Petmal

Thesis and Introduction

In this article, I will be discussing the strong quarter and solid outlook for Enovix Corporation (NASDAQ:ENVX). My previous article published in December discussed the potential for a short squeeze, which I still believe is prevalent (probably even more now). Because of the drop after earnings, I strongly believe the shorts are coming alive. The short interest has been decreasing month-over-month since September, but I believe there has been an uptick in short interest since the earnings report because of the 14.5% decline in the price (and I think the stock declining to that extent is more than exaggerated). Since my publication from Q3, the stock has fallen, but meanwhile seen significant strides and accomplishments, which is what we are here to discuss.

Enovix Rating: Strong Buy

Q4 Earnings Recap

If I were to explain Enovix’s Q4 recap in one word: astounding. I found it very hard not to be bullish about the company when presented with strong financial performance and a bright outlook from management. The remarkable leap in revenue from $1.1 million in the fourth quarter of 2022 to $7.4 million in the same quarter of 2023 illustrates a trajectory that is growing and something I want to be a part of. They are proving their strategic operations are excelling in a bumpy market. The acquisition of Routejade and the scale-up at Fab2 in Malaysia are pivotal moves. Enovix is ready to meet escalating demand, particularly regarding high-volume manufacturing. Specifically, management stated the following in their investor relations statement:

“In support of our Malaysia expansion, we continued during the quarter to strengthen our relationships in the country. Notably, in November we met with Malaysian Prime Minister Anwar Ibrahim during his visit to the Bay Area for the Asia-Pacific Economic Cooperation (APEC) summit.” – Q4 Investor Relations

I wanted to briefly touch on this in regards to broader thoughts on Enovix as a company. Not only are they creating more jobs in Malaysia, but they are growing their roots and truly watering them overseas. By meeting with the prime minister, Enovix’s management is forming a deeper partnership beyond transactional business. I admired this component aside from cold hard numbers that analysts normally put all their apples on. To me, little things like this can make the difference.

Furthermore, the company is setting milestones, including the confidence in achieving 1,000 cycles on smartphone-class silicon batteries and the development agreement with a leading automaker for their EV batteries. These are clear indicators of the company’s innovative edge, something the market isn’t recognizing after the stock’s recent dip. These are very high quality advancements that position the company at the forefront of battery tech. And what is most interesting is the dire need for higher energy density in a world increasingly driven by power-hungry AI applications. Enovix stated the following in their quarterly statement, and it’s intriguing to ponder (it’s a long quote but worth it):

“During the quarter, we contracted with Tirias Research to analyze historical battery and power consumption trends on the smartphone, along with a forecast for AI usage in the coming years. Tirias forecasted that global GenAI usage (all words, symbols, images, and video frames) will increase over 150x between 2023 and 2028. The impact on device energy budgets is likely to be massive. As an example, Tirias found that capturing video with AI features enabled on two leading flagship smartphones consumed over 50% more battery life than without AI. They also found that running chatbots ChatGPT3 and Llama 2 consumed 2x-11x more battery life than watching videos on YouTube. This AI megatrend calls into question whether today’s standard of all-day battery life on the smartphone is sustainable without a battery breakthrough like ours. We are extremely well-positioned given our engagements with Vivo, Xiaomi, Lenovo, among others, and highly motivated to solve this problem for these industry leaders in the years ahead.” – Q4 Investor Relations

It is astonishing and something very few people are giving attention to. Think less about AI startups, high-tech VR, and the metaverse. Start asking, what are the implications? Because Enovix is hitting the nail on the head. There’s a need for high quality batteries in our smartphones that are more efficient and sustainable; I didn’t even think about this when considering the raging AI wave.

More on the financials, Enovix’s jump to $7.4 million in quarterly revenue is just the start. There are some promising returns when considering the company’s rigorous FAT and SAT processes that ensure high throughput and yield and the anticipated revenue from high-energy density batteries tailored for smartphones. I really like how Enovix is expanding into different segments (the diversity is needed) and leading the battery industry with high-end tech.

Enovix’s strategic alignment with the AI megatrend’s impact on device energy budgets is a quick, yet impressive pivot in my eyes. The company stands in a unique position to solve critical challenges for industry leaders as the global trends continue to surge. The anticipated increase in GenAI usage around the world and its impact on battery life underline the market opportunity for the company’s breakthrough solutions. Other companies would struggle to compete with Enovix in this urgent environment as they are already closing in on handing samples to OEMs.

I like Enovix’s strides in their commitment to high-volume manufacturing and the delivery of EX-1M and EX-2M batteries to customers. They are active and prepared for the energy storage future with a focus on scaling silicon-anode and lithium-ion battery manufacturing capabilities.

Risks

While my stance on the company remains decidedly optimistic, I always ensure to bring some risks to the table to remain balanced in my argument. The ambitious scale-up in Malaysia carries inherent risks of expansion and growth. Potential delays in production and challenges in achieving the expected target yield are associated with the high-volume manufacturing Enovix speaks of. Additionally, I see them being slightly reliant on this technological breakthrough within the smartphone industry, which is where a large sum of my bullish perspective is derived. They do plan to achieve 1,000 cycles for smartphone-class silicon batteries, and there is always uncertainty with meeting this requirement after notifying shareholders. If technical milestones aren’t met, it could impact customer engagements and delay product launches.

Furthermore, the financial outlay for these expansions and operations are substantial, which was noted in the financial update. The short-term balance sheet could be affected due to the strategic realignment of Fab1 and the associated accelerated depreciation. Furthermore, the competitive landscape in battery technology is fierce, so market position is always a concern with rapid advancements – but I think Enovix is looking solid for some time.

To me, the last risk depends on market acceptance concerning Enovix’s new technologies. The company’s success will weigh on the adoption from major OEMs of its silicon-anode, lithium-ion batteries. This process will have associated challenges including product validation, performance, and integration, which is why it is a major goal for Enovix to hand out samples to numerous OEMs this year.

On the contrary, these risks do not diminish my thesis and rating on the company and its potential. From successful acquisitions to expanding into a new market, Enovix is on a clear path towards addressing the high demand for higher energy density batteries (and the demand can only increase with artificial intelligence needs). Management has been proactive in tackling challenges, so I am confident in their ability to navigate the upcoming market successfully. Enovix has solid financial footing evidenced by their robust cash reserves— $233.1mm. They are very stable as their cash on hand to market cap ratio is 14.3%. Their operational agility and forward-looking mindset simply reinforce my strong buy recommendation.

Now, let’s chat about the unique situation regarding Enovix’s value and where I see the stock price headed in the next 6 months…

Valuation

Firstly, the fundamental baseline is intriguing that points toward potential upside. Although strategic global expansion will cause a dent on the balance sheet now, the Fab2 in Malaysia illustrates increasing revenue potential as high-volume production can be achieved. Additionally, the partnership agreement with an upcoming automaker will better stabilize Enovix and hint at greater value because of market adoption. What really opens the door is their groundbreaking advancements in battery tech for smartphones, which is positioning the company well to take market share in this high-demand sector; this is all derived from increasing usage of AI. I find the growing need for higher energy density batteries a compelling catalyst in terms of the stock price. To me, corralling these elements suggests a strong fundamental basis for an increase in Enovix’s stock value. However, there is even more upside potential when considering the technical side.

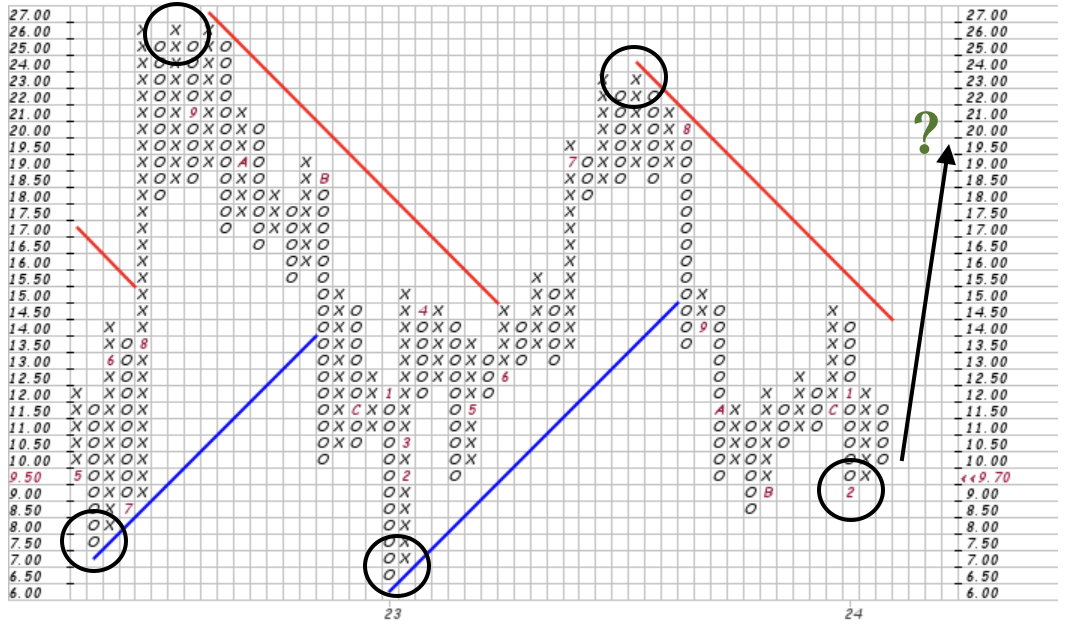

Let’s move to the graphical perspective. If you pay attention to anything in this article, by all means, take notes on the trending graph. Below I have attached a point and figure chart that will illustrate trend lines and resistance and support levels through the traditional three box reversal method. Personally, I haven’t come across such a patterned graph since PepsiCo’s quadruple mountain earlier this year.

ENVX Point and Figure (Stock Charts)

I have outlined the stock above with some spots to emphasize. Each circle represents the highs and lows of the stock for approximately a 2-year time frame. What is unique is that between each high and low is a 6-month time interval. If we look back at each low, it hovered around 6.50-8.50. The highs have been trending lower (35, 25, & 22). So, the stock is doubling over 6 months and cutting half in the same length of time. As of right now, we are getting a deep, deep discount in my view. The fundamentals and technicals align perfectly and are very promising. It is one of my favorite plays in my portfolio. I entered the market the day before earnings and will continue to add a position here in the coming days. I will likely wait until June (give or take) and predict the stock to hit $20 flat. Yes, a 100% move in under four months. I would consider selling if the stock were to double in the short term – for personal reasons. However, at this moment I strongly believe in Enovix’s long-term viability.

Looking back, this forecast aligns with my exact prediction in December – I stated that the stock would hit $14.00 by year-end (which it did) and $20 by June. My sentiment is consistent and I only feel more confident because of this recent earnings call. I’m most definitely looking forward to seeing how this plays out.

Conclusion

As I reflect on Enovix’s past quarter and its strategic moves, my strong buy rating has only solidified. Despite the stock’s recent dip (which I believe is bizarre after this successful earnings report), the company’s remarkable revenue growth, strategic acquisitions, and technological advancements in battery technology illustrate potential for short-term and long-term returns. Enovix’s focus on addressing the energy demands of AI-driven applications and its advancements in silicon-anode, lithium-ion battery manufacturing is the centric theme of my rating – it cannot be understated. I am mindful of negative aspects, like scaling operations and market acceptance of new technologies, but confident in the company’s ability to navigate such challenges. I will be closely following the delivery of EX-1M and EX-2M batteries and the continued execution of its scale-up plans (as you should keep an eye out too). All in all, I remain quite bullish on Enovix’s future. This is a unique opportunity in the market (that I am participating in), both fundamentally and technically.

Please share your insights and questions in the comment section. I will respond promptly!