also helped EOG realize a 20% increase in productivity.

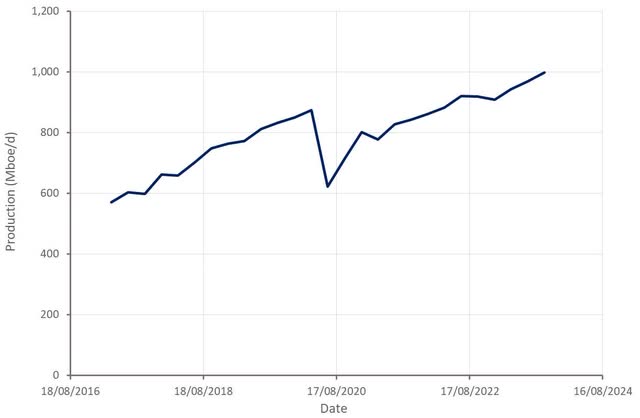

Continuous improvement in completion design and operations supports higher production and returns, even if resource quality declines over time. It also points towards why it is difficult to compare current levels of unconventional E&P investment with historical investments.

EOG’s business is also being supported by a moderation in service costs, although this varies across basins and services. EOG’s focus on efficiency generally means that it uses the latest technology and highest-performing crews and pricing in this area has been resilient.

Market Outlook

EOG remains bullish about the long-term prospects for both oil and natural gas. Given recent moves by the company it appears the company is more sanguine regarding natural gas though. The US will see a large increase in LNG demand in coming years, which will better connect the US market with the rest of the world.

Even with an industry-wide focus on returning capital to shareholders, production continues to increase though, and this is pressuring oil prices, a problem exacerbated by the relatively weak demand environment. OPEC’s willingness to support oil prices through supply cuts has so far prevented an outright market correct, but oil prices remain soft.

The outlook for shale production in the US is also being impacted by consolidation. While EOG has chosen not to engage in large scale M&A, it will likely be affected. Consolidation could help contribute to greater stability and reduce the risk of over production crashing prices. More stable activity levels should also help limit service price spikes.

Financial Analysis

EOG’s oil production increased 4% YoY in the third quarter, while total production was up 9%. Higher production has been swamped by lower commodity prices though.

EOG expects to maintain its activity level in its core plays in 2024 along with a few additional wells in the Utica and Dorado. This will likely mean a small increase in the number of wells and production, along with a modest decrease in well cost.

Figure 2: EOG Production (source: Created by author using data from EOG)

Despite a moderation in oil and gas prices over the past 18 months, EOG’s profitability and free cash flow generation remains solid. While EOG continues to drive costs lower and improve productivity, oil and gas prices are approaching levels where it could have a meaningful impact on EOG’s bottom line.

Figure 3: EOG Operating Profit Margin (source: Created by author using data from EOG)

Conclusion

EOG remains focused on generating strong returns for shareholders, and as part of this is taking a disciplined approach to create profitable growth. EOG has now committed to returning a 70% minimum of annual free cash flow to shareholders. It also believes that it can maintain its current level of production and fund its regular dividend commitment at a WTI oil price as low as 45 USD per bbl. While this potentially provides investors with some level of downside protection, it also means that EOG’s growth is likely to be fairly modest going forward.

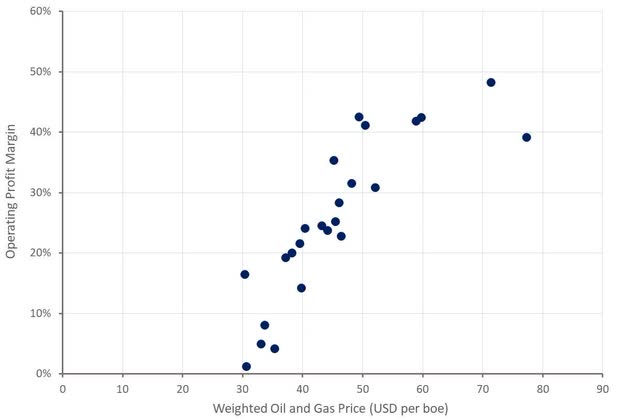

EOG’s stock continues to look inexpensive based on both forward and trailing earnings and cash flow multiples. While this could mean that the stock is undervalued, the market is likely pricing in the probability of lower oil and gas prices on the back of resilient supply and weak demand growth. Looking at EOG’s market capitalization relative to production avoids the volatility associated with commodity prices. This measure suggests EOG’s stock is priced broadly in line with its historical average.

Figure 4: EOG Relative Valuation (source: Created by author using data from EOG)