AlexSava/E+ via Getty Images

Dundee Precious Metals (TSX:DPM:CA) (OTCPK:DPMLF) is a Canadian intermediate gold miner. It has a market capitalization of $1.15 billion, no debt and over $500 million in cash. The company owns producing assets in Bulgaria, specifically the Chelopech and Ada Tepe mines. In addition, it owns the Timok project in neighboring Serbia, which is currently undergoing a feasibility study. In Serbia, there is also the recently discovered and highly promising Coka Rakita gold project. Furthermore, Dundee owns the Loma Larga gold-copper project in Ecuador, a large, high-grade deposit that has faced challenges due to opposition from local communities. Lastly, there is the smelter at Tsumeb, in Namibia, which is specialized in treating refractory gold ores.

Dundee excels in terms of operations. It has a track record of consistently achieving production targets while effectively managing costs. In fact, the company boasts some of the lowest costs in the sector. For 2023, Dundee projects an all-in sustaining cost (AISC) between $700 and $860 per ounce, lower than the previous year’s result of $885 per ounce. This reflects recent optimization efforts, as well as disinflationary pressures. Moreover, it is considerably below the industry average of $1200-$1300 per ounce. Dundee expects AISC between $720 and $880 for both 2024 and 2025.

Due to its efficient operations, Dundee is highly profitable. Unlike many other miners focused on excessive growth, Dundee prioritizes strong profit margins. Over the last 12 months, the company generated $210 million in free cash flow. This means that Dundee trades at an EV/FCF multiple of less than 3x. The significant cash position of $563 million is proof of the company’s ability to consistently generate substantial free cash flow. This number is even more impressive considering that Dundee has returned approximately 40% of its free cash flow directly to shareholders. For instance, in 2023, the company distributed over $20 million in dividends and around $66 million through stock buybacks. The emphasis on buybacks is commendable, especially considering the undervaluation of the company’s shares.

Due to its track record of effectively controlling production costs, Dundee’s share price has outperformed compared to its peers, despite a challenging market environment for gold miners. However, the company still appears significantly undervalued. The 15% decline in share price since mid-December, following the acquisition of Osino, adds to this underlying undervaluation.

When analyzing a company that looks as cheap on paper as Dundee, the initial challenge is to understand the reasons behind the undervaluation. After that, the next task is to determine whether the market is accurately assessing these factors or overreacting to their impact. Let’s start from the first task.

Dundee, being a relatively small and lesser-known miner, may not be on the radar of most investors. Additionally, the current sentiment towards gold miners is generally negative. There are also more fundamental reasons contributing to the undervaluation. One such reason is the uncertainty surrounding the Loma Larga project, which the market may be discounting as a stranded asset that will never be developed. Another factor is the relatively short life-of-mine for Dundee’s assets: while Chelopech and Ada Tepe are high-grade and low-cost mines, they are not extensive deposits. Lastly, the company’s substantial cash position on its balance sheet raises concerns that it may be misused through excessive spending on questionable acquisitions. The recent acquisition of Osino may have reinforced these fears in the market.

Let’s now address each of these points individually, starting with Loma Larga. The situation surrounding Loma Larga is quite uncertain. The main risk for Dundee is the potential revocation of its concession due to a previous referendum: the 2021 referendum in Cuenca prohibited large-scale mining activities in the region. However, both the company and the government argue that the referendum cannot be applied retroactively.

In August, the Provincial Court of Azuay ruled that the Ministry of Environment, Water, and Ecological Transition (MAATE) in Ecuador failed to consult Indigenous communities, thereby violating constitutionally protected water rights. However, the court also re-affirmed the validity of Dundee’s mining concession and outlined additional obligations for the MAATE to fulfill, thus paving a path towards extraction.

In November, Ecuador elected a new president, Daniel Noboa, who is the heir to a fortune built on the banana trade. He faces a weakened economy and significant fiscal challenges, with the country’s fiscal deficit expected to exceed 5% of its gross domestic product. Considering his personal background and the current economic situation, I anticipate his administration to be supportive of the mining industry. Loma Larga holds significant strategic importance for the state of Ecuador.

While there are uncertainties and all exploration and drilling activities have currently halted, I believe the Loma Larga project is far from being dead. It may experience delays, but ultimately, it will be developed. However, the fundamental point to highlight is that Loma Larga is no longer as crucial as it once was. It used to be important for replenishing Dundee’s depleting resource base. However, the company has successfully created a growth pipeline that doesn’t rely on the development of Loma Larga to increase production. This brings us to the second point regarding the shorter life spans of many of its assets.

Dundee has demonstrated great skill in recent years in replacing reserves and extending the operational lives of its assets. For instance, it has recently extended the mine life at Chelopech until 2032. The updated life-of-mine plan has resulted in the addition of approximately 128,000 ounces of recovered gold and 9 million pounds of recovered copper between 2024 and 2032. Additionally, Dundee plans to continue its brownfield exploration program at Chelopech, which has already yielded some promising intercepts.

In addition, Dundee has made a significant discovery at Coka Rakita, where a maiden Mineral Resource Estimate of 1.78 million ounces was announced in December. The estimate was completed in record time (about one year). As the deposit remains open to the northeast and southwest, I believe there is still considerable upside potential through further exploration. Dundee expects to complete a Preliminary Economic Assessment (PEA) for the project in the second quarter of 2024. Given its relatively high average grade of 5.67 grams per tonne and proximity to existing infrastructure (35 kilometers from the city of Bor in Serbia and 320 kilometers from the company’s Chelopech mine), the project is likely to have robust economics.

Finally, some quite encouraging exploration results have come from Tierras Coloradas in Ecuador. The company commenced a 10,000 meters drilling program in August 2023 to delineate the Aparecida and La Tuna low sulphidation epithermal vein systems. Interestingly, some promising intercepts have been found, and both targets remain open in multiple directions.

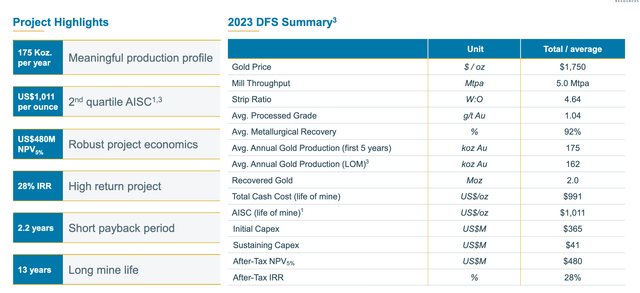

Moving on to the next point, let’s discuss the acquisition of Osino Resources. Osino owns the Twin Hills open pit gold project in Namibia. Namibia is considered a mining-friendly jurisdiction and Dundee already has operations there at Tsumeb. The total considerations for the acquisition amount to around $215 million, with 50% in cash and 50% in stock. According to a 2023 Feasibility study, the asset has a mine life of 13 years and an average annual production of 175,000 ounces of gold over the first five years.

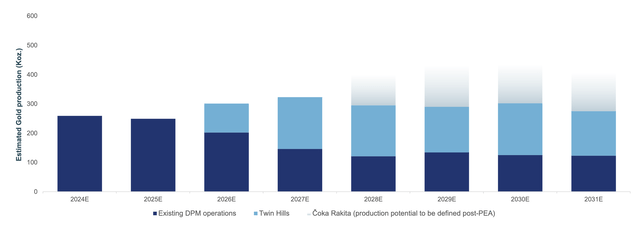

A very positive aspect is that the project is well-advanced, and first production is expected in the second half of 2026. As shown in the following visualization, Twin Hills will help Dundee offset the natural declines at its Bulgarian assets, while Coka Rakita will provide additional upside.

Future production profile from company’s assets (Company’s Presentation)

Of course, it is crucial to discuss the economics of the project. As I mentioned earlier, Dundee’s share price has declined following the announcement of the transaction. However, I believe this may be an overreaction to the somewhat high production costs. The all-in sustaining cost (AISC) is expected to be around $1000 per ounce, which is approximately 25% above Dundee’s current average cost. Despite the fact that the new mine will increase the company’s costs per ounce, I still consider it highly accretive. Firstly, the deposit is quite large, with 2.15 million ounces of Proven and Probable Reserves. Secondly, it has a short payback period of 2.2 years, a 28% after-tax internal rate of return (IRR), and an after-tax net present value (NPV) of $480 million at a 5% discount rate. These numbers are not bad, but they underestimate the quality of the asset as they assume a gold price of $1750 per ounce (currently trading $300 above that level). The initial capital expenditure of $365 million may seem substantial but, crucially, it can be fully financed from internal free cash flow and the company’s cash position. Dundee has a cash balance of approximately $563 million and an undrawn credit facility of $150 million. Twin Hills represents the long-awaited opportunity to put the cash to good use.

Twin Hills DFS Summary (Company’s Presentation)

More importantly, the market may be underestimating the significant upside potential of this transaction through exploration. In addition to Twin Hills, Dundee also gets a second, smaller deposit called Ondundu. Ondundu has an existing Inferred Mineral Resource of 0.9 million gold ounces and is located 130 km northwest of Twin Hills. Additionally, there is a recent, highly prospective gold discovery at Eureka, 35 km northeast of Ondundu, with intercepts including 47 meters of 5.92 g/t of gold. Given Dundee’s recent exploration successes in Serbia and Ecuador, it would not be surprising if the company were to make additional discoveries in the 8,000 km2 land package, which is also part of the transaction, in Namibia’s highly prospective Damara sedimentary mineral belt.

In conclusion, Dundee is an overlooked intermediate gold producer with low-cost operations, a history of profitability, and an exciting growth pipeline. I firmly believe that now is the time to buy. The gold price is near all-time highs, yet sentiment is low. The share price has fallen approximately 15% following the announcement of the Osino acquisition. However, this acquisition is highly accretive, and the project can be built without significant dilution. The company is significantly undervalued. The downside is therefore limited. When sentiment in the gold sector turns, I strongly believe investors in Dundee will be amply rewarded.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.