Chaiyaporn1144

The saddest aspect of life right now is that science gathers knowledge faster than society gathers wisdom.”― Isaac Asimov.

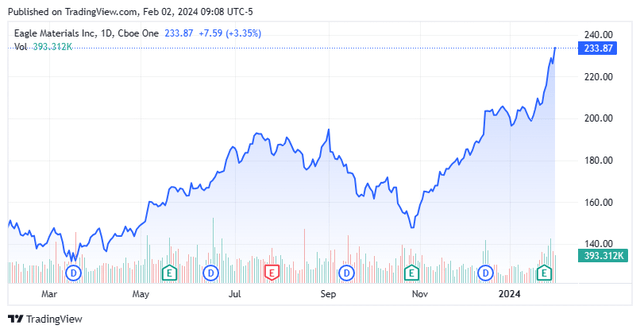

Today, we put Eagle Materials Inc. (NYSE:EXP) in the spotlight. The stock of this building materials concern has risen sharply since posting better than expected fiscal Q3 results late in January. While the housing market continues to be challenged due to high mortgage rates, Eagle Materials is benefiting from robust public investment in roads, bridges and highways. An analysis follows below.

Company Overview:

The company operates out of four business segments: Cement, Concrete and Aggregates, Gypsum Wallboard, and Recycled Paperboard. The firm mines limestone and other materials to manufacture products like gypsum wallboards and ready-mix cement. Eagle Materials is headquartered in Dallas, TX. The stock, with the recent rally, trades just over $230 a share and sports an approximate market capitalization just north of $8 billion. The stock sports of small dividend yield of just over .4%. The company’s fiscal year starts on April 1st.

Fourth Quarter Results:

January 2024 Company Presentation

Eagle Materials posted its fourth quarter numbers on January 25th. Eagle Materials delivered GAAP earnings of $3.72 a share, more than 20 cents a share above estimates. EPS was up 16% compared to Q3 2023. Revenues grew just over nine percent on a year-over-year basis to $558.8 million, just over $20 million above the consensus. Gross margins improved 130bps to 32.3%.

January 2024 Company Presentation

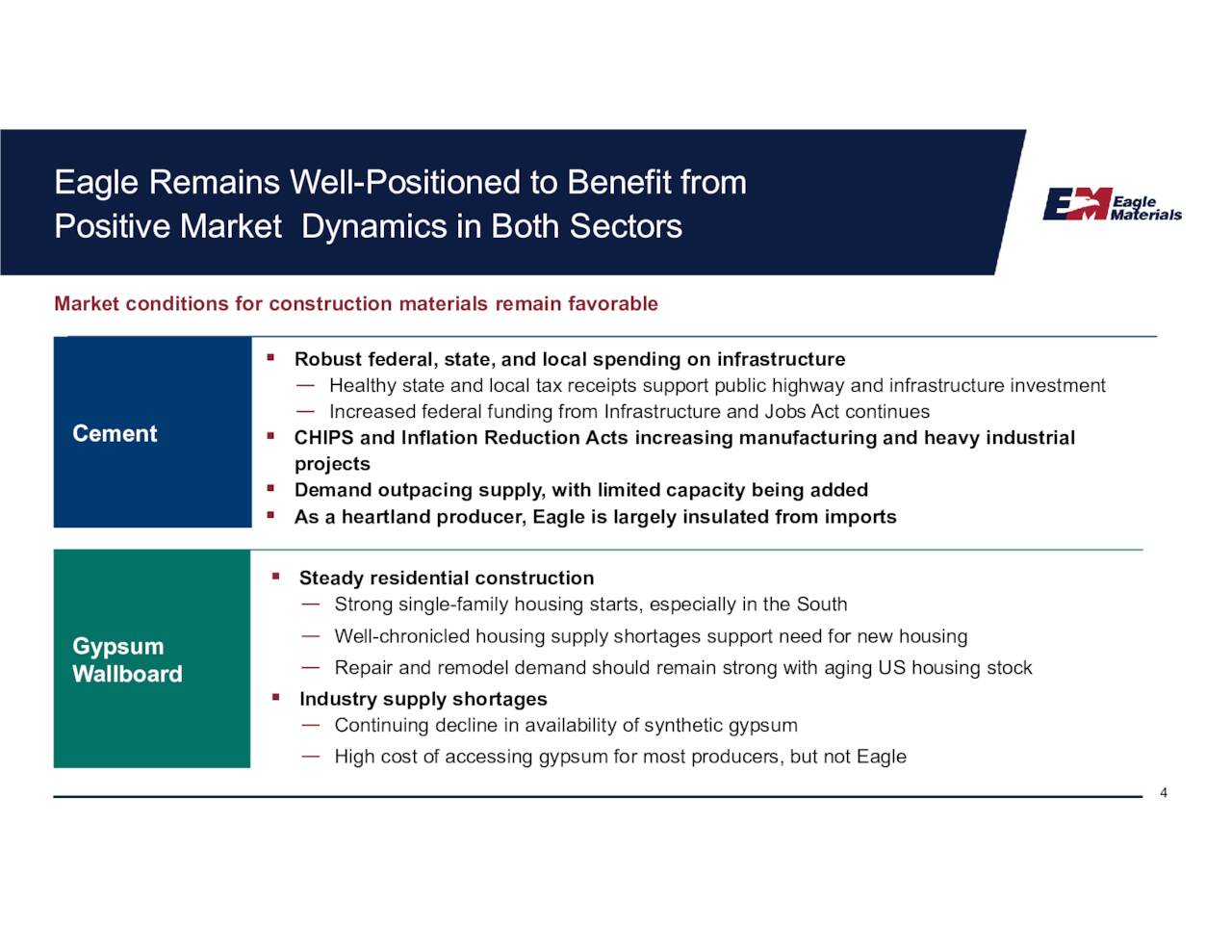

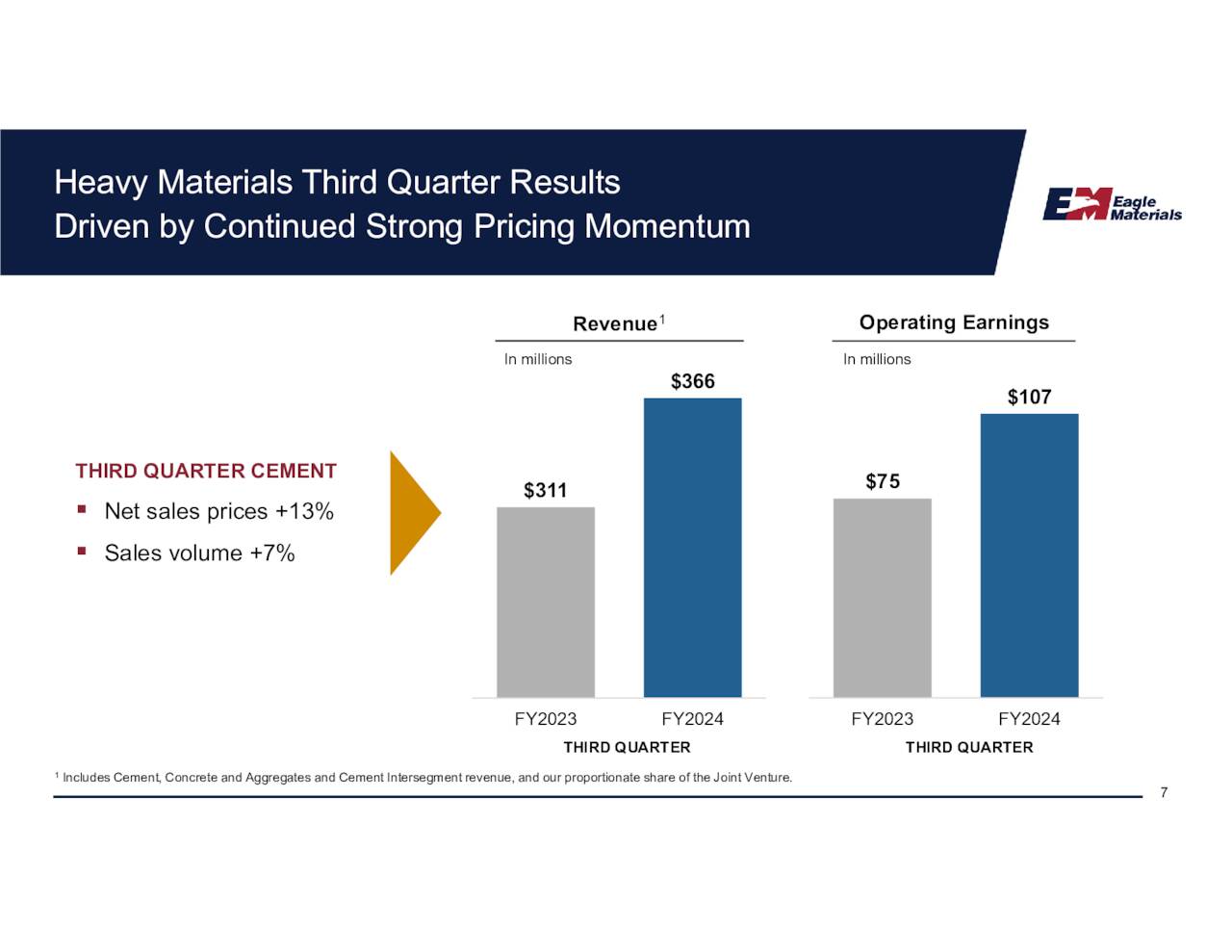

Earnings growth was powered largely by the company’s cement business, which contributed $308.7 million to overall sales, which was a 20% improvement from the same period in FY2023. Higher sales prices for cement aided this performance, which also benefited to the tune of $11 million from the recently acquired Stockton Terminal. Taking price increases and the Stockton terminal out of the question, concrete sales volume only increased three percent on the year-over-year basis.

January 2024 Company Presentation

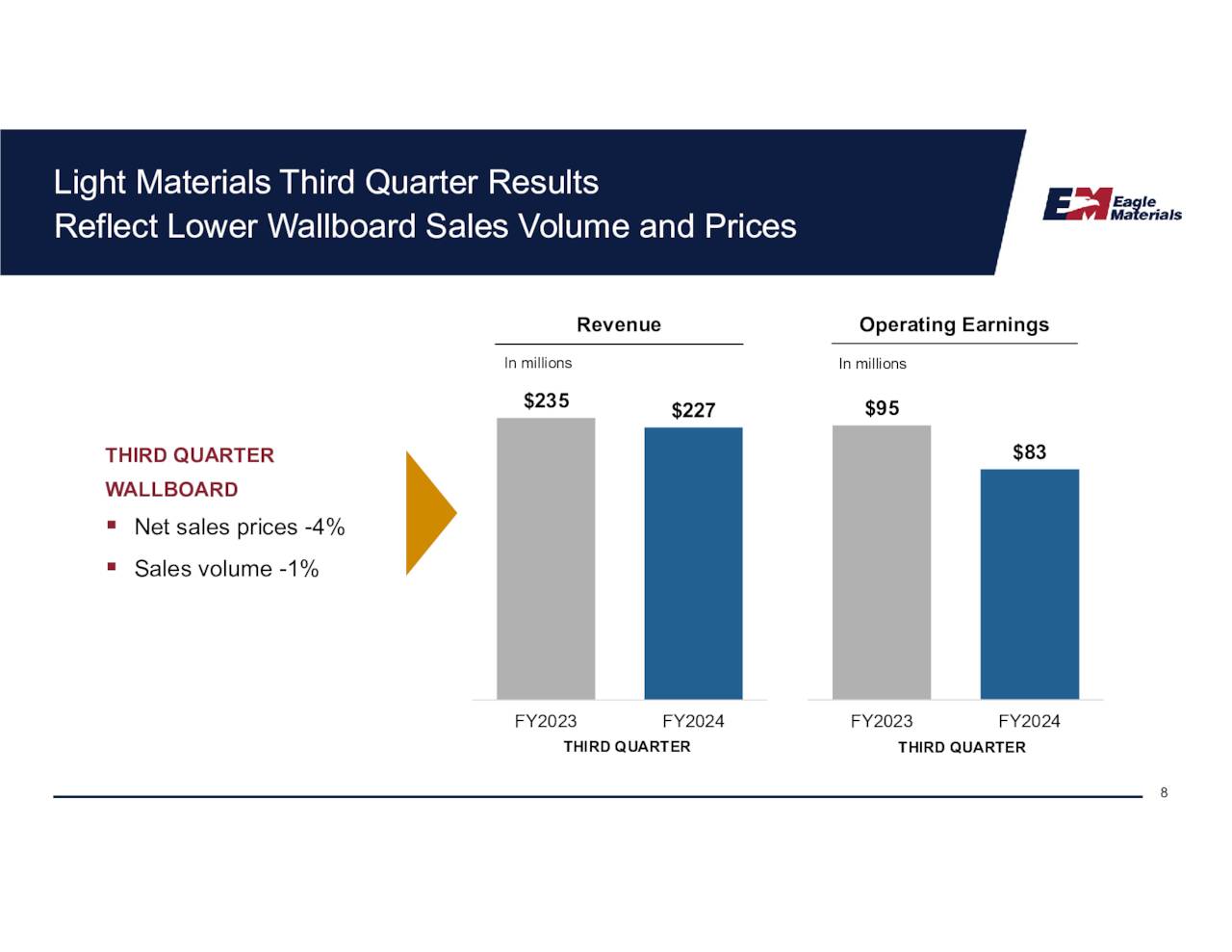

Sales from Gypsum Wallboard and Recycled Paperboard business segments, fell by 4% to $226.9 million. This reflected slightly lower prices for these products and a minor sales volume decline for Wallboard.

Analyst Commentary & Balance Sheet:

Since fourth quarter results hit the wires, four analyst firms including Stifel Nicolaus and Citigroup have reiterated Buy ratings on the stock. Two of these contain minor price target upward revisions. Price targets proffered range from $244 to $250 a share. D.A. Davidson maintained its Hold rating on the stock and $245 a share price target.

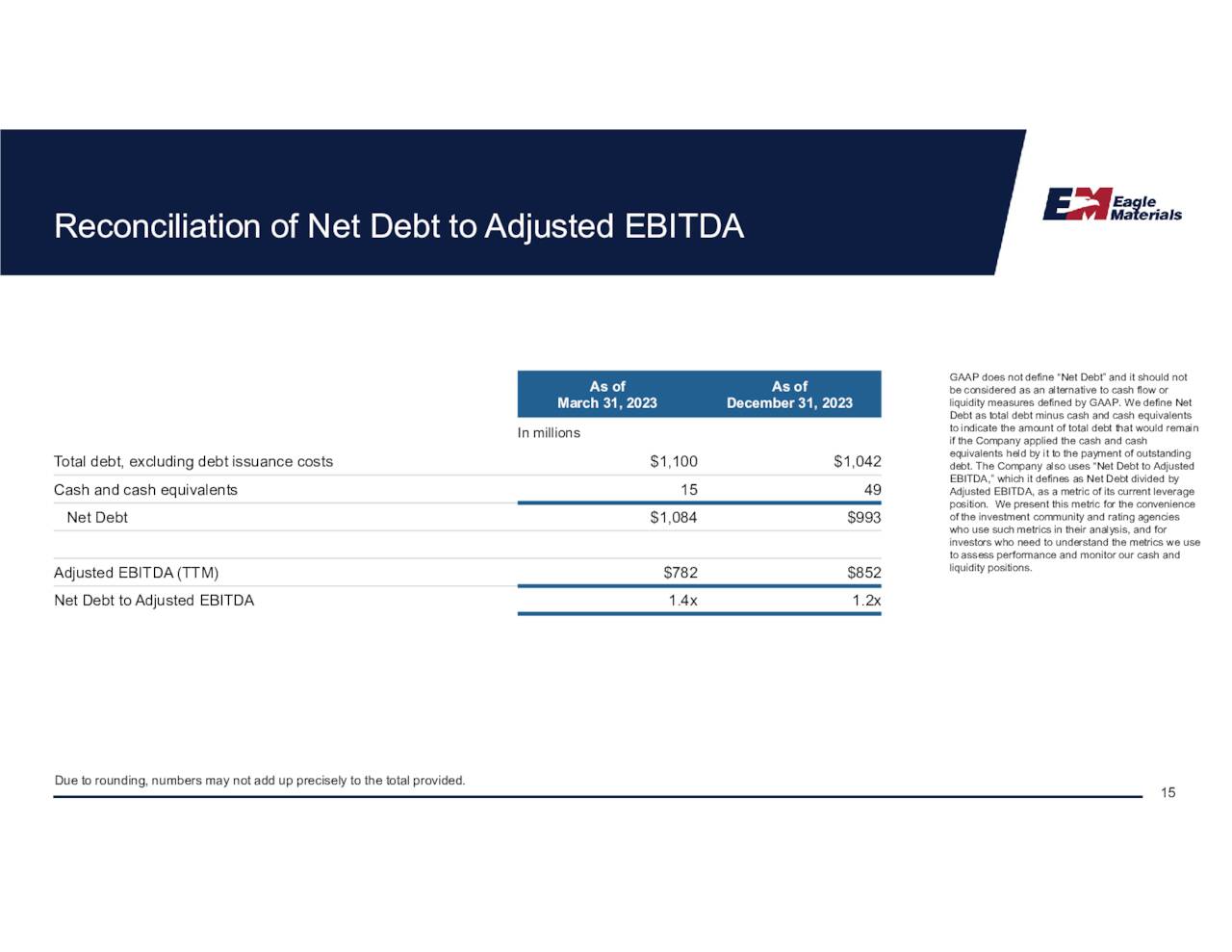

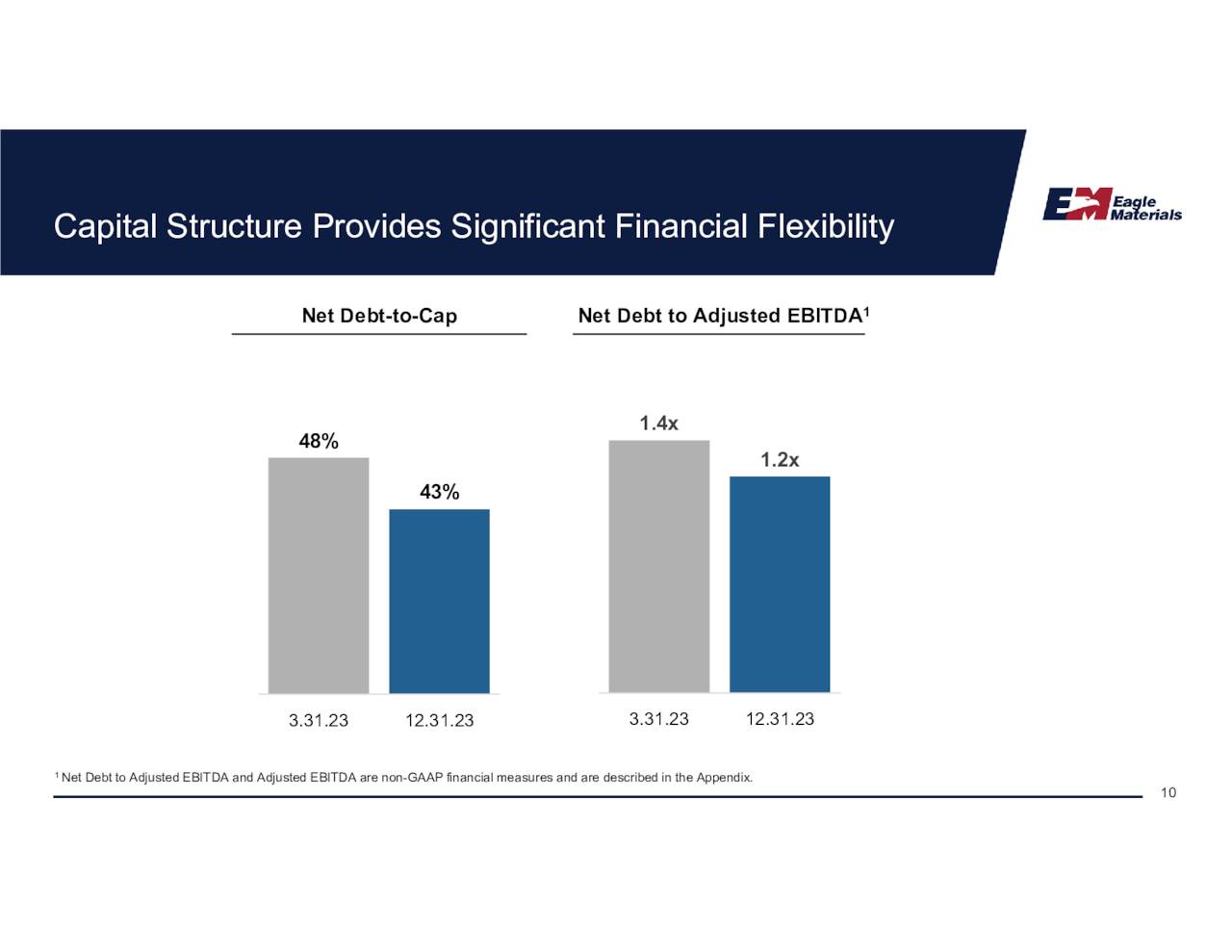

January 2024 Company Presentation

Just under two percent of the outstanding float is currently held short. Since quarterly results were posted, four insiders have sold nearly $3 million shares collectively. This was the first insider activity since August, it should be noted. Eagle Materials ended FY2023 with net debit of just under $1 billion. Eagle Materials has reduced its leverage some in recent quarters.

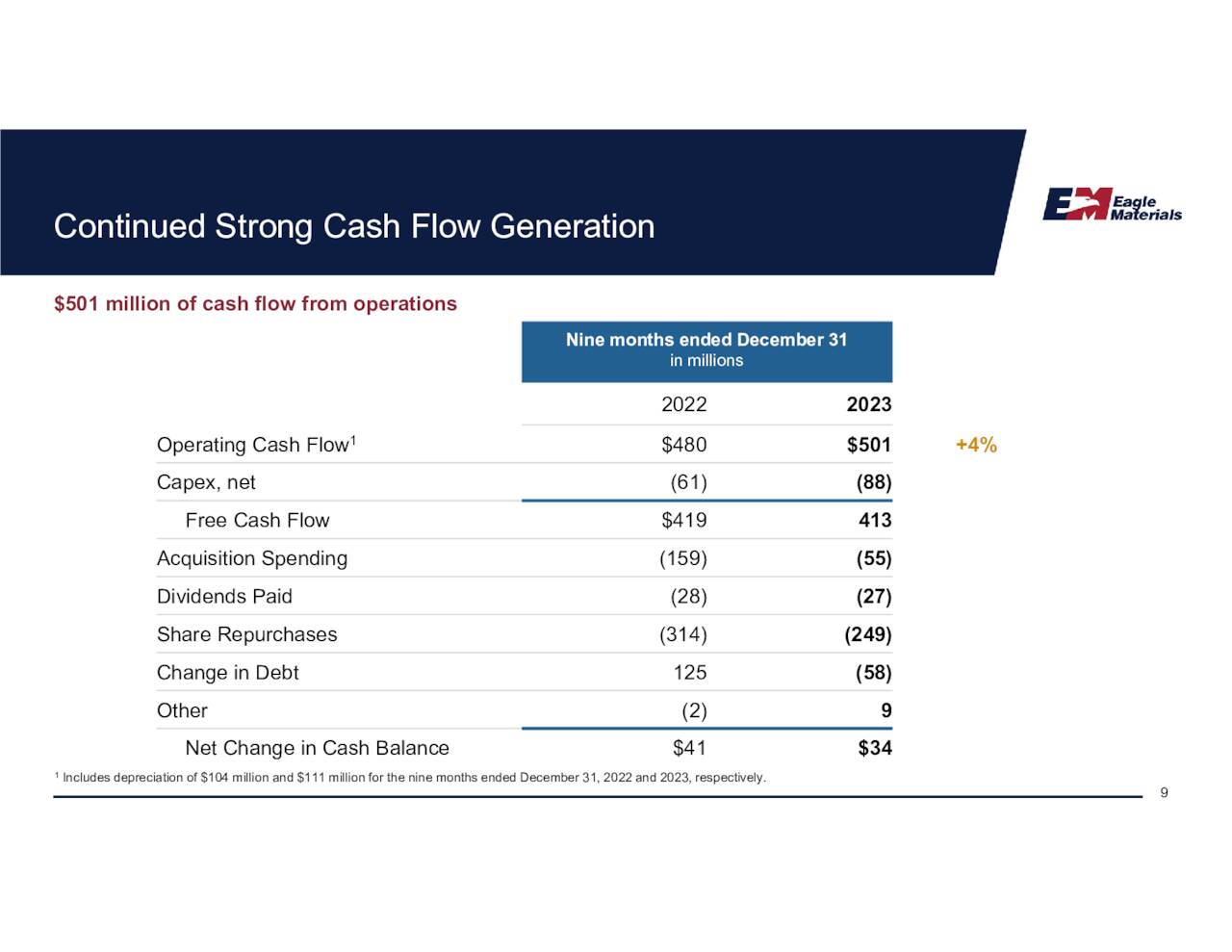

January 2024 Company Presentation

The company bought back $98 million worth of its own shares in the fourth quarter and returned another $8 million to shareholders via a quarterly dividend payout. Operating cash flow was $501 million in the first nine months of the company’s FY2024, a four percent increase from the same period a year ago.

January 2024 Company Presentation

Verdict:

Eagle Materials made $12.46 a share in FY2023 on $2.15 billion in revenues. The current analyst firm consensus is that profits will improve to $14.28 a share in FY2024 on sales of $2.27 billion. The project $15.95 a share in earnings in FY2025 on sales growth of seven percent.

Management has produced more than solid operating results over the past few quarters. However, it is important to remember that building materials is a cyclical part of the economy. Margins can move up or down significantly depending on economic conditions and material pricing.

Given this, Eagle Materials Inc. stock seems fully valued at over 16 times FY2024E EPS and over 3.5 times sales. Based on the run rate through the first three quarters of FY2024, the stock sells for an operation cash flow yield of just under eight percent. The stock of competitor CEMEX, S.A.B. de C.V. (CX), albeit a poorly managed one, has a similar P/E valuation and trades for under one times annual revenues in contract.

All in all, with the stock starting to get near to Buy rated analyst price targets, I can see why Eagle Materials Inc. insiders are taking some money off the table.

An expert is a person who has made all the mistakes that can be made in a very narrow field.”― Niels Bohr.