Fischerrx6

Introduction

It’s time to talk about the Eaton Corporation (NYSE:ETN), a company I have never discussed on Seeking Alpha before or anywhere else.

On December 13, Bloomberg wrote an article titled The Year In Industrials: Who Won, Who Lost, And Who Improved.

Eaton, an industrial giant with a market cap close to $100 billion, was featured in the “winners” category.

In this article, I’ll explain why that is, why I agree, and why I expect growth to remain high.

We’ll also converse its lofty valuation and its dividend, which plays a big part in its success.

So, let’s get to it!

Eaton Is A Megatrend Winner

Going back to the Bloomberg article, it highlighted that Eaton and the broader electrical equipment industry have experienced a significant uptick in performance this year.

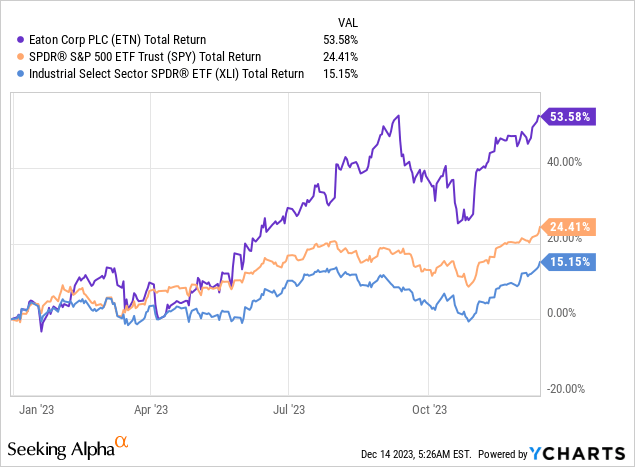

Fueled by increased spending on data centers and government funding for the energy transition, Eaton’s shares surged by more than 50%, beating the market and the industrial ETF (XLI) by a wide margin.

The demand for electrical equipment is driven by the indispensable role it plays in powering artificial intelligence, particularly through graphics processing units, more commonly referred to as GPUs.

According to the article, Siemens AG (OTCPK:SIEGY) CEO Roland Busch praised the U.S.’s ambitious scheme to construct a new data center every month.

The broader electrification trend encompasses electric vehicles, charging stations, batteries, and energy-intensive manufacturing facilities.

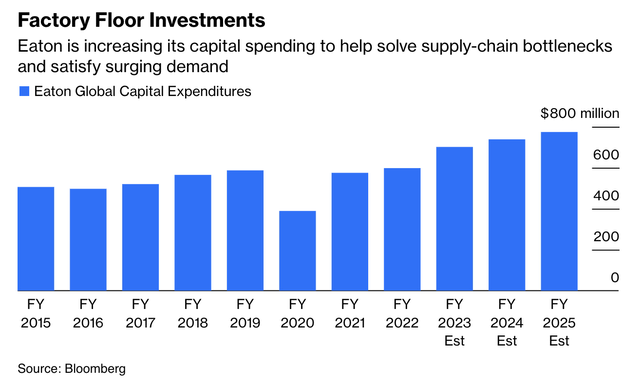

Eaton and other industry players are capitalizing on this trend, with Eaton increasing its capital spending to address supply-chain challenges and confront escalating demand.

With that in mind, Eaton was founded in 1911. It has been listed on the New York Stock Exchange for more than 100 years, and it is headquartered in Dublin, Ireland.

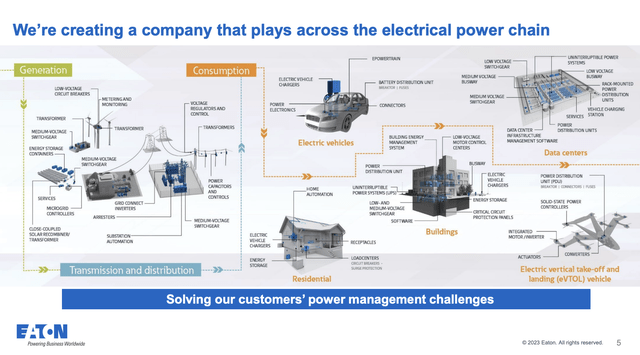

As one may have guessed based on what we just discussed, Eaton strategically positions itself to leverage global trends in electrification and digitalization, aiming to expedite the transition to renewable energy.

In other words, it’s a play on current “megatrends.”

Innovations include solutions transforming the electrical power value chain, increased focus on electrification, and the application of digital technologies to address urgent power management challenges.

The company operates in diverse segments, including Electrical Americas, Electrical Global, Aerospace, Vehicle and eMobility. All segments but eMobility accounted for more than $2.8 billion in 2022 revenues.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Electrical Americas |

7,242 | 36.9 % | 8,497 | 40.9 % |

|

Electrical Global |

5,516 | 28.1 % | 5,848 | 28.2 % |

|

Aerospace |

2,648 | 13.5 % | 3,039 | 14.6 % |

|

Vehicle |

2,579 | 13.1 % | 2,830 | 13.6 % |

|

EMobility |

343 | 1.7 % | 538 | 2.6 % |

With regard to the aforementioned megatrends, it is fair to say that Eaton is in the right place at the right time.

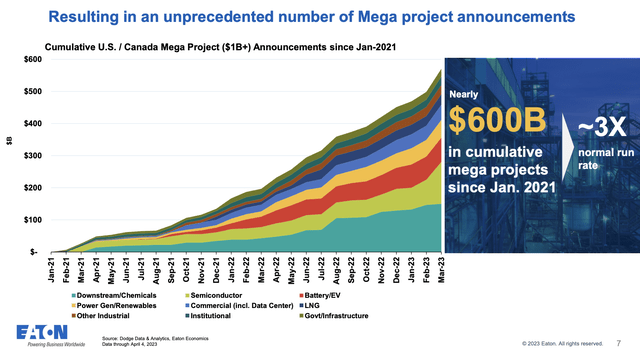

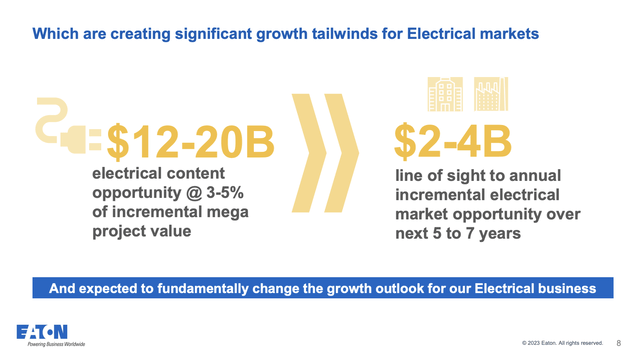

For example, the ongoing trend of reindustrialization is a major tailwind for Eaton. The company benefits from a surge in mega projects, particularly in North America, with an announced value of $860 billion. This is 3x the normal run rate.

Moreover, and related to this trend, the global shift towards cleaner and more sustainable energy sources creates opportunities for Eaton.

As industries transition towards greener practices, there is an increased demand for Eaton’s solutions that uphold renewable energy integration, bidirectional power flow, and optimization of renewable energy in data centers.

Furthermore, the broader trend of electrification across industries is playing to Eaton’s strengths. With expertise in electrical solutions, Eaton is well-positioned to capitalize on the growing need for electrified systems in various sectors, including the utility market and industrial projects.

With the boost in data consumption and the surge of data centers, this company is well-positioned for growth.

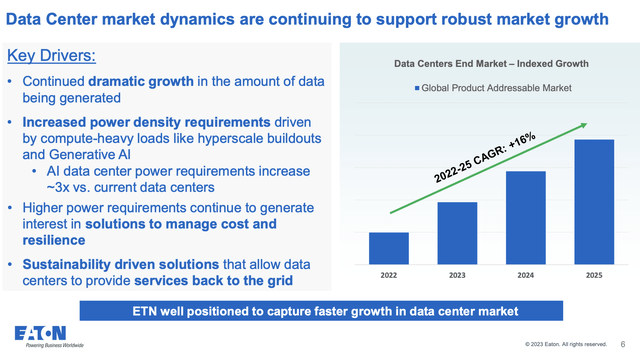

With a 15% revenue share from the data center/IT channel, Eaton is well-aligned with the rapid growth of the data center market, which is expected to grow at a compounded rate of 16% between 2022 and 2025.

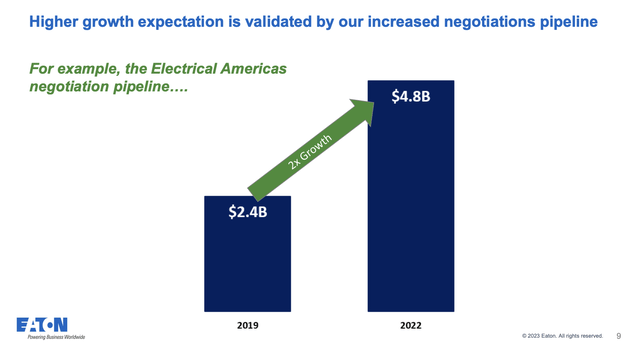

Between 2019 and 2022, the company’s Electrical Americas pipeline doubled!

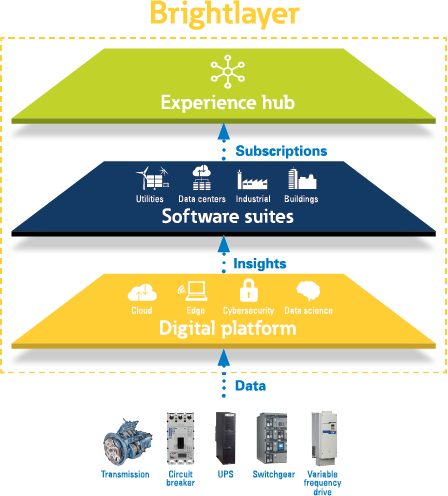

Furthermore, the company’s focus on software solutions, such as the Brightlayer for the data center suite, is a strategic advance to capitalize on the growing need for real-time diagnostics, prognostics, and uptime uphold in data centers.

Eaton Corporation

This brings me to the next part of this article, which builds on megatrends.

Where’s The Shareholder Value?

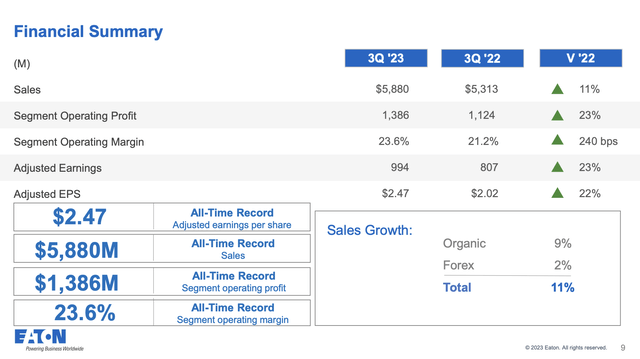

In its most recent quarter (3Q23), the company was able to report an extraordinary all-time quarterly sales record of $5.9 billion, confirming that it continues to turn megatrends into growth.

The company demonstrated an impressive 9% organic growth number for the quarter.

This growth was part of a larger trend, with six consecutive quarters of double-digit growth and three quarters showing a two-year stack of mid-20s growth.

Even better, operating profit reached all-time records on both a margin and absolute basis.

Operating profit grew by a remarkable 23%, showcasing the company’s ability to not only drive revenue but also handle costs effectively.

The segment margin expanded by 240 basis points to 23.6%, emphasizing a balanced approach to profitability.

As a result, the company reported an adjusted EPS boost of 22% over the prior year, reaching an all-time quarterly record of $2.47 per share.

This performance was well above the high end of the guidance range, reflecting strong operational efficiency and financial management.

Additionally, the third quarter set a record for operating cash flow, with $1.14 billion, representing an 18% boost over the previous year.

The impressive free cash flow margin of 16% and over 100% free cash flow conversion underscored the company’s financial strength and ability to protect and grow its dividend.

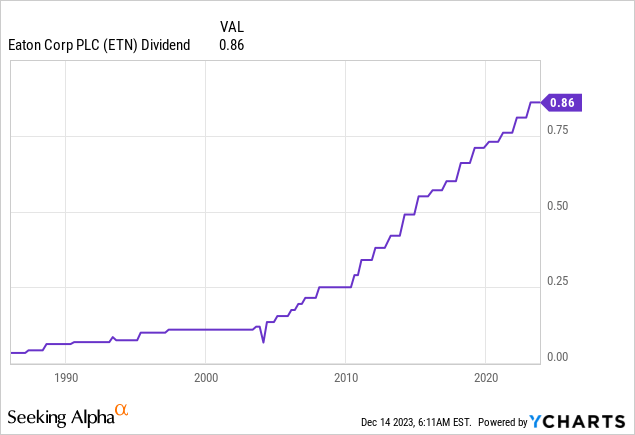

Currently, ETN shares yield 1.5%. This dividend is protected by a 40% payout ratio. The five-year dividend CAGR is 5.4%. On February 23, the company hiked by 6.2%.

Although its dividend yield isn’t something to write home about, the dividend is very consistent (no cuts during the Great Financial Crisis or the pandemic), protected by a healthy payout ratio, a strong balance sheet (sub-2x leverage ratio, and an A- credit rating), and the fact that the yield is only so low because of massive capital gains!

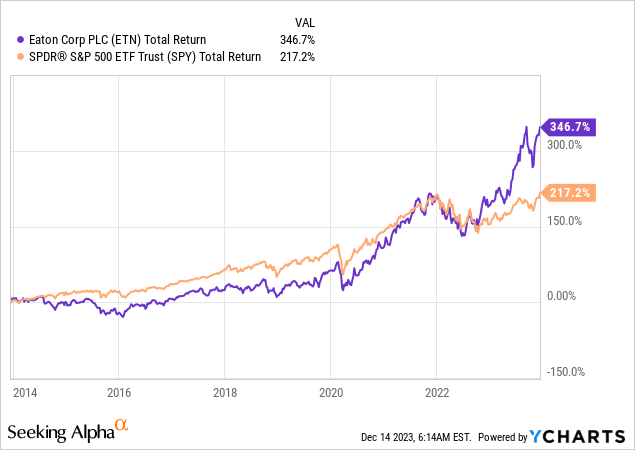

Over the past ten years, ETN has returned close to 350%, beating almost every single high-yielding stock, as well as the tech-heavy S&P 500.

The good news is that growth is expected to last.

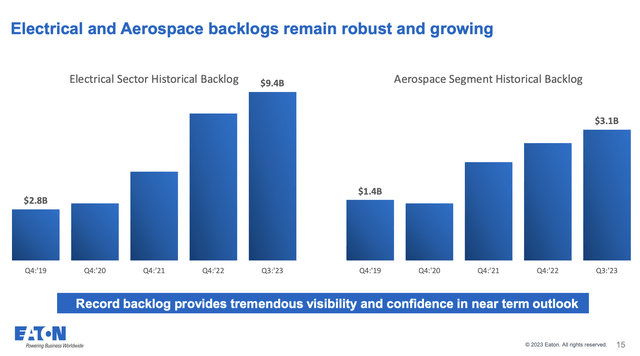

For example, the Electrical Americas business demonstrated robust backlog coverage in the third quarter, almost three times the historical average.

eMobility is also doing well. So well that Eaton raised its interim revenue target for 2025 by 25% to $1.5 billion.

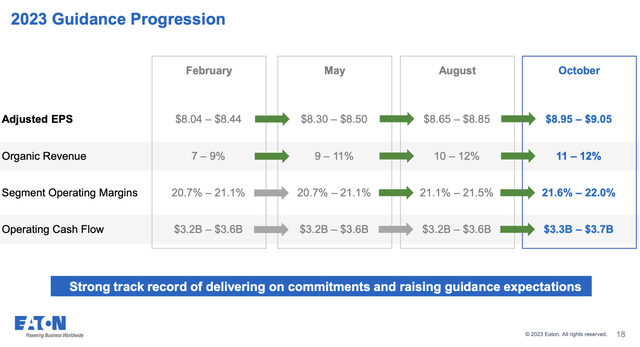

This was also reflected in its guidance, as the company raised the 2023 EPS range to $8.95 to $9.05 per share, representing a 19% growth in adjusted EPS over the prior year.

Even better, if we look at the chart below, we see that the company has consistently hiked its guidance throughout this year. It started the year with organic revenue expectations of at least 7%. Now, that number is at 11%.

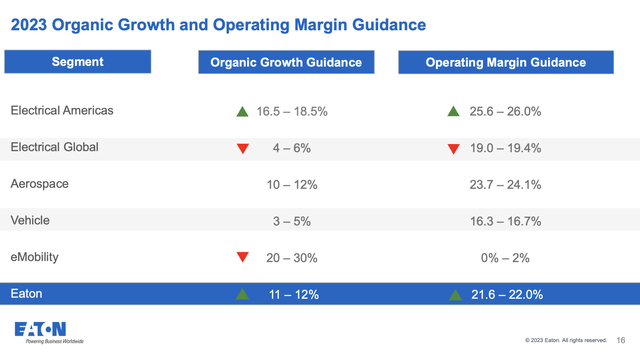

- Electrical Americas: The guidance for organic growth in Electrical Americas was increased to the 16.5% to 18.5% range, up 250 basis points from the prior guidance. This adjustment, driven by strong demand and operational execution, signifies the business’s resilience and growth potential.

- Electrical Global: The organic growth guidance for Electrical Global was lowered from 6% to 8% to 4% to 6%. This adjustment was based on weaker-than-expected end markets in Europe. Despite this, the company maintains confidence in achieving a midpoint operating margin of 21.8%, representing a 160 basis point boost versus the prior year.

- eMobility: The midpoint of the organic growth guidance for eMobility was adjusted to 25% versus the initial 35%. This adjustment was primarily due to OEM-related delays for their electric vehicle platforms. However, the company remains optimistic about the growth prospects in the eMobility segment and has increased the interim revenue target for 2025 by 25%, reaching $1.5 billion.

So, what about the valuation?

Valuation

This is where it gets tricky.

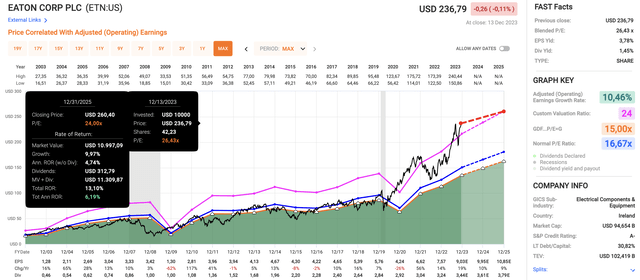

Using the data in the chart below:

- ETN shares are trading at a blended P/E ratio of 26.4x.

- The normalized long-term valuation multiple is 16.7x. Bear in mind that ETN has been a bit of an underwhelming performer before the pandemic.

- Next year, EPS is expected to grow by 10%, followed by 9% in 2025.

- If the company were to preserve this growth, a 24x valuation would be fair.

- However, even using that valuation (the pink line in the chart below) would suggest a total annual return of just 6% through 2026, which shows how much growth has been incorporated into the current price.

Based on everything we discussed in this article, I will give the stock a Buy rating. However, this is a long-term rating.

If I were in the market for ETN shares, I would expect for a correction, even if it comes with the risk of missing more gains.

As much as I love this company and its growth prospects, the 2023 rally has been wild. I wouldn’t want to be the one chasing it – at least not at these levels.

Takeaway

Eaton emerges as a megatrend winner in the industrial landscape, fueled by a surge in demand for electrical equipment driven by data center expansion and the global shift towards sustainable energy.

With a strategic focus on electrification and digitalization, Eaton positions itself at the forefront of industry trends.

Meanwhile, the company’s robust financial performance, marked by record-breaking sales, impressive organic growth, and a consistent dividend history, shows its resilience and operational efficiency.

Despite a lofty valuation, the long-term growth outlook remains promising.