JHVEPhoto/iStock Editorial via Getty Images

Energizer Holdings (NYSE:ENR) is a well-known household name that’s been around for more than a 100 years. Even though the company’s business model and product offerings have changed over the years, its main business continues to be batteries along with other battery related products. It is also involved in car care products.

Investors always had trouble properly valuing this company. Some argued that it is an energy company, others argued that it is a utility company. There were others who argued that this is a commodity company or a household company or a consumer discretionary company. In addition, there were also differing views on the company’s future. Some argued that with more smart products and hand held devices, there should be more demand for batteries, while others argued that most consumer electronics usually come with their own rechargeable batteries and people will stop buying disposable batteries after a while. It turns out that even though many electronics indeed came with their own batteries, people never stopped buying disposable batteries either.

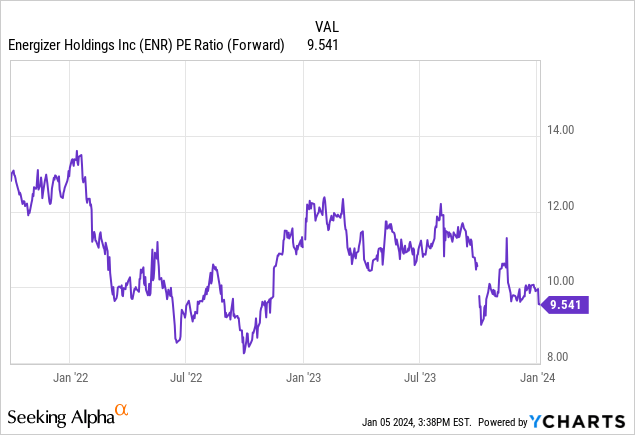

While Energizer is not exactly a growth company, it’s not a dying brand either. The company has more or less stable sales that grow in low single digits. Then again, the market has priced this company accordingly based on its low growth rate, giving it a single digit forward P/E of 9 versus the overall market average P/E of 23.

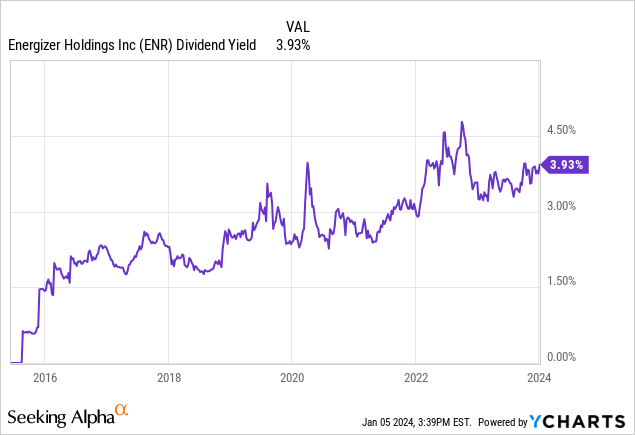

Many investors see this stable business as an income generator and enjoy its dividend yield, which is approaching 4%. This yield is definitely much higher than the market’s overall yield of 1.6%, and it attracts a lot of income investors. You may also look at the graph below where the stock’s yield more than doubled in the last 5 years and think that this is a dividend growth stock, but it isn’t so.

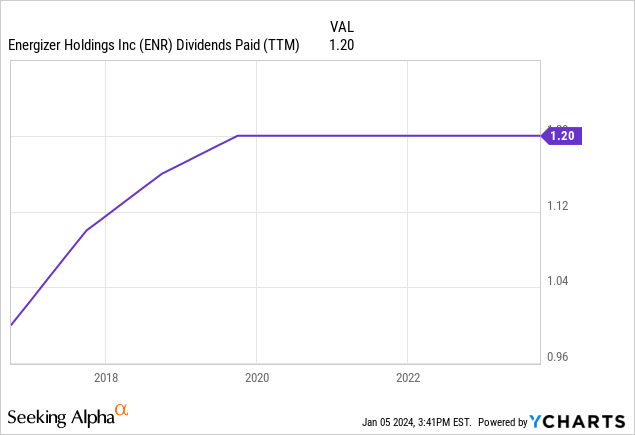

While we haven’t seen any dividend cuts recently, the company hasn’t hiked its dividends in quite some time. It’s been almost 5 years since the last dividend hike came, and the stock’s dividend payments have been pretty much flat at $1.20 per year for the last several years.

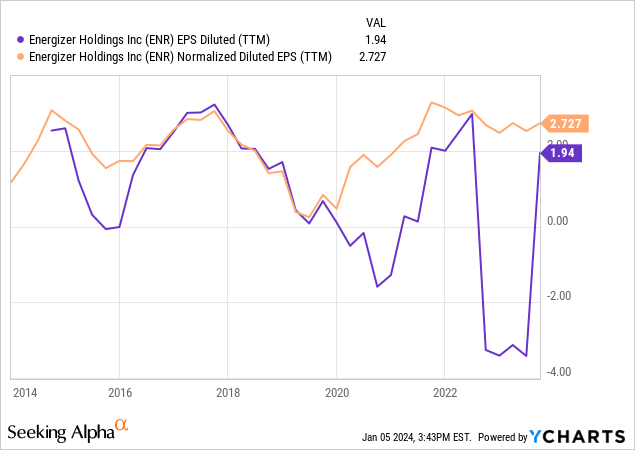

To be fair, the company’s earnings haven’t always been stable, even though its revenues were for the most part. In the last decade there has been periods where the company actually posted a loss and still continued to pay its dividends in full, so some investors might even think that we are lucky to not get a dividend cut during this time, let alone talk about a hike. Meanwhile, when we look at the company’s normalized EPS, it is hovering around $2.73 which easily supports its dividend of $1.20 per year.

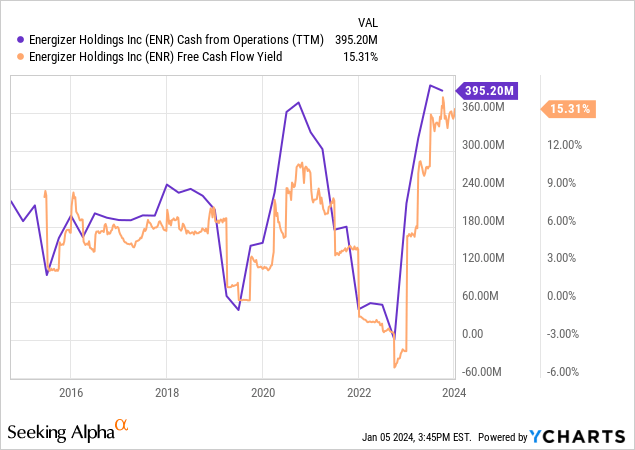

The company’s cash flow profile also seems to support a higher yield if the company chose to raise its dividends. The most recent operating cash flow came at $395 million and the company’s free-cash-flow yield came at 15% which is well above its dividend yield of 4%.

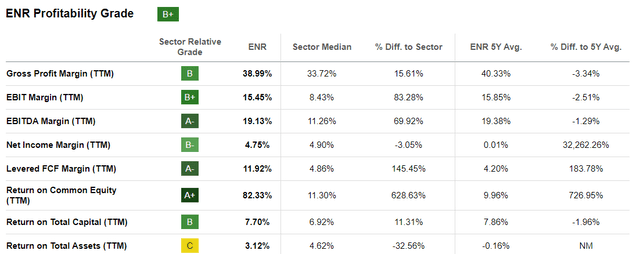

The good news is that the company’s margins are stabilizing. While its gross profit margin of 39% is slightly below its 5-year average of 40%, it’s more or less stabilized, and we can expect it to be in a 38-42% range moving forward. The company’s EBIT and EBITDA margins of 15.45% and 19.13% are slightly below its long-term average (15.85% and 19.38% respectively) but significantly above sector medians (8.43% and 11.26% respectively) and it’s been getting better since last year. After suffering from higher material costs and labor costs, the company was able to pass on these higher costs to consumers and fix its margins this year which should hold up unless we get hit by another inflation event which can tip the scale against the company again, but it’s highly unlikely at the moment.

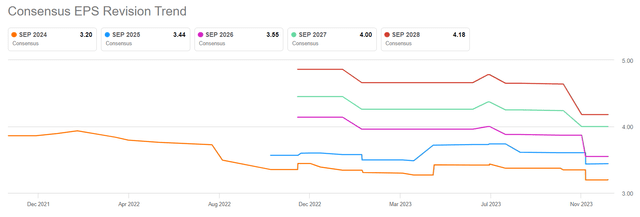

The bad news for the investors is that analysts cut their estimates for future earnings for the company after the company issued a weak guidance in its latest earnings report for next year. The company cited global uncertainties for its weak guidance back in November, and analysts didn’t like that. The good news is that even with those downgrades, investors still see modest but stable growth for the company for the foreseeable future. They are predicting that the company will earn $3.20 per share this year indicating 4% growth, followed by $3.44 per share in 2025, $3.55 per share in 2026, $4.00 per share in 2027 and $4.18 per share in 2028. We are looking at about 5% average annual growth rate for the next 5 years, which might not be too bad if inflation rate stays around the Fed’s target of 2-3%.

Analyst Estimates (Seeking Alpha)

Currently, the company’s forward P/E of 9 assumes no growth, so even a 5% growth rate is higher than what investors are giving the company credit for. As a matter of fact, the company’s P/E is as low as 7 when you calculate them based on 2027 earnings estimates, even after recent downgrades. The company’s annual dividend of $1.20 per share looks pretty sustainable when compared to analyst estimates for it to be earning anywhere from $3.44 and $4.18 per share in the next 5 years. In fact, if anything, there is plenty of room for the dividend to grow.

That’s what I would need from this stock for it to be a “buy” for me. When I’m buying an income play, I’d like to see one of two things. Either a dividend yield of at least 5% or a sustainable, repeatable dividend growth that spans multiple years. There are also some stocks that have both of these where they pay a higher than 5% yield and still post dividend growth and those are even nicer as long as they are not yield traps which aren’t always easy to identify.

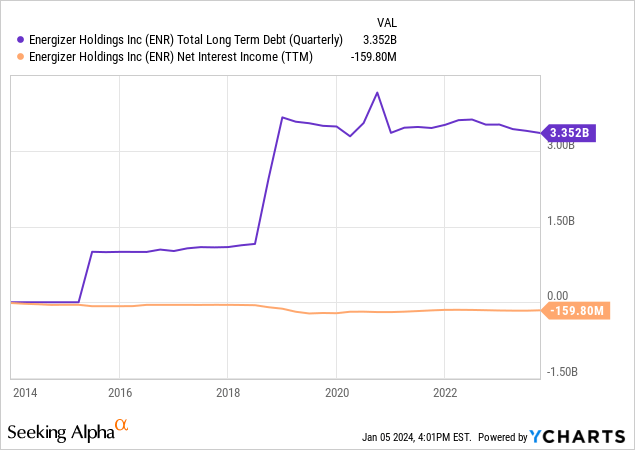

I will be keeping an eye on this stock and see if it starts hiking dividends. It certainly has the income and resources to do so. My biggest worry for this company is its high debt level which was caused by some recent acquisitions, and it forces the company to spend $160 million on annual interest payments. This is one thing that could hinder the company’s dividend growth but even with this number, it still makes anywhere from 2x to 3x its dividend amount which means it can definitely hike its dividends in a sustainable fashion especially with its cash flow numbers looking the way they are right now.

The stock appears cheap on forward basis and has a nice yield, and the only thing it’s missing for me is dividend growth. For this reason I am rating it a “hold” right now, but it can easily become a “buy” if the company starts throwing in some dividend hikes for investors.