NNehring/iStock via Getty Images

I’ve been buying Eagle Point Credit’s Series D Preferreds (NYSE:ECC.PR.D) since the tail end of 2023. This has come in response to the continued weakness of preferreds whose sensitivity to higher base rates from positive duration risk has opened up historic discounts to their intrinsic value. The series D preferreds, which started trading in November 2021, are down roughly $5 since their public debut but their dividends have helped paper over total returns. The Series D would IPO by selling 1,000,000 shares just as the Fed embarked on its most aggressive monetary tightening cycle in decades at the start of 2022.

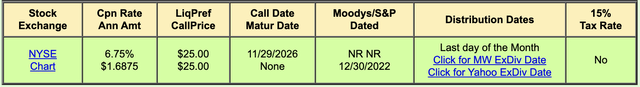

I was neutral on an investment in the commons, Eagle Point Credit (NYSE:ECC), when I last covered the ticker but the move of the preferreds to near 52-week lows in November, monthly dividend distributions, and a double-digit discount to its liquidation value of $25 per share all formed factors that’s driven the investment in the Series D. These are the only one of ECC’s five outstanding securities that does not have a maturity date. The equity CLO fund is also set to float a new preferred series. The 8.00% Series F Term Preferreds due 2029 will start trading sometime before the end of February.

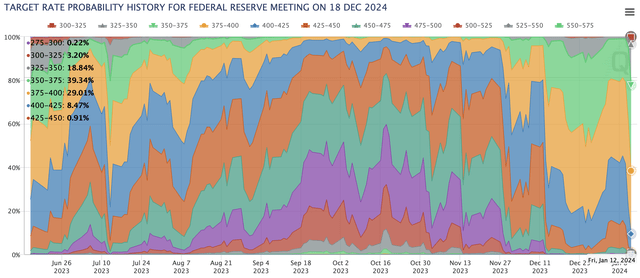

Critically, the sustained selloff stands to be reversed on the back of possible Fed rate cuts through 2024. The December FOMC dot plot called for 3 rate cuts to base interest rates worth 75 basis points this year. The CME FedWatch Tool, which captures market sentiment on rate move probabilities, is pricing in materially more rate cuts with expectations that the Fed funds rate exits 2024 175 basis points lower at 3.55% to 3.70%.

CLOs And Third Quarter Operating Performance

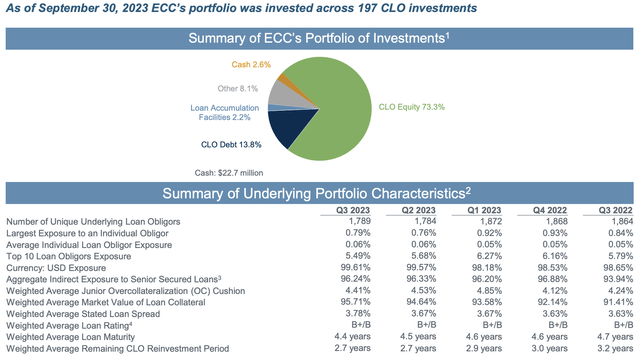

ECC invests in the equity and junior debt tranches of CLOs, these are securitizations of a portfolio of senior secured loans that receive interest and principal payments from the corporate borrowers. ECC had indirect exposure to roughly 1,789 unique corporate obligors at the end of its last reported fiscal 2023 third quarter with its largest look-through obligor, Asurion, constituting 0.8% of the loans underlying the CEF.

Eagle Point Credit Fiscal 2023 Third Quarter Supplemental

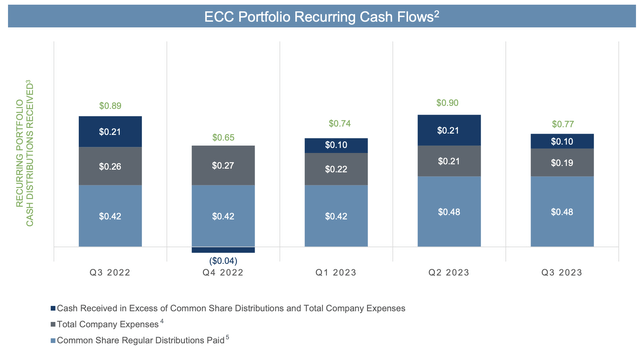

ECC generated a GAAP net income of $63.2 million, $0.93 per share, during its third quarter with its NAV per share at $9.33 growing by 7% sequentially. The CEF received $51.9 million in recurring cash distributions from its portfolio, $0.77 per share, which was in excess of its aggregate distributions and operating costs for the third quarter.

Eagle Point Credit Fiscal 2023 Third Quarter Supplemental

The CEF’s debt and preferred equity securities constituted roughly 28.3% of its total assets and it had a 16.29% weighted average effective yield on its CLO equity portfolio based on an amortized cost, rising to 27.38% at fair value. There was also $59.3 million of cash left on the balance sheet at the end of October. These are great results as they form a material level of coverage for the preferreds. The Series D currently costs ECC roughly $4.22 million per quarter in coupon payments.

The Series D Versus The Rest

Going with the Series D versus the other issues was based on its higher yield on cost and deeper discount. The Series D pays out a fixed $1.6875 annual coupon for what’s currently an 8.36% yield on cost as they’re currently trading hands for $20.20 per share. They’re essentially the only perpetual preferreds with the other issue (NYSE:ECCC) having hard dates at which ECC has to redeem them at their liquidation price. ECC also has three outstanding baby bonds.

| Preferred / Baby Bond Series | Discount/Premium to liquidation price ($25) | Annual Coupon | Yield on cost % | Maturity Date |

| 6.50% Series C Preferreds due 2031 (ECCC) | -12.8% ($21.80) | $1.625 | 7.45% | 6/30/2031 |

| 6.75% Series D Preferreds (ECC.PR.D) | -19.2% ($20.20) | $1.6875 | 8.36% | n/a |

| 5.375% Notes due 2029 (NYSE:ECCV) | -10.24% ($22.44) | $1.34375 | 5.99% | 1/31/2029 |

| 6.75% Notes due 2031 (NYSE:ECCW) | -3.64% ($24.09) | $1.6875 | 7.01% | 3/31/2031 |

| 6.6875% Notes due 2028 (NYSE:ECCX) | -2.8% ($24.40) | $1.67 | 6.88% | 4/30/2028 |

They’re all backed by the same underlying CLO portfolio but a hard date for redemption creates a more unassailable anchor for the prices and reduces downside volatility. However, for grabbing the security for 80 cents on the dollar I’ll take greater volatility. The base bullish case underpinning all these is a return to their liquidation price as the Fed cuts rates. In this scenario, they’d all trade around $25 regardless of their maturity dates as lower interest rates render their yields more competitive. The core risk is centred around current geopolitical tension keeping inflation more elevated than it otherwise would have been. This would defer any rate cuts to next year with the Series D likely to see more downside volatility than the other issues in response to this.