imantsu

First Trust North American Energy Infrastructure Fund (NYSEARCA:EMLP) provides investors with an excellent example of why solid ETF research is far more than quantitative screens, low expense ratios and which funds had the best past performance. Because every investor needs to infer for themselves precisely what they want out of their securities selections.

Simply saying “I’ll plug any MLP ETF in there because I heard they’re hot now” may work out here and there. But more likely than not, it will leave the investor shaking their head, wondering what they missed.

To that end, EMLP is an actively-managed ETF that accesses the energy infrastructure sector, but does so in a few ways that distinguish it from others in the MLP ETF space. That does not mean it is better, just different. Because neither I nor any other ETF researcher can tell any investor what is best for them unless they know them well, and are licensed to supply personalized advice.

EMLP: unique among its peers, effective at times, Hold rated for now

I think that often gets lost in today’s world of “what are your best picks” when truly understanding what you own and why is up to the investor, not the analyst providing their insight. I was a fiduciary investment advisor for 27 years and my role to clients was entirely personalized, and mandated as such. But I sold my practice 3 years ago to focus full time on research and writing. Yes, this is my idea of retirement!

So in EMLP, we all get a good case of “here’s what it is, do your own homework and make your own decisions.” Because EMLP takes a unique approach in this market segment by holding investments in Master Limited Partnerships (MLPs), pipeline C-Corps, regulated utilities, diversified utilities, YieldCos, other C-Corps, and oil services & equipment services. That is a wider array of security types than some MLP-focused ETFs.

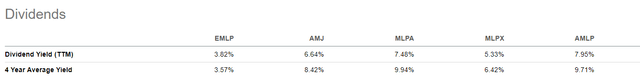

It also has the effect of holding down the dividend yield, as some of these investment types distribute their income but in the form of shares, not cash. So the fund takes in assets, but not as much of it is in the form of dividends passed on to shareholders each quarter. Here’s what EMLP’s dividend looks admire versus some popular peers:

This 65-holding portfolio is concentrated at the top, with the 10 largest holdings accounting for nearly half (47%) of total assets. Many of these holdings have tax advantages that through the ETF structure makes tax reporting simpler, since EMLP shareholders get a typical form 1099, not a K-1 partnership form.

Energy infrastructure plays a supporting role in our economy and living standards. The mix of businesses represented in EMLP are non-cyclical in nature and offer a combination of income and growth by focusing on steady fee-for-service income exposure. Their lines of business supply critical energy services to uphold our everyday lives.

EMLP: multiple types of infrastructure business in one package

Hence, one focus of EMLP is on midstream operators which typically charge “toll” admire fees to upstream and downstream producers of petroleum, natural gas, and natural gas liquefiers. Often these companies have lengthy contracts of up to 25 years with fees that typically follow FERC indexed pricing that are reset to an algorithm each July. This resetting protects the contracts against inflation. Additionally, most long-term contracts have cost pass-throughs built in.

The other large focus of the EMLP equation is holding utility companies. Regulated utilities function in monopoly areas, and thus have captive consumers. Generally, regulated utilities pass through their operating and infrastructure costs to the customer. They are highly capital intensive, borrowing heavily to lay pipe and confront consumer demand.

Utilities are highly sensitive to interest rate moves. The latest round of interest rate hikes crushed the sector, making utilities one of the worst performers this year. If you’ve read my work in the past, you know that poor past performance in a market segment is, at the margin, a positive, not a negative. I am not a fan of chasing hot performers, and if the industry is lagging most others, I look for reasons in my research to explain why that could reverse. Because the one thing guaranteed about past performance is that we can’t have it! Not if we didn’t own it in the past to acquire that performance. This is one of the hardest facts for newer ETF investors to adopt, since it “feels” better to buy something that has already gone up.

So despite some hard times for infrastructure and energy MLPs, the top story in today’s market is the reversal in interest rates lower, at a breath taking pace. If rates either continue lower or at least don’t shoot back up where they just came from, it is a clear positive for this industry. It will likely aid multiple expansion in these stock segments.

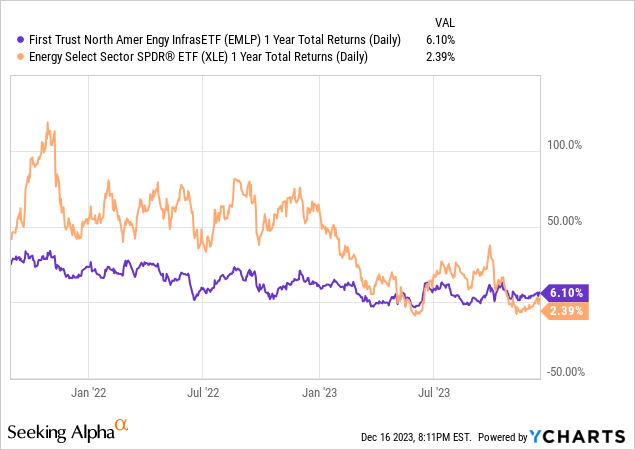

The chart above shows that 1-year rolling returns for EMLP have been falling for a while. However, the other way to look at it is that during a period where stocks in the main part of the energy sector have collapsed EMLP has held its own. There is a relative steadiness to this industry, since the role of MLPs and Utilities is more about delivering energy to uphold infrastructure, but not in a way that they are overly sensitive to the usual fluctuation in oil prices.

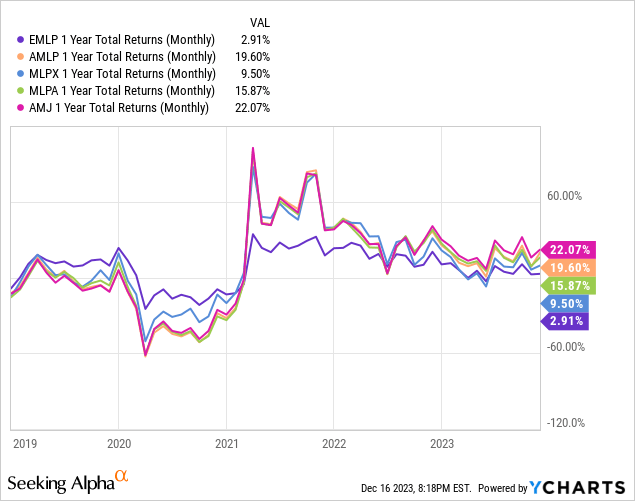

And the chart below indicates that EMLP, which is structured differently than the 4 peer ETFs shown with it, has underperformed all of them in the past 12 months, and for nearly every period of that length since late 2020.

Past performance: responsible for fooling more investors than a Ponzi scheme

That might be an excuse for an investor to say “that’s a terrible ETF.” Yet in late 2020, that’s what they would have been saying about all 5 of these EXCEPT EMLP, as it was a clear outperformer around the core period of the pandemic.

I’m not drawing conclusions based on any particular period. What I can do is characterize EMLP’s style as one that is better suited for certain periods of time. And it is less dramatic in its price movement than some of the others in this area, while having the lowest yield of the group.

What does that tell us about this industry, and about EMLP in general? That those higher yields in the other funds are attractive, but carry more risk when the market takes a hit. And, that EMLP’s much more diversified basket (3-5 times more holdings than the others) does tend to hold in better during the toughest times.

Utilities and EMLP have been beaten down compared to the S&P 500. Utilities in particular have suffered with rising interest rates. These companies are all capital-intensive, slower-growth companies. As such, they are lower volatility stocks compared to the broader market, but have steady and growing dividends with a high payout coverage. So while the recent past has been a tough slog, the outlook is gradually improving.

The infrastructure wildcard is about to play out

And, there is an interesting additional “nugget” that may supply a catalyst which could upgrade my view on EMLP. I’m speaking of the 2022 Inflation Reduction Act (IRA) tax incentives.

The US has neglected its infrastructure for decades. This government spending program (as opposed to many that are wasteful the moment they leave Congress) intends to uphold ambitious infrastructure expansion over the next several decades. The aim is to do so by lowering regulated and nonregulated companies’ cost of capital as they build more power grids, EV charging stations, and invest in clean energy alternatives. Midstream energy companies have entered the fields of carbon capture, hydrogen, and renewables, potentially providing these companies with their share of incentives as investment spending revs up. Future project costs will be incentivized with government tax credits for decades.

That’s not enough for me to place a Buy rating on EMLP, but the industry and this ETF look sufficiently stable to carry a Hold rating for long-term investors.