wing-wing/iStock via Getty Images

Note:

I have discussed Enphase Energy Inc. (NASDAQ:ENPH) previously, so investors should view this as an update to my earlier coverage of the company.

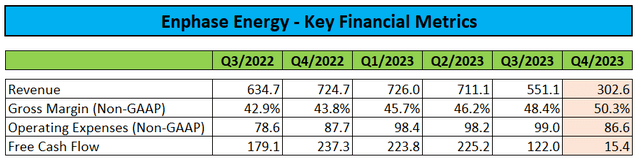

After the close of Tuesday’s session, leading microinverter and battery storage solutions supplier Enphase Energy Inc. or “Enphase” reported mediocre fourth quarter results with decent gross margins more than offset by revenues falling well short of consensus estimates.

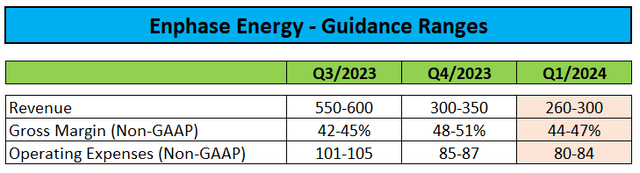

In addition, the company’s near-term outlook missed analyst expectations by a mile for a third time in a row as Enphase continues to deal with elevated channel inventory after regulatory changes and increased interest rates started to impact customer demand in H2/2023.

However, even with revenues down by almost 60% year-over-year, the company still generated $15.4 million in free cash flow.

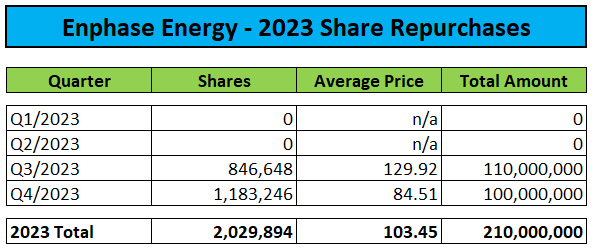

During the quarter, the company utilized another $100 million for additional buybacks under its up to $1 billion share repurchase program:

Company Press Releases

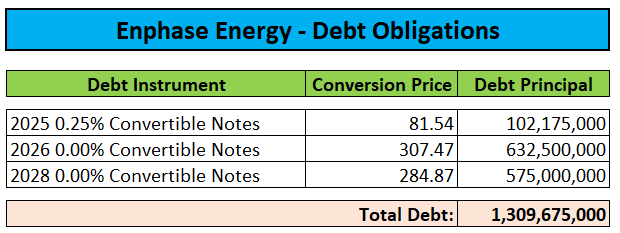

Enphase finished the year with almost $1.7 billion in cash, cash equivalents and marketable securities and approximately $1.3 billion in convertible debt obligations:

Regulatory Filings

On the conference call, management pointed to additional efforts being required to reduce channel inventory to more appropriate levels. Consequently, Enphase expects to continue undershipping underlying demand in Q2 albeit “at a much reduced level” while normalization of channel inventory is currently anticipated by the end of the second quarter.

However, even with channel inventory normalizing, the company is still grappling with weak end customer demand trends in both the United States and Europe.

In addition, transition to Net Energy Metering (“NEM”) 3.0 in California has been slower than anticipated:

Installers are still installing NEM 2.0 systems, and this has caused a delay for some of them to sell NEM 3.0 systems. The ones who started are finding the sales process a little more difficult given the complexity of the tariff structure, the added cost of batteries upfront and high interest rates. One particular challenge we hear is their lack of confidence in the payback of the systems they are selling. (…)

In addition, installers are still coming up the learning curve on installing batteries.

That said, management pointed to “early signs of a recovery” in Europe and projected U.S. demand (with the exception of California) to “bounce back quickly“.

Consequently, the current quarter is likely to represent the bottom of the recent downturn but it will take more time for revenues to return to levels recorded in H2/2022 and H1/2023.

While the company is expanding into additional overseas markets at a rapid pace, the vast majority of sales (75%) is still derived from the United States.

On the call, management estimated current end customer demand in a range of $450 million to $500 million with seasonally lower Q1 demand being closer to $400 million.

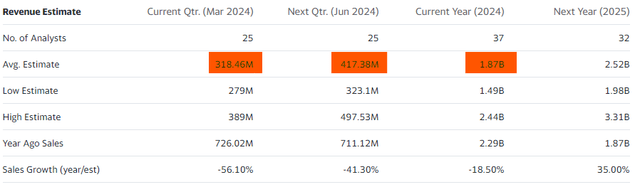

Even when assuming the rather optimistic analyst consensus for H1/2024 revenues to prove true, Enphase would still require end customer demand to pick up quite meaningfully in the second half to come even close to the $1.87 billion in full year revenues expected by analysts:

Consequently, I would expect 2024 revenue estimates to come down further in the near-term as analysts adjust their models.

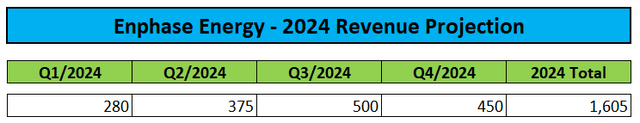

For my part, I am projecting full-year revenues of approximately $1.6 billion or almost 15% below current consensus expectations:

Company Projections / Author’s Estimates

However, considering recent changes in market sentiment and the high likelihood of Q1 representing a near-term trough for revenues, earnings, and cash flow, I am upgrading the company’s shares from “Sell” to “Hold“.

Bottom Line

Enphase Energy reported mediocre fourth quarter results and provided disappointing Q1 guidance as the company continues to deal with elevated channel inventory amid persistent weak end customer demand.

Based on the company’s Q1 outlook and statements made by management on the conference call, I would expect further near-term downward revisions to 2024 consensus expectations.

While demand headwinds are likely to persist, a further reduction in channel inventory supports higher sell-in numbers more in line with current end customer demand in the second half of the year.

With the worst apparently soon behind the company and considering the recent changes in market sentiment, I am upgrading Enphase Energy’s shares from “Sell” to “Hold“.