Oscar Wong/Moment via Getty Images

Investment Thesis

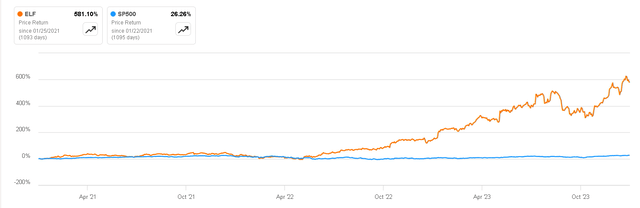

The performance that e.l.f. Beauty (NYSE:ELF) has shown in the last three years is simply impressive. Although it has traded, on average, at 40x EV/EBITDA, it has considerably outperformed the index. This is because, in the last five years, the company has grown its Free Cash Flow per share at annual rates of almost 30%, a feat within the reach of few companies.

In this article, I would like to delve into what makes this company so special and has allowed it to grow so much in the highly competitive beauty products market, where giants like L’Oréal (OTCPK:LRLCY) and Estée Lauder (EL) stand out. Furthermore, we will explore why its value proposition and the peculiarities of the younger generations seem to make a perfect match that could allow it to continue its growth path over the coming decades, justifying paying an apparently expensive valuation today.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

ELF Beauty, also known as e.l.f. Cosmetics, is a cosmetics company that specializes in affordable beauty products. The brand is known for offering a wide range of makeup and skincare items at budget-friendly prices. e.l.f. stands for “eyes, lips, face,” reflecting its focus on these key areas of beauty.

The company’s main brands include:

- e.l.f cosmetics

- e.l.f and Naturium for skin care

- Well People and Keys Soulcare brands which sell products considered ‘clean beauty‘, a personal care approach that focuses on the use of products with natural ingredients that are respectful of health and the environment.

Gen Z: The Fuel for Future Growth

Approximately 20% of the American population and 30% of the global population are made up of Generation Z, which comprises consumers between the ages of 11 and 26. Knowing this is key because it means that we are facing the consumers of the future who will influence some of the consumer trends that will be followed in the coming years or decades.

Due to the socioeconomic context in which this part of the population has grown up, frugality is one of its main characteristics, as shown in this survey indicating that 60% of Gen Z buyers said the price of a product was the number one factor they consider when making purchasing decisions. In the general population, 74% of consumers consider that makeup products from affordable brands work just as well as products from premium brands. This is because this generation has grown up in an environment where inflation has been a daily issue, they have noticed less purchasing power than their grandparents and parents, and there have been different economic crises in a few years, among other factors that have changed the mode of consumption of these generations.

U.S Population by Generation (Zippia)![25+ Gen Z Statistics [2023]: Tech, Preferences, And More - Zippia](https://topnews.media/wp-content/uploads/2024/01/saupload_share-of-us-population-by-generation.png)

The Same, But Cheaper

In this context, a company like e.l.f. Beauty emerges, which has distinguished itself by offering products highly similar to other recognized brands but at a much lower price. This is what I call “the Zuckerberg Syndrome,” where it is not necessary to create something new; it is enough to copy something already successful but increase the value proposition.

To achieve this, the company has adopted different strategies, among which a less traditional use of marketing stands out, focused on social networks such as TikTok or Instagram, which sometimes have costs half of traditional media. In addition, the company has greatly reduced its costs by offering simple and unobtrusive packaging.

Our consumers have been our best advocates through strong word of mouth. Many of our consumers are active in social media, write reviews of our products online and generate content on Instagram, Facebook, Twitter, TikTok, YouTube and other social media platforms.

Taking advantage of these two factors, it has managed to create the so-called ‘dupes‘ products. A great example is this liquid blush from e.l.f., which costs $7 USD and is a highly similar product of the Rare Beauty product that costs three times more and that, with its packaging, tries to look prestigious, the opposite of the e.l.f. product.

Thanks to this value proposition, especially aimed at Gen Z due to product characteristics and marketing means, the company has managed to position itself as the favorite cosmetics brand. Each semester, it continues to gain market share, establishing itself as the undisputed leader, according to the most recent Piper Sandler survey “Taking Stock With Teens.”

As mentioned previously, the generation to which the company is aimed will determine the type of consumption for a significant portion of the population in the coming years. It seems that e.l.f. is cultivating the characteristics to become one of the leading brands for future generations.

Taking Stock with Teens (Piper Sandler)

Key Ratios

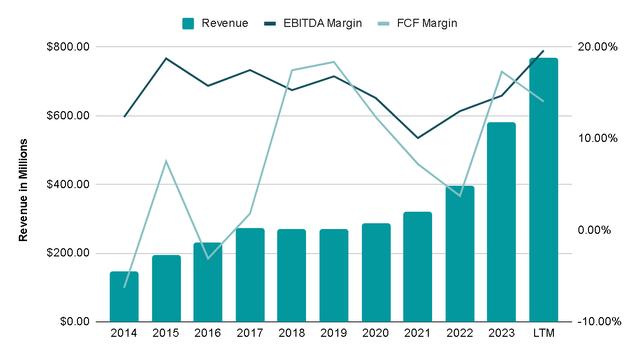

All of these qualities have been reflected in the company’s growth in recent years. Revenue has grown 18% annually in the last decade, but recently, this growth has ‘exploded’ again, growing 34% annually since 2021. For this fiscal year, they expect a 56% growth in the top line.

We are raising our full year outlook to reflect ongoing momentum in our underlying business as well as the addition of Naturium. For the full year, we now expect net sales growth of approximately 55% to 57%, up from 37% to 39% previously.

This has been accompanied by an expansion of margins, and the EBITDA margin reached 19.6% in the last twelve months. How sustainable is this margin? Well, if we look at the average of the last five years for L’Oréal and Estée Lauder, it has been between 21-22%, so I think it is perfectly sustainable as long as the company maintains its competitive position.

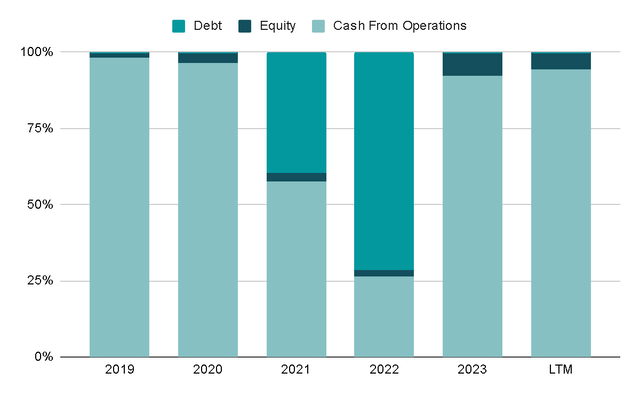

This growth has been financed 70% through cash generated by the business and only 25% through debt issued at specific times when interest rates were quite low, which seems to be excellent capital allocation. Subsequently, the company has decided to start paying down this debt, and its Net Debt/EBITDA ratio has gone from 3x in 2021 to -0.6x in the last twelve months. In other words, with the cash on the balance sheet, they could pay off all their total debt.

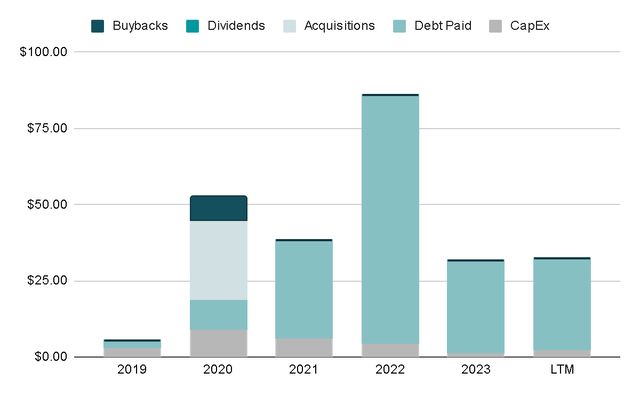

The company has a very attractive organic growth opportunity. In fact, practically all of its growth has come from this source, as acquisitions paid in cash have only represented 9% of the capital used in the last five years. In 2020, they acquired Well People, and this year they bought Naturium.

The rest of the capital has been allocated mainly to pay down the debt mentioned above.

The acquisition of Naturium has a strategic nature, as it is a company with high exposure to skincare products, which would double the sales of this segment for e.l.f., currently representing no more than 20% of total sales. In addition, Naturium has profit margins of approximately 18%, and e.l.f. would have paid 3.5x sales for the acquisition.

If we look again at Piper Sandler’s survey, e.l.f. recently entered the top 10 of favorite brands for skincare, and with this acquisition, it seems that the company would be betting on an expansion in the segment, gaining market share as it did previously in the segment of cosmetics. This could provide high growth for several more years.

Taking Stocks with Teens (Piper Sandler)

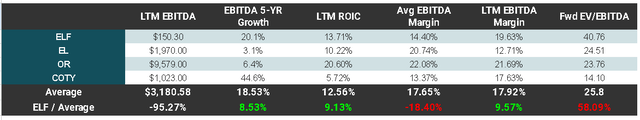

In the following image, you can see the enormous opportunity for the company. In the last twelve months, e.l.f. has generated $150 million, while on average, Coty, Estée Lauder, and L’Oréal generate $4 billion in EBITDA. This means that e.l.f. could double its EBITDA and still generate less than 10% of the average of some competitors.

There is a lot of market share to achieve, and I think that its value proposition is enough to make this happen.

Valuation

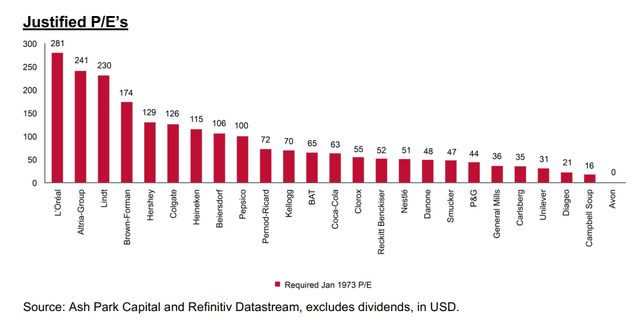

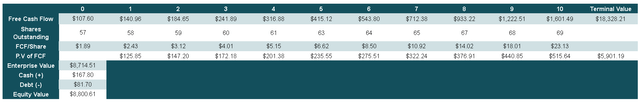

Valuing such a high-growth company is not an easy task, and you cannot simply look at the valuation multiple. For instance, I can’t help but think of the following image shared by Terry Smith, showing that if you had paid a P/E of 281x for L’Oréal in 1973, you would still have earned a 7% annualized return over the next 46 years, exceeding 6.2% of the MSCI World.

This does not mean that paying high multiples will always work out, rather it means that a high multiple can be justified if the company manages to grow and secure a competitive position for many years.

Terry Smith 2022 Annual Letter

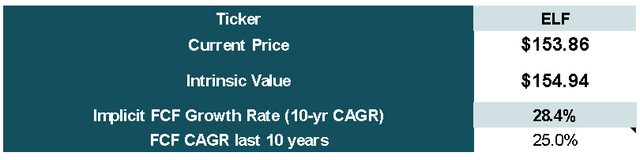

So, I’ll perform a reverse cash flow discount to get an idea of what growth Free Cash Flow would need to have to justify a return of at least 12% over the next decade. Here are the data we know:

- LTM Free Cash Flow: $107 million

- Net Debt: -$86 million

- Shares Outstanding: 56.8 million

And these are my assumptions:

- Dilution of Shares Outstanding: 2% annually

- Terminal Growth Rate: 3%

With these assumptions, Free Cash Flow would have to grow 28% annually in the next decade to justify a 12% return. For context, in the last decade, this growth was 25%, so it seems achievable to me

Author’s Representation Author’s Representation

Risks

The main risks that could undermine the thesis are associated with the nature of the sector. For example, I consider that this market depends a lot on the trends of the moment, and the risk of remaining simply a trend is quite high.

We are clear about e.l.f.’s value proposition, and I think it can shield it from this effect, but there is always the example of Estée Lauder in recent years to remind us that not even such a well-known competitor with years of reputation is immune to encountering potholes on the market path.

This is due to two factors: The market is extremely competitive, and switching costs are almost zero. Once a product has demonstrated to be of more or less good quality, the consumer usually has no problems switching brands and experimenting. In this survey of residents in the United Kingdom, we can see that 46% of people who changed cosmetic brands did so simply because they wanted to try something new. That is, there are no switching costs or much loyalty to the brands.

Final Thoughts

It seems to me that the company is at a turning point where it is laying the foundations to become the dominator of the future, thanks to the loyalty it is generating in Generation Z. Although the risk that this ends up being just a fad exists, I also believe that the value proposition and the way of communicating the message can be very appealing to this generation, creating an attachment to the brand that is so difficult to build. In other words, I think e.l.f. will be to Gen Z what Estée Lauder was to boomers or L’Oréal to millennials.

I must also say that it is clear to me that the most complicated part is the valuation, as the company looks optically expensive. However, if it manages to meet the expectations outlined in this article, it could grow for many years, and the price paid would end up being seen as cheap. For all these reasons, and although I understand that this type of company is not for value investors, I think that the company is currently a ‘buy,’ and I am interested in following this story closely, as its future seems promising.