BlackJack3D

Over the past two or three years or so biotech has seen what some call the worst bear market ever. Companies with less than 12 months of cash runway have been hit hard, with many losing over 90% of their valuations and some of them trading below their net cash values. This has created an interesting investment opportunity for various biotech companies with very low valuations. In particular, this is an opportunity for investors to take meaningful stakes in public companies at venture valuations. This is a rare event which has the potential to pay huge dividends. However, other companies have and more will go out of business, so investors need to continue to tread carefully.

I first wrote about Gain Therapeutics, Inc. (NASDAQ:GANX) a few months ago and since then I have decided to double down on the investment. I believe recent events and company progress juxtaposed against the past year’s stock price decline and recent capital raise warrant an update. I believe the investment thesis has become stronger and the valuation more attractive.

AI Drug Discovery Hasn’t Met Expectations Yet

While machine learning, AI, and AI-like technologies still hold promise for drug discovery and development, the last 18 months have been somewhat disappointing for the budding field. The first few molecules created using AI have either failed in studies or been deprioritized and the buzzword hype has subsided. In April, BenevolentAI’s (BAI) lead product failed to produce desired results in dermatitis, and Recursion Pharmaceuticals, Inc. (RXRX), hasn’t documented a trial failure but has had a handful of clinical setbacks such as depriorizing clinical assets.

Exscientia plc (EXAI), which focused on using AI and patient samples in preclinical development rather than using tumor cell lines, which have a host of issues and arguably do not accurately mimic heterogeneous cancers and their tumor microenvironment, decided to wind down its phase 1/2 study of EXS-21546 in oncology. Exscientia’s partner, Sumitomo Pharma Co., Ltd. (OTCPK:DNPUF), also recently discontinued development of an in-licensed drug,

In January 2022, Sumitomo abandoned their OCD (obsessive-compulsive disorder) drug (DSP-1181, a 5-HT1a agonist) which they licensed from Exscientia just two years prior, because the drug did not meet the phase 1 study’s criteria. The issue is that 5-HT1a agonism has been tried for decades with different approaches. It isn’t new or untested; in fact, the whole approach was reviewed back in 2009:

dysregulation of 5-HT1A receptors cannot be considered as the one simple primary factor in anxiety disorders. Possibly, the role of the serotonin system in anxiety disorders is adaptive rather than pathogenic. In the future, a better understanding of 5-HT1A receptor function will provide insight into the origins and improved clinical management of anxiety disorders.

Without knowing too much about anxiety or OCD pathophysiology, my first thought would be that it would make more sense to treat a heterogeneous disease with a dual mechanism approach using known safe compounds; for instance, magnolol/honokiol (positive allosteric modulators of GABA-A) plus a 5-HT1a agonist, or to just use biomarkers to somehow screen for patients that might benefit from the singular 5-HT1a approach. What’s the point of Exscientia’s AI in this instance-is it really solving any key problem? Derek Lowe asks another relevant question (paraphrased from his blog): do we even have enough data in CNS (central nervous system) diseases to select the right targets and make sure that these selected compounds are safe?

One must wonder if the AI models are truly providing greater chances of clinical success. It’s too early to tell since most programs fail and there haven’t been enough compounds, trials, or time to estimate improved odds of success.

What Makes a Truly Valuable AI Drug Discovery Platform?

Perhaps a drug discovery platform that can design drugs to hit desirable, known targets that nobody has been able to target yet is a more valuable approach. In this instance, computational drug discovery platforms like Gain’s SEE-Tx platform which combines AI and a physics-based approach to find allosteric binding sites on proteins, the problem of finding any target on 90% of traditionally “undruggable” targets (and in a rapid manner – 3 months), actually solves a problem. Moreover, other platforms that are solely based on AI require a massive amount of preexisting data from which the AI algorithm can learn and extrapolate new results. Gain’s approach is distinct in that it needs no prior data to identify novel binding sites on protein targets. Proof of a valuable platform is if it generates compounds that enter the clinic. Gain has achieved this, and it’s a huge differentiator.

In my prior article, I highlighted high valuations and comps for AI companies similar to Gain, which are still relevant but perhaps expectations and valuations were too high. Perhaps Gain’s AI approach is more valuable due to the specific problems it solves-saving time and drugging “undruggable” targets to find allosteric binding sites using protein structures. This is different than what many other AI drug companies, e.g. Exscientia, do.

For instance, Vividion was bought by Bayer Aktiengesellschaft (OTCPK:BAYRY) for $2 billion ($1.5 upfront) and I don’t believe any of Vividion’s programs have been deprioritized or terminated yet, although currently, only two compounds are in the clinic per the pipeline graphic. Is Vividion still “worth” close to $2 billion whereas other AI companies with different approaches have failed to deliver?

Perhaps using AI to target “undruggable” targets in an improved manner (allosteric modulation, not blocking at an active site), and to save time (2 years condensed to 3 months using See-Tx) is valuable, whereas using AI to improve odds of success or to find targets which may or may not be relevant, is not quite as valuable.

Recent Investment Activity Reduce Financial Risks and Strengthen Investor Base

In the past few months, influential and successful investors have invested in Gain. David Einhorn added 41.85k shares in last quarter per Greenlight Capital’s recent 13-F filing. Additionally, Andrew Schwartzberg, a billionaire real estate investor who is also a sophisticated biopharma investor, also participated heavily in Gain’s recent PIPE. Notably, Schwartzberg began his career with Steve Cohen at SAC Capital as one of twelve original employees. These businessmen add strength to Gain which, for a microcap company of its size, was already notably strong with Eric Richman and Dr. Islam on the board along with Matthias Alder as CEO. Additionally, former COO of Biogen and current Chair of HBM, Hans Peter Hassler is on Gain’s board along with Dr. Claude Nicaise who has created tremendous value as a Director of Alexion Pharmaceuticals, Inc. (AZN) (formerly ALXN) and Sarepta Therapeutics, Inc. (SRPT). To summarize, a robust Rolodex of successful businessmen are supporting the company, including Eric Richman, David Einhorn, Andrew Schwartzberg, Khalid Islam, and others.

Recent Biopharma Deals Provide Gain With Additional Recent Comps

With funding issues behind the company, which is now formally a phase 1 stage biotech and not preclinical, investors can focus on the potential upside again, which can be estimated using comps.

Merck recently bought a lysosomal health company called Caraway Therapeutics for $610 million, though the breakdown of cost (upfront, milestones, etc) is unknown. The valuation is notable because Caraway’s lead program is still in the preclinical stage but was found to increase lysosomal GCase activity, one of the effects of Gain’s lead drug candidate, GT-02287. Thus, Caraway’s recent buyout is a good floor valuation for a license deal of GT-02287. Caraway doesn’t have a cutting-edge drug discovery platform and did not disclose much of a pipeline aside from its lead asset. The effect of Gain’s drug is likely more robust due to its mechanism of action and thus Gain is probably worth quite a bit more.

Gain now can use this buyout as a proxy, and with the cash to move through phase 1, the company has the financial backbone to be more selective in its business development activities. Dr. Islam, Gain’s board chair, has been known to raise money before inking deals to negotiate from strength.

When pursuing additional business development, multiple forms could take place. The company could out-license the development of their internal pipeline, i.e., Parkinson’s, Gaucher’s, or GM1 Gangliosidosis, or they could do another collaboration like the one announced with Zentalis Pharmaceuticals, Inc. (ZNTL). A similar multi-target deal could include upfront, research, and milestone payments, as well as back-end royalties, etc.

A good example of what a potential collaboration could look like for Gain would be the recent Sanofi deal with Aqemias, where Sanofi is using Aqemias’ quantum physics-based platform which, like Gain’s SEE-Tx, does not require experimental data to train on. The collaboration spans multiple therapeutic indications and comprises work from hit identification through the selection of lead candidates. It’s important to note that Aqemia has not discovered any molecules to date that have entered clinical trials that we could find in the literature.

A Closer Look at GT-02287 Reveals a Potential Best-In-Class GCase/GBA1 Therapeutic for Parkinson’s Disease

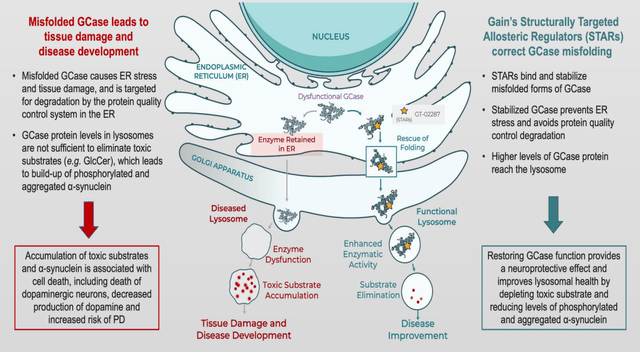

Gain’s approach to improving GCase, especially in the context of GBA1 mutations, is likely more robust than other competing approaches in improving GCase activity. Gain’s drug, GT-02287, works at the start of the disease cascade by preventing GCase from being misfolded in the first place (in the endoplasmic reticulum).

There are two main GCase modulators competing with Gain’s GT-02287. Caraway Therapeutics’ drug, which targets the lysosomal ion channel TRPML1, affects lysosomal pH and increases GCase activity. While their drug increases GCase, it is unclear if they solve the misfolding GCase issue, especially in the context of GBA1 mutation. More of this issue is detailed below, but basically, GCase activity needs to be increased, but misfolded GCase needs to be removed from the endoplasmic reticulum (ER) where it causes stress to the ER. Misfolded GCase forms sort of a feedback loop with alpha-synuclein where both propagate each other.

The potential closest competitor is Vanqua Bio which has announced plans to enter the clinic in Q1 2024 with its allosteric activator of GCase, called VQ-101:

In preclinical studies in patient-derived neuronal cells, VQ-101 robustly activates wild-type and mutant forms of GCase, reduces lipid substrates, and blocks the accumulation of pathogenic forms of alpha-synuclein. In ex vivo studies in whole blood, VQ-101 potently activates GCase in multiple species including human healthy volunteers and patients with GBA-PD. In vivo, VQ-101 demonstrated enhancement of GCase activity in four animal species, and significant CNS exposure following once-daily dosing. VQ-101 demonstrated a very promising profile in preclinical GLP safety and tolerability studies and is projected to be administered once daily in humans. Vanqua expects to initiate clinical trials in the first quarter of 2024, in which the company will seek to demonstrate safety and target engagement in healthy volunteers and GBA-PD patients.

The issue that potentially sets VQ-101 apart from GT-02287 is that GT-02287 is designed to refold GCase and not just enhance its activity once it is transported to the lysosome. In other words, it’s unclear if VQ-101 can influence misfolded GCase which gets stuck in the endoplasmic reticulum (ER) and may never make it to the lysosome.

Functional and Dysfunctional GCase Cascade (Gain Therapeutics Movement Society Disorders (Sept 2022, Madrid) Poster)

In other words, what sets Gain’s GT-02287 apart from Vanqua Bio and Caraway’s drugs is that it doesn’t just activate GCase or increase GCase activity once GCase is already in the lysosome. GT-02287 helps stabilize the GCase so that instead of being stuck in the ER where it causes cellular stress, it can be properly trafficked to the lysosome to increase functional lysosomal GCase and to increase GCase activity across both wild-type and various GBA1 mutations. In addition, Gain has shown that GT-02287 not only improves lysosomal GCase function but also mitochondrial function, showing a further advantage of acting at the beginning of the disease cascade.

Specifically regarding Vanqua Bio, there’s not much available data on VQ-101 and there’s no specific indication from the company claiming it can help chaperone GCase to the lysosome. Therefore the PD cells treated with VQ-101 will still be subject to ER stress from accumulation of misfolded/unfolded GCase. This is theoretically addressable with only GT-02287, but not the rest of Gain’s competitors’ GCase/GBA1 therapeutics-I’m unaware of other significantly developed GCase chaperone assets like GT-02287. Vanqua has a $250 million private valuation even though it is still preclinical stage and about a year behind Gain in development.

As opposed to Gain’s competitors, Gain’s drug acts ahead of a pathologic Parkinson’s feedback loop involving GCase, the hallmark alpha-synuclein and the lysosomal substrates that build up due to lack of GCase activity.

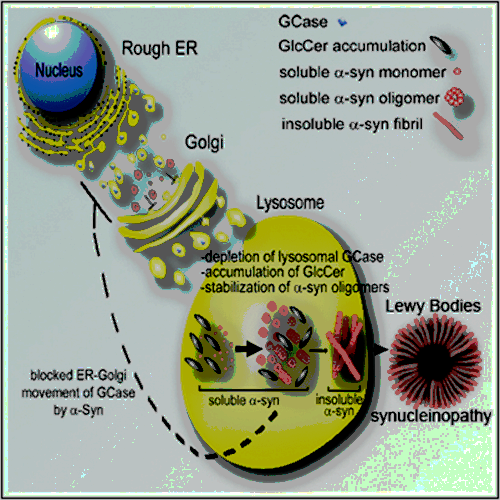

Gaucher Disease Glucocerebrosidase and α-Synuclein Form a Bidirectional Pathogenic Loop in Synucleinopathies (Cell. July 5, 2011.)

Misfolded GCase accumulates in the ER, and also causes a buildup of α-synuclein by compromising lysosomal protein degradation. This is caused specifically because glucosylceramide and glucosylsphingosine, the substrates which are not hydrolyzed when GCase activity is low, accumulate on organelle membranes; studies suggest that they may cause autophagic block (autophagosome and lysosome fusion). They also stabilize α-synuclein oligomers, which then impair the transport of GCase to the lysosome, perhaps via ER stress and ER to Golgi transport. Thus, lysosomal GCase activity is further reduced, causing increased glucosylceramide and glucosylsphyngosine accumulation, and the cycle continues. The way to stop the entire cycle is with GT-02287, to correctly fold GCase and aid its transport to the lysosome where its activity is increased. Additionally, misfolded GCase blocks CMA (chaperone-mediated autophagy), an important part of the cellular recycling process. This is caused by mutant GCase but not the loss of GCase activity, and it is hypothesized that GCase replacement alone may not normalize CMA dysfunction. Misfolded GCase would need to be addressed instead. Gain’s drug would likely address this issue while other approaches may not.

Looking at the scientific literature leads one to conclude that GT-02287 is arguably a superior approach to GBA1 Parkinsons and perhaps idiopathic Parkinson’s too. Due to the misfolded GCase feedback loop with alpha-synuclein, GT-02287 is fixing the problem where it is created instead of fixing downstream effects after the problem has been created and as it is still being created.

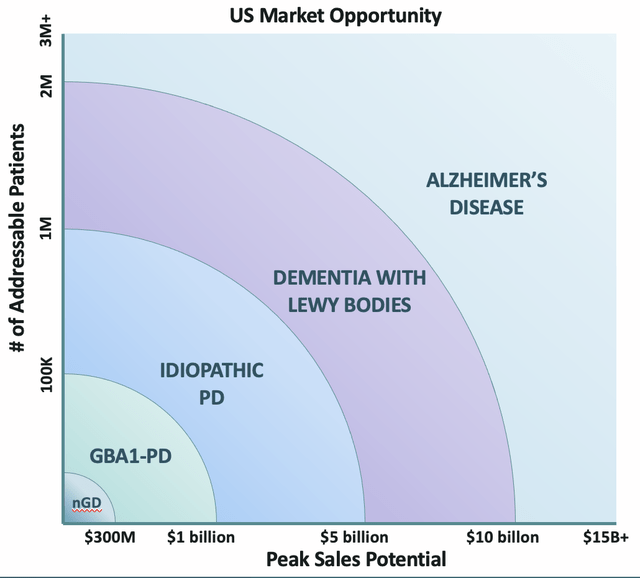

The market potential for GT-02287 is large and can be viewed below with expanded indications:

GT-02287 Market Size (Gain Therapeutics Presentation)

Gain’s A1AT Deficiency Asset

Gain also has other programs in earlier stages of development that are promising, though I’ve never dove into them on Seeking Alpha and I don’t factor them into a valuation. Here’s an example:

A consortium led by Gain recently received a €1.2 million grant award from Urostars and Innosuisse to develop novel small molecule allosteric regulators for treatment of alpha-1 antitrypsin (A1AT) deficiency. This consortium includes the Institute for Research in Biomedicine, Newcells Biotech and the University of Helsinki.

A1AT is a protein encoded by the SERPINA1 gene. It is a type of enzyme inhibitor that protects tissues, in particular the lung, from enzymes produced by inflammatory cells, particularly neutrophil elastase. While neutrophil elastase is produced by inflammatory cells primarily as a microbicidal agent, it can also target one’s own elastin, a common protein in the body, especially in the lungs, bladder large blood vessels, and ligaments. Insufficient A1AT activity allows neutrophil elastase to excessively target elastin, breaking the integrity of organs, particularly the lungs which are most susceptible. A1AT deficient patients develop severe COPD-like symptoms. Mainly only the lung is destroyed in patients with A1AT, but patients can also develop liver symptoms.

A1AT is produced mainly in the liver but also is produced in mononuclear phagocytes, neutrophils, bronchial epithelial cells, and small intestine epithelial cells. From the liver, A1AT circulates and diffuses into the lung. There is a similar concept as in Gaucher’s and GBA1 Parkinson’s disease, where misfolded A1AT-ATZ globules aggregate in the ER. This causes hepatocyte apoptosis, and over the long run the slow but continuous stress, death, and repair causes hepatic fibrosis, cirrhosis, and hepatocellular carcinoma.

Shire PLC (SHPG) and Grifols, S.A. (GRFS) sell therapies for A1AT, such as Grifol’s Prolastin, an elastase inhibitor, but no therapies cure the disease. For patients with lung disease, intravenous A1AT can be available. The A1AT market is expected to reach about $2.5 billion in 2032 despite no globally available therapies.

Vertex Pharmaceuticals Incorporated (VRTX) appears to be pursuing a similar approach to “correct” A1AT. Without more detail on Gain’s approach, its tough to compare anything. However, apparently Gain’s approach to A1AT is differentiated or unique.

Additional Thoughts

The company has a good strategy to pursue development specifically for GBA1 Parkinson’s patients as these patients have more severe GCase deficits and the patients’ conditions deteriorate more rapidly. A clinical benefit will likely be seen more robustly and in a shorter period of time, though GT-02287 may be applicable to all/idiopathic Parkinson’s patients.

In Q1 investors are expecting additional preclinical Parkinson’s data, and the clinical trial they’re currently running is enrolling well and should complete Q2 2024. After the dose escalation is complete, they’re planning on adding an additional patient cohort to look at changes in biomarkers (NfL, neuroinflammatory markers, etc.) over three months. That will be starting in Q3 2024, and ending early 2025 and will give the company a good indication of if the drug is doing what it is intended to do or not.

The oncology indications are progressing in the background but not much information has been disclosed on these programs.

Gain recently had a GM gangliosidosis paper published in PLOS One, where they proved in another indication that they could restore mutant enzyme function. This indication is a neurologically degenerative genetic disease caused by mutations in the GLB1 gene, which encodes beta-galactosidase, another lysosomal enzyme. At the biomolecular pathophysiological level, GM1 gangliosidosis is very similar to the lysosomal storage disease Gaucher’s disease as well as GBA1 Parkinson’s, which are driven by GBA1/Gcase mutation. While this isn’t a primary value driver for Gain, it’s another application providing further evidence their SEE-Tx platform can successfully find allosteric binders for proteins to address protein misfolding. Allosteric binding sites are often unique and not shared across a range of similar proteins in a protein family that share commonalities; thus, allosteric binders often have less toxicity due to fewer off-target effects (higher specificity). Therefore, this paper helps prove the utility of SEE-Tx as a discovery engine across a broader range of target proteins and diseases.

Financials and Valuation

Gain recently completed a CMPO and PIPE with $10.1 million in gross proceeds, and they had $12.3 million in cash as of September 30th, 2023. This money is expected to be enough to bring them through their phase 1 trial and the additional cohort of Parkinson’s patients.

Gain is the only funded research program in the clinic and the Michael J. Fox Foundation is starting to give grants for clinical stage activity as its programs have progressed. Gain will pursue grants (in Parkinson’s and oncology indications) to supplement its own financial support of its programs.

If we use my valuation from my past analysis but use the new fully diluted share count as of the recent financing, I previously estimated GT-02287 to be worth $180 million. The Caraway buyout would probably strengthen my case as I believe GT-02287 is most likely a better drug. Using a blended analysis where Gain’s average comp at the time was worth $1180, I estimated Gain’s enterprise value to be $680 million. Using 12.1 million shares outstanding at the time, that translated to $56/share. I would still estimate the same value given Gain’s progress weighed against the weakest biotech market ever. Using an updated share count of 22.45 million shares fully diluted, that yields a share price of just over $30. Keep in mind that about 3 million warrants/options are anti-dilutive at share prices much higher than where the stock is currently trading.

Risks

Gain is an early-stage, pre-revenue biotech. With that comes risks including but not limited to dilution, running out of money, clinical and preclinical study failures, and high market volatility.

Conclusion

Gain is clearly an undervalued biotech company that upon closer look has a derisked profile due to its platform, lead asset, investors, management and board, and recently refreshed balance sheet. Dr. Islam is well known for successful M&A activity and negotiating from a position of strength is a card he has played before. Particularly compared with any company developing assets in early clinical stages and late preclinical stages similarly to Gain, I trust their management team and board. I believe the company will make wise decisions, be excellent stewards of shareholder capital, and that the recent decline in GANX shares is simply a result of the company enduring the worst biotech market in a long, long time while existing as an early-stage player in a market with rising interest rates and a lack of biotech fundraising capacity. GANX shares should appreciate from these levels as investors digest the story, do due diligence on Gain’s lead asset, and follow multiple billionaires and other very successful biotech investors who epitomize “smart money” into investing in the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.