Seth Love

- DraftKings Inc. (NASDAQ:DKNG) has bullish prospects for 2024, but investors need to consider entry of two deep-pocketed new competitors: ESPNBet and Fanatics.

- DKNG will turn profitable next year propelled by double-digit sales growth and continued narrowing of promotional spend–unless newbies swamp the sector with crazy free bet promotions.

- The FanDuel parent Flutter Entertainment plc (OTCPK:PDYPF) begins trading on the NYSE late next month, giving investors a true apples-to-apples pure play comparison for the first time.

It may well have escaped the memory of DKNG shareholders that way back in the early days of legal sports betting’s opening floodgates (2018), DKNG and FanDuel (“FD”) held informal talks about a merger. On any criteria, that was at the time, a great idea. Both platforms were virtual carbon copies of each other with strong daily fantasy sports customer bases ready to shoehorn into real money sports bettors. Both were pouring tens of millions a month battling for the same customer base. Both showed ebullient sales growth, both were losing tons of money in the process. A merger would have been EBITDA-accretive ASAP.

But Mr. Market was willing to accept the floodtide of red ink because month after month, sales growth was a double-digit spectacular for both platforms.

The deal went nowhere for lots of reasons, most of them weak in my view. Now, with many of the same rationales that made sense for a merger still in place, such a deal no longer looks doable. First of all, the combined share of market of DKNG and FD comprise 73% of the total. Mr. Anti-trust, always on the lookout for what it craves as highly visible predators, can be expected to view such a merger with alarm. But on a pure financial basis, a merger is a no-brainer four bagger for investors. Meanwhile both companies have prospered solo.

Both companies kept producing vibrant sales growth as the roll call of U.S. states legalizing sports betting continued to swell from 2018 to 37 plus D.C. as of this writing. And two of the big kahunas yet to go legal, California and Texas, have yet to be heard from. Industry scuttlebutt I hear senses some possible movement in Texas earlier than expected. We shall see.

Subsequent to the original chats between the sector leaders, FanDuel was wolfed down by global giant Flutter Entertainment (FLTR:L), ending any reasonable shot for a deal. And DKNG proved going at it alone did not stop its sales growth momentum till this day. DKNG continued kicking the tires on possible deals for UK platforms to expand its global footprint. But, for the most part, its rocket ride this year came from its organic growth in revenue and decline in promotional spend.

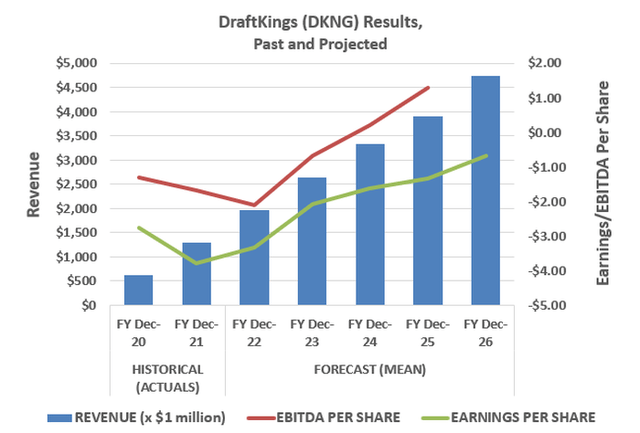

DKNG is now guiding 2024 revenue at $4.6b, and equally crucial for investors, a total staunch of the promotional bloodletting and easy glide into positive EBITDA.

Above: All signals go moving to out years, but competition will heat up.

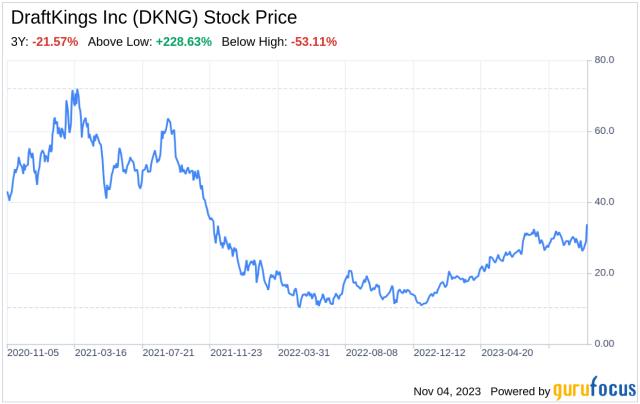

Investors along the way flipped off the naysayers worried about their huge losses (including yours truly). DKNG stock soared to over $70 before reality began to bite. The market eventually got religion and DKNG fell to around $10. Early this year, it traded under $11. Then out came the pompom twirlers, not without some reason, who traded the stock back up to $26 last October and since then, gave it another boost to where it now sits at a bit of a heady $35.60. Bullish scenarios look for a price target (“PT”) of $63.

DKNG trades at writing at ~3.6X FY 2024 estimated revenue with 25% ggr sales growth for the year. It appears to be a bit rich of a multiplier, which could be a blinking orange light to some investors. But revenue guidance is $4.6b, with an ongoing decline in promotional spend that does support higher value.

Here come the horse flies in DKNG’s ointment for 2024

Two new entries have just launched: ESPNBet and Fanatics. Both are jet-propelled by very deep-pocked parents with stated goals to ultimately be among sector leaders like DKNG and FD. I have talked with my industry associates to see if my estimate of their best case market shares can dent the market dominance of either of the two leaders.

My view, yes, an initial burst driven by a rich promotional signup deal could stir up some share for ESPNBet. But longer term, retention will pose a far bigger quantum leap for the newbies. All agreed that the two newbies faced a formidable challenge to even gain a modest footing. We have noted in another Seeking Alpha article that a group of hedgies are looking for ESPNBet to gain a 7% share of the market given its visibility and promotional reach. I think that will indeed be a tough contract. However, the newbies are not going away. They will both be barbarians pounding at the DKNG and FD citadels with lots of money and all the time in the world. To the degree that their initial foothold hardens to any respectable share, DKNG shares will be tasked to hold their current trading range.

Here comes NYSE-traded Flutter (FanDuel)

Until now, if your investing profile leans heavy on preferring taking shots at pure plays, you have signaled that is one reason you felt bullish on opening a DKNG position. And rightly so. Looking at the entire sports betting sector, it was, until now, the only pure play traded on a U.S. market.

The key watch point to determine whether ESPNBet has gained any forward thrust at DKNG expense is right after the Super Bowl February 11th at Las Vegas. We will then have enough ggr history to make a forward call on market share, but not before.

On January 29th that’s all going to change. Co-market leader Flutter (FanDuel) will begin trading on the NYSE. I am hearing inside the industry chatter that many institutions will be loading up because the base case FLUT (the new FD ticker) story on many levels could be a louder siren call than that of even the solid forward prospects for DKNG. So Mr. Market will now have two pure sports betting plays to evaluate dollar-denominated apples to apples. FLUT, of course, brings its global footprint into the calculation, and that is a biggie all by itself.

What this all means, in my view, is that the time may be closer than many think, that DKNG will find the need to again slake the thirst of its deal appetite. I see a very real possibility of some kind of DKNG deal to expand its footprint or diversify its verticals well before the end of the year.

That kind of thinking works for DKNG. In a sense, they are now all dressed up with no place to go. Their sales growth is great, their promo costs are declining, their forward EBITDA positive performance well in hand. Their prospects ahead cannot move beyond the existing state legal lineup. They have a footprint in 23 states, online or live. Their future is basically holding share where they are against present and newbie sites and leaping on new states yet to come. This will become a tougher and probably more expensive contract to execute ahead. Holders will need a bigger story to hang in.

google

Above: The DKNG roller coaster ride will continue, but in a narrower range.

A bit of options trading puzzle—no big deal, but worth a word

Benzinga analysts have lately noticed a few anomalies in the normal trending of options action on DKNG. They raised a bit of an eyebrow noticing 9 transactions that appeared a bit puzzling. Overall, 44% of the trades were bullish, 55% bearish. A special options scan found 4 puts totaling $197,281 and 5 cases of calls at $274,000. This all may be piffle as part of year-end portfolio window dressing for some institutions. But the stock is getting a bit toppy here, so take a look for yourself. DKNG has turned in a solid, good news 3Q24. Next up, 4Q23 results expected by mid-February. A prudent hedge might make sense here.

DKNG: DCF valuation at writing

For context we looked at the Alphaspread discounted cash flow (“DCF”) valuation of DKNG shares at writing:

Base case: $13.37

Worse case: $13

Best case: $61.08

Result: Overvalued by 63%.

One would be strained to make the case that DKNG could be a possible acquisition by a related online ecommerce giant at a premium above $35. Candidate one, of course: Amazon (AMZN). Consider the opposite here: DKNG buying or merging with a core competitor to essentially expand its revenue and data base. That begins to make greater sense to us. There are at least 10 current online betting operators ripe for the picking. Among them, at least four I believe that could bring accretive value to the top and bottom lines of DKNG at what could be a lower cost than revving up the marketing pump all over again.

I like Bet365, the private UK based operator that gets highly positive reviews from players for its very friendly site navigation. Its core UK business is well established. There are others that hold promise. DKNG is well versed in the process of identifying possible deals. I also see some small casino operators as DKNG targets. Bringing a bricks and mortar dimension to the company at a time when U.S. regional casinos have recovered from covid makes a story. And the overhang of a possible recession next year could shade valuations making a run reasonable. The casino sector is down 1.3% this year. We see a rebound ahead that could produce possibilities for DKNG to snatch one at a reasonable premium

An interesting one we have covered since 2014 is Full House Resorts (FLL), with footprints in Nevada, Mississippi, Colorado and a pole position for a new project in suburban Chicago.

FLL trades today at $5.11. I began coverage when the company changed hands bringing a former colleague, Mr. Dan Lee into the CEO spot. The stock was $1.50. It had traded above $10 late in 2021. It has existing sports betting deals that can be transformed into branded DKNG easily enough. But the key is to bring DKNG into the casino sector, positioned to benefit from more than the ramp of sports betting. It could trigger further acquisitions of small, profitable casino operations.

Conclusion

By most accounts, DraftKings Inc. is poised for good things ahead. Because its ownership profile is heavy with retail holders as well as institutions, its brand visibility is high. Yet because DraftKings Inc. is still losing money, its upside may be somewhat limited. That will change once it goes profit-positive. Until then, the shares could either stay dead-pooled in the 30s or perhaps erode a bit into the mid-twenties. That’s a perfect storm for acquisitions.

The key balance sheet numbers should not be an obstacle to any reasonable transaction DKNG can undertake:

Cash and equivalents: $1.11b

Long term debt: $1.34b

Current ratio: 1.29.

Revenue is forecast to rise above $4.6b in 2024 generating a profit probably by 2Q. To us, this makes a transaction in DraftKings Inc. stock very timely for the next twelve months that will move the shares into higher ground—around $48.50 in our view by 2 Q24.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.