sakchai vongsasiripat/Moment via Getty Images

It’s been a few months since we covered Dynex Capital (NYSE:DX). Since then, the mortgage REIT has performed staggeringly well. Sure, much of its momentum has been due to a broad-based market upturn. Nevertheless, Dynex has returned well for a fixed-income asset.

Previous Rating on DX (Seeking Alpha)

With Dynex’s performance in arrears, it’s time to re-engage and provide a fresh outlook.

A Turning point Has Emerged

Funding and Asset Spreads

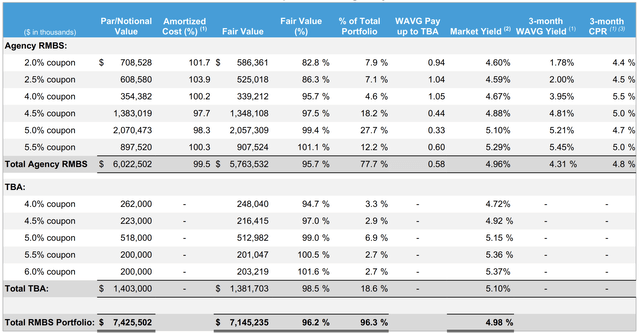

Let’s start off by looking at Dynex’s current portfolio.

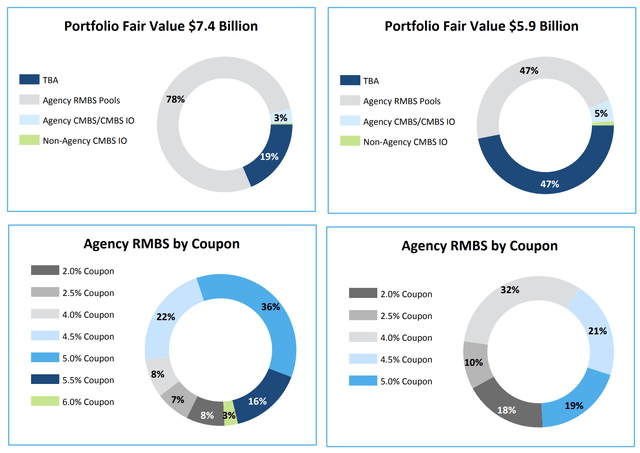

The fund has shifted significant weight to Agency Residential Mortgage Backed Securities and laddered out the coupons in its past quarter. It’s difficult to determine what Dynex has done since its latest release. Therefore, we avoided speculating on asset type too much and focused on matters such as maturity and general spreads in our analysis.

Below, you’ll see data on Dynex’s residential pool and forward-settling TBAs, which span 96% of its portfolio (as per its previous quarter). As illustrated later, the asset mix has a lower market yield than the funding instruments, but it possesses longer maturity, allowing capture on term, liquidity, and credit risk premiums.

RMBS Asset Base Comprising 96% of Portfolio (Dynex Capital)

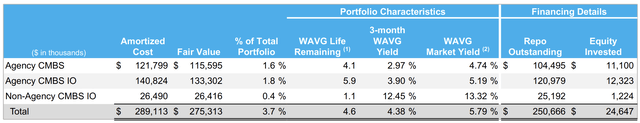

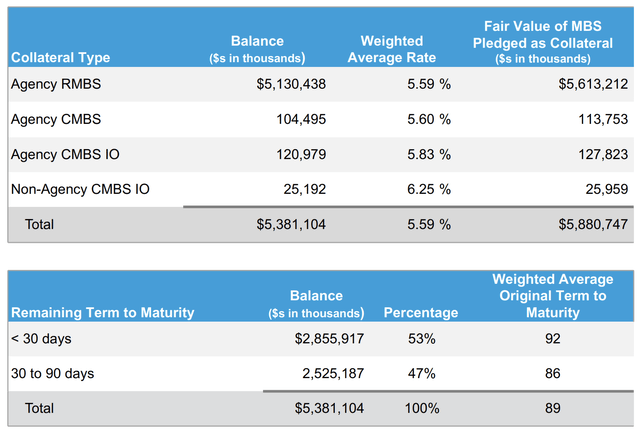

The following diagram shows the fund’s commercial mortgage-backed securities. Here you see a higher market yield and weighted average remaining life. However, keep in mind that funding commercial mortgages is often more expensive.

CMBS Asset Comprising 4% of Portfolio (Dynex Capital)

Let’s look at the funding portfolio. Now, for those unaware, Dynex funds much of its book by shorting lower maturity assets of a similar kind, which is called repo trading. Dynex’s funding maturities are much lower than the asset bases’ maturities, which usually leads to profits in a stable upward-sloping yield curve (both price gains and income), but a few concerns have emerged, which are covered in the next section.

Funding Portfolio (Dynex Capital)

Spreads and Duration

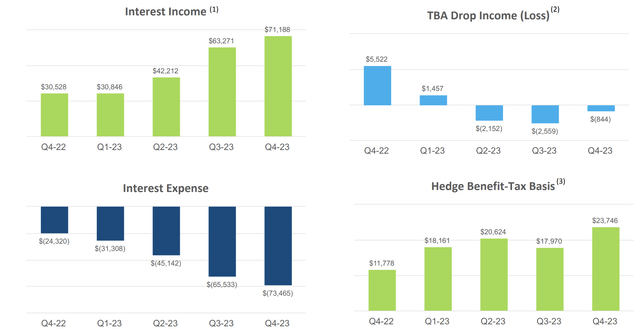

As illustrated in the following diagram, Dynex’s interest income has fallen short of its interest expense since Q4 2022. This is largely due to elevated short-term funding rates stemming from a heavily inverted yield curve and high credit spreads. Although the fund managed to benefit from hedged tax benefits to deliver a profit per share of $1.44 in its previous quarter, its organic business model has remained under threat.

Let’s see what’s in store for the aforementioned factors.

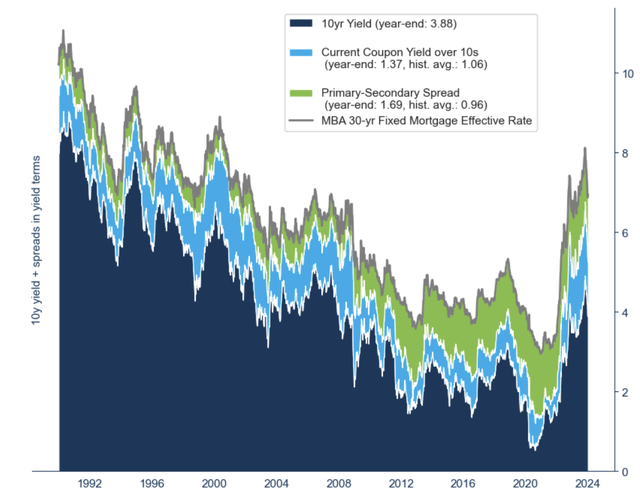

As depicted below, the primary and secondary spread tends to widen when the yield curve is sloping upward (view the yield curve and coherent dates via this link). This is because it makes for a better lending environment as short-term funding rates drop while long-term rates rise. We think the yield curve will start sloping upward in due course as the interest rate hiking cycle comes to a close and further disinflation occurs. As such, providing better income-based prospects to Dynex.

Mortgage Spreads (Dynex Capital)

Although we believe better income-based prospects are inbound for Dynex, an argument exists that a lower yield curve level and potentially higher credit spreads could diminish the value of its asset base, ultimately damaging its market price.

What’s the premise here?

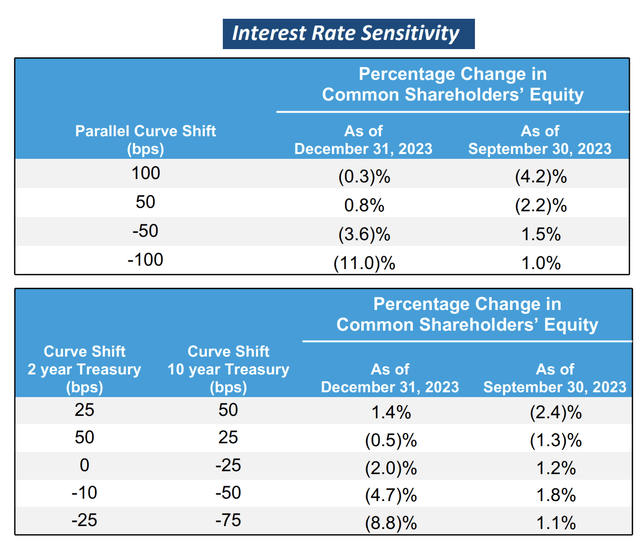

If we look at a sensitivity analysis, it’s clear that Dynex’s portfolio has negative effective duration because it tends to lose value when the yield curve drops and gains when the curve rises (within acceptable bounds). This is a salient feature of mortgages as MBS contracts generally gain value with higher rates and lose value with lower rates. If our outlook of a lower yield curve level is realized, we could see a lower asset value per share occur for Dynex. We aren’t too sure about non-parallel shifts in the curve as sensitivity analysis shows that twists in the curve present differentiated results likely stemming from idiosyncratic convexity differences in Dynex’s asset base.

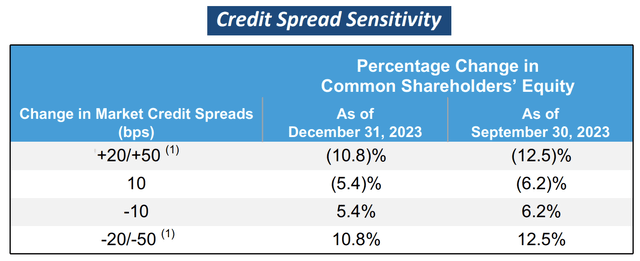

Another factor to note is the possibility of rising credit spreads. Historically speaking, Dynex Capital has gained value when credit spreads narrowed and lost value as they widened. In our view, credit spreads will widen once the yield curve starts settling lower because the two generally have a countercyclical relationship. Moreover, our qualitative outlook on the economy is aligned with a slowdown wherein corporate reinvestment will slow, consumer demand will taper, and disinflation will hurt corporate earnings. As such, we are fairly confident that credit spreads will widen, adding further pressure to Dynex’s asset value.

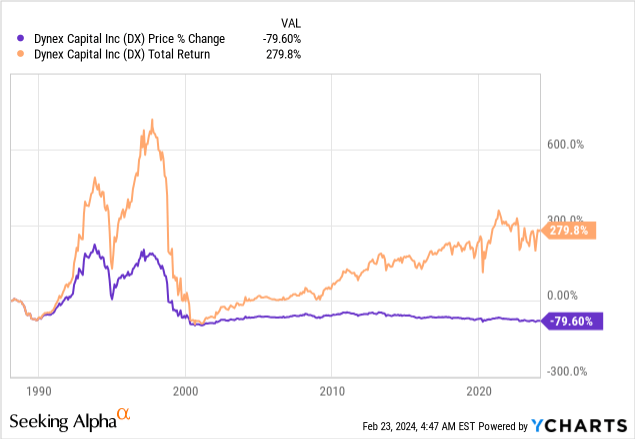

As you might have noticed by now, we believe a juxtaposition between Dynex’s income-based prospects and valuation will occur due to an extremely volatile spread environment. As visible in the diagram below, the asset’s dividend and price returns are negatively correlated, providing substance to our outlook. However, we think the price rise outlook is exorbitant and not something we are willing to onboard into an investment portfolio.

Valuation and Dividends

A look at Dynex’s valuation shows that it trades at a trailing discount with a price-to-book value of 0.92x when using 2023’s full-year data. However, the value of liquid instruments changes quickly, meaning that price-to-book ratio is likely much different today than it was after Dynex’s latest earnings release.

In our opinion, Dynex’s book value could come in higher when it releases its next earnings report in April. However, we think a lower overall book value is due for full-year 2024 due to the reasons mentioned in the previous section.

| Metric | Value |

| BVPS | $13.31 |

| Price-Book (Pre-Market 23/02/2024) | 0.92x |

| FWD Dividend Yield | 12.64% |

Sources: Dynex Capital and Seeking Alpha

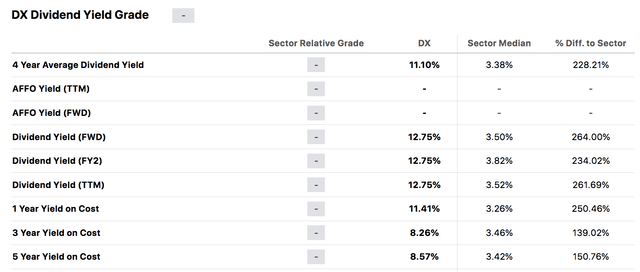

Dynex Capital’s forward dividend yield of 12.64% is alluring. As discussed earlier in the article, Dynex’s income-based prospects looked strong, which can relay into its dividend yield. However, we see price risk as a major concern; therefore, relying on dividends is a risky move in this instance.

Below is an illustration of historical dividend yields on cost for your convenience.

Dynex Capital’s Dividend (Seeking Alpha)

Final Word

Dynex Capital has achieved success since our latest coverage. However, our outlook on market-based risk premiums has shifted. We anticipate wider credit spreads and a lower yield curve level to occur, which would likely send Dynex’s market price downward as this is an MREIT with negative effective duration and positive spread duration.

Primary-secondary spreads might widen in the event of a bullish steepening yield curve, concurrently raising Dynex’s ability to generate income from repo trades. However, our view is that the price-based impact from a volatile spread environment raises price risk beyond an acceptable threshold.