Daviles/iStock via Getty Images

Investment Thesis

DraftKings Inc. (NASDAQ:DKNG) is one of my favorite inflection stocks. What’s an inflection stock? It means a business that has a very clear path towards increasing its free cash flow.

Superficially, DKNG stock looks expensive at 50x forward free cash flow. But I want to assure you that it’s cheaper than it seems and headed to $65 per share by summer 2025. Admittedly, this is slightly higher than Goldman’s call of $60, but that’s because my time horizon is slightly longer than Goldman’s.

Why is this stock headed for $65 per share?

For one, this business is still delivering hyper-growth (this means stable growth above 30% CAGR). Furthermore, its mid-30s% CAGR growth rate doesn’t even factor in its recent acquisition of Jackpocket. So, there’s still more upside optionality to come later in 2024, once Jackpocket has been integrated for a while. Expect to hear an update on Jackpocket on its Q1 2024 earnings call when it releases its earnings on May 2nd.

Altogether, I recommend buying into DKNG with a strong buy rating. Particularly for investors looking for other names aside from “yet another AI play.”

Rapid Recap

Back in October, I said:

I am optimistic that DraftKings’ relentless efforts to bolster customer engagement will pay off, reaffirming its strong market position and long-term profitability.

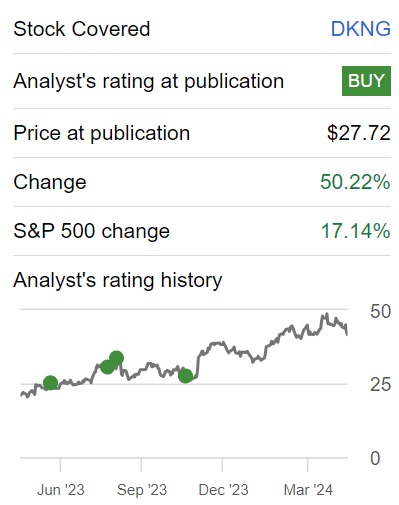

Since that time, the stock has nicely outperformed the S&P 500 (SP500), see below.

Author’s work on DKNG

And now, not only am I more bullish on its prospects, but I’ve actually bought DKNG.

Why DraftKings?

DraftKings, a key player in the U.S. online gaming sector, has established itself as a front-runner in the industry, prioritizing the preservation and expansion of its competitive advantage, while driving highly profitable unit economics. Holding the top spot in U.S. Online Sports Booking and iGaming gross revenue share, the company underscores its commitment to innovation in adapting to the ever-evolving online gaming environment. What sets DKNG apart is its significant and consistent profitability compared to many other betting platforms.

Important Context

DKNG is a seasonal business. This means that Q4 is often its strongest quarter, followed by Q1, which is weaker.

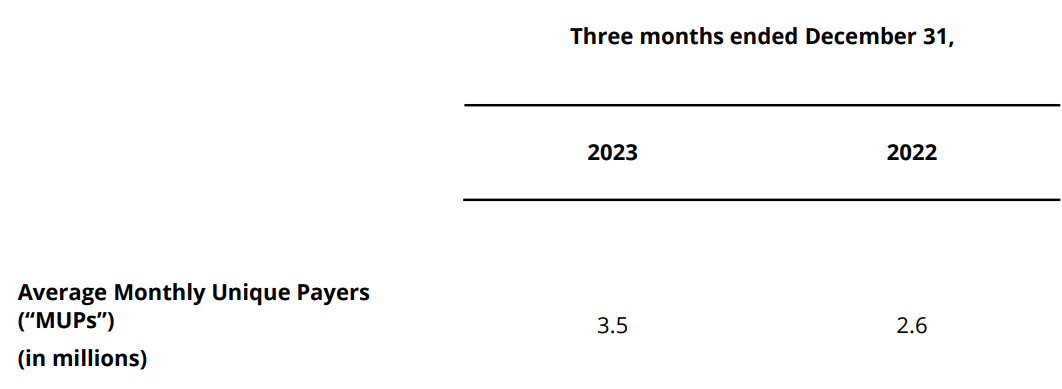

Nevertheless, given that approximately 3.5 million monthly unique payers are on its platform and this figure continues to grow with time, provided that the free cash flow is also similarly growing, it means that each of the payers is becoming more profitable for DKNG.

DKNG Q4 2023

So, you have a business that is resonating with an increasing number of payers, but also, a business that is more effectively monetizing its payers. That’s really all there is to this investment thesis. And I argue that going beyond this consideration is a distraction.

Given this context, let’s now discuss its fundamentals.

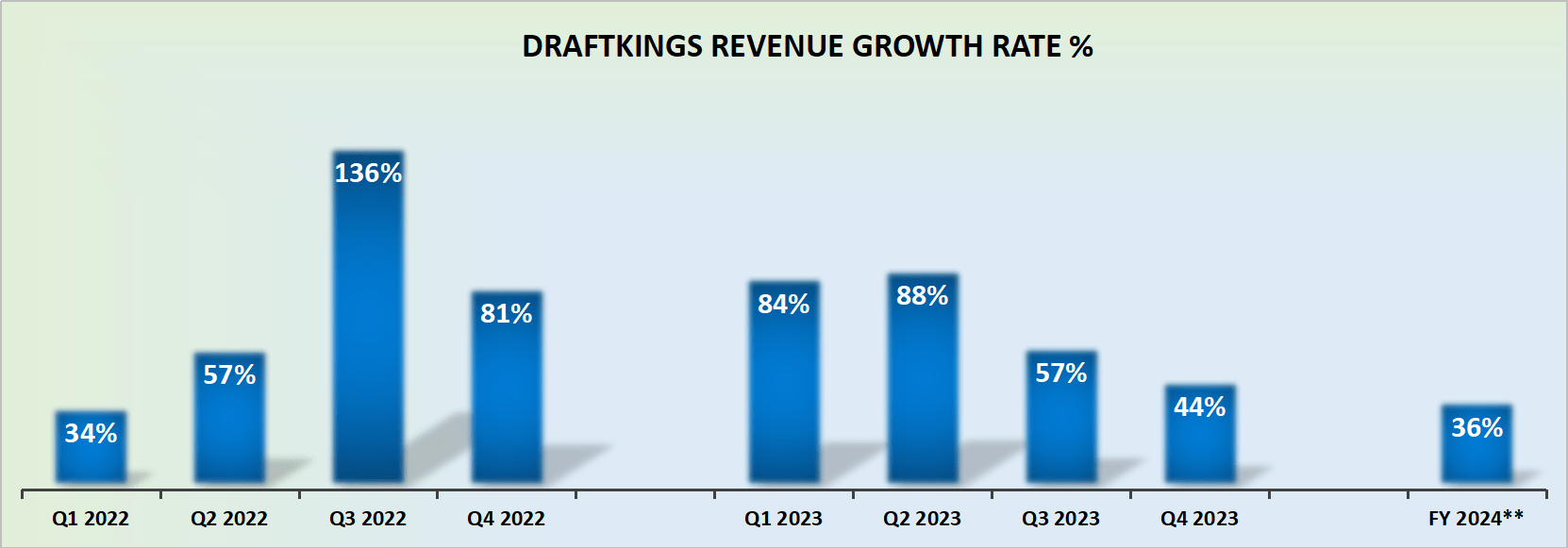

Revenue Growth Rates Expected to See 36% CAGR in 2024

DKNG Q4 2023

As illustrated by the graphic above, H1 2024 will see DKNG up against very challenging comparables with the prior year. Particularly Q2, which is expected to be especially challenging.

But once we get over the summer months, the second half of 2024 will see DKNG up against substantially easier comparables. That’s the framework.

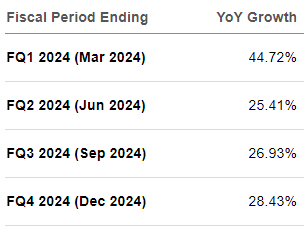

SA Premium

And yet, if you see above what analysts following the stock expect from DKNG, is that after Q1 its revenue growth rates to rapidly decelerate. But this doesn’t make a lot of sense.

Indeed, I firmly believe that analysts following DKNG will in the coming months be upwards-revising these revenue estimates as well as asserting a higher price target on the stock.

Next, we’ll discuss its valuation.

DKNG Stock Valuation – 50x Forward Free Cash Flow

On the back of its earnings, DKNG stated that it was raising the midpoint of its EBITDA guidance in 2024 to $460 million and as much as $510 million at the high end.

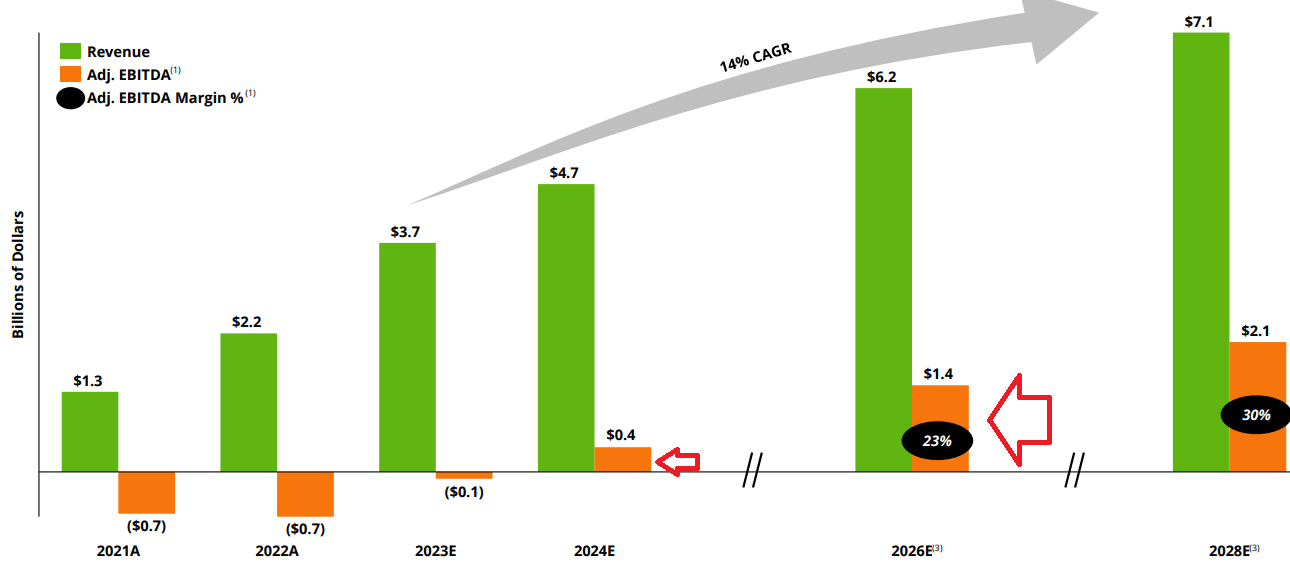

DKNG investor presentation

This implies that its EBITDA guidance provided together with its Investor Day back in November 2023 is now outdated, as its underlying free cash flows are running ahead of schedule.

Thus, here are my back-of-the-envelope calculations. DKNG guides for $510 million of EBITDA in 2024 at the high end. Given that DKNG has a habit of consistently upward revising their profitability estimates, I believe that this figure will also be further upwards revised. But for now, let’s use $510 million of EBITDA for 2024.

Moreover, I estimate that in 2024, DraftKings’ capex will be approximately $120 million. This implies that DKNG is on a path towards $450 million to $480 million of free cash flow at some point in early 2025, as a forward run-rate.

I believe that my free cash flow estimate will probably be revised higher in the next couple of quarters, particularly once Jackpocket is acquired and integrated. However, I will for now stick with this estimate to leave me a margin of safety. Afterward, I can always be more aggressive, when I get more visibility into 2024.

Risk Factors

DraftKings operates in a highly regulated industry. Part of the bull case requires favorable regulations. Negative changes to the regulatory environment would impact profitably.

While DraftKings currently holds a leading position in the U.S. online gaming market, it faces intense competition from other players.

Likewise, competitors often introduce aggressive pricing strategies, which leads to payer churn. Elevated payer churn would disrupt DraftKings’ business model and challenge its underlying profitability.

The Bottom Line

In conclusion, DraftKings stands out as a top inflection stock to buy now in my view.

Despite the seemingly high forward free cash flow (“FCF”) multiple of 50x, the company’s trajectory suggests that it may be undervalued.

DKNG continues to deliver hyper-growth, with a mid-30s% CAGR that could further accelerate with the integration of Jackpocket.

Its position as a leader in the U.S. online gaming industry, combined with its profitability and increasing number of monthly unique payers, underscores its strong fundamentals.

Further, its revenue growth rates remain promising, potentially leading to upward revisions in revenue estimates and price targets. With a path towards significant free cash flow generation expected in early 2025, DKNG offers compelling investment potential for those seeking exposure beyond typical AI plays.

DraftKings Inc. price target: $65 by mid-2025.