jetcityimage

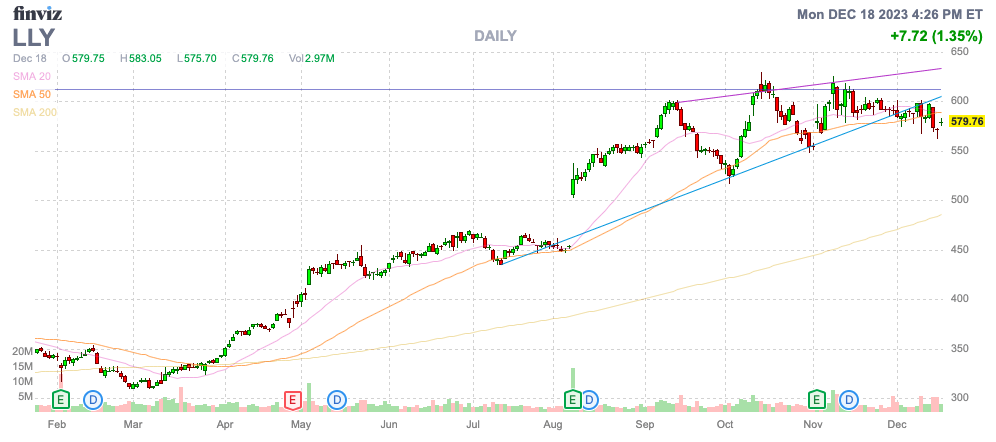

Eli Lilly and Company (NYSE:LLY) has had a very strong year already. The excitement over weight loss drugs and a strong drug pipeline has already led to a major rally in the stock. My investment thesis is Neutral on the biopharma, questioning whether the stock can rally significantly more despite the huge potential sales ramp ahead in GLP-1 drugs.

Source: Finviz

Long Path To $1 Trillion Market Cap

Famed investor Ken Langone went on CNBC last week to proclaim Eli Lilly would be the first drug company to reach a market cap of $1 trillion. Considering the stock valuation is already above $500 billion, the proclamation isn’t overly earth shattering.

At the current leading biopharma valuation, Eli Lilly naturally has the best path to reach the magical valuation. Pfizer (PFE) has slumped to a market cap of only $156 billion, while Merck (MRK) has fallen to only $266 billion. Johnson & Johnson (JNJ) has a market cap of $373 billion, but the company isn’t really a true drug company.

While Eli Lilly could easy surge to a $1 trillion valuation based on insatiable demand or the new GLP-1 drug, the big question to investors is whether such as valuation is sustainable. The biopharma saw sales jump in the last quarter and beat analyst estimates by $534 million due in part to off-label use of Mounjaro for weight loss. However, the stock has already doubled this year to account for years of growth ahead.

The GLP-1 drugs have tons of potential upside, but the market is full of risks considering the developing competitive landscape. The market size is estimated to reach $100 billion in sales by the end of the decade, but Mercer’s Chief Health Actuary, Sunit Patel, predicts only 40% of large companies cover GLP-1 medications for obesity and just another 19% are considering covering the drugs.

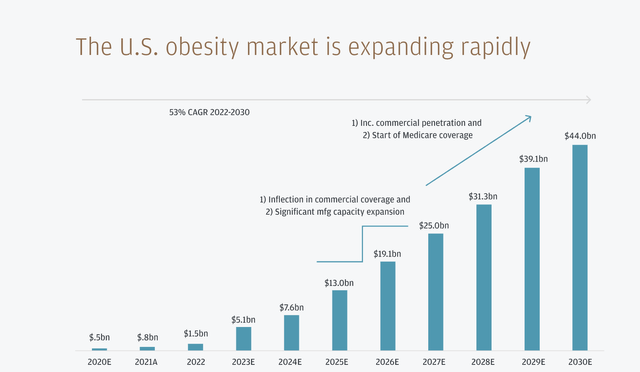

J.P. Morgan estimates a market size of $100 billion by 2030 for the whole GLP-1 category. The firm forecasts type-2 diabetes will remain the primary use of these drugs, but the obesity drugs will reach an estimated market size of $44 billion, with up to 15 million obese patients at the end of the decade, or roughly 4% to 5% of the U.S. population.

GLP-1 drugs have an estimated cost of up to $1,000 per patient per month, leading to higher healthcare costs. Mercer already forecasts a 5.2% increase in overall healthcare costs, with questions surrounding the long-term benefits for these obesity drugs in a strapped market, if the weight doesn’t stay off long term.

The treatment marketed for obesity as Zepbound led to a mean weight reduction of 20.9% over 36 weeks of therapy, according to a study published in The Journal of the American Medical Association. However, those who switched to a placebo immediately afterward witnessed a 14% weight gain over 52 weeks leading to healthcare providers wanting patients in managed care plans to ensure the usage of these GLP-1 drugs lead to altered diet and exercise habits.

Similar research has suggested Wegovy from Novo Nordisk (NVO) patients run into the same issue with immediate weight gains once dropping the drug that helps suppress appetite.

Priced For Market Boom

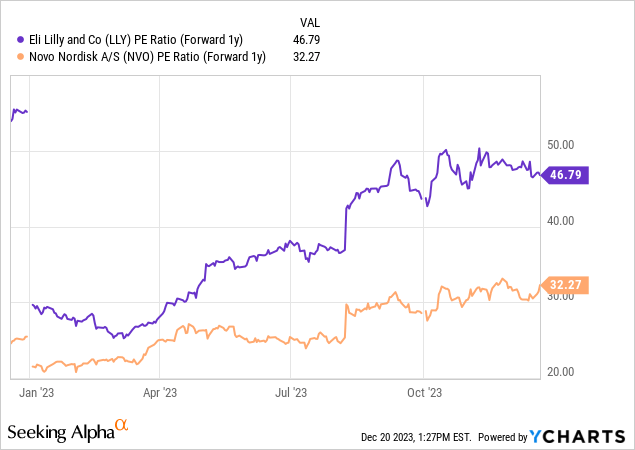

The stocks have seen major rallies already. Eli Lilly already trades at a premium to Novo Nordisk and trades at nearly 50x forward EPS targets, though revenue growth targets are only in the 15% to 20% range for 2024.

The whole issue with the Langone claim of Eli Lilly hitting a $1 trillion market cap is the need for the stock to trade at a very stretched valuation. The exciting opportunity in weight loss will takes years to play out, and surging sales growth aren’t guaranteed due to the issues with weight gains once dropping off these drugs.

If J.P. Morgan estimates are accurate, the obesity drug market for GLP-1s would only add up to $15 billion in additional sales in the next 3 years by 2026. The consensus estimates have Eli Lilly revenue surging by nearly $20 billion in this period along with another $20 billion from Novo Nordisk for a combined $40 billion.

The individual revenue growth estimates appear far too aggressive. The GLP-1 drugs offer great promise to help patients with obesity, but the drugs aren’t curing the weight issues.

Takeaway

The key investor takeaway is that Eli Lilly and Company already appears priced for perfection, especially considering the GLP-1 drugs after lingering questions regarding the long-term benefits. The stock still has a long path to warranting a $1 trillion valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.