JHVEPhoto

One of my favorite segments of the market to invest in is the midstream/pipeline space. Companies in this market niche have certain advantages that most other firms don’t. They tend to generate significant and steadily growing cash flows. They are highly predictable and, although I don’t care much about yield, they do pay out hefty distributions. Because of their business models, they are also fairly low risk. Add on top of this the fact that many of them trade on the cheap, and there is not much to dislike.

One firm in this market that I do like to pay attention to from time to time is Enbridge (NYSE:ENB) (TSX:ENB:CA). The company has an extensive network of natural gas and liquids pipelines, not to mention a variety of other assets such as storage facilities, export facilities, rail lines, and terminals, through which it transports gas, crude oil, and other liquid hydrocarbons. Although much of the business assets are physically located in the US, the firm is a Canadian business at its core. Recently, financial performance has been a bit mixed. However, management has not failed to deliver on the metrics that are most significant. While shares might not be the cheapest compared to other players in the space, they are still attractively priced at this point in time. And because of this, I cannot help but to keep the company rated a ‘buy.’ This is in spite of the fact that, since I last wrote about it in December of last year, shares have been up only 8.8% compared to the 10.8% rise seen by the S&P 500. But the way I see it, patience should eventually win the day, leading to nice upside for long-term holders.

A necessary disclosure

As I mentioned in the introduction to this article, Enbridge is a Canadian business. Because of this, all of the firm’s financial results are reported in Canadian dollars as opposed to US dollars. Given that the exhibits provided in the company’s investor presentation are also in Canadian dollars, I figured it would make the most sense to make every reference to ‘dollars’ or ‘$’ in the form of Canadian dollars.

A solid long-term play

In the past, when I have written about companies in this market, I have often said that revenue and net profits are not terribly significant when it comes to evaluating these firms. It all boils down to how they generate revenue and where their profits actually derive from. A lot of the activity that these companies engage in involves the transportation of oil, natural gas, and other resources. They capture the true value from the spread between the price at which these products come into their network and the spread at which they are ultimately sold for. Even so, for the sake of being comprehensive, I will touch briefly on the revenue and net income of this prospect.

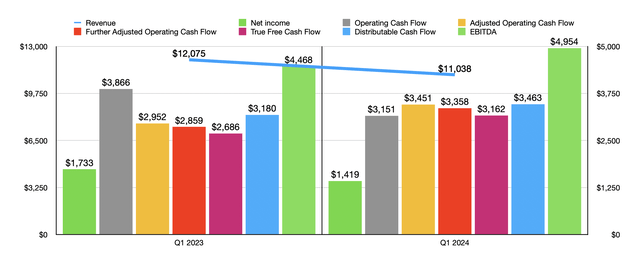

The most recent quarter for which data is available is the first quarter of the 2024 fiscal year. Revenue generated by Enbridge for this window of time came out to $11.04 billion. This represents a decline from the $12.08 billion generated one year earlier. The only increase that management reported from a sales perspective came from its transportation and other services. Sales here inched up by 3.6% from $5.01 billion to $5.19 billion. Commodity sales, meanwhile, plummeted from $4.78 billion to $4.15 billion. Meanwhile, gas distribution sales fell from $2.28 billion to $1.70 billion. Meanwhile, net profits fell from $1.73 billion to $1.42 billion.

Despite these weak spots, most of the other profitability metrics for the company came in quite strong. Yes, it’s true that operating cash flow fell from $3.87 billion to $3.15 billion. However, if we adjust for changes in working capital, we get a rise from $2.95 billion to $3.45 billion. If we adjust this further to strip out preferred distributions, we get an increase from $2.86 billion to $3.36 billion. I also like to look at what I call ‘true free cash flow,’ which removes maintenance capital expenditures, to see how much true excess cash flow the company has. Doing this, we get a rise from $2.69 billion to $3.16 billion. DCF, or distributable cash flow, grew from $3.18 billion to $3.46 billion. Meanwhile, EBITDA for the company expanded from $4.47 billion to $4.95 billion.

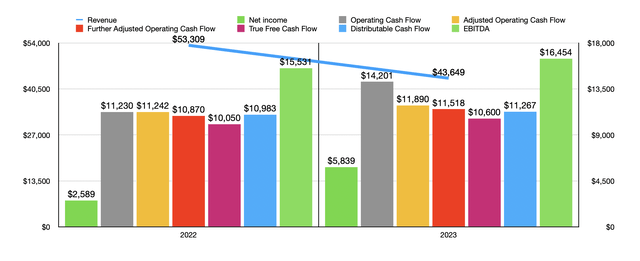

These are pretty solid figures for the company. And they follow a general uptrend that management has been able to achieve in recent years. If you look at the chart above, for instance, you can see financial results for 2022 and 2023. Even though revenue fell during this time, net profits skyrocketed. In addition to this, every cash flow metric that I looked at rose on a year-over-year basis. At the end of the day, a lot of this comes down to demand for the company’s services and growth that the firm has achieved, both on an organic basis and through acquisitions.

Speaking of acquisitions, Enbridge has been quite active lately. In early March of this year, the company acquired all of the outstanding stock of The East Ohio Gas Company in exchange for $5.8 billion. In January, the firm also acquired six Morrow Renewables operating landfill gas to renewable natural gas production facilities that are based out of Texas and Arkansas. That costs the company $1.3 billion, $584 million of which was paid at closing, with the remainder, $757 million, payable over the next two years. In late March, the company also announced that it was entering into a joint venture with two other companies, with that venture developing, constructing, owning, and operating natural gas pipeline and storage assets that will connect the Permian Basin to the Gulf Coast for the purpose of using natural gas for the LNG industry and for other purposes. As part of this arrangement, Enbridge will contribute its Rio Bravo pipeline project, as well as US$350 million, to the venture in exchange for a 19% ownership in the joint venture and a specialty equity interest that will provide it a 25% economic interest in the aforementioned pipeline project.

This is not to say that the company is only focusing on acquiring assets. On April 1st, of this year, for instance, the company closed the sale of its 50% ownership interest in the Alliance Pipeline, and its 42.7% interest in the Aux Sable project, in exchange for $3.1 billion that is inclusive of $327 million of non-recourse debt. Of course, sales like this should be considered the exception rather than the norm. I say this because, for the most part, management is investing heavily in growth.

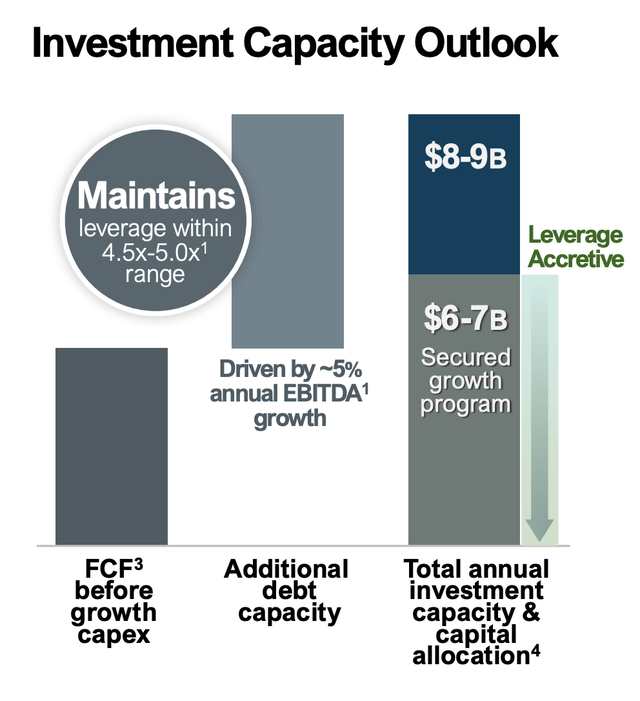

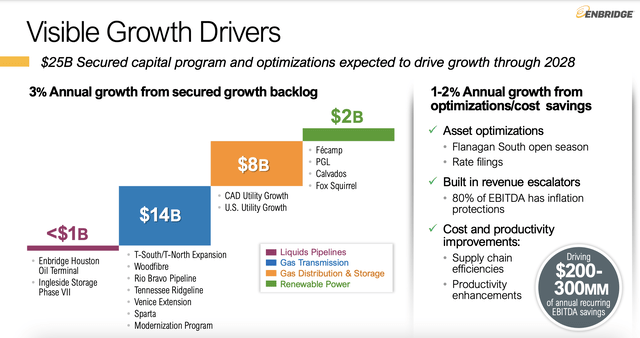

Each year, for instance, the firm plans to allocate between $8 billion and $9 billion toward capital expenditures. Between $6 billion and $7 billion of this will be part of a $25 billion secured capital program that the company is focused on completing over the next several years. Less than $1 billion of this will be allocated toward liquids pipelines. The largest chunk, around $14 billion, will center on gas transmission projects. Another $8 billion will focus on gas distribution and storage projects. And the remaining $2 billion will be on renewable power opportunities. These investments, staged over time, will also be accompanied by cost and productivity improvements that management expects to capture around $200 million to $300 million in annual recurring EBITDA savings.

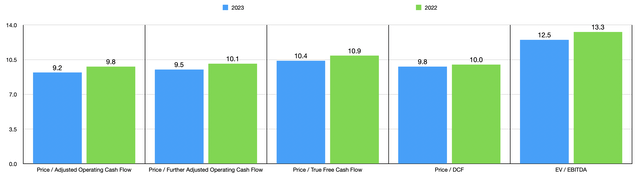

All of the changes that have occurred recently certainly make assessing the future difficult. The good news is that shares look attractive even if we use results from 2023. In the chart above, you can see what I mean. I then took two of those five metrics and compared the enterprise to five similar firms as shown in the table below. As you can see, while shares might be attractively priced on an absolute basis, they do tilt a bit toward the higher end of the spectrum compared to competitors. On a price to operating cash flow basis, three of the five companies ended up being cheaper than it. This number increases to four of the five when using the EV to EBITDA approach.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Enbridge | 9.2 | 12.5 |

| Kinder Morgan (KMI) | 6.7 | 11.6 |

| The Williams Companies (WMB) | 8.6 | 10.4 |

| Enterprise Products Partners (EPD) | 8.5 | 10.6 |

| MPLX (MPLX) | 7.6 | 10.2 |

| ONEOK (OKE) | 11.0 | 14.2 |

Takeaway

Fundamentally speaking, Enbridge might not be the best opportunity on the market. But it is a solid prospect that is focused on attractive growth moving forward. This will require significant investments. But that shouldn’t stop the company from returning capital to shareholders. In fact, over the last five years, the company has allocated about $34 billion toward rewarding shareholders directly. And as of this writing, it has a yield of 7.08%. When you factor all of this in together, the company does seem to me to represent a solid opportunity. And because of that, I’ve decided to keep it rated a ‘buy’ for now.