Galeanu Mihai

Investment overview

I give a buy rating for Enfusion (NYSE:ENFN), as I believe there is plenty of room to grow and there are visible catalysts that would drive growth acceleration in the coming years. In addition, given that ENFN is not a profitable business, as it continues to grow, its valuation gap should close relative to peers.

Business description

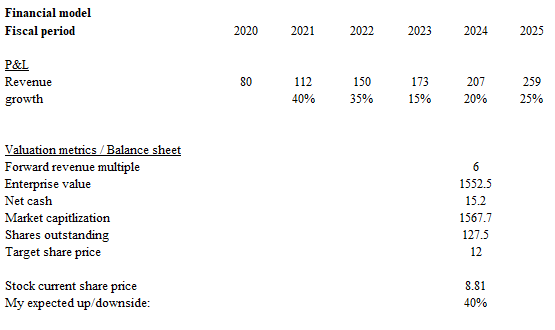

ENFN solution helps investment managers make and execute informed investment decisions. In essence, ENFN is a large database (like FactSet and Bloomberg) that helps simplify investment and operational workflows. Using ENFN’s solution, clients can manage all parts of the investment management cycle (front-, middle-, and back-end functions). ENFN has been in business for more than two decades already (founded in 1997) and went public in 2021. Since ENFN went public, revenue has more than doubled from CY20, from ~$80 million to $178 million as of 3Q23. While growth has slowed, ENFN has turned the business from a loss-making to a profitable one (EBITDA margin went from -243% to ~12% as of LTM3Q23).

Product has high cost of replacement

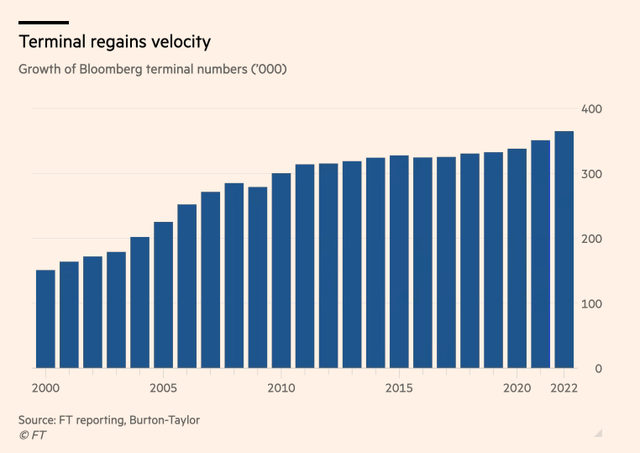

Given that ENFN provides an end-to-end SaaS solution, allowing investment managers to deal with functions across the entire investment lifecycle (from execution to reporting), it means that ENFN is being used by multiple personnel in the firm. What this also means is that the entire firm’s operation workflow revolves around ENFN’s platform, and almost every employee has been trained to facilitate the platform. As such, ENFN’s platform becomes more and more sticky over time as employees get more familiar with it and have more models and templates built into the platform. Take Bloomberg, for example. The terminal is known to be expensive, but the number of terminals just keeps growing every year, and investment firms are not switching out of it. This is because Bloomberg has become an integral part of the firm’s operations workflow (from research to execution to reporting and portfolio management). It is extremely painful to replace the entire system, as there is a need to retrain everyone and rebuild all the models and templates from scratch.

Because of this sticky nature, such products typically have high pricing power because users would rather pay than replace the entire system. Citing the example from Bloomberg again, the business has consistently raised prices over the years, and I expect ENFN to experience a similar pricing dynamic over time as it becomes more entrenched within its clients’ operations.

The company’s ability to charge for the privilege of renting a terminal is the envy of the data industry. Last year, Bloomberg raised the price for just one of its terminals by about 9 per cent to $30,000 ($2,500 a month) and the cost of multiple ones to $26,580 per unit, as reported by the FT. Because the company refuses to cut deals, even for its biggest clients, and because of how rare it is to get rid of one once they’re installed, that means the annual revenues thrown off by the terminals over the next two years are easy to calculate: at least $9.7bn. FT magazine – Bloomberg is contemplating life without its founder

TAM is large and healthy

ENFN should have no issues growing, given that the industry is extremely huge. To give a sense of how big the industry is, the total global third-party AUM is over $100 trillion, according to McKinsey, and this figure has grown from $61 trillion in 2013. If we assume a 1% asset management fee, this implies a total of $1 trillion in budget available to be deployed for services (like ENFN is offering). ENFN LTM3Q23 revenue is $170 million, which is less than 1% of its addressable market.

I also think that there are other growth catalysts that should continue to push investment firms to adopt ENFN-like products. To begin with, COVID has accelerated technological advancements because of the necessity for funds to manage their IT systems remotely in addition to on-premise. In order to do so, they would need a product that can facilitate the end-to-end process of an investment lifecycle. Secondly, as the asset management industry continues to see fee compression, managers are forced to think of ways to reduce their cost structure. To do so, they need digital solutions to streamline operations and improve productivity.

In addition, I think the timing for capital to flow back to the asset management industry is about to come when the Fed starts cutting rates. My view is that capital around the world has shifted to risk-free assets because of the attractive returns. However, when the Fed cuts rates, this pool of capital will unlikely to find a 2% return attractive; as such, it will need to see other investment alternatives to make an attractive return. What this means for ENFN is that there is likely to be an increase in the number of asset management firms, which means more opportunities for ENFN solutions to be deployed.

Healthy balance sheet

Finally, I think an underappreciated part about ENFN is that it has a pretty clean balance sheet. As of 3Q23, ENFN has cash of $31 million and gross debt of $16 million, for a net cash position of ~$15 million. Unlike the past, when ENFN was operating at a loss, the business is now EBITDA-positive and growing. With this P&L profile and the nature of its revenue (highly recurring), I believe there is a path for ENFN to lever up the balance sheet at some point. That extra cash could be used to invest in sales and marketing to grow the business or R&D to improve the product.

Valuation

May Investing Ideas

My target price for ENFN is $12, a 40% upside from the current share price of $8.81. I expect growth to accelerate from here back to >20% in FY25 as ENFN rides on the industry tailwinds (asset management firms adopting digital tools for productivity and cost savings) and flow-in of capital back to the asset management industry when the Fed cuts rates. ENFN stock should see a positive revision from here as the business’s growth profile has improved compared to the current mid-teens. Comparing ENFN to other similar providers like FactSet and Morningstar, ENFN is expected to grow faster, but it is trading at a discount. My understanding is that ENFN is not as profiled as the other two peers, which is why it is trading at a discount. However, as ENFN continues to scale, its margin profile should eventually reach peer level (ENFN has a higher gross margin, in fact), and as such, the valuation gap should close over time.

Risk

Rates could go higher and stay high for longer than expected. This would delay the timing of capital flowing back to the asset management industry as they remain invested in risk-free assets, given the attractive return. This impacts ENFN’s ability to grow in the near term.

Conclusion

My conclusion is a buy rating for ENFN. Its sticky product, deeply integrated into clients’ operations leads to strong pricing power. In addition, the substantial industry size, with a total global third-party AUM exceeding $100 trillion, provides ample room for ENFN’s growth. ENFN also has a neat balance sheet, and coupled with positive EBITDA, gives it sufficient financial flexibility to tap on the debt market for dry powder (for growth or R&D) when needed.