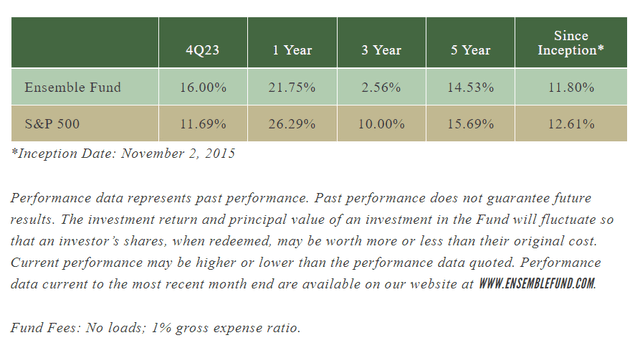

The fourth quarter saw very strong absolute and relative performance in the fund. In the quarter the fund was up 16.00% while the S&P 500 appreciated 11.69%. For the full year, the fund was up 21.75% vs the S&P 500 up 26.29%. While we trailed the market, this underperformance was more than 100% due to our investment in First Republic (0% weight in the Fund), which we exited in March. Excluding our investment in First Republic, the fund was up approximately 32.7%, besting the S&P 500 by over 6%.

Notably, we underperformed during the first few weeks of the quarter and then saw a sharp positive reversal as earnings season kicked off and inflation data began to show broad-based improvement. From October 18th, the date our first fund holding reported earnings, to the end of the year, the fund was up 18.84% vs the S&P 500 up 10.92%.

The significant improvement of the fund’s performance since mid-October was rooted in strong corporate results reported by the fund holdings and a dramatic shift in the economic outlook. The economic data in recent months has turned much more positive and the risks of inflation or stagflation have seemingly evaporated. While the future of the economy is always uncertain, and we recognize our own ability to forecast the future of the economy is limited, the current economic statistics are about as ideal as the US economy has ever seen. This is not an exaggeration. After nearly two years of the twin threats of inflation and recession stalking the economic landscape, it feels difficult to accept that the US economy has spent the last six months in what can only be called a “Goldilocks Economy” – “not too hot and not too cold” – with no current signs of either an inflation problem or a growth recession.

Now to be clear, in making this statement, we are observing the actually reported economic statistics of the past six months, not making a forecast about what comes next. But there is no doubt that the last six months have delivered an extraordinary economic outcome. Consider;

- Core PCE inflation, the inflation rate economists view as the most accurate and useful to understanding inflation dynamics, has now been running for 6 months at 1.9%. This is slightly below the Fed’s 2.0% target.

- Monthly new job growth has averaged 190,000 over the last 6 months and 216,000 in the most recent month. We need 100,000 jobs a month to absorb population growth. So, we are drawing more people into the workforce. We have been at higher employment-to-population rates in the past, so this trend can continue.

- The 10-year treasury yield is a bit below 4%. This is not so high as to prevent the prudent use of debt, but not so low as to drive reckless debt usage.

- Productivity growth has been 4.4% over the last two quarters and 5.2% in the most recent quarter. This is crazy high, but crazy high productivity is all to the good. Productivity can’t be “too hot,” it only brings benefits. But the recent productivity surge is mostly just reversing declines and weak results in 2022. So, looking at the year-over-year productivity growth of 2.4% is probably a better measure and this is a very good, sustainable outcome.

- Wage growth has been about 4% over the last two quarters, about 4% in the most recent quarter, and high frequency data which helps us understand monthly wage changes also point to about 4%. This is the level of wage growth that is consistent with 2% inflation and 2% productivity growth, which are ideal levels for the US economy. While wages are growing faster than they did in the decade prior to COVID, this period was also one characterized by weak growth. Current wage growth dynamics are more similar to the 1990s and early 2000s, when the economy was strong but we did not have an inflation problem.

At the Federal Reserve meeting last month, Chairman Jay Powell said the same. He pointed out that there are no signs of a current recession, and that inflation is rapidly returning to a normal, sustainable level. He also announced that the Fed is very unlikely to be raising interest rates again and that, in fact, the Fed now plans to lower interest rates sharply in 2024.

The fund is not designed to be a bet on any particular macroeconomic outcome. Prior to the inflation surge of 2022, the fund had successfully navigated periods of falling and rising interest rates, as well as accelerating and decelerating real economic growth. But starting in 2022, the specter of stagflation, a period of inflation even during recessionary conditions, ripped through the economy. While across all of US economic history other than the 1970s, periods of inflation were accompanied by strong real growth, and periods of weak real growth were accompanied by falling interest rates, 2022 and much of 2023 saw investors worry that we would experience contracting real growth even as inflation stayed high.

This unique combination of economic factors was the root cause of our underperformance that we identified and EXPLAINED TO INVESTORS in early March 2022. By the early fall of 2022, investor panic over stagflation risks reached a crescendo as investors worried that a repeat of the 1970s was what the years ahead held in store. At that time, we wrote a piece that looked at the lessons of the 1970s and explained that if inflation/stagflation was going to last for a decade, as it did in the 1970s, then investor concerns were very valid.

But we also explained why we expected stock market returns, and in particular returns for the type of businesses that were down the most in the fund, would flip very positive once the inflation/stagflation risk receded. And we argued that these risks were unlikely to last nearly as long as investors were then worrying they would. You can read our analysis HERE.

This combination of falling corporate earnings, even while inflation drove interest rates higher, was radioactive to the value of equities. The value of a company is based on its future earnings. So when earnings start falling, even as higher inflation and interest rates make future earnings worth less today, it is a double whammy to the value of companies, particularly those that relentlessly reinvest in their businesses to drive future results. And it was this combination of macroeconomic variables that drove levels of underperformance and heightened volatility not seen in the fund over its prior 8-year history.

Starting with the earnings reports in October, we are now experiencing rising earnings and falling interest rates. Just as the opposite was damaging to the stock market and the fund earlier, the reversion to more normal economic behavior is having a very strong positive effect on the market and the fund.

This is what we told our investors to expect in our fall 2022 post on the topic, “The lesson of the 1970s is that when equity investors come to believe that inflation will persist for many years, valuations contract dramatically and stay low until such time that investors come to believe that inflation will trend back to more normal levels over time. Once those beliefs shift, equity market valuations come screaming back to more normal levels.” And this recovery is what we now see playing out as inflation trends back to normal levels.

Separate from the economic drama of 2023, the big mega trend was the explosion of artificial intelligence. In July of this past year, we provided a discussion of our investment in Google (GOOG) (7.19% weight in the Fund) and how we were thinking about artificial intelligence in general. Now we’d like to provide an update on how we are seeing the fund companies adopt artificial intelligence in their businesses today.

Booking Holdings (BKNG) (7.60% weight in the Fund): Earlier this year, Booking Holdings rolled out an AI trip planner. Traditionally Booking helps users find the right hotel by offering a search engine to define which city you want to stay in and apply various filters to narrow down the hotel options. With Booking’s AI Trip Planner, a user can use natural language such as “plan a road trip on Route 66, starting in Chicago and ending to Los Angeles.” The Trip Planner then engages with the user like a travel agent, suggesting which cities to stay in each night and various sights to see along the way. Once the trip is planned out, the user can use natural language to generate hotel options, such as by writing “My budget is $200 to $300 a night. It will be my husband and I traveling together.”

Booking’s experiments in AI demonstrate the value of proprietary data sets. While general AI systems such as ChatGPT are designed to answer questions about anything, focused AI systems that leverage a company’s unique data can be far more powerful when applied to specific use cases. With Booking’s AI Trip Planner, the system is unable to answer questions unrelated to making travel reservations. But on the other hand, it is far more likely to understand what the user wants since it already knows that the entire conversation will be about travel. Importantly, Booking’s AI Trip planner has access to the company’s enormous dataset that includes hotel ratings, popular hotels, and all sorts of detailed information about each hotel.

Broadridge Financial Solutions (BR) (5.98% weight in the Fund): Broadridge processes back office financial paperwork such as monthly statements, trade confirms, and corporate proxy votes. While the company provides software and services to its customers, it isn’t typically thought of as a cutting-edge tech company. Yet Broadridge is already rolling out AI applications to both its employees and customers. BondGPT allows Broadridge’s bond trading customers to use an AI system to search for bonds that meet their specific criteria. The bond market is far less liquid with far more unique securities than the equity market. BondGPT provides similar functionality to traditional bond screening tools, but its natural language interface means that traders can source bonds in a fraction of the time it would take using a traditional tool. The company has also rolled out OpsGPT to its employees. This program recommends solutions to Broadridge operations employees as they deal with trade or account opening errors.

Both BondGPT and OpsGPT show how AI can be leveraged to enhance productivity within very mundane areas of business. For all of the “magic” of bleeding edge AI capabilities, much of the work of the world is mundane activities. To the extent AI can be used to save bond traders and operations employees time; it won’t change the world but it will certainly improve the economics of the financial industry.

Illumina (ILMN) (3.56% weight in the Fund): Illumina has long deployed AI-powered software in genetic research. Earlier this year, the company announced a new AI algorithm that predicts whether a given genetic mutation will cause disease. The new tool will be integrated into customer-facing software solutions. While ChatGPT has been trained on human language, Illumina’s PrimateAI-3D program was trained on genome sequences. The resulting output from the program can help identify patients who have low frequency variants that put them at risk for various diseases.

The potential for AI in genetic research is huge. In fact, genetic research has been identified by Nvidia’s CEO Jensen Huang as one of the biggest areas of potential for AI. AI is particularly good at sorting through massive amounts of data to identify patterns and this simple concept is at the heart of genetic research.

Mastercard (MA) (7.21% weight in the Fund): Payment companies are data companies. As we discussed last quarter in our write-up of Mastercard, merchants can generate significant value from analyzing payment data to better understand their customers. Mastercard has long built AI-based products to enhance payment security and provide merchants with rich data analytics. In December, they rolled out Muse, a new online shopping companion that merchants who utilize certain Mastercard services can install on their own websites.

Muse seeks to replicate the in-store experience of working with a sales clerk by allowing the customer to use natural language to browse products. Online shopping already works well if you know exactly what you are looking for, but Muse is striving to help customers find things to buy even when they aren’t sure what they are looking for.

ServiceNow (NOW) (5.01% weight in the Fund): ServiceNow, a company which Nvidia’s (NVDA) CEO has highlighted as one of the best positioned companies to bring the value of AI to its customers, offers online workflow systems to corporations. For instance, if you work at a large company and you call the HR department to ask about parental leave policies, the person you are talking to may well be working in a ServiceNow software package as they process your request. With their new generative AI-powered Now Assist offering, corporate customers can deploy a ChatGPT-like interface to their employees that has been trained on the company’s own HR policies. And the system can take actions based on employee requests.

The company is also deploying generative AI solutions to support workers in the field. For instance, a service representative sent out to fix a bank ATM can use ServiceNow’s traditional system to enter details about the work they’ve completed. But using Now Assist, the AI will draft notes based on the actions taken by the field worker, which can then simply be reviewed and approved.

Nike (NKE) (2.79% weight in the Fund): More speculatively, we believe that in the years ahead Nike will be able to use generative AI to allow their customers to craft custom shoe designs. Nike already offers Nike By You, their custom shoe design service. But one of the amazing things about generative AI is its ability to create entirely novel and realistic images based on very limited information entered by the user. For instance, today the DALL-E AI offered by OpenAI can be prompted with statements such as “create a Nike shoe design inspired by the work of the painter Van Gogh.” By empowering everyday people to create novel concepts based on their ideas alone and without any design expertise, Nike can create entirely new, premium products in a way never before seen.

Nintendo (OTCPK:NTDOY) (4.59% weight in the Fund): In recent months AI systems have been put to work rendering old video game characters in modern, high resolution. The systems work by providing the AI with the old, pixelated video game images as a reference and ask it to create a new image in the style of modern video game graphics. Over time, a company like Nintendo, which has a massive library of popular old games from the 1980s and 1990s, can use this type of AI system to reimagine their old games in modern, life-like images.

AI is going to impact the economy and every industry. But it will take time. Most importantly, it is starting to become clear that it is not only the companies with the most bleeding edge AI technology that will succeed, but rather those companies that can harness AI to better serve customers, better run their business, and better create value for all of their stakeholders that will leverage AI to the benefit of shareholders.

Notable detractors from our performance came from our investments in Paychex (PAYX) (3.71% weight in the Fund), Mastercard (7.21% weight in the Fund), and Google (8.52% weight in the Fund). While every stock in the fund generated positive performance during the quarter, the following stocks underperformed and detracted the most from our relative performance.

Paychex (3.71% weight in the Fund): While employment growth was strong in 2023, the Fed’s efforts to moderate job growth were successful. Paychex business is driven by the number of employees on the payrolls of its small to medium size business customers. With recession worries percolating all year, the stock was flat on a year-to-date basis in late October just as the economic outlook began to brighten. As recession worries faded the stock rallied to gains of as much as 13% in the fourth quarter. But in the late December earnings report, the company said that core payroll services growth would be a bit weaker than investors expected. Despite this, the company slightly raised full year earnings guidance as demand for their full service solution that incorporates human resources services beyond payroll improved. The stock finished the quarter up 4.1%.

Mastercard (7.21% weight in the Fund): In late October, Mastercard reported earnings that investors interpreted as pointing to a near-term slowdown in payment growth. The stock fell 5.6% on the day. By the end of the next week, the stock had recovered its losses and went on to reach a new all-time high on the last day of the year. But the 7.9% gain on the quarter slightly trailed the S&P 500.

Google (8.52% weight in the Fund): Google’s earnings report in October showed its core advertising business accelerating to double digit growth as the digital advertising recession of 2022 and early 2023 fades away. However, the company’s Cloud division, which is expected to generate growth from selling access to artificial intelligence services, saw its growth rate slow modestly. Juxtaposed with Microsoft’s (MSFT) Cloud business seeing growth pick up slightly, investors sold off Google’s stock on the report. While the stock recovered to new highs by the end of the year, the earnings report setback caused the stock to trail behind the S&P 500 with a gain of 6.8% for the quarter.

On the more positive side, we saw notable performance contribution from Netflix (NFLX) (7.19% weight in the Fund), ServiceNow (5.01% weight in the Fund), and Masimo (MASI) (4.00% weight in the Fund).

Netflix (7.19% weight in the Fund): During the quarter, Netflix reported another quarter of strong subscriber growth and guided for full year subscriber growth of over 25 million new members. This result would be just short of the average growth in new subscribers reported during the company’s boom period of 2018-2021 despite many investors worrying in 2022 that Netflix’s growth may be done for good. In addition, legacy media providers continue to dial back their streaming ambitions, with some of Netflix’s would-be competitors starting to license their shows to be shown on Netflix. The stock gained 28.9% in the quarter.

ServiceNow (5.01% weight in the Fund): Despite persistent worries of global macroeconomic weakness slowing demand for ServiceNow’s software, the company reported third quarter growth accelerated to 25%. Strong results in their core business, as well as expectations that the company is well positioned to help its customers leverage artificial intelligence, sent the stock up 26.4% in the quarter. Despite the stock falling 51% from its highs in 2021 to its lows in 2022, the stock finished 2023 at new highs.

Masimo (4.00% weight in the Fund): Masimo reported disappointing third quarter earnings, although they did indicate that demand for their core hospital sensing solutions is seeing a pickup in demand. But as the economic outlook improved beginning in mid-October, investors began returning to stocks like Masimo that have been beaten down on investor worries. At least this quarter, our view that Masimo’s share price has fallen far, far more than its corporate fundamentals would justify was supported by the market, with the share price rallying 33.7%.

Company Focus: Netflix (7.19% weight in the Fund)

We last discussed Netflix three years ago. At that time, five months into the COVID pandemic shutdowns in 2020, Netflix had added 26 million new subscribers to its service and went on to add 10 million more for a total of 36 million, ending the year with 204 million subscribers. Then in 2021, the company added 18 million subscribers culminating with 8 million new subscribers added in 4Q 2021, aided by the global success of the Korean-produced show Squid Game.

The share price hit a record high of $687 in November 2021 before commencing a steep decline in December and January, presaging a significant reversal in its fortunes. Subscriber losses of 200,000 and 1 million in Q1 and Q2 of 2022, the first such net subscriber loss in Netflix’s history, caused shares to fall 75% from the November 2021 peak to its bottom six months later. As it turned out, through all of 2022, Netflix grew subscribers by 9 million or 4%, a big drop compared to the 20% average growth over the previous five years, but less than the worst fears.

Inflation had taken off in 2021 causing central banks around the world to pivot their view of it being a transitory phenomenon into a more ingrained process. Russia invaded Ukraine in February 2022 further pressuring energy and food prices globally. The ensuing aggressive increase in interest rates led to a recalibration in liquidity and market multiples, with those companies that missed expectations punished even harder. From peak to trough, Netflix went from a market capitalization of $300 billion to just $75 billion.

Netflix’s gross subscriber adds, i.e., the number of new subscribers signing up for the service, stalled in all geographies in a manner that even the management team seemed at a loss to explain. The market narrative shifted, and with it future financial expectations, from a company with a seemingly unstoppable business model accelerated by the COVID pandemic to one that had saturated its market and succumbed to burgeoning streaming competition from legacy media companies.

From our perspective having a major war break out in Europe’s borders and another major global economic shock so soon after the COVID shock seemed the most likely explanation for why people abruptly paused in signing up for a new Netflix subscription en masse. We had seen regional changes in new sign-ups historically when people’s attention had been drawn to certain events like the World Cup or the Olympics, only to see additions rebound in subsequent quarters, but we had not seen a globally synchronized pause before.

This was the second time in Netflix’s history as a public company that it had faced a crisis of confidence among investors, where management’s ability to adapt was tested. It had faced a similar test when it pivoted its business model from a very profitable DVD by mail service into a money losing streaming service back in 2011, resulting in a similar fall in its share price before regaining investor trust over the next 2 years and increasing its value over 10x thereafter.

This time it was the inexplicable stall in subscriber growth that led the company to pivot its business model from a pure subscription video service into one that incorporated both advertising as a new revenue source and monetizing the 100 million engaged viewers that were borrowing someone else’s password by implementing tighter password security. This complimentary approach of tightening user password sharing and offering a new lower priced, economically accretive ad-supported plan (or additional add-on subscriber fee) opened up a large pool of already engaged users to reenergize revenue and profit growth rather than solely depending on new to Netflix sign-ups.

This effectively multiplies the total available market (TAM) for Netflix over a subscription-only model, while also raising the ultimate pricing umbrella for the service over time. For context, US TV advertising revenue was about $67 billion in 2022 compared to Pay TV subscription revenue of $86 billion. This amounts to advertising increasing the total revenue from TV content by 80% over subscription rates alone.

Furthermore, Netflix continued investment in its nascent games business, which has the potential to expand the TAM even more. Globally, gaming is a $213 billion market. The net result of all of these service extensions multiplies Netflix’s monetization value for each subscriber dramatically, especially as the adjacent services revolve around the same end user and complement one another.

One other pivot by management was on capital allocation in relation to content. Netflix’s strategy on content spending had been to “overinvest” in content in order to grow the scale of its catalog ahead of subscribers along two vectors – category expansion and geographic expansion. This in turn drove new subscriber additions in existing and new geographic markets. With subscriber growth slowing drastically under indefinite macro-geopolitical circumstances, management rationally adapted and reprioritized the scale of that investment. The result is faster growth in free cash flow generation, now on track to surpass $6 billion this year.

With Netflix letting its foot off the content pedal for the first time in a decade, we fully expected competing streaming services to see blood in the water and get more aggressive. While we did not believe that competition was a factor in the subscriber growth slowdown as the common narrative believed, we did assume that scaling competitors like Disney (DIS) (whose courage and humility in copying the Netflix growth strategy we were impressed by) or Warner Bros. Discovery (WBD) could get more aggressive and use the content growth strategy to win a greater share of new streaming subscribers, eventually eroding some of Netflix’s scale dependent competitive advantage.

To our surprise, both companies announced their own cutbacks in content spending and increased prices aggressively for their own streaming services, finally finding the breathing room Netflix’s reduced aggressiveness allowed to improve the profitability of their own money-losing streaming services rather than trying to take share from Netflix.

This was great news to us as investors as it allowed Netflix to become less aggressive on its content growth strategy, drive higher positive free cash flow, while retaining its relative moat advantage as it adapted its business model. The company has been clear that as revenue reaccelerates to its goal of double-digit growth, it will become more aggressive again in content investment to drive further subscriber gains, to the extent it’s justified.

In retrospect, Disney and Warner Brothers Discovery’s reactions made sense given their financial circumstances of high debt loads and weakening linear TV revenue, traditional media’s cash cow. US Cable TV subscribers, the main source of their linear TV subscription and advertising revenue, has seen its subscriber defections accelerating to a record pace of -7% as of 3Q 2023.

Despite Netflix’s nickname from only a couple of years ago being “Debtflix” as it took advantage of low-cost debt to “overinvest” in scaling its own content catalog, it never put itself in a position where the debt load became a precarious noose around its strategic hands.

As a result of their business and financial issues, Warner Brothers Discovery stock price has declined approximately -70% (setting aside the WBD pre-merger DISCA stock spike above $30 during the Archegos scandal) while Disney declined -60% from its peak. Benchmarking their prices back to 2019, Netflix has outperformed its notable US-based media competitors getting back near its pre-Squid Game highs because it is the only one with a significantly profitable, cash generating streaming video business.

So where does this leave Netflix’s position today and prospects for its future as investors today?

We have a number of positive data points indicating a reinvigorated business with a reacceleration in subscriber growth as consumers have adjusted to economic and geopolitical conditions globally albeit nudged along with the end of free password sharing. The company is on track to have added about 25 million new subscribers in 2023, a similar number to its pre-Covid pace, and has outpaced Disney’s and Warner Brothers Discovery’s streaming service subscriber growth over the past year.

Netflix’s advertising business has reportedly seen strong interest from advertisers looking to move more of their brand advertising spend from linear television, with its declining share of engagement, to streaming. Roughly 200 billion hours being spent on Netflix by its 250 million subscribers is premium advertising real estate that brand advertisers want access to and are willing to pay a premium to do so. While Netflix has seen huge success in content engagement, it still has work to do to build out and extend the advertising capabilities addressable by its platform and scale the number of subscribers accepting its ad-plan (most subscribers signing up still prefer to pay more for the ad-free experience).

We estimate ARM (average revenue per month) for this service near or above the $15.49 standard ad-free plan in the US (comprising of a $6.99 subscription coupled with a $8-10 per month per subscriber in advertising revenue) despite only four minutes of advertising served per hour of viewing. In our view, this has a lot of headroom to grow from these levels as ad targeting and customization improves. In the other 11 countries where it has launched the ad plan, advertising economics aren’t quite as good but there is a clear path to improvement for the business in the dual goals of eliminating password sharing while offering a more economical service for those sharing out of necessity, creating a win-win solution for both customers and the company.

As legacy media companies have begun to focus on reducing their losses from their streaming services, they’ve returned to licensing some of their premier content to Netflix after previously suspending deals in favor of their own buildouts. This is true for even the bigger ones like Disney/ABC and Warner Brothers Discovery/HBO, who have inked deals with Netflix for some of their most popular content. This is great news for Netflix subscribers – valuable and unique content is non-fungible, which is why we never subscribed to the competition argument, and we’ve seen how unique new content has driven subscriber additions for all the major services.

Consumers have increased the number of streaming services they subscribe to because they want access to all this great content. However, “subscription fatigue” has more recently led them to stay more loyal to core streaming services with content scale and velocity (represented by lower churn) while shuffling through secondary services where they may want to binge on a certain more limited set of content. By having access to license unique sought-after content from other media companies, Netflix gets to satisfy members of its own service while reducing the content cash demands required of only relying on original content.

We’ve argued since our initiation in 2016 that there are likely to be a handful of key global subscription services and most other media companies are going to find superior economics in licensing to them rather than building their own platforms – and this thesis appears to be coming to fruition. Beyond the legacy media players are the large tech giants also playing in the space with different economic business models like Apple, Amazon, and YouTube, who are also building successful global platforms. Our belief that Netflix had the right strategic approach to building this business persists and as the leader in the space it continues to be well-positioned to win more than its fair share of the very large global entertainment pie.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.