JHVEPhoto/iStock Editorial via Getty Images

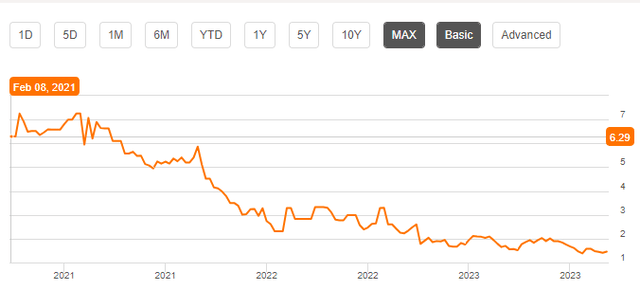

Since the IPO in early 2021 Dr. Martens (OTCPK:DOCMF) has never found peace, in fact the price per share has plummeted month after month until today. Yet, from an earnings and financial point of view there is no major problem.

After the recent results for H1 FY2024 were released, the market has once again punished the stock; in fact, the stock was down over 25% earlier today (November 30). At the current price I consider Dr. Martens an excellent opportunity.

Context

Dr. Martens was founded in 1960 in London and is engaged in manufacturing and selling footwear in the United Kingdom and internationally. During its long history it has alternated between highly successful moments such as in the 1970s and 1980s and difficult times such as in the early 2000s. In any case, for the past 10 years or so it started to rise again, and in early 2021 management made the decision to be listed.

Seeking Alpha

From that point on, however, a gradual reject began until the present day, and the stock has plummeted more than 80% overall. In my opinion, the reason for such a disappointing performance lies in the excessive hype of the IPO; in fact, at £3.70 per share Dr. Martens was rather overvalued. Its collapse was justified up to a certain point, but today at £0.85 per share the argument totally changes.

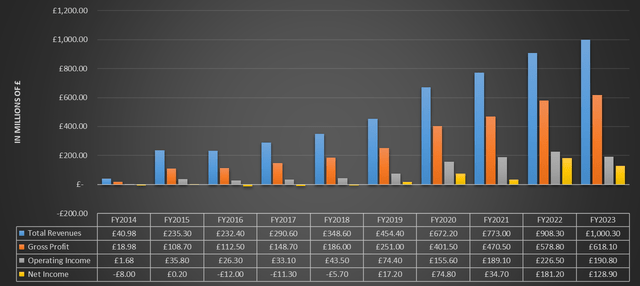

Chart based on Seeking Alpha data

From FY2014 to FY2023, this company has demonstrated continuous and sustainable growth: revenues and gross profit have improved every single year. Operating income has followed the same trend, except for last year. In contrast, as far as net income is concerned, Dr. Martens has been profitable for years. Similar reasoning can be made with cash flow.

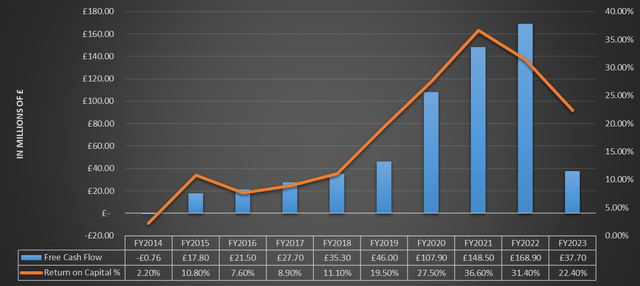

Chart based on Seeking Alpha data

Free cash flow also has improved every year, and the current slowdown is not about brand deterioration but simply an enhance in inventory. Compared with previous years, demand has declined, so the enhance in inventory has led to a deterioration in cash from operations. In any case, this is a common problem currently for all companies selling clothing/shoes and does not uphold a slump of such a magnitude.

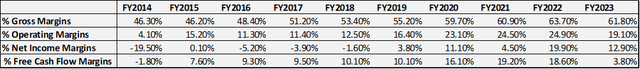

Finally, Dr. Martens’ margins are excellent when compared to both past margins and peers.

Chart based on Seeking Alpha data

In FY2014 the gross margin was only 46.30%, in FY2023 it was 61.80%. This is a major improvement and one that highlights this company’s competitive advantage. Its boots are in the premium price range and customers are willing to spend more than average given their quality. Such a high gross margin in this industry is uncommon; in fact, peers are struggling to keep up: V.F. Corporation (VFC) reported a gross margin of 52.54% in FY 2023, Steven Madden (SHOO) 41.17%. To give a better idea, Dr. Martens in terms of gross profit is close to LVMH (OTCPK:LVMHF), 68.44% last year.

Overall, this company has shown good long-term growth not only in revenues but also in margins. In addition, free cash flow denotes good earnings quality. It certainly does not deserve to trade at £3.70 per share, but neither at £0.85 per share.

H1 2024 analysis

As soon as the H1 FY2024 report was released, the market lashed out at Dr. Martens and knocked it down by 25%, even though up to that point the stock had done nothing but plummet since the IPO.

When I heard about this reaction I was expecting a disastrous first half of FY2023, however, in my opinion the situation is not as dramatic as it seems at first glance.

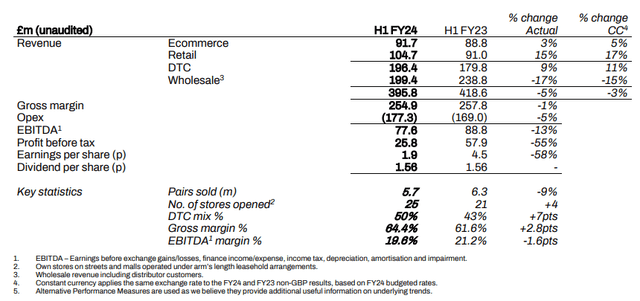

First half results for the six months to 30 September 2023

H1 FY2024 revenues were £3.95 billion, 5% less than last year’s £4.18 billion. Certainly, this is not a positive result, but we are talking about a minimal decrease, especially when compared to constant currency, only -3% in that case. Dr. Martens has grown a lot in the last 10 years, both in terms of revenue and in terms of brand quality, which is why I tolerate a negative year. After all, the macroeconomic environment is not the best and all companies manifest difficult times sooner or later.

Gross profit was £254.90 million, only 1% less than the first half of last year. Again, I uphold a slow start in a difficult environment after years of strong growth. By the way, the gross profit margin has improved and now stands at 64.40%, but apparently the market only considered the negative news. This improvement was mainly due to £10 million saved in the supply chain. Management has been reducing dependence on suppliers for years, and in fact the improvements are evident year after year. Let us now turn to profits.

First half results for the six months to 30 September 2023

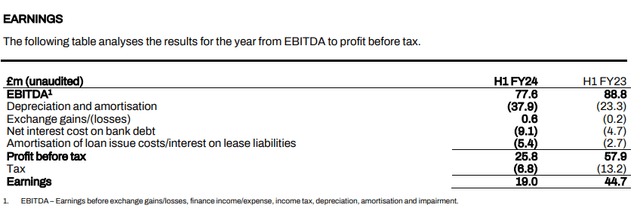

H1 FY2024 profits were £19 million, £25.70 million less than the previous year, and this did not please the market. Certainly this is a disappointing performance, but there are a number of points to consider that make it less bitter.

The first is that management has focused heavily on expanding the company in recent years, and as a result depreciation and amortization increased by £14.60 million over last year.

Depreciation and amortization charged in the period was £37.9m (H1 FY23: £23.3) with the enhance due to the annualisation of new store openings in prior year, increased DC space in North America and investment in the IT infrastructure including the implementation of the OMS and omnichannel capabilities in EMEA.

Although this mechanism negatively impacts profits, since depreciation and amortization is a non-cash cost, it does not affect cash from operations.

The second reason why profits fell a lot is that the wholesale segment is not performing as hoped: in H1 FY2024 it generated £199.40 million, £39.40 million less than the previous year. A very disappointing result, determined by a number of strategies adopted by management in order to enhance long-term growth. However, these strategies were carried out at the expense of short-term results and the market did not appreciate it.

Firstly, we significantly reduced the quantity and range of product sold into EMEA etailers, in order to ensure scarcity of supply in the region and migrate sales to our own websites. Secondly, we ceased sales to our distributor in China ahead of the contract ending in June 2023. In the Americas we worked with two large wholesale accounts who had excess inventory, reducing shipments through the first half in order to rightsize their inventory positions. In addition to these strategic decisions, we also saw industry-wide destocking amongst USA wholesale customers.

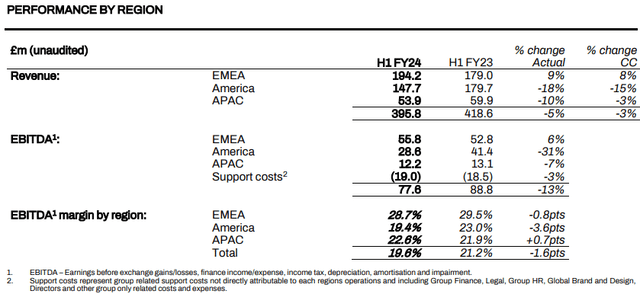

Breaking down revenues by region, there was evidence of a slowdown in demand, especially in America.

First half results for the six months to 30 September 2023

EMEA proved resilient once again, but the Americas had disappointing figures both in terms of revenue and EBITDA. The latter, declining by as much as 31%. Again, this outcome was influenced by the strategic choices mentioned above.

Finally, there are two pieces of news regarding shareholder compensation. The first is that the company believes strongly in its soundness and will keep the dividend unchanged, and the second is that the buyback will continue. For now, 13.9 million shares have been purchased since July 2023 at an average price of £1.50 per share. Dr. Martens still has about £30 million available to buy back its own shares, and doing so at the current price will boost its outcome. It could buy as many as 35.29 million if the price remains unchanged, about 3.50% of all outstanding shares. In addition, the dividend yield is about 7%.

Valuation and final considerations

Dr. Martens is undoubtedly a solid company, but what most prompted me to buy it is that it is severely undervalued, and now I will show you why.

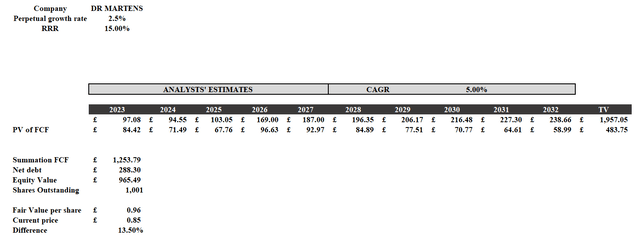

I created a discounted cash flow model by entering the following assumptions:

- Dr. Martens’ CAPM is about 10% with an equity risk premium of 6%, but I wanted to be much more conservative in choosing the discount rate. I selected an arbitrary rate of 15%, which is significantly higher and highlights how undervalued this company is.

- Free cash flow up to 2027 represents that estimated by analysts; from 2028 to 2032 it exhibits 5% growth.

- The perpetual growth rate is 2.50%.

Discounted cash flow

Based on these very conservative assumptions, Dr. Martens remains undervalued and has a fair value of £0.96 per share. In other words, by investing in it at the current price, there is the potential for returns of +15% per year.

Overall, Dr. Martens is a company that is having several issues with the wholesale and American segments. In any case, I don’t think this is a valid reason to sell off a company with decades of history, high margins, a high ROIC, and a major competitive advantage in its niche. It may just be momentary problems, since the brand is still strong in America. Management believes very much in the potential of this company, and the buyback strategize is proof of that; I would not be surprised if it is increased. Finally, beyond the capital gain, there is also an impressive dividend yield of about 7%.

I personally do not believe that Dr. Martens will turn out to be the investment of a lifetime, but at the current price it is undoubtedly interesting, which is why after this 25% drop I started buying.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.