The first two weeks of 2024 have not been kind to Tesla (TSLA -3.67%). The electric vehicle (EV) stock is already trading down 12% year to date after a solid rebound in 2023. Zoom out, however, and Tesla is surprisingly down over 22% over the last three years and 46.6% from its all-time high.

Here’s what the electric car company needs to do to reverse course and restore investor optimism.

Image source: Getty Images.

Tesla was on target with its production goals in 2023

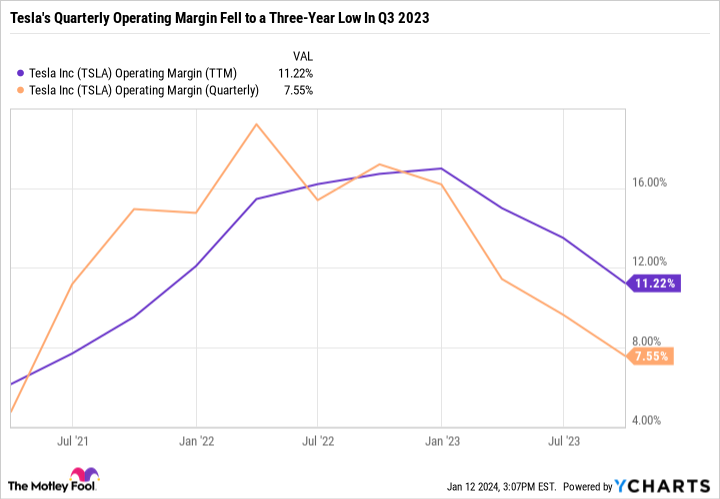

As interest rates rose and consumer demand fell, Tesla relied on price cuts to sustain sales growth. The decision took a sledgehammer to Tesla’s margins.

TSLA Operating Margin (TTM) data by YCharts. TTM = trailing 12 months.

Still, the automaker deserves a lot of credit for hitting its 2023 goal to produce and deliver over 1.8 million vehicles, a goal management set back in its Q4 2022 earnings presentation. The final numbers came in on Jan. 2, when Tesla reported production of 1.85 million and deliveries of 1.81 million vehicles.

We’ll get a better idea of Tesla’s financials when it reports Q4 earnings on Jan. 24. However, more than likely, Tesla’s 2023 results will be viewed as a success, given the challenging operating environment.

Cloudy skies ahead for Tesla

2024 may prove to be a difficult year for Tesla. The company has a long-term goal to grow production, on average, by 50% per year. That would imply 2.77 million vehicles produced in 2024 — which seems like a stretch. Tesla management did state that year-over-year growth can deviate from that 50% goal. Even if Tesla makes that many vehicles, the question remains whether it can sell them for a price that boosts the company’s bottom line.

Tesla stock is already down in 2024 for several valid reasons. In China, Tesla announced a 5.9% price cut on the Model 3 and a 2.8% cut on its Model Y. It also idled production short-term at its factory in Germany due to supply chain bottlenecks in the Red Sea.

Tesla has arguably the best supply chain, best brand, and best manufacturing of any EV maker. But it isn’t immune to market challenges, competition, and factors outside its control, like unexpected shipping snags. A lot has to go right for Tesla to grow production and deliveries at the pace investors are used to while also maintaining its margins.

Tesla is dealing with mounting competition

Legacy automakers and new pure-play EV companies have been gunning for a slice of Tesla’s market share for some time. But we have yet to see the full scale of this threat.

Toyota (TM 0.37%) and other giants were slow to adopt EV strategies. But soon, they aim to produce some serious EV volume that could rival Tesla. In September, reports surfaced that Toyota was aiming for 600,000 EVs in 2025. But the real growth is expected in 2026 when Toyota plans to sell 1.5 million EVs annually. By 2030, Toyota expects EVs to comprise half of its production.

For context, the Toyota brand alone sold 7.57 million vehicles in the first three quarters of 2023. So, by 2030, it’s safe to say that Toyota expects to sell well over 5 million EVs.

Toyota is just one sleeping giant Tesla will soon deal with. Currently, Tesla is juggling a slew of formidable Chinese EV makers, namely BYD, China’s largest EV manufacturer.

Tesla rose to prominence because it cracked the code and proved EVs could be a viable business model. But its moat is eroding, not due to anything Tesla has done, but because the rest of the industry is fully awake and shifting gears.

The glass-half-full perspective

There have been and always will be plenty of ways to spin a negative narrative on Tesla. But the company has a lot going for it that shouldn’t be overlooked.

Tesla’s margins may have declined, but it is still a cash cow. It generates plenty of cash to reinvest in the business and fuel future growth. It also has a thriving business model and can tap into the global growth of EVs. It has a powerful brand that doesn’t depend on expensive advertising.

Tesla also has an impeccable balance sheet with a net cash position. This is almost unheard of in the capital-intensive auto industry, where many legacy automakers carry a ton of debt. Toyota, for example, has $147.1 billion in net long-term debt on its balance sheet compared to a net cash position of $22.4 billion for Tesla.

When dealing with a battleground stock like Tesla, sometimes it’s best to separate the business from the stock price.

Tesla is a phenomenal business now and will likely continue to be for decades to come. The stock can be flat-out annoying to own because of the volatility. And for some folks, the headache may be best avoided. But if any company will crack the code on fully autonomous driving and the coveted robo taxi concept, it’s Tesla. And if that happens, Tesla could be worth magnitudes more in the future than it is today.

If Tesla can grow its deliveries at a rapid rate, even if margins stay low, I think that’s a net positive for the company. Higher earnings will make the stock a better value. And a sustained high growth rate will help Tesla keep its market share, scale production, and undercut the competition.

In sum, it’s best not to read too much into Tesla’s margin story and focus more on market share.

Know what you’re getting into

By now, investors should understand that Tesla stock could do anything in the short term. Just look at the last two years.

In 2023, Tesla stock doubled. In 2022, it lost nearly two-thirds of its value in a single year.

Given all the volatility, I think the best way to approach Tesla is to save some dry power to load up if it really nosedives as it did in December 2022. But the main objective should be to simply dollar-cost-average and build a position over time.

If Tesla crashes in 2024, it will probably be a great buying opportunity. But even if it doesn’t, Tesla is still a stock worth owning if you can stomach the volatility.