Palantir Technologies (PLTR 0.06%) has a data-centered business that has been leveraging artificial intelligence (AI) to provide better, more efficient and effective solutions for its customers. The company has become profitable, and there still looks to be plenty of growth ahead for the business.

But even given all those reasons for investors to be bullish on the stock’s long-term prospects, shares of Palantir have been falling recently. At less than $17 per share, the stock is now down 23% from its 52-week high. Is this a buying opportunity for investors?

Has Palantir’s stock become overvalued?

Although Palantir’s stock is not trading near its 52-week high anymore, it still had an impressive year in 2023, with its share price climbing by 167%. Part of that was due to the emergence of AI, and part was undoubtedly due to a recovery from 2022 when it crashed 65% as investors grew concerned about growth stocks amid a rise in interest rates. The net result is that today the stock is trading around where it was two years ago.

But even that seems high for Wall Street. The consensus analyst price target for Palantir is just over $13, which implies that the stock could fall by as much as 21% from where it is now. And while the company is profitable, its earnings still aren’t high; the stock trades at a whopping 240 times its trailing earnings. Even based on analyst projections, its forward price-to-earnings multiple is 57. That’s double the multiple of the Technology Select Sector SPDR Fund, which averages a forward earnings multiple of 28.

There’s no doubt that investors are paying a premium for Palantir’s stock. The big question is whether it’s worth it.

Should Palantir’s stock be worth a big premium?

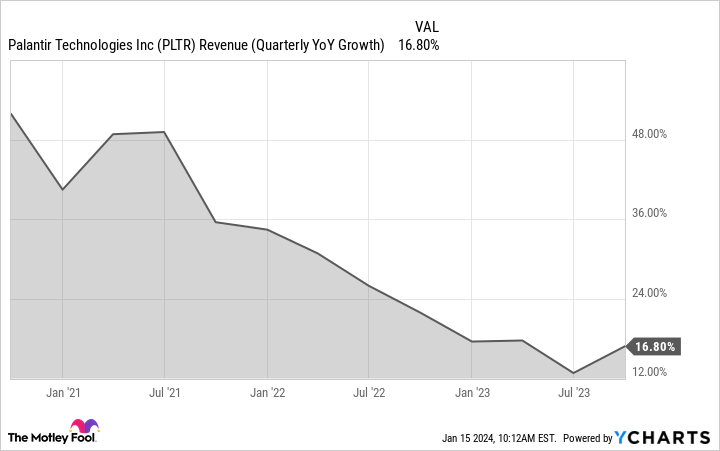

If you’re looking at the short term, then it would be easy to be bearish on Palantir’s stock. The company’s profit margin over the trailing 12 months is just under 7%, and it could be a while before its AI platform generates any strong growth. The biggest drawback on the stock is that while Palantir is growing, it’s at a slowing rate.

PLTR Revenue (Quarterly YoY Growth) data by YCharts

If you’re paying nearly 60 times forward earnings, you would probably be demanding a much stronger growth rate than just mid-single digits. But that’s where the business is today. A lot depends on just how much growth there will be due to AI. Palantir has been running AI bootcamps to help attract customers and to show them how AI can help improve their operations.

It has, however, been less than a year since Palantir launched its AI platform AIP. And over the past year, businesses have been hesitant to take on new projects and expenditures as they prepare for a possible recession in 2024; it may not be an easy time for Palantir to sign up new customers.

Is Palantir’s stock a buy right now?

Palantir has the potential to be a solid long-term buy for AI investors. With a solid mix of both government and commercial customers, the company now being profitable, and AI being a potential growth catalyst for years, the future does look bright for Palantir. But it may not necessarily be a smooth ride for investors.

As long as you’re willing to buy and hold the stock for multiple years, Palantir’s current valuation shouldn’t be a big concern as there could be plenty of growth ahead for the business in the long run. And over time, its valuation should improve.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.