USO/iStock via Getty Images

Investment Thesis

In dissecting Dorian LPG (NYSE:LPG), my investment article aims to lay out a compelling case for why this company is destined for growth. As we dive into the nuances of Dorian’s operations and financial health, readers should anticipate highlights on the company’s current performance but also its strategic positioning for future success. My confidence in Dorian stems from their ability to rightfully navigate the complex landscape of international trade. They think forwardly with investments in green technology and are committed to efficiency and safety. I give a detailed exploration of financial metrics and market outlook, and continuously analyze a company that’s actively shaping industry demands. Expect an examination that reveals why Dorian is in a compelling spot for an investment.

Dorian LPG: Strong Buy Rating

Introduction

Dorian LPG is in the international shipping sector, specializing in the transportation of Liquefied Petroleum Gas (LPG). The company plays a pivotal role in meeting global energy needs by facilitating the efficient and reliable transport of LPG across oceans. They manage this through a robust fleet of very large gas carriers (VLGCs). The company has invested heavily in greener technology and operational efficiencies to ensure compliance with evolving environmental regulations while striving to deliver optimal service to its clients. Dorian stands as a significant player in the maritime transport industry as they emphasize safety, sustainability, and efficiency. They navigate the complex dynamics of international trade and energy distribution.

Financials and Forward Outlook

In my assessment of Dorian LPG’s latest earnings call, I firmly believe that the company stands as a compelling buy in the current market landscape. The company’s financial robustness and strategic foresight presented by the management are very reassuring and signal a trajectory of growth. Let’s look into the data!

Financially, Dorian’s performance is very impressive. The company announced a record EBITDA, which made me think clearly there is strong cash flow and profitability. The management’s commitment to returning value to shareholders is highlighted by the staggering $650 million returned since its IPO. That’s astonishing, and I think this team is the driving force. For more depth, Dorian’s net debt to total capitalization is about 30%. And with the shareholder returns, I think this reflects a financially sound organization; it’s an oiled machine.

But there is more that promotes my strong buy thesis, like the strategic direction and market outlook shared by the company’s leadership. John Hadjipateras, the company’s Chairman, President, and CEO, expressed the following:

“We are cautiously optimistic about the market… supported by U.S. production and exports and demand in Asia and PDH demand in China.” – Q2 Earnings Transcript

I thought that was a solid statement from the leader of Dorian. And what I think is also notable are the active investments into greener technology and environmental initiatives. 20 of the 25 ships in the fleet reflect these investments, and Dorian is positioning itself to remain ahead of industry changes and regulations. The forward-thinking is great for investors to be aware of because this is in an industry that’s increasingly sensitive to environmental concerns.

Following, the operational efficiency of Dorian is another pillar of strength. Achieving a Time Charter Equivalent (TCE) of $65,128 per operating day with total utilization of 96.5% is speaking volumes about the company’s operational abilities.

However, I do want to briefly slip in the inherent risks, including geopolitical tensions and the potential impact of climate on Panama Canal transits. These were mentioned in the transcript and they are valid concerns. But in point of view, the company’s robust financial cushion and strategic investments in tech, while continuing to operate efficiently, provide a strong buffer against these uncertainties.

So overall, Dorian financial health looks very solid, and their strategic investments are staying ahead of the curve. The company is thriving and truly paving the way forward with strategic foresight. I think they have a clear vision and some might want to be a part of their growth. The robust dividend payouts and enhanced fleet technology and environmental compliance are screaming future growth, or at least positioned very well for it. While each of us are mindful of the risks, the seesaw, for me, is tilting heavily toward a strong buy rating.

How Do Yemen Airstrikes Impact Dorian?

In light of recent developments in the Red Sea, I still advocate a strong buy position for Dorian. The U.S. and U.K. response to Houthi rebels has created some geopolitical tension, which has set the stage to impact the tanker industry landscape. Notably, companies like Dorian are poised to navigate these turbulent waters with potential profitability. The company stands out to me since it is more than capable to leverage this situation. Let’s uncover the details.

The conflict-induced rerouting and heightened security measures naturally escalate operational costs, an undeniable risk. However, this landscape also cultivates fertile ground for higher charter rates due to the increased demand for secure and efficient transportation routes. With those two notes in mind, Dorian’s fleet could maneuver this correctly and capitalize on such rate hikes. And I think that would offset the operational cost spikes that we could see. I think Dorian is in a unique spot, and somewhere an investor would likely prefer to be.

Moreover, the potential for a constrained supply of available ships in safer areas can further tilt the balance in favor of Dorian. This would also potentially boost its market standing and financial outcomes, who doesn’t like the sound of that. I really have an optimistic outlook with Dorian because, in light of this analysis, the reward seems to outweigh the risks. But as always, it’s crucial to recognize the balancing act required here. We do need to think about the escalating insurance premiums and just the unpredictable nature of geopolitical conflicts. It is the uncertainty that you need to ask yourself how much you are willing to allow.

So, while there are inherent risks, the unique positioning of Dorian within this volatile environment is pointing me toward a higher stock price. And with the potential for strategic operational adjustments and market dynamics favoring tanker demands, it emphasizes my strong buy thesis.

Increasing Charter Rates

In my view, the recent surge in charter rates for Very Large Crude Carriers, jumping from around $8M to $10M, significantly bolsters my ‘strong buy’ thesis for Dorian. This spike, driven by a high demand for vessels from the U.S. Gulf, directly translates to increased revenue per shipment for companies like Dorian. It’s not just about the immediate revenue bump; the tightened vessel availability hints at the potential for securing longer-term contracts at these lucrative rates. This could be offering a stable revenue stream, but I also want to note that we will see an immediate revenue bump, too. These are positive elements that reinforce my buy thesis.

However, I’m not overlooking the flip side; I will stay balanced in this analysis. The shipping and oil markets are no doubt volatile. The unpredictable geopolitical and economic shifts are what influence the stock in sudden sways. Although, the current scenario is enticing for possible upside. But a sudden change in oil prices or a shift in the geopolitical landscape could alter the demand for shipping services overnight; always be wary and up to date with news.

But here’s why I maintain a ‘strong buy’ stance. Dorian can capitalize on the current upswing in charter rates, which will demonstrate its market position. The company can leverage this to potentially secure more favorable, long-term contracts, too. This would set a strong foundation for future growth, something that is always helpful and needed. While the risks tied to market volatility can’t be ignored, the immediate and tangible benefits are worthy to possibly act on. Nonetheless, a compelling case for investors.

Valuation

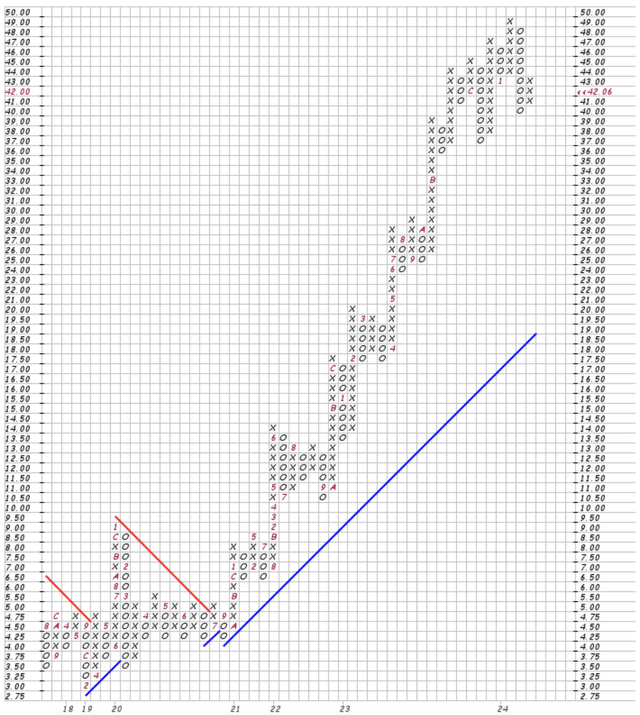

Firstly, I would like to hone in on a graphical perspective. Below I have attached a point and figure chart. With this, we should be able to identify some support levels and trending patterns. It’s depicted in a traditional three box reversal method, so I suggest you direct your attention in the top-right part of the chart. If we look at the most recent reversal in the upward trend, I think we are standing in a good spot right now. The tide is turning after recent sways in the stock. But, what’s interesting, are the support levels continuing to rise. Looking back at the 36.00 price, we see an O — identifying a support level. The stock surged, then fell and we saw it test the support, marked at 37.00. And as we look at another huge increase and subsequent fall, we identify yet another heightened support level now sitting at 40.00. Being at its discounted price, through a technical lens, I see upward growth of roughly 20%. I say this because of the trending highs that increased slowly– topping one another four times (44, 45, 47, 49). So my target price for a short-term gain would be nearing 51.00 based on this perspective. And I think the fundamental analysis backs this technical perspective.

LPG Point & Figure (Stock Charts)

Now I would like to move to a few valuation metrics. When comparing Dorian’s investment potential, the numbers are very persuasive, so I will try to cut out my enthusiasm when writing. Let’s start with the forward Price to Earnings ((P/E)) ratio sitting at 4.90, considerably lower than the sector median of 10.33. This signals that the stock is trading at a discount relative to earnings expectations. It tells me we’re getting a very deep discount, approximately 52.63% in terms of the difference to the industry average. I think the market is missing something here, and that’s the very upside I’m recommending.

Moving on to the Forward Enterprise Value to EBIT ((EV/EBIT)), Dorian’s figure is 6.34, a contrast yet again to the sector median of 8.99. This is indicating the company is valued more attractively relative to its earnings before interest and taxes. This is a metric I pay close attention to because it cuts through the noise of differing capital structures and tax rates, and I think it has given a clearer picture of valuation. And this illustrates Dorian at a valuation that’s nearly 30% lower than its peers, another one that is hard to ignore.

But here’s the kicker. I saved the best for last. The Total Trailing Twelve Months Dividend Yield. Dorian has offered a whopping 15.86% in the past, which makes the sector median of 3.86% look like pocket change. This is a statement to the company’s confidence in its ability to generate and distribute cash to shareholders. I know the income-focused investors’ ears perked up. The yield is signifying financial health and a management team committed to rewarding investors. And just to deepen the story for you I have provided the image below to illustrate the dividend safety. Seeking Alpha Quant has put this together and I think it’s something to note. They believe the dividend is ‘safe,’ explaining that the company is in a financially stable spot to pay this dividend.

Dividend Safety Grade (Seeking Alpha Quant)

So, when I combine these metrics together, they undoubtedly strengthen by strong buy thesis. This valuation is screaming deep value and primed for re-rating one the market catches up to its true worth. I also provided the Seeking Alpha Quant Score below. It is high up there folks!

Quant Score (Seeking Alpha Quant)

The Key Takeaway

After researching deeply on Dorian LPG, I believe I uncovered a company with strong financials and strategic foresight. The firm’s record EBITDA and prudent debt management reflect financial strength, while its commitment to green technology and operational efficiency aligns with the industry’s evolving demands. Despite the geopolitical risks and climate-related uncertainties that are inherent to the sector, Dorian’s adaptability and strategic investments show resilience. To me, they really know how to navigate market shifts. The surge in charter rates and potential for long-term contracts highlight Dorian’s market position. And when we observe very attractive valuation metrics and a chart analysis also pointing toward upward growth, I only can reinforce my rating. Dorian LPG should be on your short list.

Thank you for reading and I will be engaging with you in the comment section below!