Justin Sullivan

(A Long) Introduction

It’s time to talk about one of the most reliable wealth growers of the past decade: McCormick & Company (NYSE:MKC).

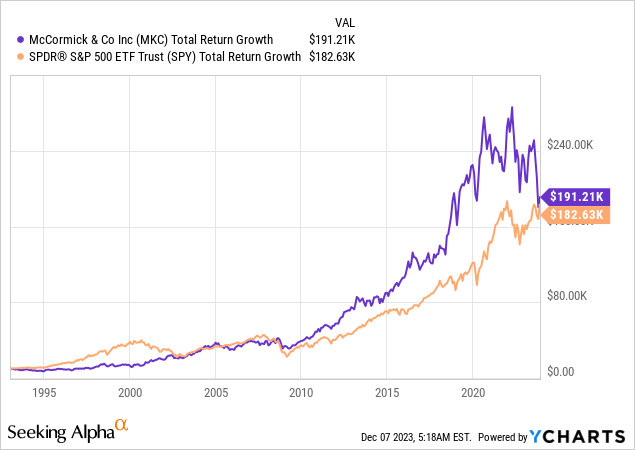

Going back to 1993, MKC shares have turned a $10,000 investment into more than $190,000. This beats an equal investment in the S&P 500 ETF (SPY) by almost $10,000.

As we can see in the chart above, the company is still outperforming despite a severe sell-off.

MKC shares are currently trading almost 40% below their all-time high, as the company has become a victim of a vicious macroeconomic trend.

The company, which sells premium spices, suffers from a very weak consumer, which has resulted in a shift to cheaper brands and an overall refuse in consumption.

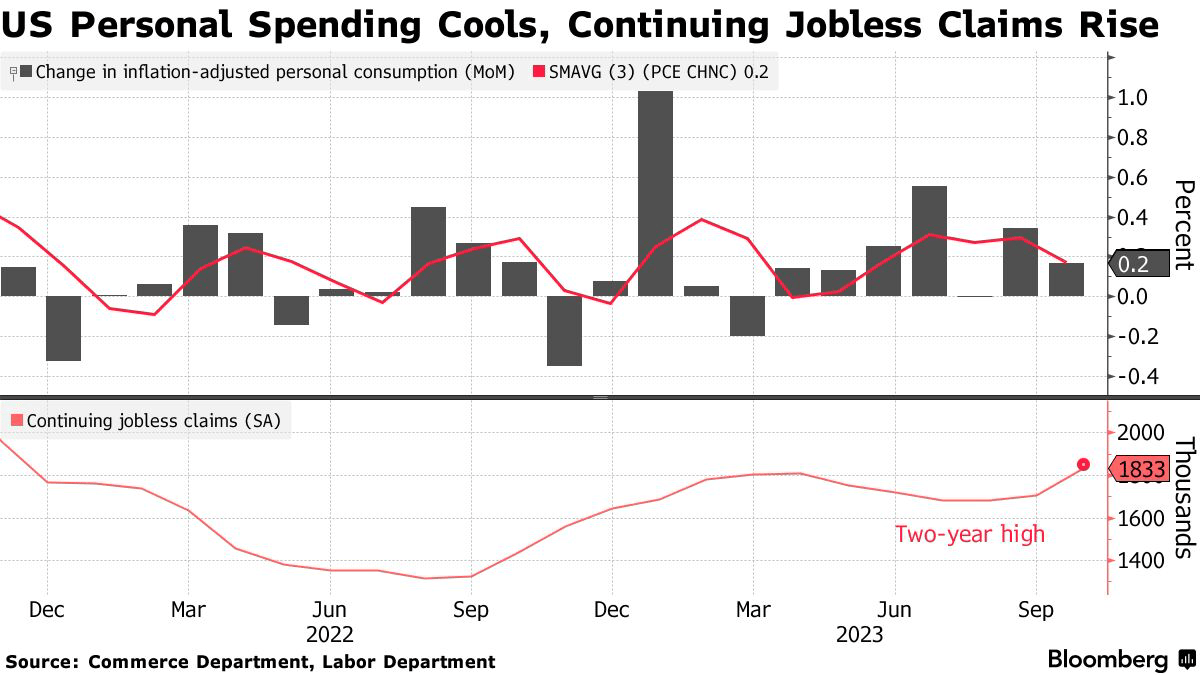

For example, on the first day of this month, Bloomberg published an article highlighting the increasing pressure weak consumer spending is putting on the economy.

Bloomberg

According to the article, the long-anticipated economic slowdown in the United States is finally underway, evident in recent data, warnings from major retailers admire Walmart (WMT), and observations from local businesses across the nation.

Despite defying expectations and indulging in summer spending, American households are now showing signs of restraint.

Furthermore, the latest monthly government data reveals cutbacks in discretionary spending categories such as cars, furniture, and gym memberships at the beginning of the fourth quarter.

Holiday shopping, including Black Friday, experienced a less festive atmosphere, with spending down at major chains and increased use of buy-now-pay-later schemes on Cyber Monday.

Adding to that, economists traditionally link consumer consumption to labor-market conditions, but there are signs that the once robust job market is cooling.

Wages and salaries rose minimally in October, and the data shows challenges for out-of-work Americans in securing new jobs.

Bloomberg

Here are a few quotes from regional Federal Reserve banks (from the same article) that show what the nation’s federal bankers are witnessing (emphasis):

Philadelphia Fed: “Electric vehicles were accumulating on dealer lots as high prices, high interest rates, and consumer hesitancy curbed demand.”

Dallas Fed: “The pace of hiring decelerated broadly, and some freight carriers, high-tech, and manufacturing companies reported layoffs.”

Minneapolis Fed: A northern Wisconsin banker said that “People are mad about eggs costing more, but they’ll still buy a car.” Other banking contacts noted that consumers were using credit cards and HELOCs to preserve spending.

Kansas City Fed: Consumers are increasingly likely to “share a roof and share meals” to handle household budget challenges. Restaurateurs noted that revenues fell as more customers split dishes and eschewed expensive items.

The recent developments have caused investors to steer clear from investing in McCormick.

Despite having a strong track record, McCormick’s yield has always been somewhat subdued (below 2%), and its valuation has remained elevated. Investors were previously betting on its high future growth for the company, and spices in the higher-priced segment relied on a stronger consumer.

On August 22, I wrote an article titled McCormick: A Dividend Gem Awaiting The Right Price. Since then, shares have fallen 18%, underperforming the S&P 500 by more than 21 points!

Since my neutral article, I’m now turning bullish. Not necessarily because I’m suddenly bullish on the consumer but because I believe that a lot of weakness has been priced in.

The total return outlook has become much better, and the company is doing well despite headwinds.

Now, as we’re closing in on a 600-word introduction, let me quickly get to the details!

Withstanding Headwinds Through Pricing And Efficiencies

I admire to cook. I wouldn’t say that I’m an excellent home cook, but I do believe that I have mastered a number of dishes.

When it comes to spices, I have to say that I’m one of the people who buy generic brands whenever possible – especially since the post-pandemic inflation made some spices quite expensive.

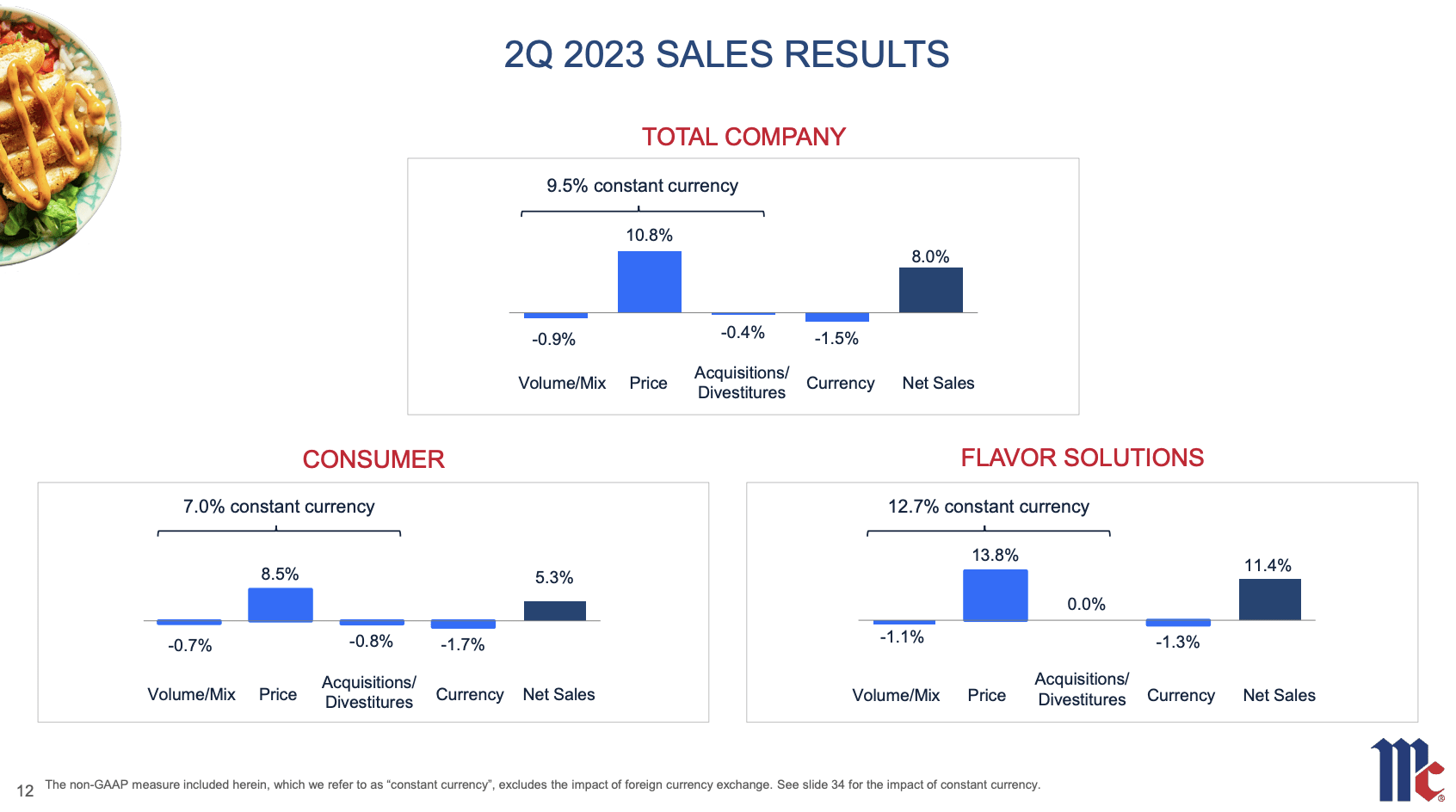

The good news is that McCormick has pricing power. For example, in my August article, I showed that net sales rose by 8% despite a refuse in volumes/mix of roughly 1%, currency headwinds, and a slightly negative impact from acquisitions/divestitures.

The driving factor was pricing, rising almost 11%, led by 13.8% pricing growth in its Flavor Solutions segment, which sells to major food producers instead of consumers.

McCormick & Company

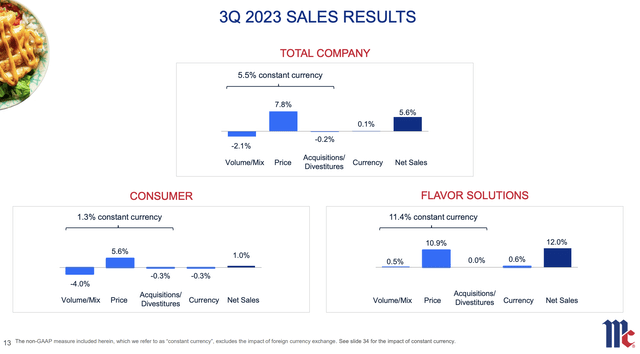

Unfortunately, as the consumer and economic trends are unfavorable, 3Q23 was a bit worse.

When looking at the headline numbers, the situation doesn’t look very bad.

Net sales were up 6%, with a subdued negative impact from unfavorable sales developments in China and diversities.

However, looking at the overview below, we see that the constant currency sales growth was 6%, driven by an 8% enhance in pricing, partially offset by a 2% refuse in volume and mix, which is a bit worse compared to the second quarter.

McCormick & Company

According to the company, various factors impacted volume, including slower China recovery, Kitchen Basics divestiture, and strategic portfolio decisions.

Consumer segment sales in the Americas increased by 2%, EMEA grew by 10%, and APAC decreased by 11%.

Adding to that, I find it interesting to see how well MKC has positioned itself higher up the food supply chain as it continues to shine in its Flavor Solutions segment. 10.9% pricing gains did not result in lower volume/mix, which is not something I expected.

It also needs to be said that margin improvements are visible.

The gross profit margin expanded by 150 basis points, reaching 37%.

This improvement was driven by the company’s focus on profit realization, successful implementation of CCI and GOE programs, and recovery from cost inflation over the past two years, which are programs to streamline the business, including its supply chains.

Unfortunately, the company saw a $0.04 refuse in adjusted earnings per share between 3Q22 and 3Q23. A $0.06 gain from higher operating income and unconsolidated income was more than offset by a refuse in “other” income and higher interest expenses.

Despite challenges, MKC maintains confidence in its sales and operating profit outlook for 2023. The company expects 5-7% top-line growth, reflecting a positive outlook on its ability to drive sales.

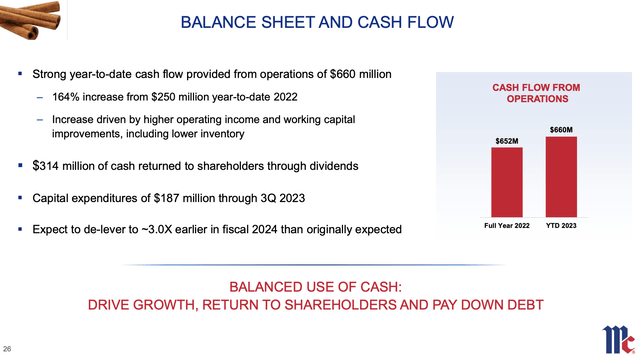

Furthermore, the strong core business benefited shareholders through higher cash flows.

Operating cash flow increased by 164% year-to-date, which was primarily due to higher operating income and working capital improvements resulting from the company’s efficient financial management, which has benefited investors for decades.

McCormick & Company

This brings me to the next part of this article.

Shareholder Value Has Become Attractive Again

The company, which is increasingly focusing on partnerships with celebrity chefs and companies admire Mars to launch new Skittle variations, is using its free cash flow to boost shareholder value.

For example, the company is expected to deleverage its balance sheet to 3.0x EBITDA next year (earlier than expected).

Analysts expect the company to lower net debt to $4.2 billion next year, which translates to a 3.2x leverage ratio.

The company has an investment-grade BBB credit rating from Standard & Poor’s.

Next year, the company is expected to create $860 million in free cash flow. That’s operating cash flow minus capital expenditures. This would translate to a 4.7% yield.

In 2025, the company is expected to enhance free cash flow by 11% to $960 million, or 5.3% of its market cap.

This means at least two things: a well-covered dividend and a favorable valuation.

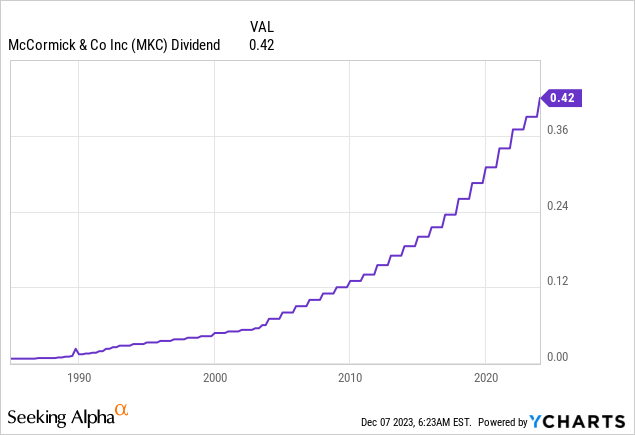

- After hiking its dividend by 7.7% on November 28, it currently pays a 2.5% dividend. Expected free cash flows cover this dividend with enough room for debt repayment. In general, the company’s dividend is attractive, as its five-year CAGR is 8.5%. The dividend has been hiked for 36 consecutive years. This is one of the best dividend track records in its sector.

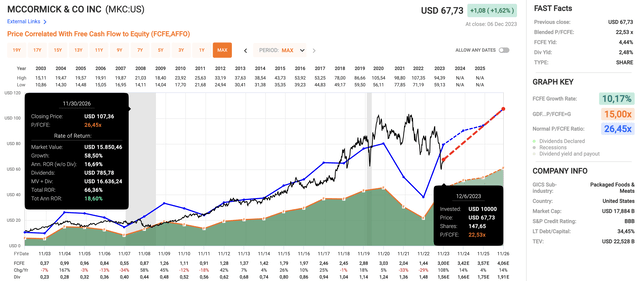

- The company’s expected free cash flow trajectory is indicating a favorable valuation. In the chart below, I’m using FCFE – free cash flow to equity. This is net income adjusted for depreciation/amortization, net-working capital changes, capital expenditures, and net borrowing changes.

Using the data in the chart below:

- This year, the company is expected to grow FCFE by 108%, followed by a more moderate enhance of 14% in 2024. 2025 is expected to see 4% growth, followed by 14% growth in 2026. While these volatile numbers are subject to change, they show an expected return to normality.

- Currently, MKC trades at a blended P/FCFE ratio of 22.5x. Going back to 2002, the normalized multiple is 26.5x, which continues to fit the company’s growth profile quite well.

- A return to its normalized valuation by incorporation of its expected growth rates, the stock could return 18.4% per year through 2026, including dividends. That would imply a $107 price target, more than 50% above the current price.

FAST Graphs

However, that’s a theoretical return. Unless inflation comes down to 2% quickly, allowing the Federal Reserve to cut rates gradually without doing too much economic damage.

While I cannot promise a total return over 18%, I do believe that MKC is attractively valued after falling almost 40%.

Longer-term returns will likely be higher than the market’s return, making MKC an attractive long-term investment.

Takeaway

Amidst challenging consumer trends and economic headwinds, McCormick displays resilience.

Despite a significant stock price refuse, its pricing power, efficient cost management, and focus on Flavor Solutions position it strategically.

Meanwhile, the company’s commitment to shareholder value shines through debt reduction, dividend growth, and a positive cash flow trajectory.

After a 40% drop, MKC’s attractive valuation offers potential for a robust long-term investment. A return to its normalized valuation could yield a double-digit annual return through 2026, making it an enticing opportunity.